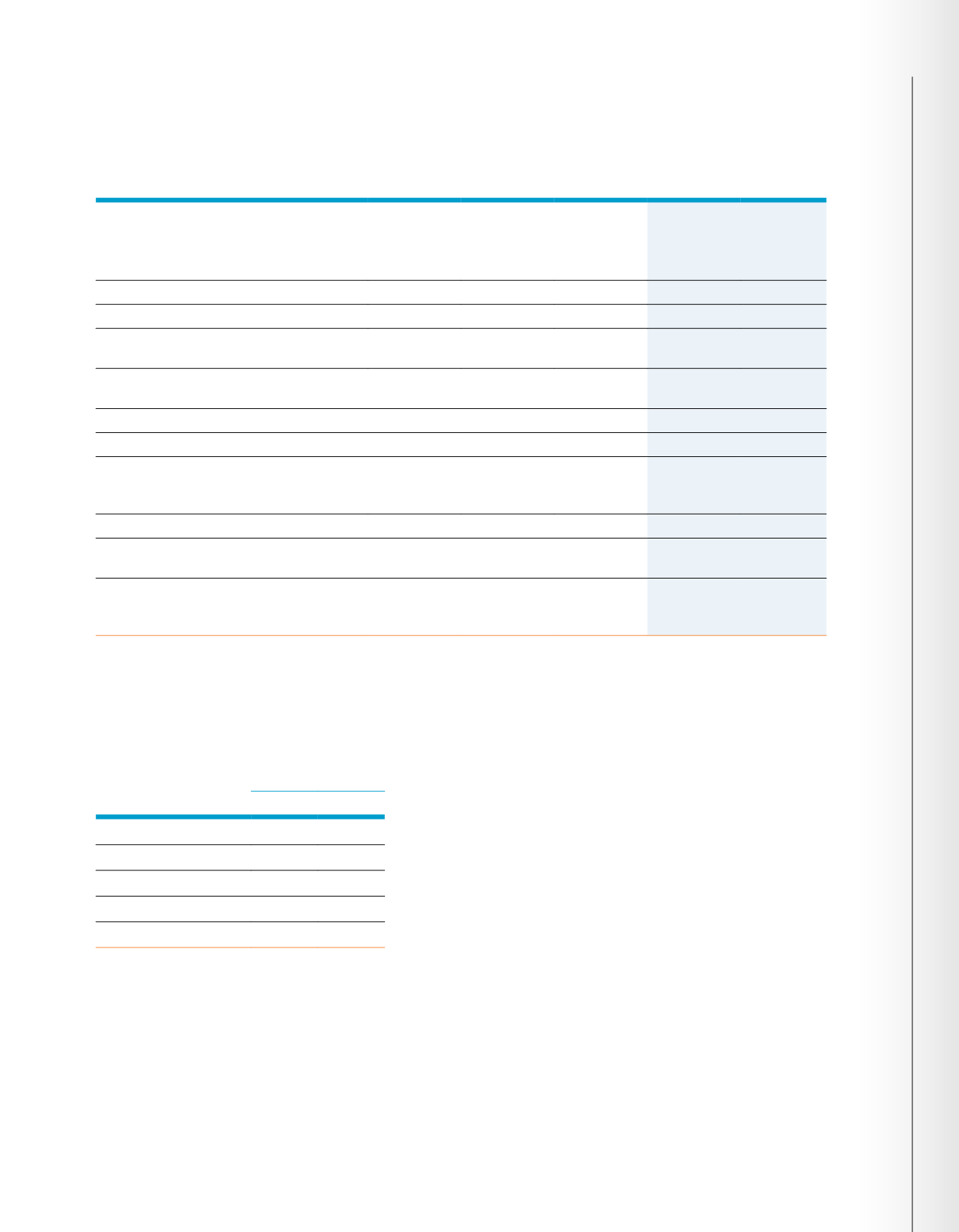

2016 MIP TARGETS AND ACTUAL PERFORMANCE

Actual performance relative to MIP targets was determined after the end of the year and presented to the

Compensation Committee for discussion and approval at its February 2017 meeting. The following table shows

the corporate and business segment metrics, objectives, and results for the 2016 MIP awards.

Minimum Goal

Target Goal

Maximum Goal

2016 Actual

2016 Payout

Percentages

Corporate Metrics:

Operating earnings per diluted share on

a consolidated basis for the Company

(excluding foreign currency effect)*

$6.17

$6.29

$6.41

$6.45

200%

OROE (excluding foreign currency effect)

17%

19.5%

22%

17.3%

56%

SMR

500%

600%

700%

945%

200%

Net Investment Income excluding hedge costs

(Consolidated)

Budget

minus 2%

Budget

Budget

plus 2.25%

Budget

plus 0.91%

140.42%

U.S. Segment Metrics:

Increase in New Annualized Premiums

3.00%

4.00%

5.00%

-.34%

–

Increase in Direct Premiums

1.50%

2.25%

3.00%

2.08%

88.39%

Increase in Pretax Operating Earnings

1.00%

3.00%

5.00%

9.67%

200%

Japan Segment Metrics:

New Annualized Premiums

(third sector sales) (billions)

¥74.22

¥75.84

¥77.45

¥83.99

200%

Increase in Direct Premiums

0.25%

0.75%

1.25%

.96%

141.51%

Increase in Pretax Operating Earnings before

allocated expenses and foreign currency change

-4.00%

-3.25%

-2.00%

-2.02%

198.56%

Global Investments Metrics

(Eric M. Kirsch only):

Credit Losses/Impairments (in millions)

($465)

($315)

($165)

($97)

200%

* Corresponds to an increase of a minimum goal of .2%, a target goal of 2%, and a maximum goal of 4% from a 2015 base or $6.16 per share.

Please refer to the 2016 Business Overview section on page 31 for additional information.

2016 MIP PAYOUTS

The following table reflects target and earned percentages of salary for each NEO for the MIP based on 2016

performance results.

The Compensation Committee has the discretion in certain limited circumstances to adjust the MIP results related

to particular performance measures if the Committee determines that a class of MIP participants would be

unduly penalized or rewarded because a payout is incompatible with the performance measure. There were no

adjustments to the NEOs’ MIP payouts for 2016.

For additional information about the MIP, please refer to the 2016 Grants of Plan-Based Awards table below,

which shows the threshold, target, and maximum award amounts payable under the MIP for 2016, and the 2016

Summary Compensation Table, which shows the actual amount of non-equity incentive plan compensation paid to

the NEOs for 2016.

As a % of base salary

NEO

Target

Earned

Daniel P. Amos

220% 339%

Frederick J. Crawford 125% 200%

Kriss Cloninger III

150% 238%

Paul S. Amos II

125% 223%

Eric M. Kirsch

200% 321%

Compensation Discussion & Analysis

|

Elements of Our Executive Compensation Program

AFLAC INCORPORATED

2017 PROXY STATEMENT

37