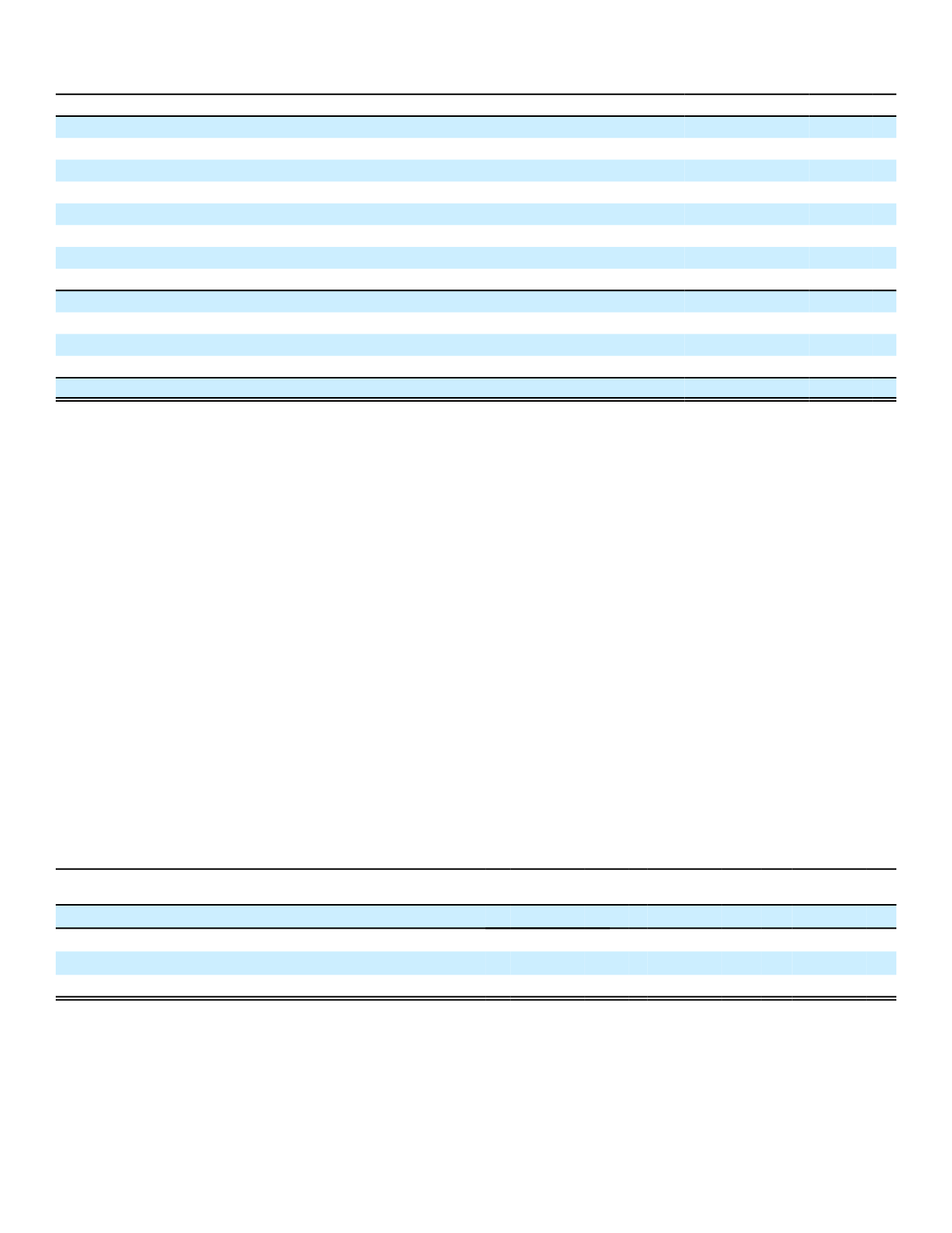

Composition of Portfolio by Sector

2016

2015

Debt and perpetual securities, at amortized cost:

Banks/financial institutions

(1)

9.8%

10.4%

Government and agencies

.6

.7

Municipalities

4.8

5.1

Public utilities

15.9

16.9

Sovereign and supranational

1.4

1.4

Mortgage- and asset-backed securities

.3

.3

Other corporate

53.7

52.0

Total debt and perpetual securities

86.5

86.8

Equity securities

.8

.0

Other investments

(2)

2.6

1.3

Cash and cash equivalents

10.1

11.9

Total investments and cash

100.0%

100.0%

(1)

Includes .3% of perpetual securities at December 31, 2016 and 2015, respectively.

(2)

Includes 2.5% and .9% of loan receivables at December 31, 2016 and 2015, respectively.

See Note 3 of the Notes to the Consolidated Financial Statements and the Market Risks of Financial Instruments -

Credit Risk subsection of MD&A for more information regarding the sector concentrations of our investments.

53

OTHER OPERATIONS

Corporate operating expenses consist primarily of personnel compensation, benefits, reinsurance retrocession

activities, and facilities expenses. Corporate expenses, excluding investment and retrocession income, were $141 million

in 2016, $90 million in 2015 and $91 million in 2014. Investment income included in reported corporate expenses was $18

million in 2016, $22 million in 2015 and $13 million in 2014, and net retrocession income was $7 million in 2016 and 2015.

ANALYSIS OF FINANCIAL CONDITION

Our financial condition has remained strong in the functional currencies of our operations. The yen/dollar exchange

rate at the end of each period is used to translate yen-denominated balance sheet items to U.S. dollars for reporting

purposes.

The following table demonstrates the effect of the change in the yen/dollar exchange rate by comparing select

balance sheet items as reported at December 31, 2016, with the amounts that would have been reported had the

exchange rate remained unchanged from December 31, 2015.

Impact of Foreign Exchange on Balance Sheet Items

(In millions)

As

Reported

Exchange

Effect

Net of

Exchange Effect

(1)

Yen/dollar exchange rate

(2)

116.49

120.61

Investments and cash

$116,361

$ 2,522

$113,839

Deferred policy acquisition costs

8,993

197

8,796

Policy liabilities

93,726

2,853

90,873

(1)

Amounts excluding foreign currency changes on U.S. dollar-denominated items (a non-U.S. GAAP measure) were determined using

the same yen/dollar exchange rate for the current period as the comparable period in the prior year.

(2)

The exchange rate at December 31, 2016, was 116.49 yen to one dollar, or 3.5% stronger than the December 31, 2015, exchange

rate of 120.61.