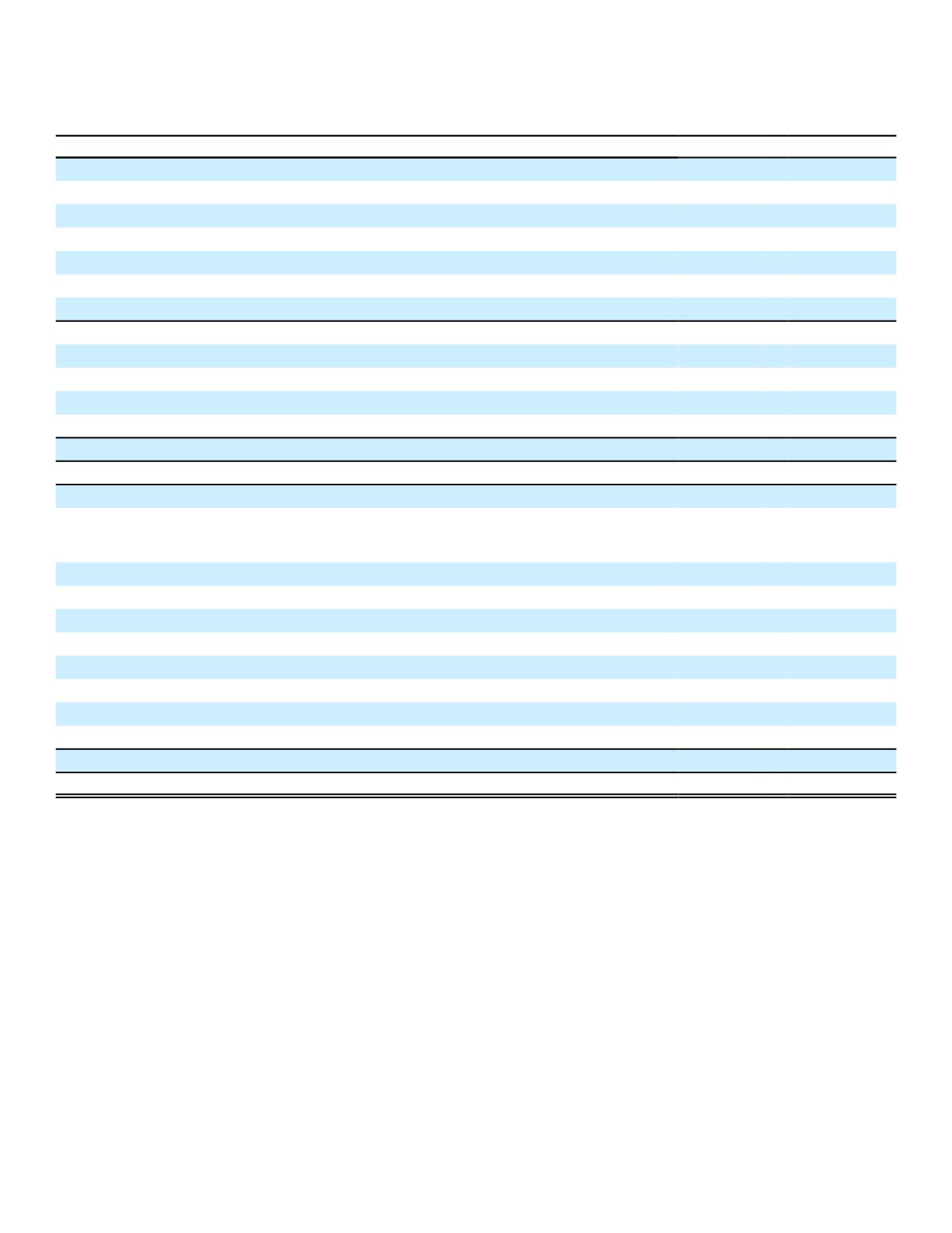

Aflac Incorporated and Subsidiaries

Consolidated Balance Sheets (continued)

December 31,

(In millions, except for share and per-share amounts)

2016

2015

Liabilities and shareholders’ equity:

Liabilities:

Policy liabilities:

Future policy benefits

$ 76,106

$ 69,687

Unpaid policy claims

4,045

3,802

Unearned premiums

6,916

7,857

Other policyholders’ funds

6,659

6,285

Total policy liabilities

93,726

87,631

Income taxes

5,387

4,340

Payables for return of cash collateral on loaned securities

526

941

Notes payable

5,360

4,971

Other

(3)

4,338

2,665

Total liabilities

109,337

100,548

Commitments and contingent liabilities (Note 15)

Shareholders’ equity:

Common stock of $.10 par value. In thousands: authorized 1,900,000

shares in 2016 and 2015; issued 671,249 shares in 2016 and 669,723

shares in 2015

67

67

Additional paid-in capital

1,976

1,828

Retained earnings

25,981

24,007

Accumulated other comprehensive income (loss):

Unrealized foreign currency translation gains (losses)

(1,983)

(2,196)

Unrealized gains (losses) on investment securities

4,805

2,986

Unrealized gains (losses) on derivatives

(24)

(26)

Pension liability adjustment

(168)

(139)

Treasury stock, at average cost

(10,172)

(8,819)

Total shareholders’ equity

20,482

17,708

Total liabilities and shareholders’ equity

$ 129,819

$ 118,256

(3)

Includes $146 in 2016 and $293 in 2015 of derivatives from consolidated variable interest entities

Prior-year amounts have been adjusted for the adoption of accounting guidance on January 1, 2016 related to debt issuance costs.

See the accompanying Notes to the Consolidated Financial Statements.

83