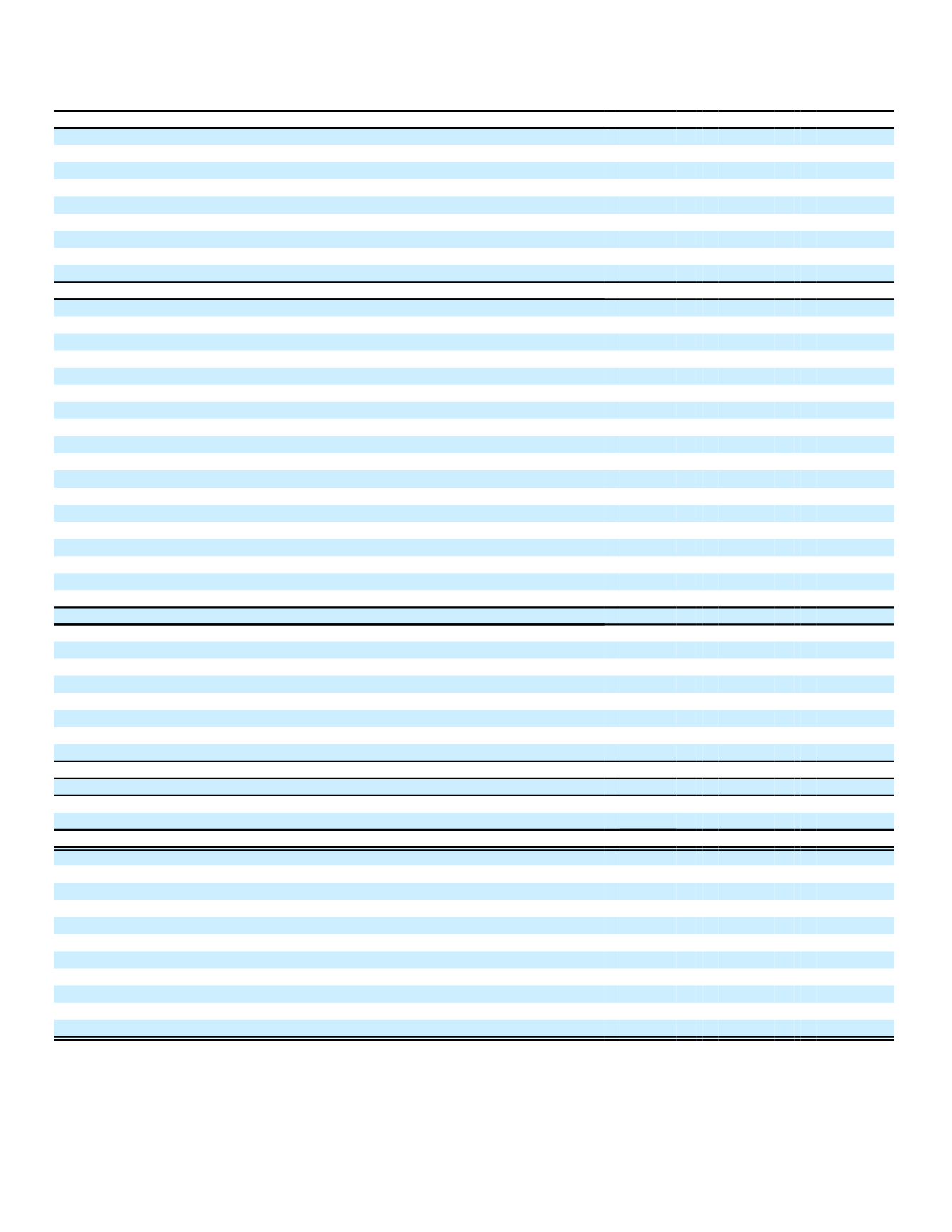

Aflac Incorporated and Subsidiaries

Consolidated Statements of Cash Flows

Years Ended December 31,

(In millions)

2016

2015

2014

Cash flows from operating activities:

Net earnings

$ 2,659

$ 2,533

$ 2,951

Adjustments to reconcile net earnings to net cash provided by operating activities:

Change in receivables and advance premiums

42

147

(7)

Increase in deferred policy acquisition costs

(306)

(241)

(225)

Increase in policy liabilities

3,331

3,524

3,614

Change in income tax liabilities

(93)

(36)

123

Realized investment (gains) losses

123

(140)

(215)

Other, net

231

(1)

989

(1)

309

Net cash provided (used) by operating activities

5,987

6,776

6,550

Cash flows from investing activities:

Proceeds from investments sold or matured:

Securities available for sale:

Fixed maturities sold

5,157

3,224

4,178

Fixed maturities matured or called

1,096

1,132

1,001

Perpetual securities matured or called

470

647

203

Equity securities sold

350

1

0

Securities held to maturity:

Fixed maturities matured or called

1,399

766

8,475

Costs of investments acquired:

Available-for-sale fixed maturities acquired

(10,890)

(6,507)

(10,978)

Available-for-sale equity securities acquired

(1,079)

(454)

(5)

Held-to-maturity fixed maturities acquired

0

0

(3,564)

Other investments, net

(1,118)

(70)

272

Purchase of subsidiary

0

(40)

0

Settlement of derivatives, net

1,252

(2,119)

(636)

Cash received (pledged or returned) as collateral, net

(416)

(1,391)

(3,217)

Other, net

(76)

(86)

30

Net cash provided (used) by investing activities

(3,855)

(4,897)

(4,241)

Cash flows from financing activities:

Purchases of treasury stock

(1,422)

(1,315)

(1,210)

Proceeds from borrowings

986

998

750

Principal payments under debt obligations

(610)

(1,272)

(335)

Dividends paid to shareholders

(658)

(656)

(654)

Change in investment-type contracts, net

159

256

1,253

Treasury stock reissued

46

36

33

Other, net

(120)

(1)

(234)

(1)

16

Net cash provided (used) by financing activities

(1,619)

(2,187)

(147)

Effect of exchange rate changes on cash and cash equivalents

(4)

0

(47)

Net change in cash and cash equivalents

509

(308)

2,115

Cash and cash equivalents, beginning of period

4,350

4,658

2,543

Cash and cash equivalents, end of period

$ 4,859

$ 4,350

$ 4,658

Supplemental disclosures of cash flow information:

Income taxes paid

$ 1,526

$ 996

$ 1,416

Interest paid

211

236

241

Noncash interest

57

53

76

Impairment losses included in realized investment losses

83

153

31

Noncash financing activities:

Capital lease obligations

1

6

9

Treasury stock issued for:

Associate stock bonus

30

35

35

Shareholder dividend reinvestment

27

26

26

Share-based compensation grants

4

3

4

(1)

Operating activities excludes and financing activities includes a cash outflow of $137 in 2016 and $230 in 2015 for the payments associated with the

early extinguishment of debt

See the accompanying Notes to the Consolidated Financial Statements.

85