SCHEDULE II

CONDENSED FINANCIAL INFORMATION OF REGISTRANT

Aflac Incorporated (Parent Only)

Notes to Condensed Financial Statements

The accompanying condensed financial statements should be read in conjunction with the consolidated financial

statements and notes thereto of Aflac Incorporated and Subsidiaries included in Part II, Item 8 of this report.

176

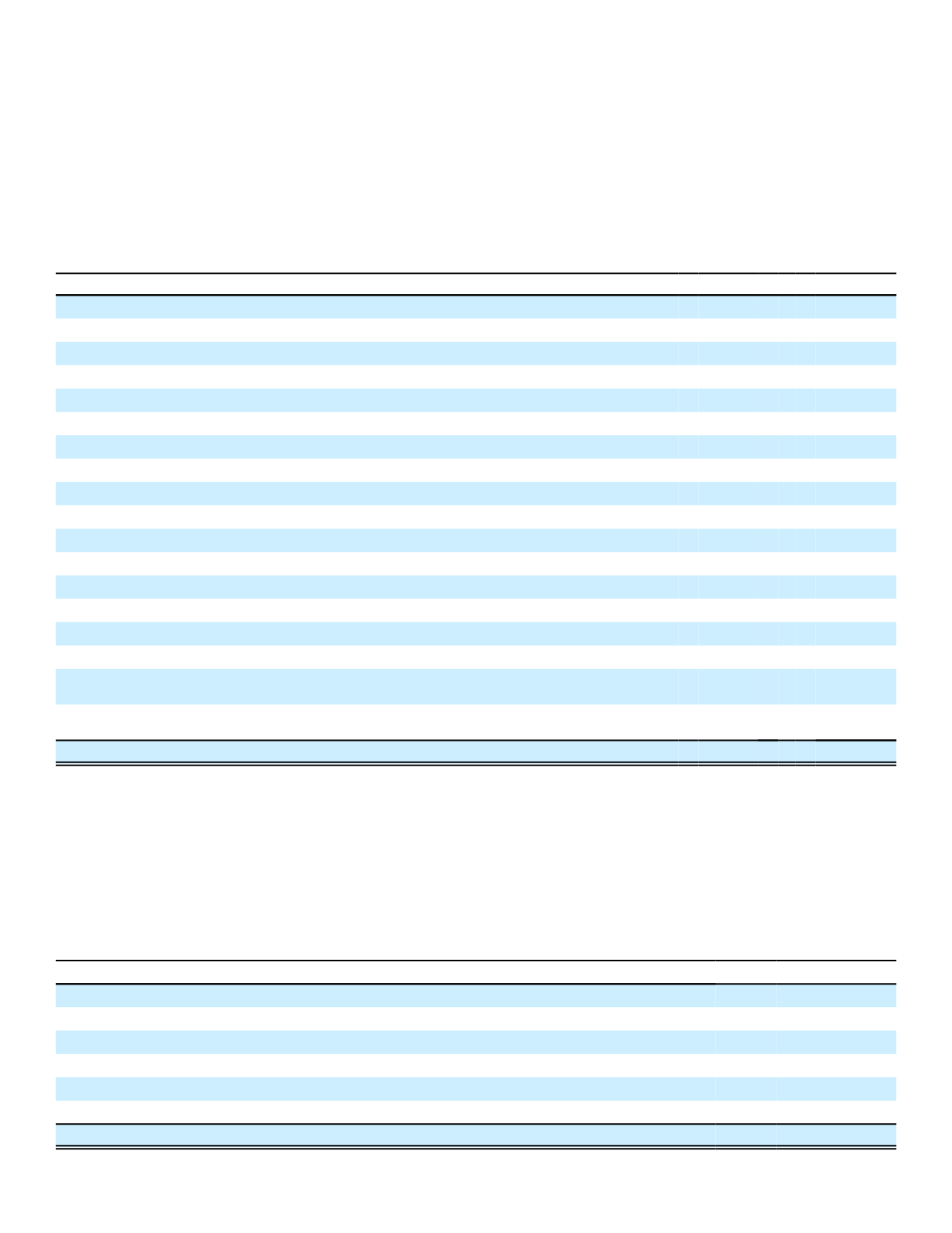

(A) Notes Payable

A summary of notes payable as of December 31 follows:

(In millions)

2016

2015

2.65% senior notes due February 2017

$ 649

$ 651

2.40% senior notes due March 2020

547

546

4.00% senior notes due February 2022

348

348

3.625% senior notes due June 2023

696

696

3.625% senior notes due November 2024

745

744

3.25% senior notes due March 2025

445

445

2.875% senior notes due October 2026

298

0

6.90% senior notes due December 2039

220

393

6.45% senior notes due August 2040

254

445

4.00% senior notes due October 2046

394

0

5.50% subordinated debentures due September 2052

486

486

Yen-denominated Uridashi notes:

2.26% notes paid September 2016 (principal amount 10 billion yen)

0

83

Yen-denominated Samurai notes:

1.84% notes paid July 2016 (principal amount 15.8 billion yen)

0

131

Yen-denominated loans:

Variable interest rate loan due September 2021 (.31% in 2016, principal amount 5.0

billion yen)

43

0

Variable interest rate loan due September 2023 (.46% in 2016, principal amount 25.0

billion yen)

214

0

Total notes payable

$5,339

$4,968

Prior-year amounts have been adjusted for the adoption of accounting guidance on January 1, 2016 related to debt issuance costs.

Amounts in the table above are reported net of debt issuance costs and issuance premiums or discounts, if applicable, that are being

amortized over the life of the notes.

During 2009, Aflac Japan bought on the open market 2.0 billion yen of yen-denominated Uridashi notes issued by the

Parent Company. These notes were redeemed in September 2016. In consolidation, those notes were extinguished;

however, they remained an outstanding liability for the Parent Company until their maturity date.

The aggregate contractual maturities of notes payable during each of the years after December 31, 2016, are as

follows:

(In millions)

2017

$ 650

2018

0

2019

0

2020

550

2021

43

Thereafter

4,145

Total

$ 5,388