Profitable growth

ScS Annual Report 2018

A year in review

Financial highlights

Operational highlights

Strategy reviewed

- Providing focus and priorities for the business for the next three years.

Improving our store network

- New ScS store opened in Chelmsford – now trading from 101 stores.

Improved online sales

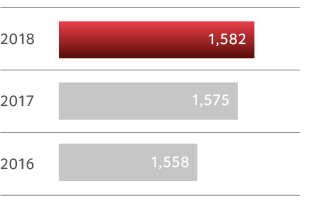

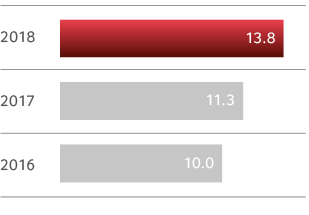

- Increased investment in team and website grew online sales by 22.6% to £13.8m.

Customer service

- Became the first UK furniture retailer to achieve 100,000 Trustpilot reviews.

- Trustpilot reviews now exceed 113,000.

- Truspilot 5-star 'Excellent' rating maintained.

Building resilience

- Increased the balance sheet strength, whilst increasing margins and cost flexibility.

- £12.0m committed revolving credit facility extended to November 2021.

At a glance

What we do

ScS, the 'Sofa Carpet Specialist', are one of the UK's leading furniture and flooring retailers. Principally located in modern retail park locations throughout the UK, we also run a furniture and flooring concession in House of Fraser.

We have over 100 years' furniture and retailing experience and our dedicated team of specialists are highly-trained in their fields, which means we can offer our customers the best combination of value-for-money, product choice, quality and customer service.

Our people and our customers are paramount to us and they are placed at the very heart of the Group through our mission, culture and values. Having been established since the 1890s as a family-owned business in Sunderland, we know our customers and how important customer experience and value are to them. Our business and reputation is built on offering outstanding value-for-money in the marketplace along with a 5-star rated customer experience. We combine this with a relentless focus on great quality and choice, from our bespoke and extensive sofa ranges to our specialist flooring collections.

During the year we have refreshed our mission statement, values and company strategy, which we reference throughout the remainder of the Annual Report. However, our aim remains simple – to provide 'An excellent customer experience with outstanding value, quality & choice.'

As a Board we are committed to listening to our employees. We received 1,571 responses to the Group's Culture Survey and having considered all feedback we have committed to:

- Greater openness to change and a willingness to challenge the status quo;

- Improved clarity on our key strategic objectives and prioritisation;

- Enhanced communication to all levels of the business; and

- Making ScS a great place to work.

We live by our RIGHT values:

Responsive

To our customers, colleagues, markets and new ways of working.

Inclusive

Working and communicating with each other to achieve common goals.

Get it right

Doing things right first time.

Hard working

Passionate, committed and driven with a winning attitude.

Trusted

Operating with fairness, respect, honesty and integrity.

At a glance

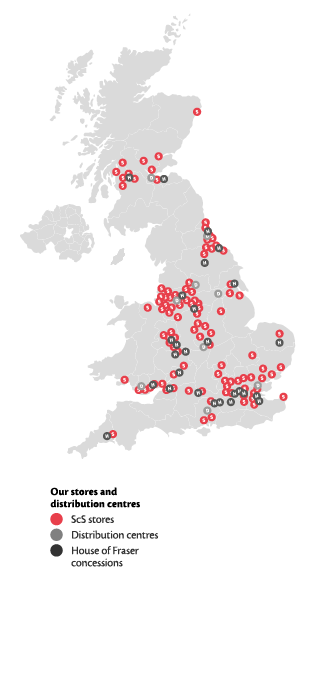

Where we are

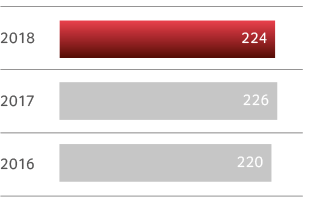

We trade from 101 ScS stores and operate 27 concessions within House of Fraser department stores across the country – from Aberdeen to Plymouth.

Managing our store footprint is critical to our success. The right store in the right location works hand-in-hand with having great people, great product, service and value. We review our store network on an ongoing basis in order to optimise the store estate and ensure we are retailing in the best available locations. This review covers both the existing network and any opportunities we have identified for new locations. These reviews have identified a further 10-15 potential locations where we would consider opening a new ScS store. We have also identified opportunities to improve our existing network by either relocating to better retail parks in the same area or to rationalise our network to improve our profitability, flexibility and resilience.

Our view is the reach offered by our existing and targeted network is optimum to meet customer demand, whilst ensuring we make an appropriate return. All new locations and existing store lease extensions are subject to a judicious review and Board sign off.

Our online sales grew to £13.8m, up from just £0.5m in 2009. We offer our full in-store ranges on our ScS website.

In 2014 ScS began operating a furniture and flooring range for House of Fraser and we offer a collection of sofas, flooring, dining and occasional products. Throughout the year the concession operated from 27 House of Fraser stores across the UK.

The retail network is supported by nine strategically placed regional distribution centres. We believe this regional footprint is ideal for optimising customer deliveries, whilst maximising business efficiency.

houseoffrasermadetoordersofas.co.uk

Download At a glanceWhere we are

Chairman's statement

A strong year of profitable growth and increased resilience

I am pleased to report a third consecutive year of progress, with growth in sales and margins, coupled with increased resilience in the business. These results are particularly encouraging given the ongoing uncertainty in the UK retail sector.

In light of this challenging environment, a review of the Group’s strategy was completed during the year. This has provided increased focus on the areas we feel will continue to deliver value to our customers, colleagues and shareholders.

Financial and strategic objectives

The strategy continues to pursue the same key objectives:

- Deliver profitable and sustainable growth;

- Improve the quality of earnings;

- Improve business resilience through the economic cycle; and

- Increase shareholder returns.

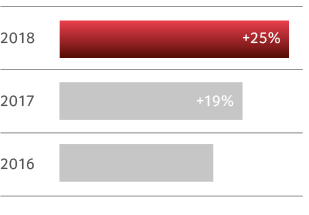

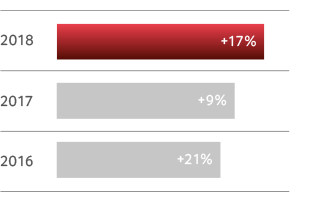

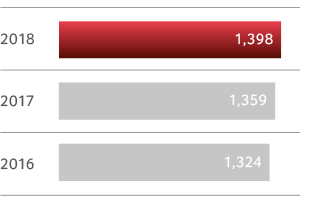

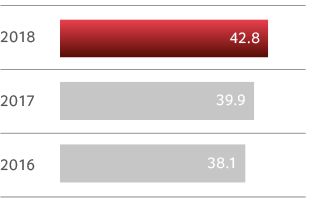

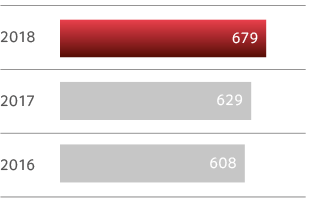

The business has continued to deliver against these objectives, further increasing revenue, gross profit, EBITDA and margins, whilst diligently controlling overheads. The continued strong cash flow generation has also strengthened our balance sheet and further enhanced the resilience of the Group.

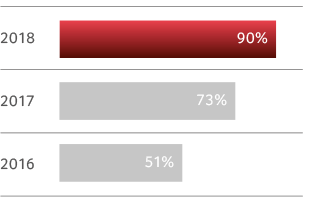

Our relentless focus on the customer experience and our value offering is a key part of the current and future strategy. Reaching the milestone of 100,000 customer reviews on Trustpilot was a considerable achievement for the Group; maintaining our 5-star ‘Excellent’ rating provides further evidence that customers enjoy shopping with us.

Results and dividend

I am once again pleased to report that the Group has delivered results ahead of market expectations. This is particularly pleasing given the continued challenging trading environment, and demonstrates the resilience of the business and the success of our focus on offering an excellent customer experience with outstanding value, quality and choice.

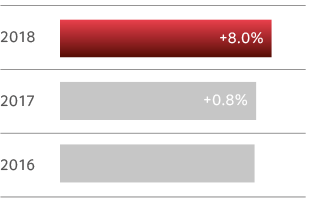

The first half of the financial year saw the Group trade strongly, with overall like-for-like performance growth of 2.2%. However, the second half of the year brought more challenging conditions across the market. Extreme bad weather at the end of February and exceptionally warm weather through June and July, coupled with the World Cup, resulted in like-for-like orders in the second half declining by 2.6%. Given these headwinds, it is encouraging that we have delivered a full-year like-for-like order increase of 0.2%.

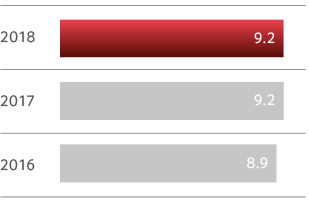

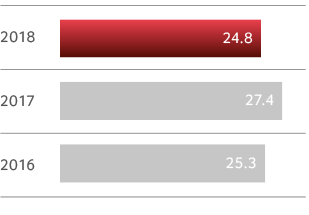

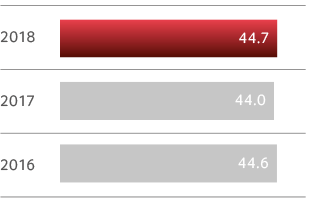

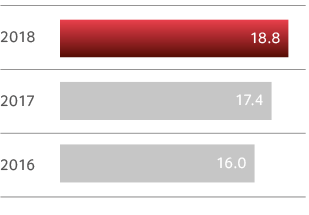

As part of our continued aim to improve profitability, we have continued to identify and implement various business efficiencies, both within gross margin and overhead costs, and these initiatives have helped to increase our EBITDA margin, resulting in a 14.0% increase in earnings per share (EPS) from 23.5p to 26.8p.

During the year we successfully opened one new ScS store in Chelmsford and this, along with the full year impact of new stores opened during the previous financial year, has helped to drive the increase in revenue in the year. As part of our ongoing reviews to ensure we have the best stores in the best locations we also took the decision to not renew the lease on one of our Edinburgh stores, which was not achieving the level of return the Group desires for the capital invested.

Our concession within House of Fraser, which represented 7.1% of gross sales, has had a particularly challenging year. The ongoing uncertainty throughout the year as to the viability of the House of Fraser business culminated in the business going into administration shortly after our year end. The business and assets were subsequently bought by Sports Direct International plc and, whilst we continue to trade from all 27 concessions, order performance has continued to be disappointing. We are currently in discussions with the new owners with a view to agreeing a mutually beneficial arrangement, which will allow us to continue trading in a profitable manner in as many of the current concessions as possible.

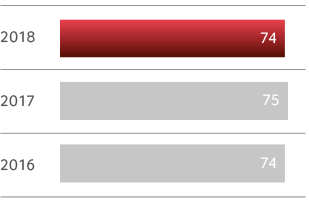

The Group continues to hold no debt, had cash reserves of £48.2m at 28 July 2018 (2017: £40.1m) and, after paying out a further £6.0m (2017: £5.9m) in dividends in the year, generated net cash flows in the year of £8.0m (2017: £17.7m). The Group continues to maintain a £12.0m committed revolving credit facility, which was extended during the year to November 2021. This provides further resilience, whilst also allowing the Group to take advantage of opportunities as they arise.

Whilst the continued uncertain economic environment means that we expect trading to continue to be challenging, the improved results year-on-year, coupled with the strength of the Group’s balance sheet, has resulted in the Board proposing a final dividend of 10.90p. If approved, this would give a full year dividend of 16.2p, an increase of 10.2% on the full-year dividend for 2017.

Conclusion

The continued strength and resilience of the Group is built on the hard work, dedication and expertise of all of the people who work for the business. On behalf of the Board, I would like to thank all of our 1,932 team members throughout the business, in particular for their determination and commitment in helping us to continue to grow despite the continued challenging trading conditions. This is a particularly difficult time for our 124 employees working across our House of Fraser concessions, and I would especially like to thank them for their professionalism and patience whilst we do our very best to agree a way forward with the new owners.

The Group has a clear strategy, underpinned by strong cash flows and the increasing resilience of the Group’s balance sheet. The Group is positioned to take advantage of future opportunities and whilst there remains a level of uncertainty in the wider economy and within our House of Fraser concessions, the Board remains positive about the long-term prospects for the business.

Alan Smith

Chairman

1 October 2018

Alan Smith

Chairman

1 October 2018

Our business model

The ScS business model offers a high quality, competitively priced range of furniture, flooring and related products to our customers with great service – supported by experienced expert staff, modern comfortable stores, an efficient supply chain and flexible cost base – resulting in outstanding value, quality and choice for our customers.

Our competitive strengths

Expert staff

Experienced and knowledgeable staff who are passionate about helping our customers operate throughout the business. This starts with our product sourcing team, who ensure our customers have the right choice, value and quality available to them in-store and online. Great product is supported by our knowledgeable in-store teams who help customers make the right choices. Our in-house delivery teams and dedicated service and support teams ensure the whole customer journey is as smooth as possible.

Customer service, awareness and nationwide coverage

Customers can shop with confidence with our maximum 5-star Trustpilot rating. With over 100 years of trading experience and many years of marketing investment we are a known destination for customers looking for their next sofa or flooring. With 101 stores and 27 House of Fraser concessions we offer nationwide coverage from Aberdeen to Plymouth.

Modern and comfortable stores

Our stores offer a wide range of fabric and leather sofas, flooring and furniture that help make a house a home.

An omnichannel shopping experience

Our continued investment in our trading websites ensures the customer has a first class experience, whether looking to buy online or simply using the site to research and view our great products and offers.

Efficient, reliable supply chain

We source from a small group of specialist, mainly UK-based suppliers, most of whom we have worked with for many years and we are their key customer.

Flexible cost base

Our make to order business model ensures over 75% of our costs are proportioned to sales, or are discretionary.

How we leverage our strengths to deliver the best experience for our customers

Choice & value

We are sofa and flooring specialists and this is the core of our customer proposition – offering a wide range of styles, fabrics, brands and value.

Credit

Offering choices for our customers with affordable monthly payments.

Quality

Working with leading furniture and flooring brands and a small group of trusted suppliers, we aim to provide a quality and durable product for our customers.

Service

Customer deliveries are principally carried out by our own experienced workforce, which is central to our strategy of providing the best customer experience.

Convenience

Our customers can find many of their home furnishing needs under one roof, with 128 locations to choose from around the UK, in addition to our online offering.

Online

Our digital channels are key to our customer experience and are designed to support and compliment our stores.

Revenue generating activities

Value creation

For customers

Providing an excellent customer experience with outstanding value, quality and choice.

We have now received feedback from over 100,000 of our customers via Trustpilot and we are proud to have retained our 5-star 'Excellent' rating.

For colleagues

Building a great place to work, where growth continues in a challenging economy.

A workplace where hard work is recognised and opportunities exist for progression.

Improving communication and clarity with the launch of the refreshed company strategy and values.

For our stakeholders

Through our continued growth of revenue, margins, profits and dividends underpinned by our strong cash flows we continue to deliver value for our shareholders, whilst building resilience.

Our strategy

To continue to achieve growth in today’s economy we are focused on creating a great place to work. Recognising the contribution individuals make and creating opportunities for progression is important to us.

Core valuesWe’ve refreshed our core values and have helped our teams focus on getting it RIGHT:

- Responsive

- Inclusive

- Get it right

- Hard working

- Trusted

Our new mobile-first recruitment website takes candidates straight to the available positions local to them; applying online is easy and quick and if candidates don't see a role that suits them they can register with us and join our candidate bank for when a future opportunity arises.

Creating opportunitiesDuring FY18 12% of our staff were promoted within our business. Every member of the team was given an opportunity to participate in training activities. Our most recent staff survey showed improvements in all the areas measured compared to previous surveys.

For such an important purchase, customers want confidence that their retailer of choice can deliver on their promises. To aid this, we encourage our customers to leave feedback on the independent Trustpilot platform. Nothing gives customers more insight than other customers' feedback.

Every review is taken seriously, especially where they identify areas for improvement. Part of our management's remuneration is driven by the quality of customer experience they deliver.

We are currently investing in technology that will enhance our customer journey, covering web research, in-store experience, delivery and aftercare.

The advancements will offer customers more choice and flexibility throughout their buying journey.

In addition we will be reviewing our internal processes and procedures to ensure that we adopt a customer-first focused approach across all of our teams.

We are able to utilise feedback from customers provided via Trustpilot and our Aftercare team to provide our suppliers with detailed information on the performance of their product.

The feedback is utilised by our suppliers to improve product quality and durability with targets set for levels of improvement.

Product performanceWe monitor the performance of each of the products in our range. This helps identify changing customer preferences and allows the business to act appropriately to ensure we maximise our retail space.

A full review of the range (furniture and flooring) offered in store and online was carried out in the current year, ensuring we continue to provide great value, quality and choice. During the year, we refreshed a number of our products, including the re-launch of our dining and occasional furniture offering.

BrandsBeing home to some of the UK’s best-loved furniture and flooring brands gives customer’s further confidence in our authority and the quality we can offer. The majority of our branded products are exclusive to the Group, making ScS the destination for buying the biggest and best brands.

With our heritage and authority in the sofa and flooring marketplace, customers can feel confident that our teams will help them make the right choice. Building on this experience and quality is a key priority for 2019.

AffordabilityOur wide range of products at different price points allow customers to choose furniture and flooring they love. To compliment this we also offer a number of credit options, including 48 month interest free credit.

The year saw the Group open one ScS store in Chelmsford. Following the successful opening of a new store in Edinburgh in December 2016, we have closed our existing Edinburgh store.

MarketingCalling our customers to action is a key activity in the Group. We advertise on all the traditional media platforms (TV, radio and press) and also on the emerging digital platforms. Making our spend have the biggest impact is critical, often focusing activity around key trading days and in line with seasonal spending patterns.

The existing site is under review to see how we can improve the user experience, including navigation, speed and content. Recently deployed insight tools have provided insight into the areas where we can make quick wins.

Improving product presentation and user experienceThe Group is exploring how it best meets the ever changing demands of the online customer and optimises the research tools for our customers who prefer to shop in store. This includes improved search functionality product imagery, and video content.

Over the past three years the Group has increased its digital spend. With the improved insight and improved website content and functionality this is an area the Group will continue to grow its investment in 2019.

Creating a market leading websiteWe have recently appointed a new provider to help replatform the website, striving for best-in-class functionality and performance.

Promoted under the House of Fraser 'Made to order, Sofas, Furniture and Flooring' brand, the product offering is tailored to the target market.

Building customer confidence and awarenessWith the well-publicised challenges and changes House of Fraser has seen over the past few months, rebuilding customer confidence in the brand is key. Awareness that the department store also houses a furniture and flooring offering that is one of the strongest on the high street is also a key focus.

The Group currently operates from 27 House of Fraser stores.

We remain in dialogue with House of Fraser as they restructure and reinvest, with possible opportunities in their remaining stores network, and remain hopeful that the long-term outcome of the restructuring will be a stronger House of Fraser that can benefit both its customers and ourselves as concession partners.

Just as we do with our furniture services, we measure the performance of our teams involved in the provision of flooring. Trustpilot reviews specific to flooring are fed back to our teams so we can learn and improve.

Optimising our footprintA review of our flooring offer and positioning in our stores in 2018 has led to a refurbishment programme that will be completed in 2019. This refit and re-location will enhance the flooring offer, increase awareness and improve the customer shopping experience.

Our non-stock operation allows the Group to carry a range of flooring products that rivals the market leaders, with over 120 ranges available and 5,000 SKUs. In the current year, the range has been re-categorised to improve and simplify the shopping experience.

Customer awarenessWe are confident that further growth can be achieved through increasing customer’s awareness of the ScS flooring offering. We increasingly find customers are interested in the proposition of fitting new flooring and purchasing furniture at the same time.

A review of the Group's procurement (both direct and indirect) commenced in the current year and continues. This review has helped with the increase in gross margin noted in the current year. Services and products purchased by the Group will be tendered in line with procurement best practice.

Cost base flexibilityWhilst the Group is happy to invest in taking the business forward, it continues to recognise the importance of having a cost base that is appropriate to a business with a high level of operational gearing. The business estimates that 75% of its cost base is flexible.

The current year has seen the establishment of regular margin reviews with the key operating units of the business. This has been aided by improved reporting and insight from a strengthened reporting team.

Simplifying processesProcess reviews are ongoing in a number of the areas of the business with the aim of finding a more efficient way of operating. The use of technology is also being considered where the business case supports the required investment.

Ensuring that we are able to attract and retain high quality and experienced people right across our business, is key to ensuring the growth and development of the Group.

The UK is currently experiencing high levels of employment. This,along with increases to the minimum and living wage, is placing upward pressure on salaries and demands for skilled labour.

Our people are key to all aspects of our business operation. It is essential that we ensure that each of our team members have the skills necessary to be able to do their job and sufficient knowledge to ensure that our strong brand and reputation continue to grow.

Customers have a great deal of choice and flexibility when it comes to where they shop. If our brand or reputation becomes damaged in any way, customers may choose to shop elsewhere rather than visit us to consider a purchase.

Our people and cultureFailure to attract, develop and retain good people working with our customers can impact on the customers buying experience.

Customers are increasingly demanding of retailers and want a service that suits their needs and requirements. Without investment in business systems that facilitate this, customers may become unhappy with a lack of flexibility to meet their needs.

Failure to deliver a safe, quality product in line with customer expectations risks the reputation of the Group, resulting in a loss of customer confidence and declining sales volumes.

Regulation and complianceIf we are supplied with a product that does not meet the required safety and quality standards this could result in financial or reputational damage.

A challenging consumer market can lead to a drop in revenue for suppliers with an impact on their long-term viability.

With the big-ticket nature of our sales, a reduction in consumer confidence may lead to a fall in discretionary spending.

CompetitionWith an increasingly competitive market, the ability to respond to the changing customers’ needs and shopping habits is critical.

The inability to offer interest free credit would have a material impact on the Group’s proposition.

Seasonality/extreme weatherProlonged extreme weather, either hot or cold, could impact on store footfall. This is important due to the seasonal nature of big ticket furniture retailing.

With the ongoing emergence of online businesses offering furniture coupled with the increase of products researched/purchased online the Group’s trading websites must be of good standard.

Our peopleFailure to attract, develop and retain good people in this area increases the reliance on third party providers.

A loss of the websites or underlying business operating system would cause a disruption to the customer-purchasing journey and could lead to loss of business.

Recent news will have reduced consumer confidence in House of Fraser. A failure to rebuild this confidence will lead to a deterioration of sales.

Our peopleGiven the uncertainty surrounding the high street and House of Fraser in particular, attracting and retaining good quality people will prove challenging.

Failure of the traditional department stores to adapt to changing customer shopping habits may lead to reduced shopper footfall.

A reduction in consumer confidence or activity levels in the housing market could reduce demand for new flooring.

Our people and cultureAttracting and retaining high quality, experienced sales and operating teams is key to continuing to offer the high levels of service we currently deliver. The availability of these people will be critical if the Group is to maximise the opportunity in the flooring market.

The market is in a period of change following the market leader’s decision to reduce the number of operating locations. Whilst the impact this will have on the market is not yet clear, this change will create opportunities as well as risks.

A reduction in consumer confidence could lead to reduced demand which, due to the level of operational gearing in the business could have a significant impact on the Group’s profit levels. Exchange and interest rate fluctuations could also lead to cost pressure.

As seen in the current year, extreme weather conditions can lead to reduced footfall and in turn reduced revenue.

Consumer financeA reduction in the availability of reasonably priced finance may reduce the ability of the Group to offer interest free credit, which is a key part of the Group’s customer proposition.

Download centre

Download full Annual Report and Accounts 2018 (2.5MB)

Strategic Report

Corporate Governance

Financial Statements