inputs or current observable market data. As a result, the derivatives associated with our consolidated VIEs are classified

as Level 3 of the fair value hierarchy.

Loan Receivables

Our loan receivables do not have readily determinable market prices and generally lack market liquidity. Fair values

for loan receivables are determined based on the present value of expected future cash flows discounted at the applicable

U.S. Treasury or London Interbank Offered Rate (LIBOR) yield plus an appropriate spread that considers other risk

factors, such as credit and liquidity risk. These spreads are provided by the applicable asset managers based on their

knowledge of the current loan pricing environment and market conditions. The spreads are a significant component of the

pricing inputs and are generally considered unobservable. Therefore, these investments have been assigned a Level 3

within the fair value hierarchy. Loan receivables are included in other investments on the consolidated balance sheets.

Other policyholders' funds

The largest component of the other policyholders' funds liability is our annuity line of business in Aflac Japan. Our

annuities have fixed benefits and premiums. For this product, we estimated the fair value to be equal to the cash

surrender value. This is analogous to the value paid to policyholders on the valuation date if they were to surrender their

policy. We periodically check the cash value against discounted cash flow projections for reasonableness. We consider

our inputs for this valuation to be unobservable and have accordingly classified this valuation as Level 3.

Notes payable

The fair values of our publicly issued notes payable classified as Level 3 were obtained from a limited number of

independent brokers. These brokers base their quotes on a combination of their knowledge of the current pricing

environment and market conditions. We consider these inputs to be unobservable. The fair values of our yen-

denominated loans approximate their carrying values.

131

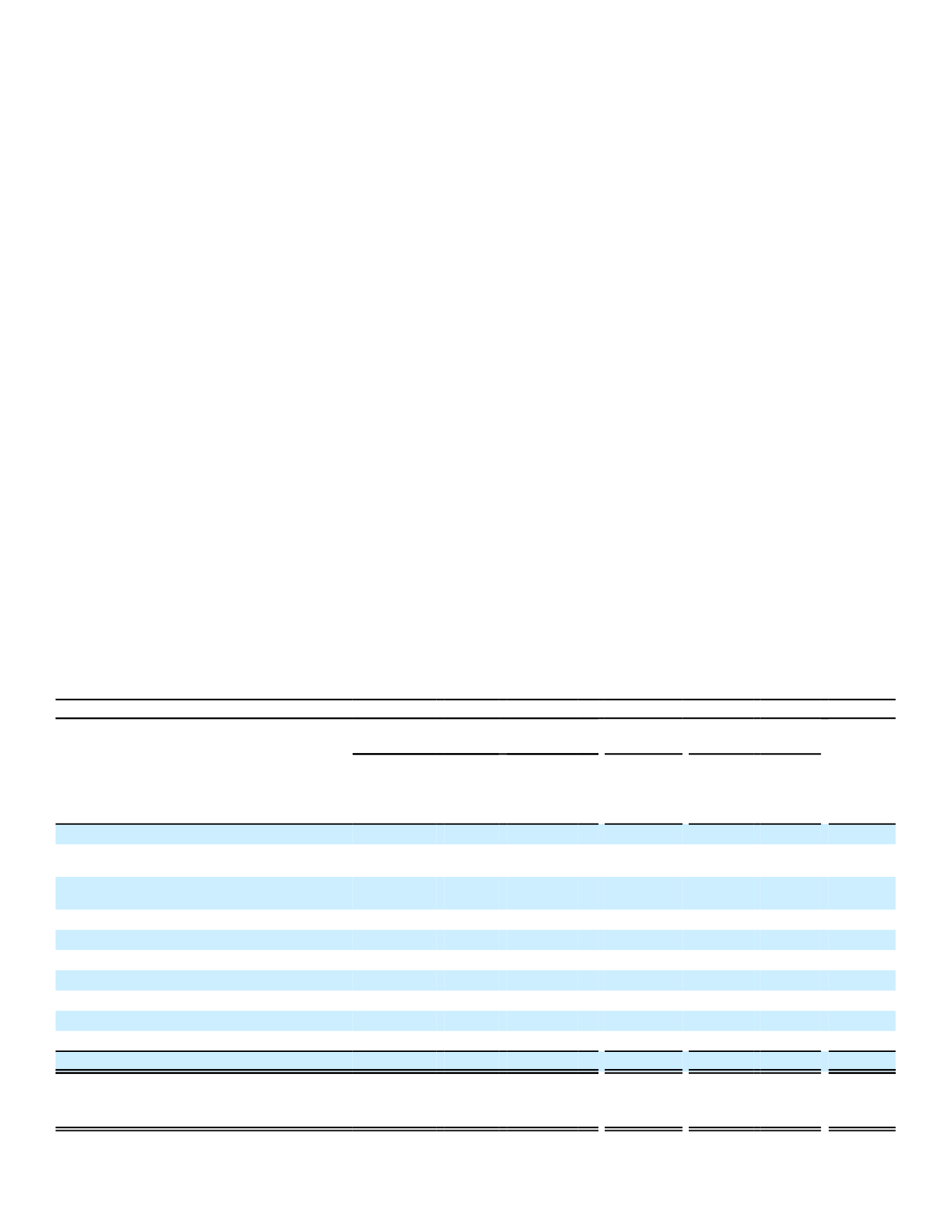

Transfers between Hierarchy Levels and Level 3 Rollforward

There were no transfers between Level 1 and 2 for the years ended December 31, 2016 and 2015, respectively.

The following tables present the changes in fair value of our available-for-sale investments and derivatives classified

as Level 3 as of December 31.

2016

Fixed Maturities

Equity

Securities

Derivatives

(1)

(In millions)

Mortgage-

and

Asset-

Backed

Securities

Public

Utilities

Banks/

Financial

Institutions

Foreign

Currency

Swaps

Credit

Default

Swaps

Total

Balance, beginning of period

$

220 $ 0 $

26

$

3 $ (192) $

1 $

58

Realized investment gains (losses) included

in earnings

0

0

0

0

194

1

195

Unrealized gains (losses) included in other

comprehensive income (loss)

38

0

(1)

0

(22)

0

15

Purchases, issuances, sales and settlements:

Purchases

0

16

0

0

0

0

16

Issuances

0

0

0

0

0

0

0

Sales

0

0

0

0

0

0

0

Settlements

(60)

0

0

0

(1)

0

(61)

Transfers into Level 3

0

0

0

0

0

0

0

Transfers out of Level 3

0

0

0

0

0

0

0

Balance, end of period

$

198 $ 16 $

25

$

3 $ (21) $

2 $ 223

Changes in unrealized gains (losses) relating

to Level 3 assets and liabilities still held at

the end of the period included in realized

investment gains (losses)

$

0 $ 0 $

0

$

0 $ 194 $

1 $ 195

(1)

Derivative assets and liabilities are presented net