Corporate Governance Report (cont’d)

Key Board activities in 2014

As the year opened, IMI became a more focused specialist flow

control business with the completion of the $1,100m (£690m)

disposal of the Retail Dispense divisions. The Board undertook

a thorough process of mapping out the next stage of the

Group’s development under the new executive leadership team.

As a result, the latest strategic thinking was set out in the interim

results announcement in August 2014 and is now reflected in

this Annual Report.

Highlights of other Board activity in 2014 included:

• Progress with Board succession

- New Finance Director appointed

- New non-executive with a strong financial background

appointed to take up the chair of the Audit Committee

- Search for a new Chairman commenced

• Organisation

- New management and organisation structures established

for the three divisions and corporate centre

- New role and composition for the Executive Committee

approved

• Brand exercise

- Rebranding of the businesses and refresh of the

corporate branding

• Growth and process investments

- Growth investments made in new products and business

IT systems

- New core process disciplines introduced across a broad

spectrum including for lean, project management, internal

controls, legal & compliance and human resources

- Announcement of the acquisition of Bopp & Reuther

to complement our control valve businesses in our

Critical Engineering division

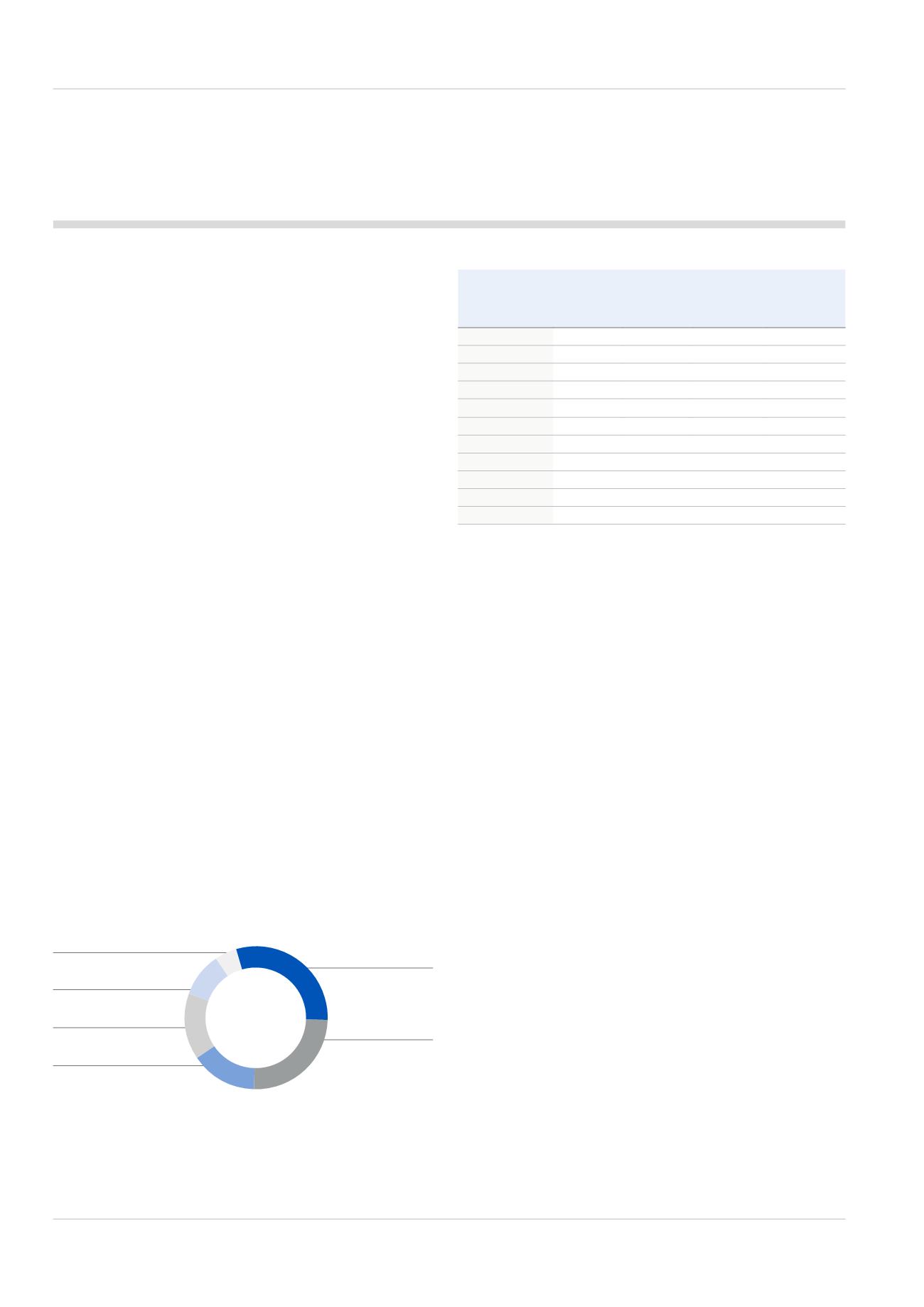

The Board’s time

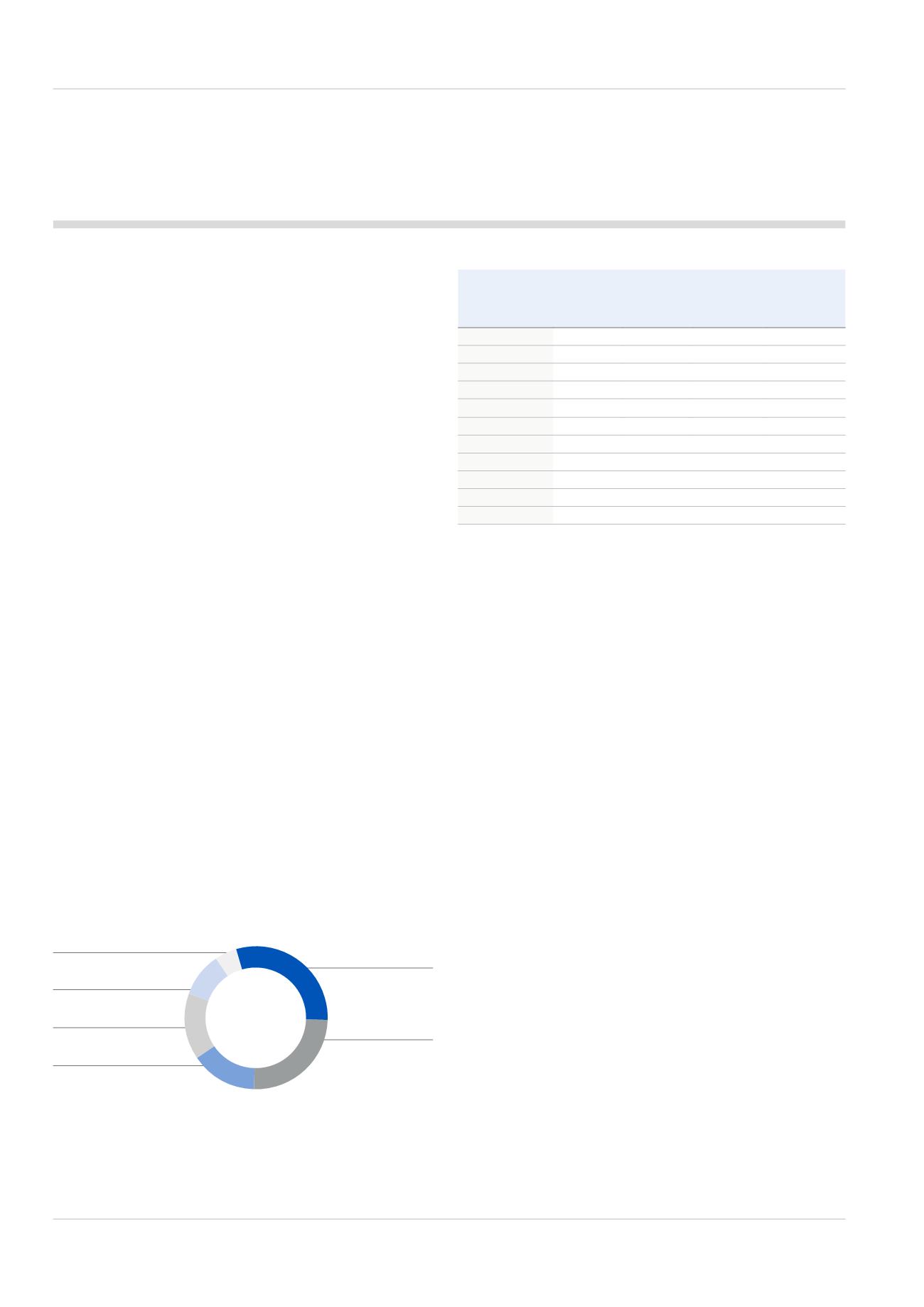

Board and Committee attendance 2014

(i)

Full attendance from appointment in October 2014

(ii)

Full attendance as joined the Audit Committee in March 2014

(iii)

Retired as a director in May 2014

Induction and continuing development programme

A formal induction process for new directors has been well

established for several years and is the responsibility of the

Chairman with support from the Chief Executive and Company

Secretary. This process was refreshed in the year to reflect

changes in Group businesses and management structure.

Business familiarisation is at the core of induction and continuing

development for non-executive directors at IMI is based around

gaining an understanding of the business and getting to know

the wider management team. There is also a committee

induction process designed to brief new committee members

on the relevant committee’s activity and the issues it faces.

During and after induction, directors are required to visit

business units around the Group and, most importantly,

to meet face-to-face with senior operating management and

key corporate staff. Non-executive directors continue to become

familiar with the businesses during and after induction and there

is regular contact between management and non-executive

directors during site visits, formal meetings and events.

Appropriate coaching and access to training and other

continuing professional development is available to all directors

and all directors participated in appropriate updates during the

year at Board and committee meetings.

Board evaluation

In line with the Code, the Board has agreed that the Chairman

should arrange an externally facilitated evaluation process,

normally at least once every three years. In 2013 such a

process was postponed due to the Chief Executive transition

and a full, externally facilitated Board evaluation exercise

was conducted in 2014. The evaluation was facilitated by

Director

Board

Meetings

9

Audit

Committee

Meetings

4

Nominations

Committee

Meetings

5

Remuneration

Committee

Meetings

4

Roberto Quarta

9

-

5

4

Phil Bentley

7

4

-

Carl-Peter Forster

9

4

-

4

Anita Frew

9

4

5

4

Ross McInnes

(i)

4

1

-

Birgit Nørgaard

(ii)

9

3

-

4

Bob Stack

9

-

5

4

Mark Selway

9

-

5

Douglas Hurt

9

-

-

Martin Lamb

(iii)

0

Roy Twite

9

-

-

48

IMI plc

Financial

15%

Major investments

15%

Risk, Legal and Compliance

10%

Corporate Governance

5%

Operational performance

and plans

30%

Strategy

25%