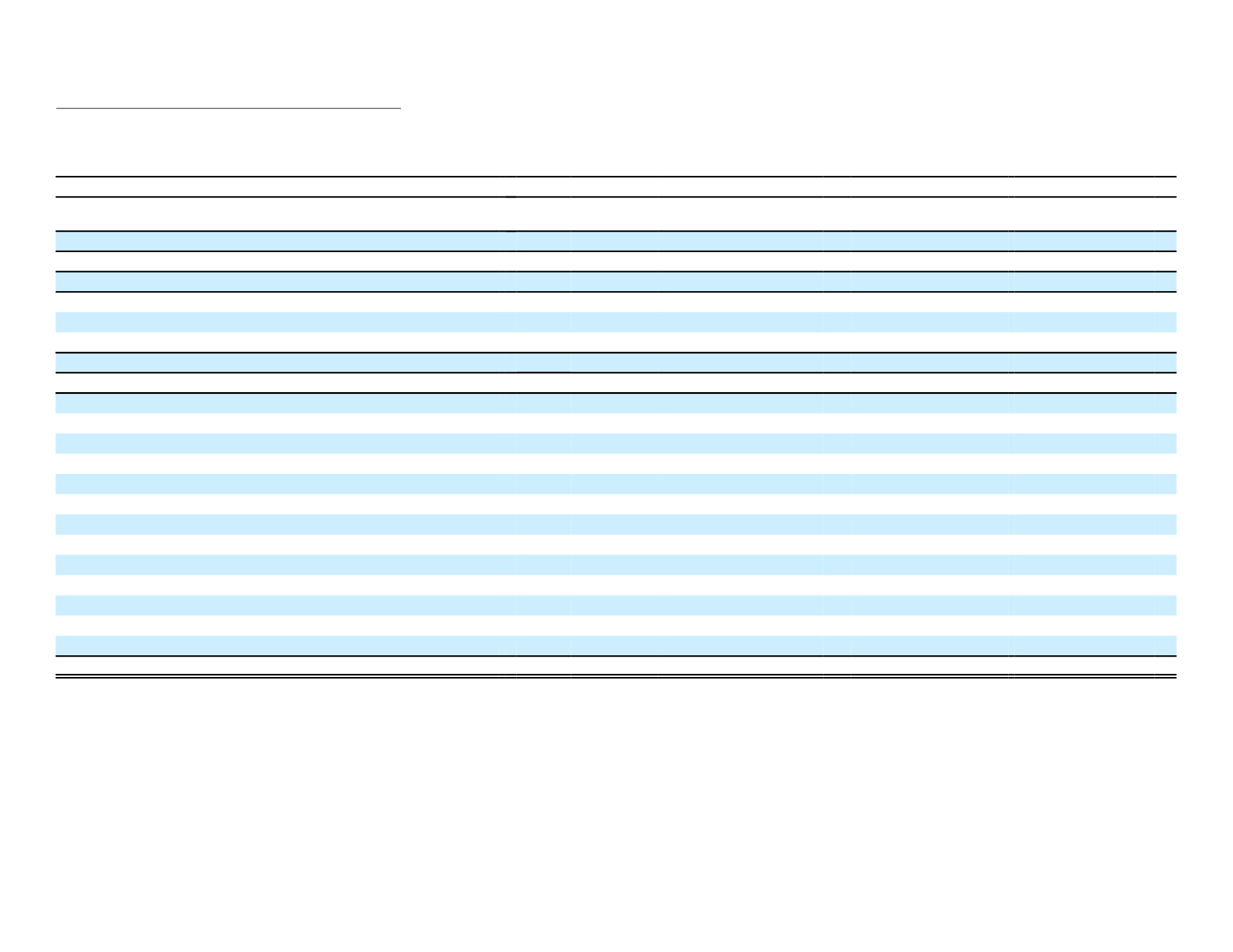

Fair Value Sensitivity

Level 3 Significant Unobservable Input Sensitivity

The following tables summarize the significant unobservable inputs used in the valuation of our Level 3 available-for-sale investments and derivatives as of

December 31. Included in the tables are the inputs or range of possible inputs that have an effect on the overall valuation of the financial instruments.

2016

(In millions)

Fair Value

Valuation Technique(s)

Unobservable Input

Range

(Weighted Average)

Assets:

Securities available for sale, carried at fair value:

Fixed maturities:

Mortgage- and asset-backed securities

$ 198

Consensus pricing

Offered quotes

N/A

(d)

Public utilities

16

Discounted cash flow

Historical volatility

N/A

(d)

Banks/financial institutions

25

Consensus pricing

Offered quotes

N/A

(d)

Equity securities

3

Net asset value

Offered quotes

$1 - $701 ($8)

Other assets:

Foreign currency swaps

16

Discounted cash flow

Interest rates (USD)

2.34% - 2.59%

(a)

Interest rates (JPY)

.22% - .80%

(b)

CDS spreads

17 - 172 bps

Foreign exchange rates

21.47%

(c)

29

Discounted cash flow

Interest rates (USD)

2.34% - 2.59%

(a)

Interest rates (JPY)

.22% - .80%

(b)

CDS spreads

16 - 88 bps

80

Discounted cash flow

Interest rates (USD)

2.34% - 2.59%

(a)

Interest rates (JPY)

.22% - .80%

(b)

Foreign exchange rates

21.47%

(c)

Credit default swaps

2

Discounted cash flow

Base correlation

52.18% - 56.07%

(e)

CDS spreads

54 bps

Recovery rate

36.69%

Total assets

$ 369

(a) Inputs derived from U.S. long-term rates to accommodate long maturity nature of our swaps

(b) Inputs derived from Japan long-term rates to accommodate long maturity nature of our swaps

(c) Based on 10 year volatility of JPY/USD exchange rate

(d) N/A represents securities where we receive unadjusted broker quotes and for which there is no transparency into the providers' valuation techniques or unobservable inputs.

(e) Range of base correlation for our bespoke tranche for attachment and detachment points corresponding to market indices

133