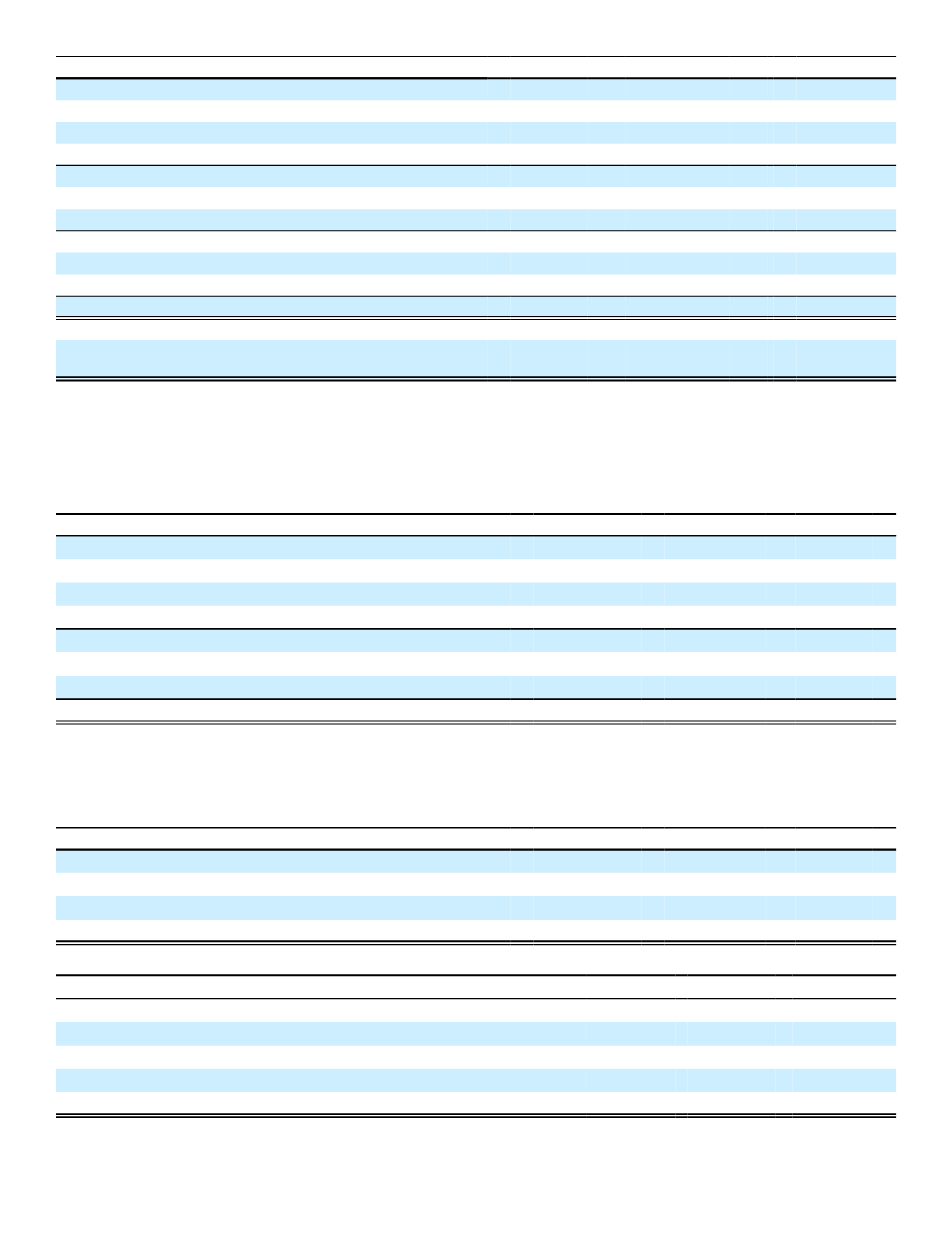

(In millions)

2016

2015

2014

Pretax earnings:

Aflac Japan

$ 3,334

$ 3,175

$ 3,458

Aflac U.S.

1,208

1,101

1,073

Other business segments

18

14

(2)

Total business segment pretax operating earnings

4,560

4,290

4,529

Interest expense, noninsurance operations

(128)

(146)

(198)

Corporate and eliminations

(129)

(71)

(78)

Pretax operating earnings

4,303

4,073

4,253

Realized investment gains (losses)

(1)

(208)

55

171

Other non-operating income (loss)

(28)

(3)

(266)

(2),(3)

67

Total earnings before income taxes

$ 4,067

$ 3,862

$ 4,491

Income taxes applicable to pretax operating earnings

$ 1,491

$ 1,403

$ 1,456

Effect of foreign currency translation on after-tax operating

earnings

141

(198)

(117)

(1)

Excluding a gain of $85 in both 2016 and 2015 and $44 in 2014 related to the interest rate component of the change in fair value of

foreign currency swaps on notes payable which is classified as an operating gain when analyzing segment operations

(2)

Includes a loss of $20 related to the change in value of yen repatriation received in advance of settlement of certain foreign currency

derivatives. This loss was offset by derivative gains included in realized investment gains (losses).

(3)

Includes expense of $137 in 2016 and $230 in 2015 for the payments associated with the early extinguishment of debt

Assets as of December 31 were as follows:

(In millions)

2016

2015

2014

Assets:

Aflac Japan

$ 107,858

$ 97,646

$ 98,525

Aflac U.S.

19,453

18,537

18,383

Other business segments

270

188

128

Total business segment assets

127,581

116,371

117,036

Corporate

26,476

23,375

24,596

Intercompany eliminations

(24,238)

(21,490)

(21,905)

Total assets

$ 129,819

$ 118,256

$ 119,727

Prior year amounts have been adjusted for the adoption of the accounting guidance on January 1, 2016 related to debt issuance costs.

Yen-Translation Effects:

The following table shows the yen/dollar exchange rates used for or during the periods

ended December 31. Exchange effects were calculated using the same yen/dollar exchange rate for the current year as

for each respective prior year.

2016

2015

2014

Statements of Earnings:

Weighted-average yen/dollar exchange rate

108.70

120.99

105.46

Yen percent strengthening (weakening)

11.3%

(12.8)%

(7.5)%

Exchange effect on pretax operating earnings (in millions)

$ 218

$ (288)

$ (180)

2016

2015

Balance Sheets:

Yen/dollar exchange rate at December 31

116.49

120.61

Yen percent strengthening (weakening)

3.54%

(.05)%

Exchange effect on total assets (in millions)

$ 2,820

$ (36)

Exchange effect on total liabilities (in millions)

3,109

(41)

100