Highlights

Highlights/ Strong operating performance delivers 32% earnings growth

| Financial metrics | Year ended 31 March 2015 |

Year ended 31 March 2014 |

% Growth |

|

|---|---|---|---|---|

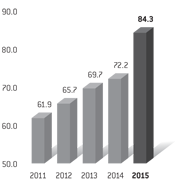

| Revenue | £84.3m | £72.2m | 17 | |

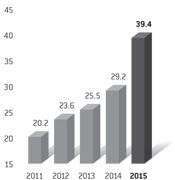

| Adjusted profit before tax(1) | £39.4m | £29.2m | 35 | |

| Adjusted diluted EPRA earnings per share(2) | 27.1p | 20.5p | 32 | |

| Dividend | – final | 11.3p | 8.4p | 35 |

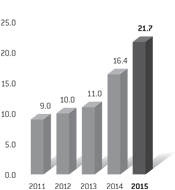

| – total | 21.7p | 16.4p | 32 | |

| Adjusted NAV per share(3) | 510.4p | 446.5p | 14 | |

| Cash flow from operating activities (after net finance costs) | £42.4m | £32.8m | 29 | |

| Store metrics | ||||

| Occupancy growth(4) | 267,000 sq ft | 200,000 sq ft | 34 | |

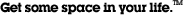

| Occupancy (%)(4) | 73.2% | 67.9% | 8 | |

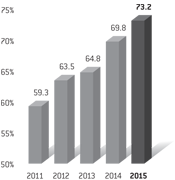

| Average net achieved rent per sq ft(4) | £24.95 | £24.32 | 3 | |

| Statutory metrics | ||||

| Profit before tax | £105.2m | £59.8m | 76 | |

| Basic earnings per share | 72.5p | 42.5p | 71 | |

1 See note 10 2 See note 12 3 See notes 12 and 14 4 See Portfolio Summary and Operating and Financial Review

- Increased demand throughout UK

- Growth in all our key store metrics

- 32% increase in adjusted earnings per share and total dividend

- Acquisition of remaining two thirds of Big Yellow Limited Partnership and

£76.4m placing - Platform expanded by 234,000 sq ft:

- –Two new freehold stores constructed at Gypsy Corner and Enfield

- –Two existing freehold stores acquired in Oxford and Chester

- Acquisition of freehold building in Cambridge for conversion

- Acquisition of freehold interest in existing store in Battersea

- Debt refinanced – diversified pool, extended maturity, lower cost

- Two Armadillo joint ventures with Australian consortium

- –April 2014: Acquisition of ten store portfolio totalling 401,000 sq ft

- –February 2015: Acquisition of four store portfolio totalling 270,000 sq ft

We are pleased to report very strong results, with demand growth across our network reflecting improved economic growth, not just in London, but within the UK as a whole.

Demand Growth

Occupancy (%)

Net rent (per sq ft)

Revenue (£m)

Adjusted profit

before tax (£m)

Adjusted earnings

per share (pence)

Dividend per share (pence)