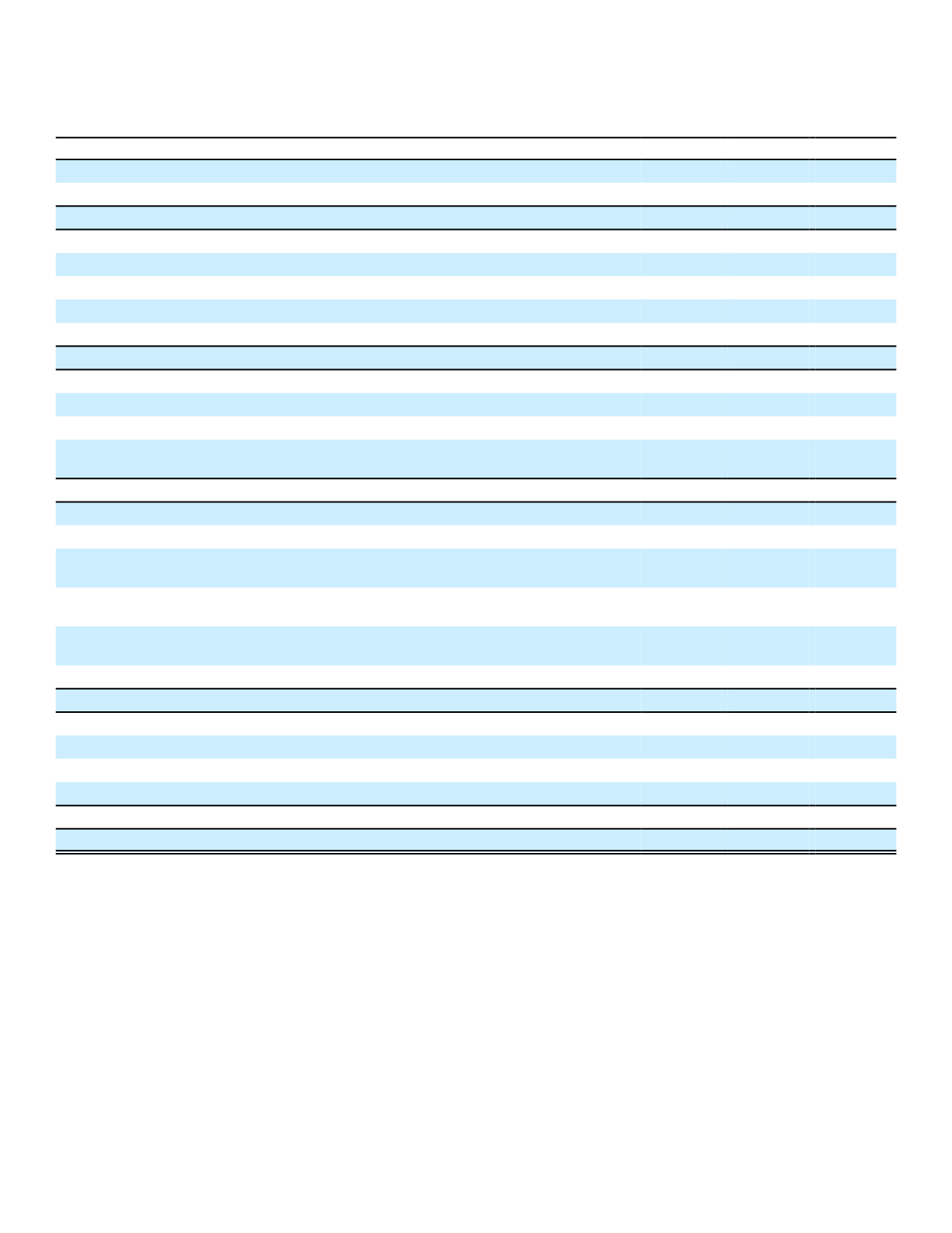

Aflac Incorporated and Subsidiaries

Consolidated Statements of Shareholders’ Equity

Years Ended December 31,

(In millions, except for per-share amounts)

2016

2015

2014

Common stock:

Balance, beginning of period

$

67

$

67 $

67

Balance, end of period

67

67

67

Additional paid-in capital:

Balance, beginning of period

1,828

1,711

1,644

Exercise of stock options

46

43

29

Share-based compensation

64

36

(3)

Gain (loss) on treasury stock reissued

38

38

41

Balance, end of period

1,976

1,828

1,711

Retained earnings:

Balance, beginning of period

24,007

22,156 19,885

Net earnings

2,659

2,533

2,951

Dividends to shareholders ($1.66 per share in 2016, $1.58 per share in 2015 and

$1.50 per share in 2014)

(685)

(682)

(680)

Balance, end of period

25,981

24,007 22,156

Accumulated other comprehensive income (loss):

Balance, beginning of period

625

1,979

(563)

Unrealized foreign currency translation gains (losses) during

period, net of income taxes

213

345 (1,036)

Unrealized gains (losses) on investment securities during period,

net of income taxes and reclassification adjustments

1,819

(1,686)

3,637

Unrealized gains (losses) on derivatives during period, net of

income taxes

2

0

(14)

Pension liability adjustment during period, net of income taxes

(29)

(13)

(45)

Balance, end of period

2,630

625

1,979

Treasury stock:

Balance, beginning of period

(8,819)

(7,566)

(6,413)

Purchases of treasury stock

(1,422)

(1,315)

(1,210)

Cost of shares issued

69

62

57

Balance, end of period

(10,172)

(8,819)

(7,566)

Total shareholders’ equity

$ 20,482

$ 17,708 $ 18,347

See the accompanying Notes to the Consolidated Financial Statements.

84