Highlights

“We have delivered occupancy, cash flow and earnings growth for the fifth year in a row following the deep recession in 2008 and 2009.”

Another year of

cash flow, earnings

& dividend growth

| Financial metrics | Year ended 31 March 2014 |

Year ended 31 March 2013 |

Growth % |

|

|---|---|---|---|---|

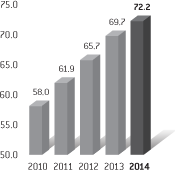

| Revenue | £72.2m | £69.7m | 4 | |

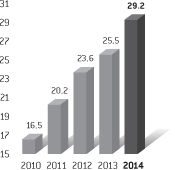

| Adjusted profit before tax(1) | £29.2m | £25.5m | 15 | |

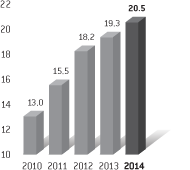

| Adjusted EPRA earnings per share(2) | 20.5p | 19.3p | 6 | |

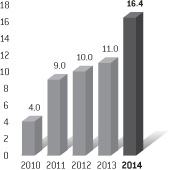

| Dividend | – final | 8.4p | 6.0p | 40 |

| – total | 16.4p | 11.0p | 49 | |

| Adjusted NAV per share(3) | 446.5p | 419.2p | 7 | |

| Cash flow from operating activities (after net finance costs) | £32.8m | £30.2m | 9 | |

| Store metrics | ||||

| Occupancy growth – all stores | 200,000 sq ft | 174,000 sq ft | 15 | |

| Occupancy growth – wholly owned stores | 165,000 sq ft | 90,000 sq ft | 83 | |

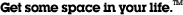

| Occupancy – wholly owned stores | 69.8% | 64.8% | 8 | |

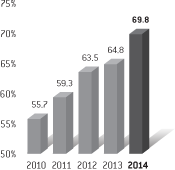

| Net achieved rent per sq ft | £26.15 | £24.65 | 6 | |

| Revenue per available foot (“REVPAF”)(4) | £20.64 | £19.94 | 4 | |

| Statutory metrics | ||||

| Profit before tax | £59.8m | £31.9m | 87 | |

| Basic earnings per share | 42.5p | 24.4p | 74 | |

- Growth in all our key store metrics

- Year-on-year fourth quarter store revenue increased by 11% to £17.7 million

(same quarter last year: £16.0 million) - Cash flows from operating activities (after net finance costs) increased by

9% to £32.8 million - 49% increase in the total dividend for the year to 16.4p

- Reduction of Group net debt(5) by £4.4 million to £226.1 million

- Opening of our prominent store at Gypsy Corner, West London, on the A40 in April 2014

- Acquisition of ten store Armadillo Self Storage portfolio through a joint venture

with an Australian consortium in April 2014 - Big Yellow’s national brand leadership confirmed by 2014 YouGov survey

1 See note 10 2 See note 12 3 See notes 12 and 14 4 See Portfolio Summary 5 See note 18

Occupancy (%)

Net rent (per sq ft)

Revenue (£m)

Adjusted profit

before tax (£m)

Adjusted earnings

per share (pence)

Dividend per share

(pence)