Who we are

Dairy Crest processes and markets branded dairy products and nutritious fresh milk

Vision

- We are proud of our links to the countryside, our dairy heritage and the part they play in everyday life

- We want to earn the right to consumers’ loyalty by providing healthy, enjoyable, convenient products

- We aim to meet consumers’ needs and go where this takes us

- As we grow, we will look after our people and the communities where we work

Strategy

- To generate growth by building strong positions in branded and added value markets

- To simplify, make sustainable and reduce costs

- To generate cash and reduce risk

- To make acquisitions where they will generate value

Markets

|

IRI market data, 52 weeks ended 28 March 2015 |

£ million |

|

Cheese |

2,453 |

|

Butter and spreads |

1,161 |

|

Milk |

2,764 |

|

Ready to drink flavoured milk |

268 |

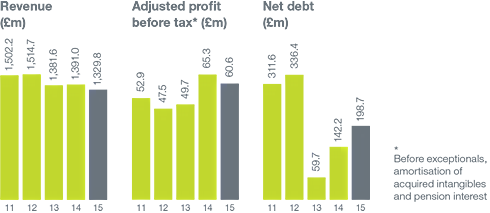

Financial highlights

Product groups

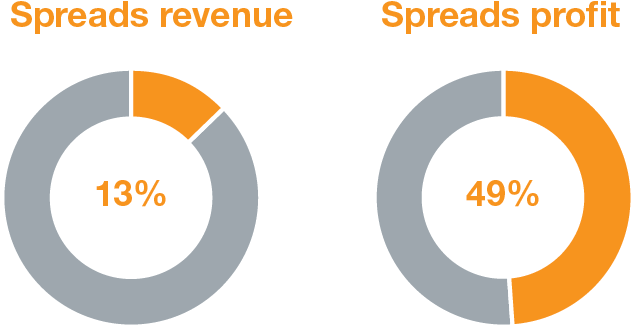

Spreads & butters: read more

Dairy Crest produces some of the UK’s leading spreads and butter brands. We focus on two key brands Clover and Country Life.

We also manufacture and sell Frylight one calorie cooking spray.

During the year we have consolidated the production of spreads and packet butters at Kirkby, Merseyside.

No1 UK

dairy spread

Frylight 1Cal

Contribution to Group

% of total Group

Revenue excludes other revenue. Profit is product group profit excluding associates

Highlights

- Country Life Spreadable continues to grow and outperform the market

- Clover maintains market share – awarded ‘Best Buy’ in spreads category by Which magazine

- Frylight sales growing strongly

- Packet butter and spreads manufacturing consolidated into one site

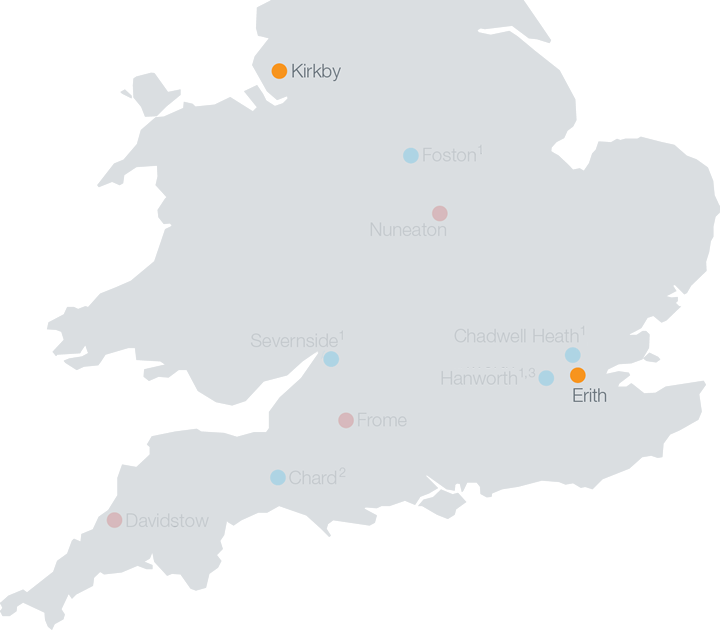

Production sites

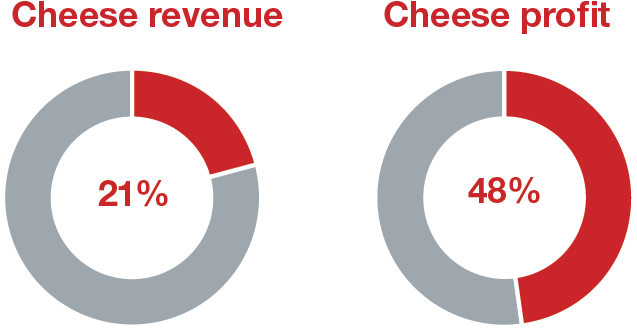

Cheese & whey: read more

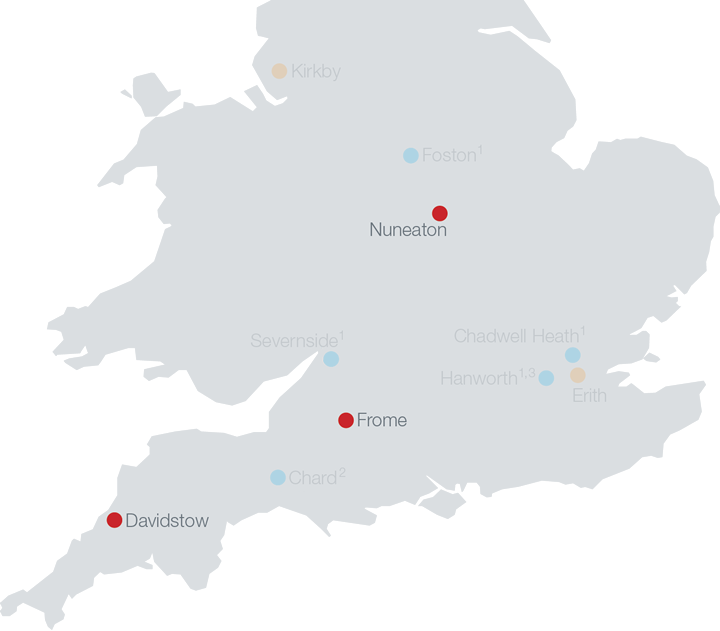

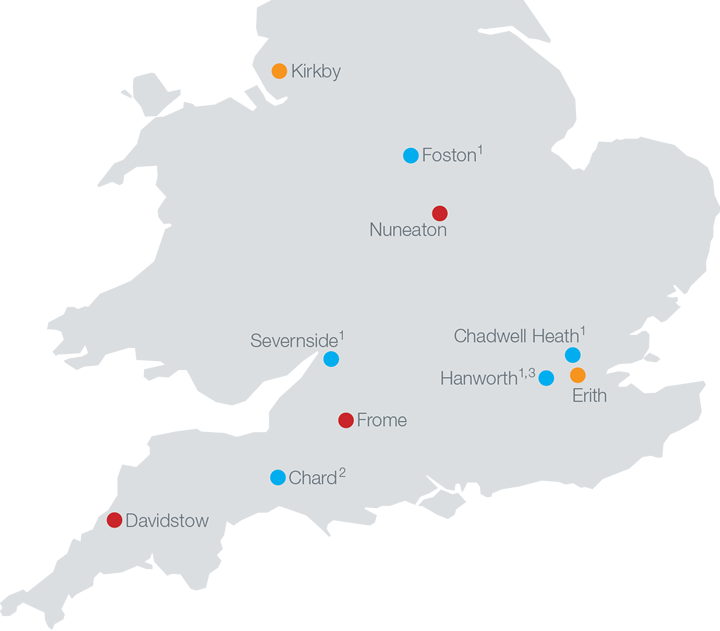

Dairy Crest has the leading cheese brand in the UK, Cathedral City, and a world-class cheese supply chain. Cathedral City is made at our Davidstow creamery in Cornwall from milk supplied by local dairy farmers. The cheese is matured, cut and wrapped at our purpose-built facility in Nuneaton from where it is despatched to retailers. We also have a smaller cheese packing facility at Frome, Somerset which provides the business with additional flexibility. We currently dry the whey that is produced as a by-product of cheese making at Davidstow. We are developing a new facility that will manufacture demineralised whey powder and galacto-oligosaccharide, a lactose based prebiotic.

No1 UK

branded cheese

Contribution to Group

% of total Group

Revenue excludes other revenue. Profit is product group profit excluding associates

Highlights

- Cathedral City continues to grow market share and is now Britain’s 16th largest grocery brand (Source: The Grocer)

- Cathedral City now accounts for over 50% of total retail branded cheddar sales

- Our premium brand Davidstow has also grown market share

- On track to produce demineralised whey and galacto-oligosaccharide later in 2015

Production sites

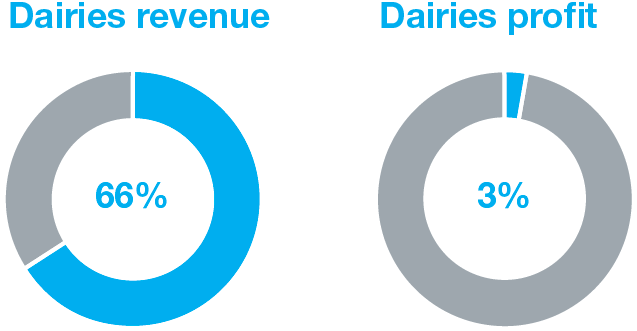

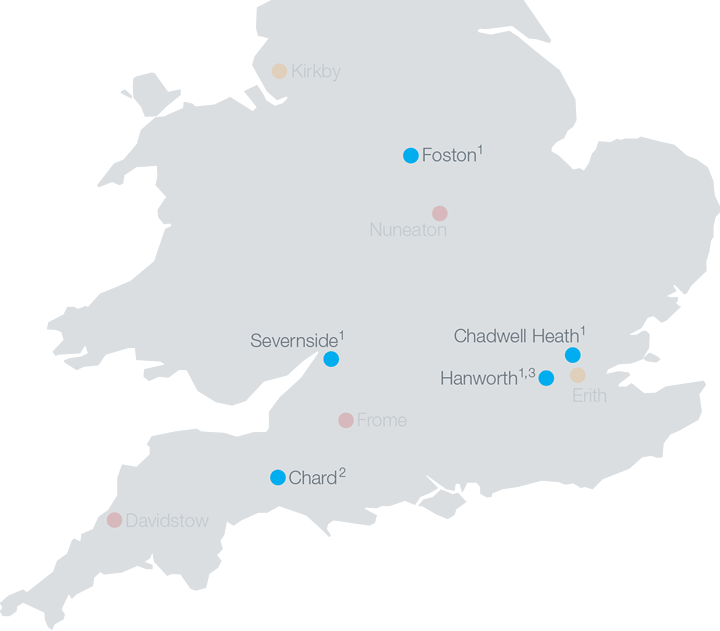

Dairies: read more

We process and deliver fresh conventional, organic and flavoured milk to major retailers, ‘middle ground’ customers including smaller retailers, coffee shops and hospitals, and residential customers.

We also manufacture and sell FRijj, the leading fresh flavoured milk brand, cream and milk powders.

Dairies also benefit from property profits arising from the sale of surplus depots.

Contribution to Group

% of total Group

Revenue excludes other revenue. Profit is product group profit excluding associates

Highlights

- FRijj sales up by 7%

- Reduced sugar FRijj variant introduced

- Ongoing cost reductions achieved

- Property profits £17.6 million

Sale of Dairies

On 6 November 2014 Dairy Crest agreed to sell its Dairies operations to Muller UK and Ireland Group LLP for £80 million in cash on completion. The sale has been approved by shareholders but remains conditional on the approval of the relevant competition authorities.

Details of the sale are included in the Financial review.

Production sites

1. Site included in the proposed sale of Dairies operations.

2. Planning to close 2015.

3. Planning to close 2016.

Production sites

1. Site included in the proposed sale of Dairies operations.

2. Planning to close 2015.

3. Planning to close 2016.