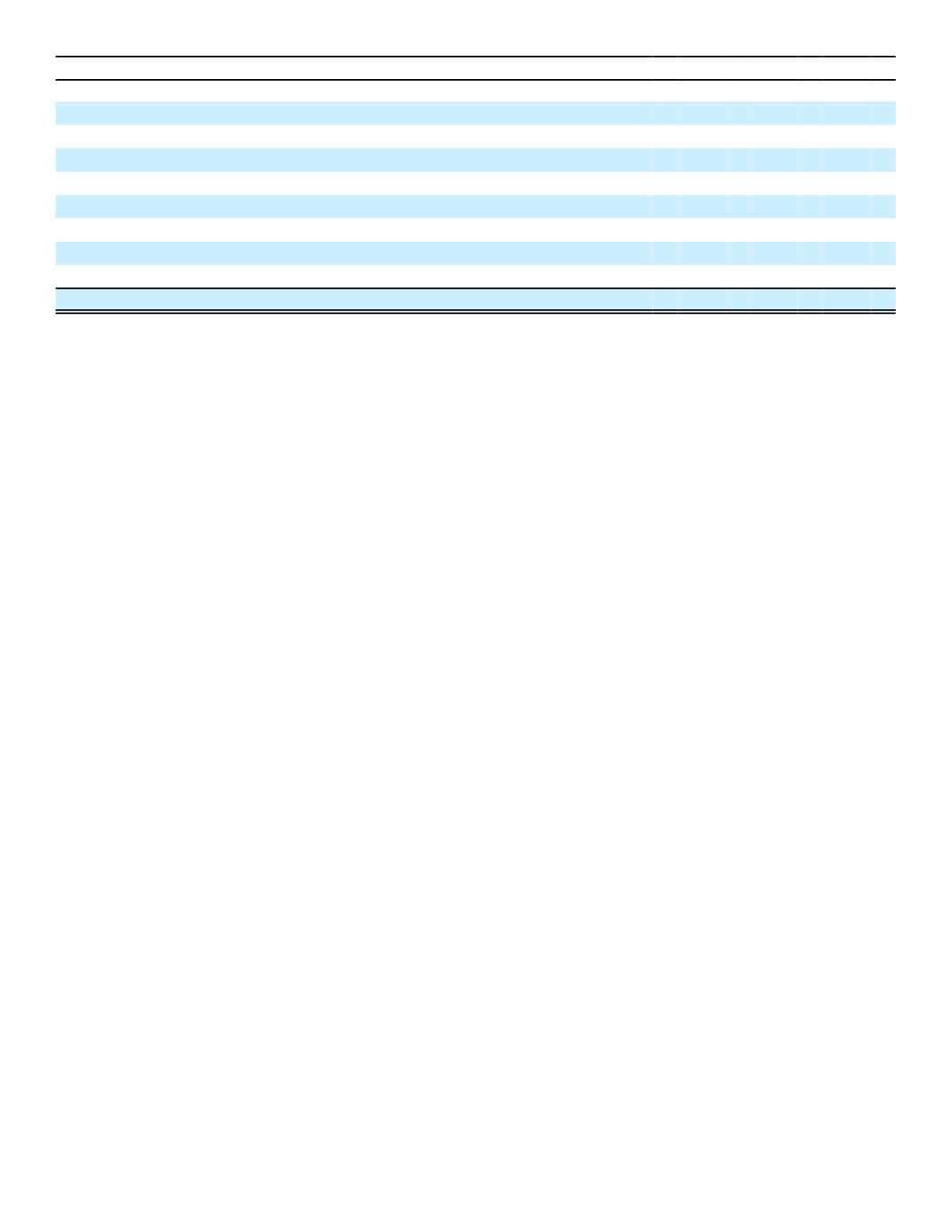

(In millions)

2016

2015

U.S. pension plan assets:

Mutual funds:

Large cap equity funds

$ 104

$ 94

Mid cap equity funds

19

16

Real estate equity funds

10

10

International equity funds

85

77

Fixed income bond funds

136

134

Aflac Incorporated common stock

4

4

Cash and cash equivalents

1

1

Total

$ 359

$ 336

The fair values of our pension plan investments categorized as Level 1, consisting of mutual funds and common

stock, are based on quoted market prices for identical securities traded in active markets that are readily and regularly

available to us. The fair values of our pension plan investments classified as Level 2 are based on quoted prices for

similar assets in markets that are not active, other inputs that are observable, such as interest rates, yield curves,

volatilities, prepayment speeds, loss severities, credit risks, and default rates, or other market-corroborated inputs.

401(k) Plan

The Company sponsors a 401(k) plan in which we match a portion of U.S. employees' contributions. The plan

provides for salary reduction contributions by employees and, in 2016, 2015, and 2014, provided matching contributions

by the Company of 50% of each employee's contributions which were not in excess of 6% of the employee's annual cash

compensation.

On January 1, 2014, the Company began providing a nonelective contribution to the 401(k) plan of 2% of annual cash

compensation for employees who elected to opt out of the future benefits of the U.S. defined benefit plan during the

election period provided during the fourth quarter of 2013 and for new U.S. employees who started working for the

Company after September 30, 2013.

The 401(k) contributions by the Company, included in acquisition and operating expenses in the consolidated

statements of earnings, were $11 million in 2016, $9 million in 2015 and $7 million in 2014. The plan trustee held

approximately one million shares of our common stock for plan participants at December 31, 2016.

Stock Bonus Plan

Aflac U.S. maintains a stock bonus plan for eligible U.S. sales associates. Plan participants receive shares of Aflac

Incorporated common stock based on their new annualized premium sales and their first-year persistency of substantially

all new insurance policies. The cost of this plan, which was capitalized as deferred policy acquisition costs, amounted to

$31 million in 2016, compared with $34 million in 2015 and $36 million in 2014.

161

15. COMMITMENTS AND CONTINGENT LIABILITIES

We have two outsourcing agreements with a technology and consulting corporation. The first agreement provides

mainframe computer operations, distributed mid-range server computer operations, and related support for Aflac Japan. It

has a remaining term of four years and an aggregate remaining cost of 36.7 billion yen ($315 million using the

December 31, 2016, exchange rate). The second agreement provides application maintenance and development services

for Aflac Japan. It has a remaining term of five years and an aggregate remaining cost of 11.9 billion yen ($102 million

using the December 31, 2016, exchange rate).

We have an outsourcing agreement with a management consulting and technology services company to provide

application maintenance and development services for our Japanese operation. The agreement has a remaining term of

five years with an aggregate remaining cost of 15.4 billion yen ($132 million using the December 31, 2016, exchange

rate).