INSURANCE OPERATIONS

Aflac's insurance business consists of two segments: Aflac Japan and Aflac U.S. Aflac Japan, which operates as a

branch of Aflac, is the principal contributor to consolidated earnings. U.S. GAAP financial reporting requires that a

company report financial and descriptive information about operating segments in its annual and interim period financial

statements. Furthermore, we are required to report a measure of segment profit or loss, certain revenue and expense

items, and segment assets.

We evaluate our sales efforts using new annualized premium sales, an industry operating measure. New annualized

premium sales, which include both new sales and the incremental increase in premiums due to conversions, represent the

premiums that we would collect over a 12-month period, assuming the policies remain in force. For Aflac Japan, new

annualized premium sales are determined by applications submitted during the reporting period. For Aflac U.S., new

annualized premium sales are determined by applications that are issued during the reporting period. Premium income, or

earned premiums, is a financial performance measure that reflects collected or due premiums that have been earned

ratably on policies in force during the reporting period.

44

AFLAC JAPAN SEGMENT

Aflac Japan Pretax Operating Earnings

Changes in Aflac Japan's pretax operating earnings and profit margins are primarily affected by morbidity, mortality,

expenses, persistency and investment yields. The following table presents a summary of operating results for Aflac Japan

for the years ended December 31.

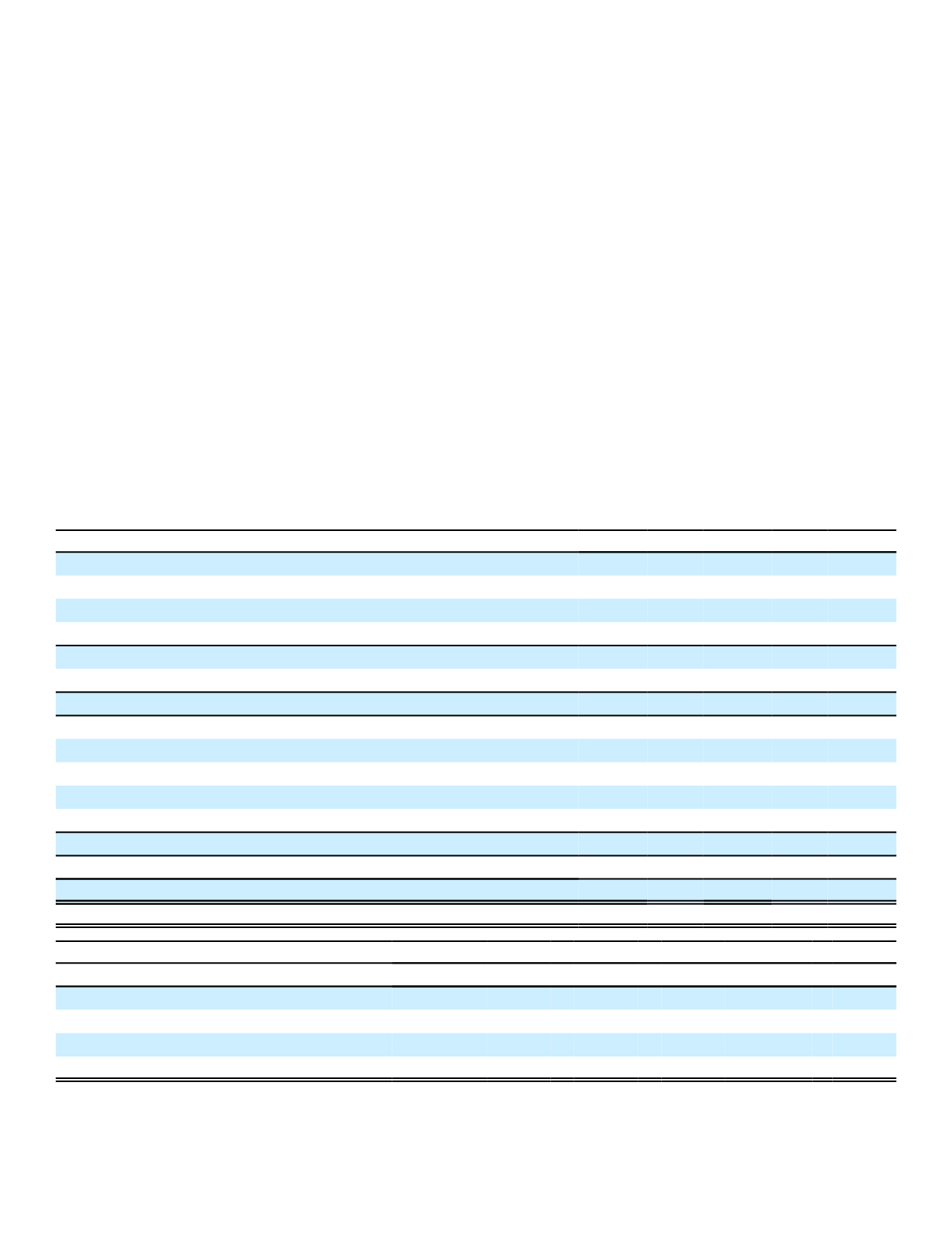

Aflac Japan Summary of Operating Results

(In millions)

2016

2015

2014

Net premium income

$ 13,537

$ 12,046

$ 13,861

Net investment income:

Yen-denominated investment income

1,346

1,227

1,429

Dollar-denominated investment income

1,208

1,209

1,233

Net investment income

2,554

2,436

2,662

Other income (loss)

40

31

32

Total operating revenues

16,131

14,513

16,555

Benefits and claims, net

9,828

8,705

10,084

Operating expenses:

Amortization of deferred policy acquisition costs

644

578

649

Insurance commissions

787

719

845

Insurance and other expenses

1,538

1,336

1,519

Total operating expenses

2,969

2,633

3,013

Total benefits and expenses

12,797

11,338

13,097

Pretax operating earnings

(1)

$ 3,334

$ 3,175

$ 3,458

Weighted-average yen/dollar exchange rate

108.70

120.99

105.46

In Dollars

In Yen

Percentage change over previous period:

2016

2015

2014

2016

2015

2014

Net premium income

12.4%

(13.1)% (7.5)%

.8%

(.4)% .1%

Net investment income

4.9

(8.5)

.4

(5.8)

4.8

8.8

Total operating revenues

11.2

(12.3)

(6.4)

(.3)

.5

1.3

Pretax operating earnings

(1)

5.0

(8.2)

(4.7)

(5.7)

5.3

3.1

(1)

See the Insurance Operations section of this MD&A for our definition of segment operating earnings.

Annualized premiums in force at December 31, 2016, were 1.61 trillion yen, compared with 1.62 trillion yen in 2015

and 1.59 trillion yen in 2014. The decrease in annualized premiums in force in yen of .7% in 2016 reflects the net effect of

sales of new policies combined with limited-pay policies becoming paid-up and the persistency of Aflac Japan’s business.