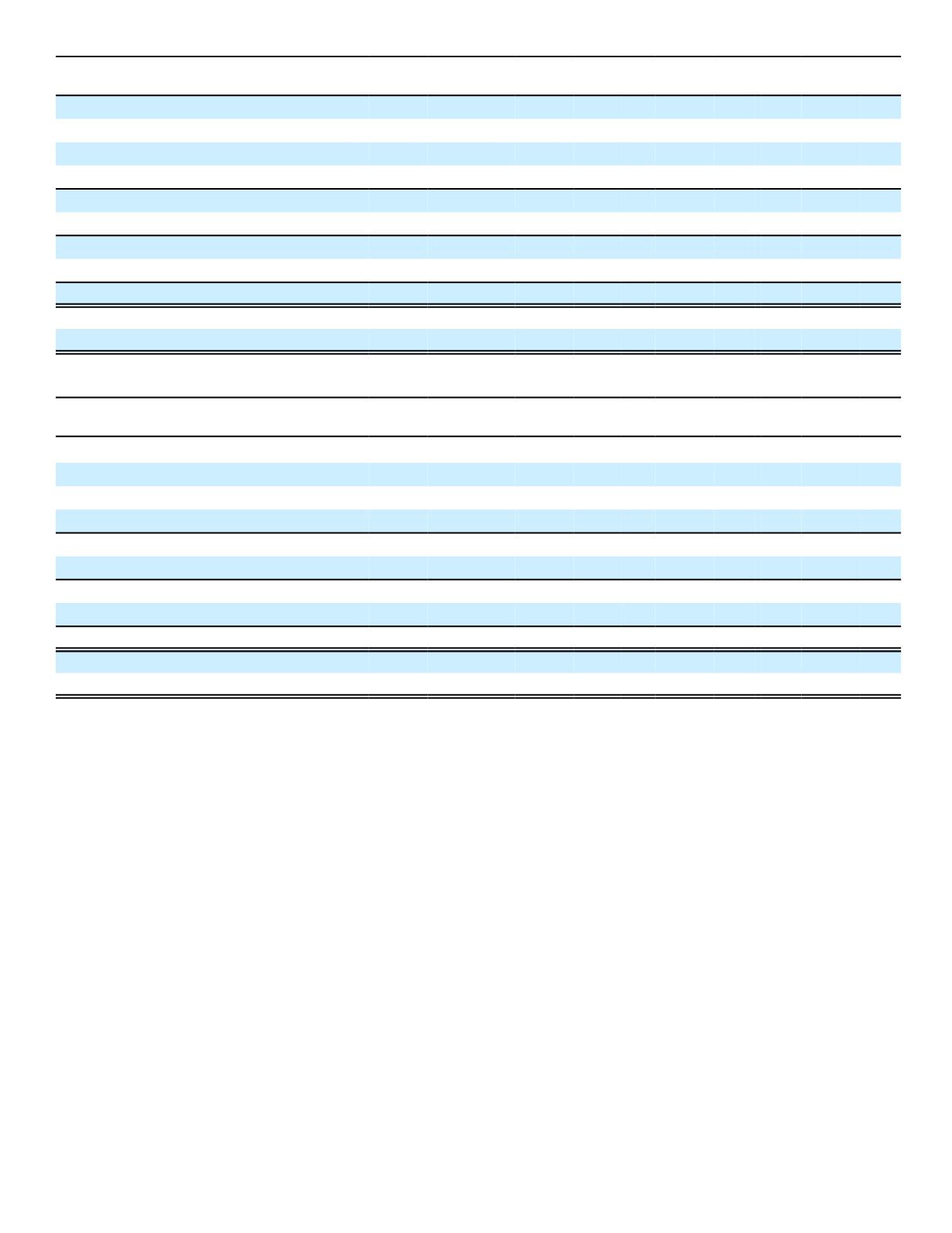

(In millions, except for per-share amounts)

March 31,

2016

June 30,

2016

September 30,

2016

December 31,

2016

Net premium income

$4,602

$4,823

$5,022

$4,778

Net investment income

801

822

842

813

Realized investment gains (losses)

73

(187)

(146)

137

Other income (loss)

(25)

(21)

(2)

227

Total revenues

5,451

5,437

5,716

5,955

Total benefits and expenses

4,334

4,603

4,753

4,802

Earnings before income taxes

1,117

834

963

1,153

Total income tax

386

286

334

402

Net earnings

$ 731

$ 548

$ 629

$ 751

Net earnings per basic share

$ 1.75

$ 1.33

$ 1.54

$ 1.85

Net earnings per diluted share

1.74

1.32

1.53

1.84

Quarterly amounts may not agree in total to the corresponding annual amounts due to rounding.

(In millions, except for per-share amounts)

March 31,

2015

June 30,

2015

September 30,

2015

December 31,

2015

Net premium income

$4,432

$4,364

$4,380

$4,394

Net investment income

782

777

784

792

Realized investment gains (losses)

13

127

(114)

114

Other income (loss)

(1)

19

(10)

19

Total revenues

5,226

5,287

5,040

5,319

Total benefits and expenses

4,213

4,413

4,176

4,209

Earnings before income taxes

1,013

874

864

1,110

Total income tax

350

301

297

380

Net earnings

$ 663

$ 573

$ 567

$ 730

Net earnings per basic share

$ 1.52

$ 1.33

$ 1.32

$ 1.72

Net earnings per diluted share

1.51

1.32

1.32

1.71

Quarterly amounts may not agree in total to the corresponding annual amounts due to rounding.

163

17. SUBSEQUENT EVENTS

In January 2017, the Parent Company issued 60.0 billion yen of senior notes through a U.S. public debt offering. The

notes bear interest at a fixed rate of .932% per annum, payable semi-annually, and have a 10-year maturity. These notes

may only be redeemed before maturity, in whole but not in part, upon the occurrence of certain changes affecting U.S.

taxation, as specified in the indenture governing the terms of the issuance.