For further information regarding Aflac's U.S. financial results and sales, see the Aflac U.S. Segment subsection of

MD&A in this report.

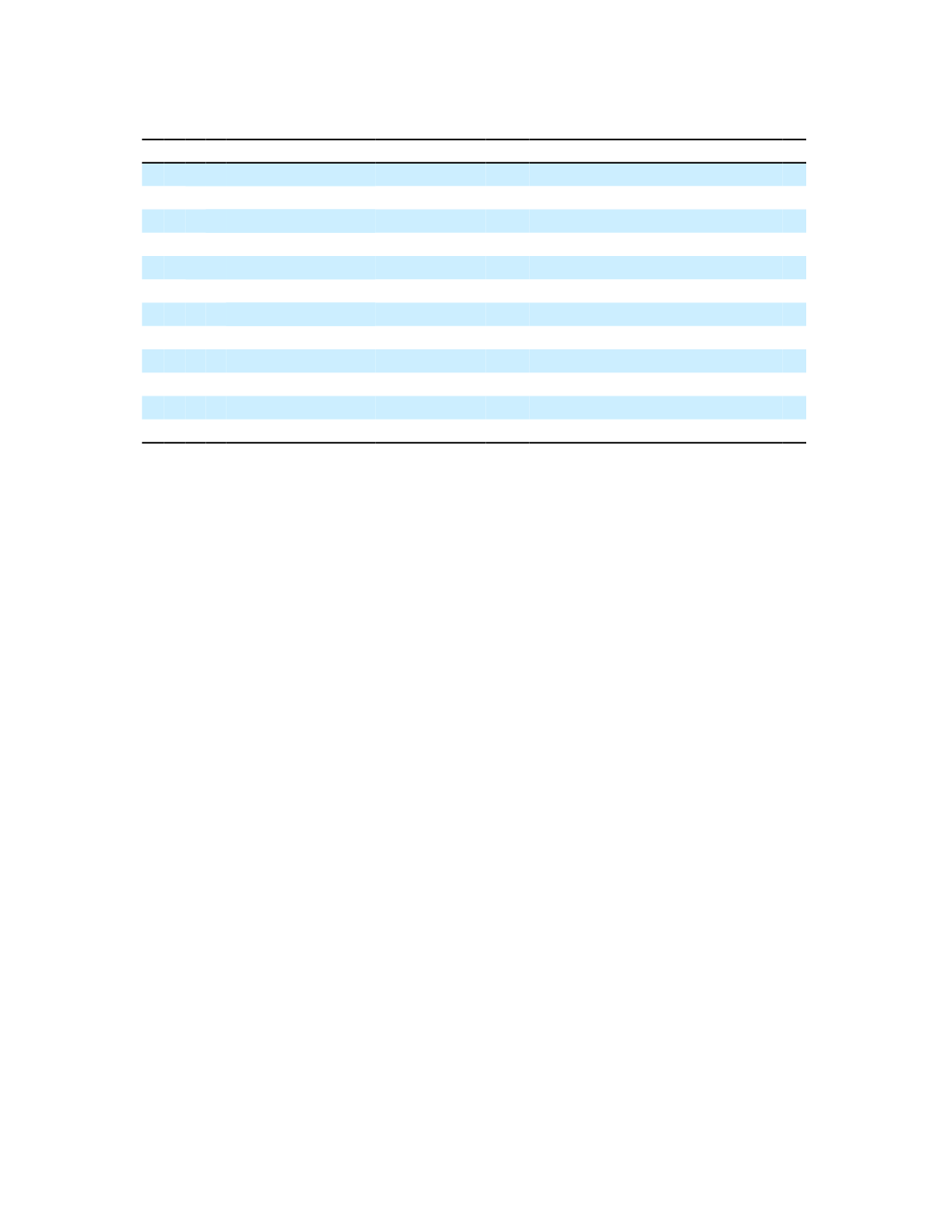

Insurance Products

Aflac Japan

Aflac U.S.

Third Sector Insurance

Cancer

Cancer

Accident

Medical

Short-Term Disability

Income Support

Critical Illness

First Sector Insurance

Hospital Indemnity

Life

Dental

Protection

Vision

Term

Life (Term, Whole)

Whole

Savings

Hybrid (WAYS)

Child Endowment

Japan

Aflac Japan's insurance products are designed to help consumers pay for medical and nonmedical costs that are not

reimbursed under Japan's national health insurance system. Changes in Japan's economy and an aging population have

put increasing pressure on Japan's national health care system. As a result, more costs have been shifted to Japanese

consumers, who in turn have become increasingly interested in insurance products that help them manage those costs.

Aflac Japan has responded to this consumer need by enhancing existing products and developing new products.

The foundation of Aflac Japan's product portfolio has been, and continues to be, our third sector cancer and medical

insurance products. Aflac pioneered the cancer insurance market in Japan in 1974, and we remain the number one

provider of cancer insurance in Japan today. Over the years, we’ve customized our cancer insurance product to respond

to, and anticipate, the needs of our consumers and the advances in medical treatments. The cancer insurance plans we

offer in Japan provide a lump-sum benefit upon initial diagnosis of internal cancer and benefits for treatment received due

to internal cancer such as fixed daily benefits for hospitalization, outpatient services and convalescent care, and surgical

and terminal care benefits. In September 2014, Aflac Japan introduced New Cancer DAYS, a new cancer insurance

product which provides enhanced coverage, including outpatient treatments and multiple cancer occurrence benefits. At

the same time, premiums for this product have been lowered for most ages compared to prior plans. In October 2014,

Aflac Japan introduced a unique Aflac-branded cancer insurance product for Japan's postal system, Japan Post (see the

Distribution - Japan section for background information). In March 2016, we launched a cancer insurance product that

offers protection to customers who have survived cancer. As the number one provider of cancer insurance in Japan, we

believe these products further strengthen our brand, and most importantly, provide valuable benefits to consumers who

are looking for solutions to manage cancer-related costs.

In early 2002, we introduced EVER, a stand-alone, whole-life medical insurance product which offers a basic level of

hospitalization coverage with an affordable premium. Since its initial introduction, we have expanded our suite of EVER

product offerings to appeal to specific types of Japanese consumers and achieve greater market penetration. In June

2015, we upgraded our EVER insurance product to include riders to be associated with three critical illnesses (cancer,

heart attack, and stroke) to better respond to consumer’s needs for coverage of serious illnesses. These riders provide

policyholders with a benefit upon the diagnosis for those three critical illnesses, waiver of premium payment thereafter and

unlimited hospital days for such critical illnesses. Gentle EVER, our non-standard medical insurance product, is designed

to meet the needs of certain consumers who cannot qualify for our base EVER plan. An upgrade to our Gentle EVER

insurance product, released in July 2012, included expanded benefits and an attached advanced medical care rider.

In

March 2016, we made revisions to our Gentle EVER insurance product to enhance its alignment with changing customer

needs.

3