“2014 was a year of good progress for the Group. In particular, in the first half of the year

we undertook a detailed strategic review of all our activities and developed a robust growth

plan to harness the Group’s full potential and deliver accelerated growth and long-term

shareholder value.”

Highlights

• Delivered another set of positive results

with organic revenue growth of 2% and

adjusted EPS growth of 7%

• Recommending a 7% increase in the

full year dividend

• New strategic plan embedded across

the Group

• Strategic initiatives beginning to deliver

• Acquired the global power generation

valve specialist Bopp & Reuther in

January 2015, significantly enhancing

the Group’s presence in the attractive

power sector

• Disposed of two non-core businesses

to increase focus on specialist flow

control activities

• 14 new products launched by IMI

Hydronic Engineering

* On an organic basis, after adjusting for the impact of acquisitions, disposals and

movements in exchange rates, see Section 2.1.1 on page 94.

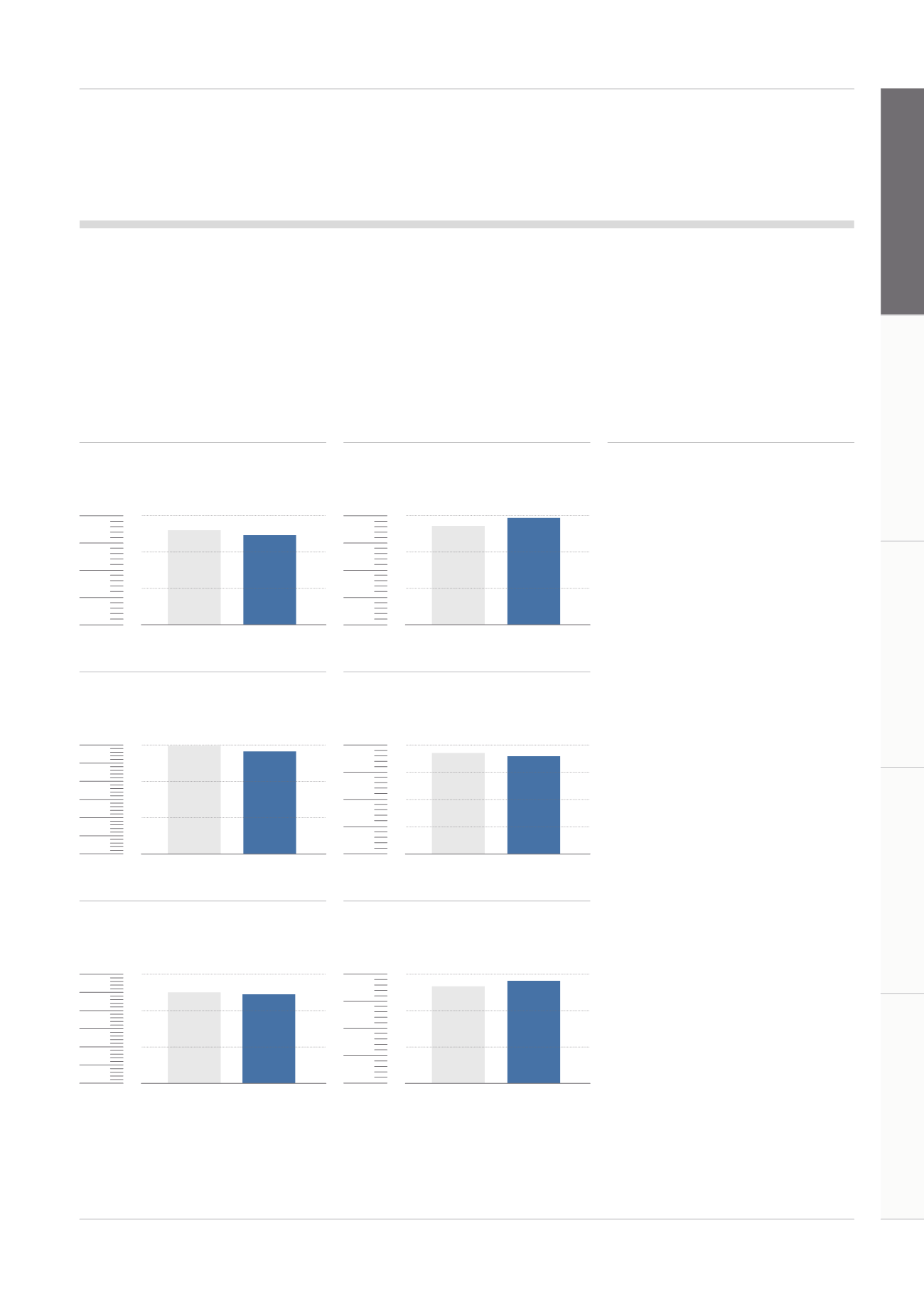

Revenue

+2%*

£1,686m

£1,686m

£1,744m

2013

2014

Adjusted profit before tax

-7%

£278.1m

£278.1m

£297.7m

300

200

100

2013

2014

Reported profit before tax

-1%

£245.7m

£245.7m

£249.3m

300

200

100

2013

2014

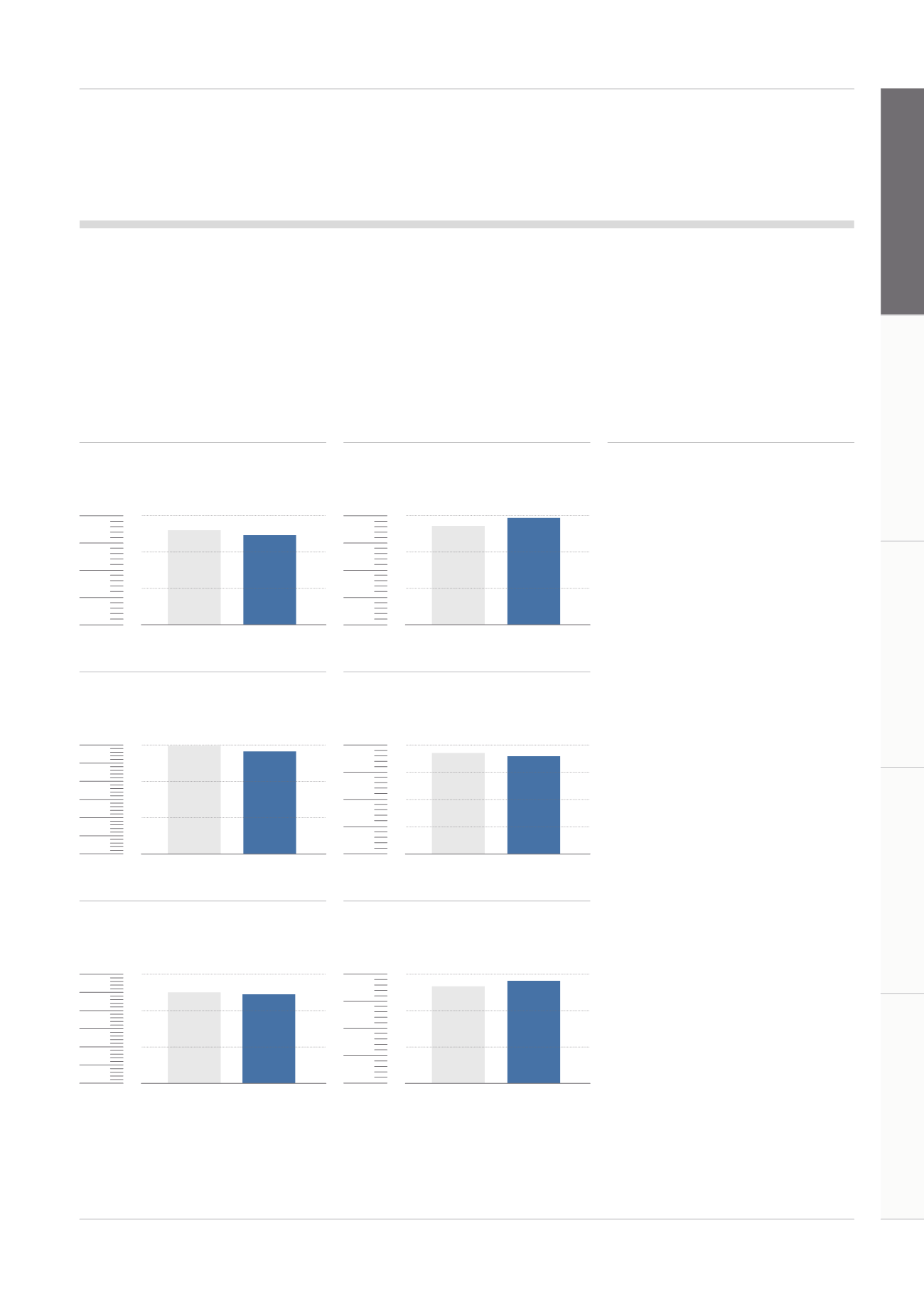

Adjusted basic earnings per share

+7%

78.0p

78.0p

72.6p

2013

2014

Segmental operating margin

-70bps

17.7%

17.7%

18.4%

2013

2014

15

20

10

5

60

80

40

20

1500

2000

1000

500

30

40

20

10

Total dividend for year

+7%

37.6p

37.6p

35.3p

2013

2014

Roberto Quarta

Chairman

1

Strategic Review

Performance Review

Corporate Governance

Financial Statements

Introduction

Annual Report and Accounts 2014

Introduction