Financial review

Overview

The sale of our French spreads business, St Hubert, in August 2012 significantly reduced levels of Group borrowings and has enabled us to increase investment in our core UK business this year. This investment, targeted at areas of growth opportunity and cost efficiency will help drive growth in future years. The three main areas of capital investment are:

- A new demineralised whey capability at Davidstow to take advantage of high global growth in added value whey protein products

- Increased FRijj capacity and capability at Severnside to drive the brand in a growing category

- Expansion of our spreads site at Kirkby to enable the closure of Crudgington in 2014

Group profits have benefited this year from reduced interest charges following the St Hubert sale and the early repayment of loan notes in April 2013. Furthermore, we had higher than usual profits from the sale of surplus depots due to the gain of £15.3 million on the sale of a site in Nine Elms, Battersea. The trading environment remains challenging as milk input costs have increased by over £40 million in the year and consumers’ real incomes remain under pressure, however we have continued to focus on cost reduction and on our key brands in order to maintain margins.

|

Product group revenue |

2014 £m |

2013 £m |

Change £m |

Change % |

|---|---|---|---|---|

|

Cheese |

264.6 |

231.3 |

33.3 |

14.4 |

|

Spreads |

177.4 |

194.5 |

(17.1) |

(8.8) |

|

Dairies |

944.8 |

951.6 |

(6.8) |

(0.7) |

|

Other |

4.2 |

4.2 |

– |

– |

|

Total external revenue |

1,391.0 |

1,381.6 |

9.4 |

0.7 |

Following our major reorganisation at the start of the financial year which removed the divisional structure, we have assessed that the Group has only one reporting segment in accordance with the requirements of IFRS 8. However, we have chosen to provide product group analysis consistent with prior years to assist the users of the Accounts.

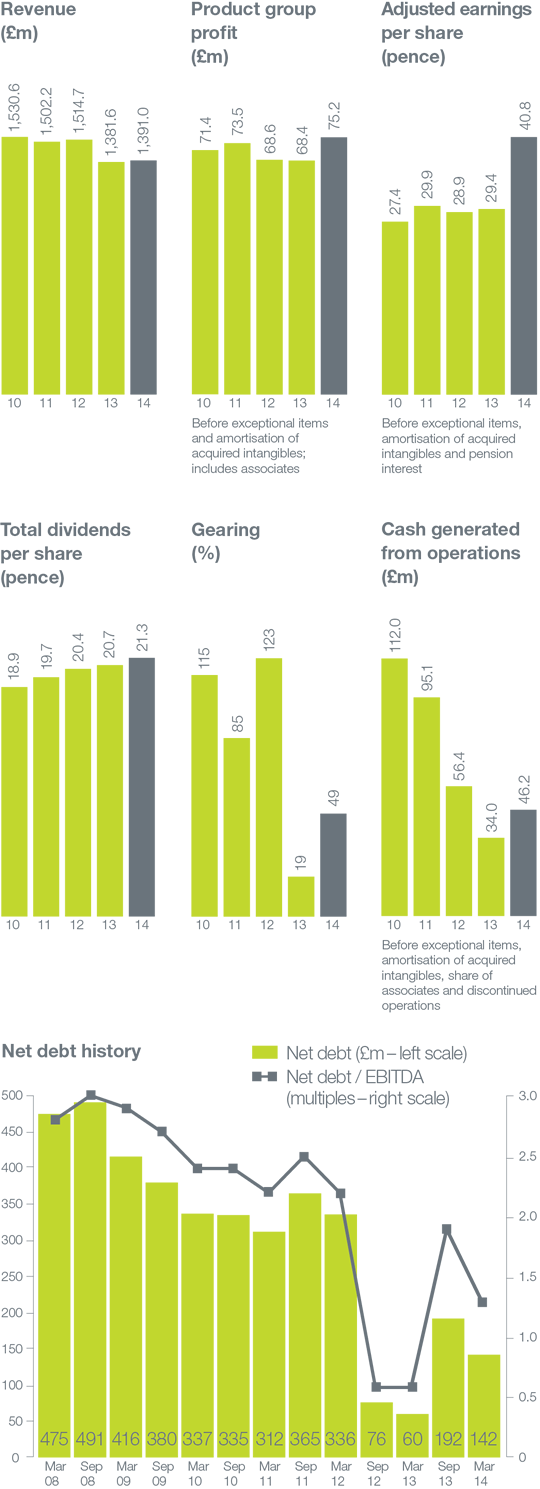

Group revenue increased by 0.7% to £1,391.0 million, predominantly as a result of increased revenues in the Cheese business as volumes rose and selling prices increased reflecting higher milk costs. Spreads revenue decreased by 8.8% as we promoted less butter for much of the year in an environment where cream prices were high and Utterly Butterly volumes reduced. Dairies revenues decreased slightly reflecting levels of decline in our residential business.

|

Product group profit |

2014 £m |

2013 £m |

Change £m |

Change % |

|---|---|---|---|---|

|

Cheese |

39.3 |

33.1 |

6.2 |

18.7 |

|

Spreads |

16.8 |

25.5 |

(8.7) |

(34.1) |

|

Dairies |

18.8 |

9.8 |

9.0 |

91.8 |

|

Share of associate |

0.3 |

– |

0.3 |

n/a |

|

Total product group profit |

75.2 |

68.4 |

6.8 |

9.9 |

|

Remove share of associate |

(0.3) |

– |

(0.3) |

n/a |

|

Acquired intangible amortisation |

(0.4) |

(0.4) |

– |

n/a |

|

Group profit on operations (pre-exceptionals) |

74.5 |

68.0 |

6.5 |

9.6 |

Product group profit increased by £6.8 million to £75.2 million driven by a strong performance in Cheese and a higher than usual level of property profits in Dairies. Our Spreads business had a challenging year as the category declined overall and we promoted less butter. However, our plans to close Crudgington in 2014 are on track and this will deliver cost savings in 2014/15.

Following changes to IAS 19 that took effect from 1 April 2013, the Group recognises pension scheme administrative expenses within operating costs. All prior year amounts have been restated accordingly and further details are set out in Note 20 to the Accounts. The table above quotes profit after pension scheme administrative expenses of £1.0 million (2013: £0.9 million).

Exceptional items

Pre-tax exceptional charges of £10.4 million have been recorded in the year (2013: £56.5 million).

In September 2012 we announced the closure of the Crudgington site with production moving to Kirkby. This project, now nearing completion, will generate significant savings in future years. Exceptional costs of £3.8 million have been recorded in the year, the majority of which are non-cash asset write-downs. Cash expenditure in the year was £2.4 million. We expect further exceptional costs of approximately £8.0 million in 2014/15 as this project comes to an end.

In February 2013 the Company announced a major reorganisation, removing divisional structures and resulting in one unified business. Exceptional costs of £4.4 million have been charged in the year being redundancy and restructuring costs. No further exceptional costs will be incurred in 2014/15.

In December 2013 we announced the closure of Proper Welsh Milk, a processing facility in Wales. In March 2014, we announced a strategic review of FoodTec UK Limited, an ingredients plant near Crewe. In line with Group policy, the costs of closure of these sites, which are predominantly non-cash write-downs, have been classified as exceptional. In total, the exceptional costs in relation to the closure of these peripheral elements of the Dairies manufacturing base amounted to £2.0 million.

A small £0.2 million adjustment to the exceptional finance charges accrued in 2012/13 was made during the year. This relates to the early repayment of loan notes completed in April 2014.

Finance costs

Finance costs have reduced by £8.8 million to £9.9 million. This primarily reflects the reduction in net debt following the sale of St Hubert in August 2012 and the further benefit from the early repayment of loan notes in April 2013 which removed the inefficiency of holding excess levels of cash on the balance sheet.

Other finance expenses of £0.3 million (2013: £3.5 million) comprise the net expected return on pension scheme assets after deducting the interest cost on the defined benefit obligation. Following changes to IAS 19 that took effect from 1 April 2013, the expected return on assets is calculated by reference to the discount rate applied to scheme liabilities rather than assumed rates of return on asset classes held by the pension scheme. Prior year amounts have been restated and further details are set out in Note 20 to the Accounts.

Other finance expenses are dependent upon the pension scheme position at 31 March each year and are volatile, being subject to market conditions. We therefore exclude this item from headline adjusted profit before tax.

Interest cover excluding pension interest, calculated on total product group profit, remains comfortable, at 7.6 times (2013: 3.7 times).

|

Profit before tax |

2014 £m |

2013 £m |

Change £m |

Change % |

|---|---|---|---|---|

|

Total product group profit |

75.2 |

68.4 |

6.8 |

9.9 |

|

Finance costs |

(9.9) |

(18.7) |

8.8 |

47.1 |

|

Adjusted profit before tax |

65.3 |

49.7 |

15.6 |

31.4 |

|

Amortisation of acquired intangibles |

(0.4) |

(0.4) |

– |

– |

|

Exceptional items |

(10.4) |

(56.5) |

46.1 |

81.6 |

|

Other finance expense – pensions |

(0.3) |

(3.5) |

3.2 |

91.4 |

|

Reported profit/(loss) before tax |

54.2 |

(10.7) |

64.9 |

n/a |

Adjusted profit before tax (before exceptional items and amortisation of acquired intangibles) increased by 31% to £65.3 million. This is one of management’s key Group profit measures. The reported profit before tax of £54.2 million represents a significant improvement from 2013 (£10.7 million loss) reflecting improved profit before tax and significantly lower levels of exceptional charges in 2013/14.

Taxation

The Group’s effective tax rate on profits from continuing operations (excluding exceptional items) was 14.6% (2013: 20.1%). The effective tax rate continues to be below the headline rate of UK corporation tax due to the property profit income stream, on which the tax charges are sheltered by brought forward capital losses or roll over relief. The higher level of property profits this year has reduced the effective rate of tax but we expect the effective tax rate to increase next year to approximately 18%.

Future decreases in the rate of UK corporation tax to 20% were enacted in 2013 and the one-off impact that this has on deferred tax balances has been classified as exceptional. This resulted in an exceptional tax credit of £1.9 million in the year ended 31 March 2014.

Group result for the year

The reported Group profit for the year amounted to £50.2 million (2013: £46.6 million). The 2013 result included discontinued operations in relation to St Hubert; both profits for the period to August 2012 and the gain on disposal of the business.

Earnings per share

The Group’s adjusted basic earnings per share from continuing operations increased by 39% to 40.8 pence per share (2013: 29.4 pence per share). This reflects improved operating profits and reduced interest costs benefiting from the loan note repayments made in April 2013.

Basic earnings per share from continuing operations, which includes the impact of exceptional items, pension interest expense and the amortisation of acquired intangibles, amounted to 35.8 pence per share (2013: 5.9 pence loss per share).

Dividends

We are committed to a progressive dividend policy and have delivered against that policy in the year ended March 2014. The proposed final dividend of 15.4 pence per share represents a 0.4 pence per share increase compared to last year. Together with the interim dividend of 5.9 pence per share this brings the total dividend to 21.3 pence per share for the full year, 2.9% higher than last year (2013: 20.7 pence per share). The final dividend will be paid on 7 August 2014 to shareholders on the register on 4 July 2014.

Dividend cover of 1.9 times is within the target range of 1.5 to 2.5 times (2013: 1.4 times).

Pensions

Following the sale of St Hubert, the Group entered into discussions with the Pension Fund Trustee about the impact of early loan note repayments. Consequently, on 18 April 2013 the Group made an additional one-off cash contribution to the Fund of £40 million. At the same time the Group granted the Trustee a floating charge over maturing cheese inventories, with a maximum realisable value of £60 million. This charge was put in place to protect the Fund in the unlikely event of an insolvency of Dairy Crest Limited.

During the year, the Group paid £20 million cash contributions into the closed defined benefit pension scheme in line with the schedule of contributions agreed in June 2011. The latest full actuarial valuation was performed at 31 March 2013 and resulted in an actuarial deficit of £145 million (£105 million after taking account of the £40 million one-off contribution paid in April 2013).

Following discussions with the Trustee a new schedule of contributions was signed in March 2014. The Trustee has recognised that investments we are making in the business are expected to improve the covenant strength in future years and as a consequence the level of cash contributions has been reduced over the next three years. For 2014/15 and 2015/16 cash contributions will total £13 million per annum and in 2016/17 will total £16 million. No further security has been granted to the Trustee to support this position.

The biggest threat to future levels of cash contribution is the relatively high proportion of risk assets held by the scheme (predominantly equities). Excluding insurance policies, approximately 75% of scheme assets are currently held in equities or other risk asset classes. The main focus of both the Trustee and the Group over the coming years is further to reduce pension risk by reducing the proportion of equities to which the scheme is exposed. The latest funding plan assumes a full funding position within six years, based on company contributions reverting to £20 million per annum from 2017/18 and the proportion of risk assets reducing from 75% to 20%. However, the level of contribution for 2017/18 and beyond and the recovery period will be reassessed at the next triennial actuarial valuation in March 2016 and changes to this plan will be made accordingly based on actual performance of the scheme.

The reported IAS19 pension liability at 31 March 2014 was £57.7 million comprising an IAS 19 deficit of £47.6 million and a £10.1 million additional liability reflecting an unrecoverable notional surplus that is required to be recognised under IFRIC 14. The reported deficit at 31 March 2013 was £67.2 million. Asset returns were strong during the year, however, corporate bond yields declined as investor demand for corporate bonds picked up as the global economic outlook improved.

Cash flow

Cash used in operations was £13.8 million in the year (2013: cash generated £19.1 million). This includes a working capital outflow of £22.6 million (2013: £40.0 million outflow) due mainly to the higher value of cheese stocks compared to March 2013 – £167.2 million in March 2014 versus £155.5 million last year. Stock value increases are a result of increased manufacturing to support future volume growth and milk cost increases during 2013. Furthermore, the cash outflow from operations includes £20.8 million of exceptional items (2013: £29.9 million) and the £40 million one-off cash contribution to the pension scheme.

Capital expenditure of £58.8 million was £7.9 million higher than last year (2013: £50.9 million). Significant investment has been made at our spreads manufacturing site, Kirkby, to accommodate production of spreads following the closure of Crudgington planned for 2014. We invested in our FRijj capacity and capability at Severnside to support future brand growth and substantial investment has already been incurred at our cheese creamery in Davidstow in relation to the demineralised whey production, albeit we have spent less in the year to March 2014 than was originally anticipated.

Proceeds from the sale of depots amounted to £25.1 million including £17.6 million from the sale of our Nine Elms depot in Battersea. In addition, certain FRijj capital expenditure was funded through equipment finance resulting in a cash inflow of £7.4 million. Financing was for six years at fixed rates of interest and allowed us to take advantage of attractive longer term funding rates in the absence of any required refinancing in the next 12 months.

Cash interest amounted to £14.0 million (2013: £18.0 million) and tax refunds totalled £2.1 million resulting from high levels of restructuring charges, pension contributions and capital expenditure in previous years (2013: tax payments £4.7 million).

Looking ahead, our ambition is to generate strong free cash flows. Higher conversion of profits into cash will be helped in the future by: lower levels of cash exceptionals; reduced capital expenditure in our existing business; lower pension contributions; and lower working capital requirements following two years of milk cost inflation.

Capital expenditure in our core business will reduce in 2014/15 to approximately £35 million and we expect to spend a further £35 million completing our investment in demineralised whey capability.

Net debt

Net debt increased by £82 million to £142 million at the end of the year albeit it reduced by £50 million in the second half of the year. The opening net debt of £60 million did not include the costs of the April 2013 one-off pension contribution (£40 million) or the cost of loan note repayments (£9 million).

Net debt as defined includes the fixed Sterling equivalent of foreign currency loan notes subject to swaps and excludes unamortised facility fees. At 31 March 2014, gearing (being the ratio of net debt to shareholders’ funds) was 49% (2013: 19%).

Borrowing facilities

At the start of the financial year, the Group’s borrowing facilities comprised: £330 million of loan notes (at the effective swapped exchange rate) maturing between April 2013 and November 2021, and a £170 million plus €150 million revolving credit facility expiring in October 2016.

On 4 April 2013, £60 million of notes from the 2006 series which had reached their maturity were repaid.

On 18 April 2013, a further £100 million of loan notes were repaid from the 2007 series. Of these notes, the majority (£69 million) were due for repayment in April 2014 with the balance due in April 2017. This has reduced the Group’s future interest payments. The repayment was effected by exercising the Group’s right to early redemption on payment of a make-whole premium.

Following these repayments, the Group has £170 million of notes outstanding which mature between 2014 and 2021. A further £25 million of notes matured in April 2014 funded from the revolving credit facility.

In 2013 the Group also reduced its revolving credit facility by €60 million to £170 million plus €90 million (approximately £244 million).

Borrowing facilities are subject to covenants which specify a maximum ratio of net debt to EBITDA of 3.5 times and a minimum interest cover ratio of 3.0 times. The Group remains very comfortably within its covenants with a net debt to EBITDA ratio of 1.3 times as of 31 March 2014 (March 2013: 0.6 times).

Post balance sheet events

On 16 May 2014, we completed the sale of our 30% shareholding in Wexford Creamery Limited for €3.4 million (£2.8 million). At 31 March 2014, the net carrying value totalled £2.1 million comprising share of associates, deferred consideration and valuation of options net of contract provisions.

On 14 April 2014, we completed the sale of a depot in Surbiton, Surrey for proceeds of £5.4 million resulting in a profit on disposal of £4.9 million.

Treasury policies

The Group operates a centralised treasury function, which controls cash management and borrowings and the Group’s financial risks. The main treasury risks faced by the Group are liquidity, interest rates and foreign currency. The Group only uses derivatives to manage its foreign currency and interest rate risks arising from underlying business and financing activities. Transactions of a speculative nature are prohibited. The Group’s treasury activities are governed by policies approved and monitored by the Board. These policies are summarised in Note 30 to the financial statements.

Going concern

The financial statements have been prepared on a going concern basis as the Directors are satisfied that the Group has adequate financial resources to continue its operations for the foreseeable future. In making this statement, the Group’s Directors have: reviewed the Group budget, strategic plans and available facilities; have made such other enquiries as they considered appropriate; and have taken into account ‘Going Concern and Liquidity Risk: Guidance for Directors of UK Companies 2009’ published by the Financial Reporting Council in October 2009. Further information is presented in the Directors’ Report on page 63.

Tom Atherton Finance Director

21 May 2014

The Strategic report from pages 4 to 31 has been approved by the Board and is signed on its behalf by

Robin Miller Company Secretary & General Counsel.

21 May 2014