Corporate governance

Acting Chairman’s introduction

Strong governance promotes better business and helps boards to run companies well. It is the Chairman’s responsibility to lead the Board in fulfilling its obligations to the Company’s shareholders, the Group’s employees, suppliers, the customers and consumers of our products, in short, all our stakeholders, to ensure that an appropriate governance framework is in place at Dairy Crest. Your Board and I believe in the importance of corporate governance and the vital role it plays in underpinning the integrity and performance of our organisation. Amongst the myriad duties the Board and I owe to the broad constituency of stakeholders in our organisation, establishing, embedding and maintaining an effective governance framework through which it is able effectively to direct and control the Group is paramount. The Board recognises its duty to set the right tone at the top in order to guide our organisation’s behaviour and ensure that we live by and demonstrate the right values which in turn enable entrepreneurial and prudent management of the resources which you, our shareholders, have entrusted to us so that we can deliver long-term success for Dairy Crest and all its stakeholders.

In this, our Corporate Governance report, the Board and I shall try and demonstrate how we have brought to life the principles of good governance through, amongst other things, ensuring that an effective internal framework of systems and controls is in place which clearly defines authority and accountability while at the same time allowing the appropriate management of risk. A key benchmark is our compliance with the UK Corporate Governance Code published by the Financial Reporting Council (‘FRC’) in September 2012 (‘Code’) – which can be found at www.frc.org.uk. I am pleased to report that apart from Code provision B6 (for further information see page 37) we have complied with all relevant provisions of the Code during the 2013/14 year.

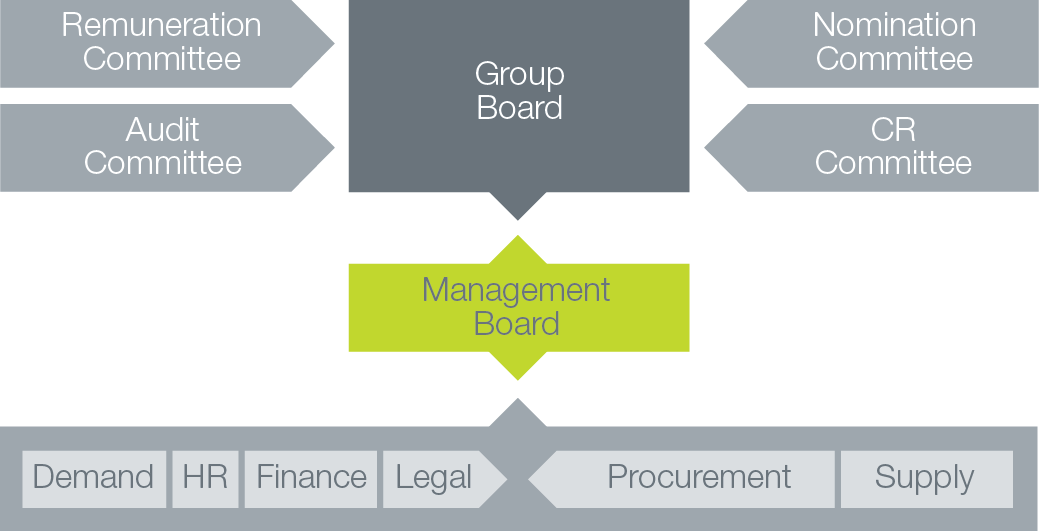

The Board recognises its collective responsibility for the governance of the Company. Its strong governance framework (as illustrated below) is supported by a combination of clear values which are discussed elsewhere in this Report (see pages 6 to 7), appropriate policy and an environment of transparency and accountability. The Board’s central role is to work alongside the executive team providing support, challenge, guidance and leadership. I believe that the Board of Dairy Crest is well balanced with a broad range of skills, diversity and experience.

One of the Chairman’s key objectives for the coming year is to maintain focus on succession planning at Board and senior management levels. The changes which the Group underwent in 2013 with the One Dairy Crest project demonstrated the value of good succession planning and I and the Board were pleased to see the promotion of good internal candidates as some of the personnel changes associated with that project were implemented.

We continue to review our governance structure and processes, to ensure that governance at Dairy Crest evolves against the backdrop of an ever-changing world.

Richard Macdonald Acting Chairman

21 May 2014

Governance framework

The diagram below sets out the structure used to govern the Company. Through our governance structure we have established a clearly defined set of values which are communicated throughout the Group. Our values are supported by a range of procedures and guidelines providing an appropriate roadmap to inform employees’ behaviour. Together with external governance codes they set an effective framework for the Group’s standards and governance.

The Board

Role: The Board is collectively responsible for the entrepreneurial leadership and control of the Company against a framework of prudent and effective controls enabling the assessment and management of risk. As custodian of the Group’s strategic aims, vision and values it ensures that the necessary human, financial and other resources necessary for the delivery of long-term success of the Group are in place and scrutinises and reviews Management’s performance. Each Director is aware of his/her responsibilities, individually and collectively, to promote the long-term success of the Company consistent with their statutory duties.

How it operates: The Board’s agenda through the year is pre-planned with sufficient time allowed to enable the Board to react and respond to the changing landscape of the Group’s business as the year progresses. The Board’s key accountabilities are:

- Approval of the Group’s long-term objectives and business strategy.

- Approval of the annual operating and capital expenditure budgets.

- Maintaining an overview and control of the Group’s operating and financial performance.

- Ensuring the maintenance of a sound system of internal control and risk management.

- Oversight of the Company’s governance and compliance framework, including key Group policies, for example Health and Safety and Business Conduct and considering regulatory changes and developments.

A formal schedule of matters reserved has been adopted by the Board and is available on the Group’s website www.dairycrest.co.uk.

Delegation of authority: the Board has delegated authority to five committees;

- Management Board

- Audit Committee

- Nomination Committee

- Corporate Responsibility Committee

- Remuneration Committee

The individual reports of the Audit, Nomination, Corporate Responsibility and Remuneration Committees prefaced by an introduction from the chairman of each can be found at pages 39 to 62. The Committees’ terms of reference, which to the extent required, comply with the Code can be found on the Group’s website. Day-to-day management responsibility rests with the Management Board which under its terms of reference has delegated authority from the Board over operational decisions.

Composition: At the date of this Report, the Board comprises eight Directors (three Executive, a Non-executive Chairman (who was independent on appointment) and four independent Non-executive Directors). Directors’ biographical details, experience, responsibilities and other commitments set out at pages 32 to 33.

Balance and Independence: With four independent Non-executive Directors and a Chairman who was independent on appointment, all of whom are free of any relationship which could materially interfere with the exercise of their independent judgement, the composition of the Board satisfies the requirements of the Code. The Board considers that the Directors demonstrate the suitable breadth of experience and backgrounds required to provide effective leadership for the Group. Details of the Group’s approach to diversity are set out in the Report of the Nomination Committee at pages 42 to 43.

Chairman and Chief Executive: These roles are distinct and separate with clearly defined accountabilities set out for each which can be found on the Group’s website (Chairman/Chief Executive Division of Responsibilities). The Chairman has particular responsibility for the effectiveness of the Group’s governance. He is accountable for ensuring the Board’s effectiveness in discharging its responsibilities, safeguarding shareholder and other stakeholder interests and promoting effective communication with shareholders. Together with the Chief Executive and with the assistance of the Company Secretary he sets the agenda for Board Meetings and directs the focus of the Board ensuring that adequate time is available for all agenda items. In promoting a culture of openness among the Board and ensuring constructive relations between Executive and Non-executive Directors, he facilitates the effective contribution of all Directors. To help ensure a proper dialogue with all Directors the Chairman meets with Directors individually and talks to the Non-executive Directors in the absence of Executive Directors.

Senior Independent Director: As a result of Anthony Fry’s absence from the Group for medical reasons, Richard Macdonald is currently fulfilling the role of Acting Chairman. Ordinarily in his role as Senior Independent Director, Richard provides a sounding board to the Chairman. He also acts as a lightning rod should matters arise which Directors wish to discuss with someone other than the Chairman. He is available to shareholders and other stakeholders in the Group’s business as needed; and where required, he deputises for the Chairman.

Non-executive Directors: All Non-executive Directors (including the Chairman) confirmed on appointment that they had sufficient time available to fulfil their obligations as Directors and that they would inform the Board should the position change. Details of the Chairman’s other significant professional commitments are included in his biography (page 32). The Board is satisfied that he continues to have sufficient time available to fulfil his obligations as a Director and Chairman. All significant commitments of Non-executive Directors were disclosed to the Board prior to their appointment and the Board was informed of subsequent changes.

As members of a unitary board, the Non-executive Directors scrutinise Management’s performance in meeting agreed goals and objectives. The Board as a whole monitors the reporting of performance. The Chief Executive’s objectives, achievement of which influences his remuneration, are agreed with the Remuneration Committee following initial discussion with the Chairman. Performance against those objectives is scrutinised by the Remuneration Committee. The Audit Committee monitors and scrutinises the integrity of financial information as well as the robustness and defensibility of financial controls and systems of risk management. The Remuneration Committee is responsible for determining appropriate levels of remuneration for Executive Directors. The Nomination Committee has a prime role in selecting and appointing Directors and in succession planning. The appointment of Directors to or the removal of Directors from the Board is a matter reserved to the Board as a whole.

The Chairman periodically meets individually or collectively with the Non-executive Directors in the absence of the Executive Directors. Were Directors to have unresolved concerns about the running of the Company or a proposed action, they would be recorded in the Board minutes. The Non-executive Directors recognise the principle that if on resignation from the Board a Director has unresolved concerns, that Director should provide a written statement to the Chairman for circulation to the Board. The concept that Non-executive Directors are free to question any executive decision of the Company is enshrined in the engagement letter of each Non-executive Director.

Information and Support: The Company Secretary advises the Chairman and the Board on all governance matters and ensures Board procedures are followed and applicable rules and regulations complied with. He ensures that the Board is supplied in a timely manner with information in a form and of a quality which enables the Board to discharge its duties. The Board, the Committees and all Directors have access to the advice and services of the Company Secretary. He provides the Board with regular reports on governance issues. Procedures exist for Directors to seek independent professional advice at the Company’s expense where required.

Effectiveness: Normally the Board has eight scheduled meetings in its annual work plan. It holds additional meetings on an ad hoc basis as and when required. Details of the Board and Committee meetings held during the 2013/14 year and Directors’ attendance at those meetings is set out in the table below.

Board and main Committee meetings

The following Directors held office during the year. The number of Board and Committee meetings attended by Directors in the year is shown in the table below. The numbers in brackets show the maximum number of meetings Directors could have attended during 2013/14.

|

Board |

Audit |

Remuneration |

Nomination |

Corporate Responsibility |

Management Board |

|

|---|---|---|---|---|---|---|

|

Mr A Fry |

6(8) |

– |

– |

1(1) |

– |

– |

|

Mr M Allen |

8(8) |

– |

– |

– |

4(4) |

29(39) |

|

Mr T Athertoni |

7(7) |

– |

– |

– |

3(3) |

32(39) |

|

Mr A Murrayii |

1(1) |

– |

– |

– |

1(1) |

4(7) |

|

Mr M Wilks |

8(8) |

– |

– |

– |

4(4) |

34(39) |

|

Mr S Alexander |

8(8) |

5(5) |

9(9) |

1(1) |

– |

– |

|

Mr A Carr-Locke |

8(8) |

5(5) |

8(9) |

1(1) |

– |

– |

|

Ms S Farr |

8(8) |

– |

7(9) |

– |

4(4) |

– |

|

Mr R Macdonald |

8(8) |

5(5) |

– |

– |

4(4) |

– |

i Tom Atherton was appointed to the Board on 23 May 2013

ii Alastair Murray stepped down from the Board on 23 May 2013

In 2011/12 the Board undertook an externally facilitated process to evaluate its effectiveness. Rathmullan, a boutique evaluation and performance audit consultancy, conducted interviews with each of the Directors and the Company Secretary leading to a discursive review of the output from those interviews focusing not only on Board effectiveness but the effectiveness of the Chairman. 2012/13 was an important year for the Board being the first full year of its then applicable composition and the second full year of Anthony Fry’s chairmanship. Accordingly, rather than immediately revert to an internally managed evaluation process, the Board felt there would be added value brought to the process by adopting a hybrid approach starting with an internal process using questionnaires which it then followed up with individual interviews with the Directors and Company Secretary. Interviews were conducted by IDDAS, a specialist mentoring, coaching and effectiveness consultancy focused on boards and senior executives. At the time of the last Report that effectiveness review had not been concluded, but has been concluded in the interim. Its focus was to continue with the themes of the previous effectiveness review and in particular to ensure adequate progress had been made with the conclusions drawn from the previous review. The review concluded that the Board had made good progress in ensuring its visibility through more regular site visits and that relationships amongst the Board continued to work well with any issues arising being quickly resolved in an open and constructive manner. During the year the Board visited the Group’s sites at Frome, Somerset (September 2013) and Chadwell Heath, London (January 2014). The Board expects to continue to rotate visits around the Group’s sites. The review further concluded that following changes to the Board’s composition in May 2013 when Alastair Murray had stepped down from the Board and Tom Atherton had been appointed Group Finance Director, Tom had assimilated well into the Board quickly consolidating the relationships which he had begun to build with the Directors in his previous role as Director of Financial Control.

It had been intended that the annual appraisal of the Board’s effectiveness required by provision B6 of the Code for the 2013/14 financial year would be undertaken in the spring of 2014. However, in light of Anthony Fry’s absence due to ill health and in recognition of the pivotal role played by the Chairman and the appraisal of his performance in the overall appraisal of the Board’s effectiveness and performance, the Board has decided to postpone the annual appraisal of its performance pending Anthony’s return to his duties as Chairman.

The performance of Executive Directors in the context of their management and operational responsibilities was appraised in the normal way. As is the case with all management grade employees, Executive Directors participate in the Group’s performance and development review process. Under that process, the Chairman appraises the performance of the Chief Executive and the Chief Executive appraises the performance of the other Executive Directors. The outcome of reviews of performance of all of the Executive Directors is scrutinised by the Remuneration Committee. The outcome of the performance review of Executive Directors is set out in the Directors’ Remuneration Report at page 52.

Induction and development: the Company Secretary ensures that Directors undergo a comprehensive induction programme on appointment. In addition to equipping Directors with sufficiently detailed knowledge of the operations of the Group’s business necessary to enable them effectively to carry out their duties, the induction programme is tailored to their experience, background and particular area of focus. A detailed development programme has been implemented to assist Tom Atherton’s development as Group Finance Director, details of which are set out in the Report of the Nomination Committee.

Conflicts of interest: CA 2006 places a duty on each Director to avoid a situation in which he or she has or can have a direct or indirect interest which conflicts or may conflict with the interests of the Company. That duty is in addition to the obligation owed by Directors to the Company to disclose to the Board any transaction or arrangement which gives rise or may give rise to a conflict of interest under consideration by the Company. Procedures are in place for Directors to disclose conflicts or potential conflicts of interest. The Company’s Articles of Association (‘Articles’) authorise the Directors, where appropriate, to authorise conflicts or possible conflicts of interest between Directors and the Company. Non-executive Directors’ letters of appointment require Non-executives to obtain the prior approval of the Board to appointments external to the Company. That requirement assists the Board to ensure no conflict of interest may result from such appointments. When considering conflicts or potential conflicts of interest, the conflicted or potentially conflicted Director is excluded from participation in the Board’s consideration of the conflict or potential conflict situation. At its meeting in July 2013, the Board received confirmation from all Directors that there were no arrangements, situations or transactions either current or anticipated, which they believed might give rise to any conflict of interest between them and the Company. Directors are required to confirm that there are no actual or anticipated conflicts of interest at least annually as part of the year-end sign off process when they approve of their emoluments statements and the confirmation process was repeated at the Board’s meeting on 14 April 2014. No Director had a material interest in any significant contract with the Company or any of its subsidiaries during the year.

Appointment and re-election: The Articles provide that the Directors or the members, by ordinary resolution, may appoint a Director either to fill a vacancy or as an additional director. A Director appointed by the Directors shall retire at the next AGM following appointment and shall be eligible for election by the members. The Articles require all Directors to be elected annually. All Directors will stand for re-election at the Company’s 2014 Annual General Meeting (‘AGM’). Having regard to the roles performed by each of the Directors, the individual input and contribution they make and their individual expertise and experience, the Board is satisfied that each candidate’s performance justifies nomination for re-election by shareholders. Service agreements of Executive Directors and a template letter of appointment of Non-executive Directors are published on the Company’s website and are available for inspection by any person at the Company’s registered office during normal office hours and will also be available at the 2014 AGM for 15 minutes before and throughout the meeting.

Dialogue with shareholders

The Board believes in the importance of an on-going relationship with its shareholders. It fully supports the principles encouraging dialogue between companies and their shareholders in the Code and the UK Stewardship Code. The Chief Executive and Group Finance Director have primary responsibility for investor relations. They are supported by the Group’s Corporate Affairs Director who, amongst other matters, organises presentations for analysts and institutional investors and holds meetings with key institutional shareholders to discuss strategy, financial performance and investment activities immediately after the Interim and Preliminary Results Announcements. Slide presentations made to institutional shareholders are made available on the Company’s website along with annual and interim reports, interim management statements, trading updates and company announcements. Announcements are made as appropriate and required through a Regulatory Information Service.

All the Non-executive Directors, and, in particular, the Chairman and Senior Independent Director, are available to meet with shareholders. Feedback from meetings with shareholders is provided to the Board to ensure that all Directors have a balanced understanding of the issues and concerns of shareholders. The Board receives feedback from the Chief Executive and the Group Finance Director on their meetings with shareholders, periodic reports on investor relations and independent feedback from the Company’s brokers on the views of major shareholders.

The notice of each AGM together with other related papers is dispatched to shareholders at least 20 working days before the meeting. All Directors attend the AGM and are available to answer shareholder questions before, during and after the meeting. The Chairman of the Board provides the meeting with an update on the progress and performance of the Group before the formal business of each AGM is addressed and a resolution is proposed relating to the Annual Report and Accounts. Details of the proxy voting on each resolution are announced at the AGM including the level of votes for and against resolutions and abstentions, and are posted on the Company’s website following the conclusion of the meeting. At the last AGM, consistent with corporate governance best practice, voting was conducted on a poll and the result was published on the Company’s website after the meeting. Voting will again be conducted on a pole at this year’s AGM.

Risk management and internal control

The Board determines the nature and extent of the significant risks it is willing to take in achieving its strategic objectives. It has overall responsibility for the Group’s system of internal control and for reviewing its effectiveness in which task it is assisted by the Audit Committee and the Group Internal Audit function. It has delegated responsibility for management of day-to-day operational risks to the Management Board and responsibility for the detailed review of internal control to the Audit Committee. It has established a sound system of risk management and internal control, the key components of which are set out below. Group Internal Audit supports the Board and Audit Committee in reviewing the effectiveness of the system of internal control. Through periodic reviews during the year, the Board has satisfied itself that its systems accord with the FRC’s Guidance on Internal Control (the ‘Turnbull Guidance’) and that satisfactory internal control procedures and systems have been in place throughout the year in compliance with the requirements of the Code. A rolling audit programme conducted by Group Internal Audit across the Group forms a key facet of the Group’s systems of internal control. The Head of Group Internal Audit reports independently to the chairman of the Audit Committee on assurance matters. It is not possible entirely to eliminate risk; accordingly, although the systems are designed to manage risks they cannot provide absolute assurance against material misstatement or loss. They provide reasonable assurance that potential issues can be identified promptly and remedied appropriately. The key components of the risk management and internal control systems include:

- Reservation to the Board of control of, amongst other matters, all significant strategic, financial and organisational risks.

- A management structure which includes clear lines of responsibility and documented delegations of authority with appropriate policies, levels and rules for, amongst other matters, incurring capital expenditure or divesting of the Group’s assets.

- The operation of comprehensive financial and strategic planning, forecasting and review processes.

- Exercise of oversight by the Audit Committee, with input from the Head of Group Internal Audit, over the Group’s control processes designed to ensure the integrity of internal and external financial reporting.

- The preparation of monthly management accounts packs for the business, including KPI dashboards for each constituent part of the Group’s business, trading results, balance sheet and cash flow information with comparison against prior year and budget, all of which are reviewed by the Management Board and the Board.

- Monthly scrutiny of performance against budget (including analysis of key trends, variances and key risks and plans for mitigation as well as the continued appropriateness of those risks) in meetings known internally as Accounts Reviews where each key constituent part of the Group and key departments report performance year-to-date and forecast against budget to a panel comprising the Management Board and other senior executives.

- Formal documented financial controls and procedures including specific procedures for treasury transactions and the approval of significant contracts.

- Quarterly completion by each key constituent part of the Group of a self-assessment controls questionnaire that requires the approval of business unit management.

- Preparation and refreshment of risk registers which are reviewed by senior management, the Management Board and the Board with the assignment of individual responsibility for the ownership and mitigation of significant risks to members of the Management Board and independent assurance over the appropriate implementation and operation of mitigating activities provided by Group Internal Audit

- Review by the Audit Committee of the Group’s risk register processes.

- Review and approval of the audit plan for the Group’s Internal Audit function together with progress against and revision of the plan as appropriate, throughout the year.

- Receipt by the Audit Committee and the Management Board of all Group Internal Audit reports detailing audit issues noted, corrective action plans and progress against those plans.

- The implementation of an integrated business planning process with formal procedures for highlighting on a monthly cycle financial performance and risks to budgetary delivery together with associated opportunities to counteract or mitigate those risks to performance.

Fair balanced and understandable: Provision C.1 of the Code introduces the new principle that the Directors should present a fair, balanced and understandable assessment of the Company’s position and prospects. At its meeting in September 2013 the Audit Committee with the assistance of the external auditor considered the adoption of a detailed process to enable the Board to ensure its ability to report against this principle of the Code. That has resulted in a more structured approach to the preparation of this year’s Report and Accounts which was formally signed off at the Board’s meeting in May 2014 at which meeting, the Board was satisfied that the Annual Report and Accounts for financial year 2013/14, taken as a whole, is fair, balanced and understandable and the Board believes that the information contained therein provides the information necessary for shareholders to assess the Company’s performance, business model and strategy.

Audit Committee report

In his introduction to the Corporate Governance section of the Annual Report the Acting Chairman stressed the importance of governance and the emphasis which the Board places on it. Being entirely independent of Management and enjoying a free ranging remit on behalf of the Board, the Audit Committee plays a critical role in the governance of Dairy Crest, providing oversight of the essential checks, balances and controls on which the owners of our business rely in order to have confidence that their interests are appropriately safeguarded. It is not possible to succeed in business without taking some risk. However, risk should be properly understood and appropriately mitigated. The Board is responsible for the identification, assessment and management of risk. It has asked the Committee to assist it in the oversight of risk. The Committee and I are acutely conscious of the responsibility entrusted to us to ensure that the Group operates an appropriate framework within which the risks which Dairy Crest assumes to generate growth in our business and enhance shareholder value are properly controlled and mitigated. Oversight of the control environment is only one facet of our accountability as a Committee. Equally important is our responsibility to give shareholders the comfort and reassurance that there is appropriate independent oversight of the Group’s financial management and reporting so that they may have confidence in the integrity of reporting on the Company’s financial performance and have sound information on which to base their investment decisions.

In the fulfilment of the responsibilities which I have identified above, the Committee has clearly defined accountabilities which are set out in its terms of reference and has a work programme which encompasses regular, routine activity, planned proactive activity and when necessary, reactive activity. The Committee is supported in its work by Ernst & Young LLP (‘EY’), the Company and Group’s external auditor, and by Group Internal Audit. The Code provides us with a useful framework against which to judge the appropriateness of the governance structure we have in place and performance against it.

Details of the Committee’s work programme undertaken during the year are set out in the Report below. For the first time this year though, the Code encourages audit committees to report not just on the areas of work they have undertaken, but also on the significant issues they have considered during the year. From my perspective, as Dairy Crest has gone through a period of significant change over the last year and the major internal restructuring associated with the One Dairy Crest project has been implemented, the Committee’s key activity has been ensuring oversight of the continued integrity of financial reporting as the Group’s finance team has undergone significant change; including, the promotion of good internal talent into new and more stretching roles with greater responsibility, not least the transition Tom Atherton has undertaken from Director of Financial Control to Group Finance Director. The other notably significant issues which the Committee considered during the year which particularly stand out were:

- An enquiry from the Financial Reporting Review Panel (‘FRRP’) concerning the manner of calculation of diluted EPS in the Company’s interim results announcement for the period ended 30 September 2012 and the Company’s compliance with IAS 33 in the preparation of that disclosure: Although there had been no material misstatement of diluted EPS for the period in question and prior year comparatives, the FRRP’s enquiry was welcomed by the Committee and led to corrections to the prior year comparatives used in the Company’s interim results announcement and to proposed disclosure in its 2012/13 financial statements

- The appropriate approach to adopt to segmental reporting following the changes brought about to the Group through the One Dairy Crest project: The Committee concluded that for IFRS8 purposes only one segment should be reported on but that the previous product group analysis should be reported on as well in order to assist users of the financial statements in the transition to the new segmental analysis

- The changes and potential risks arising from the significant internal restructuring: I have already referred above to the focus brought to bear on ensuring the effectiveness of the Group’s finance function; in addition, the Committee reviewed the Group’s policies and internal controls to ensure the control environment was maintained during the transition

- Cyber security: In response to the identified growing threat to business organisations generally from cyber security issues, the Committee instigated a third party review of risk and controls and reviewed recommended changes in policy to ensure continued appropriate security

- The carrying value of property, plant and equipment in the Dairies cash generating unit: In the context of possible indicators of impairment, the Committee reviewed an assessment of the carrying value of the Dairies cash generating unit compared to its value in use. The assessment concluded that no impairment was required; however, as the value in use headroom over carrying value is limited and sensitive to small changes in key assumptions the Committee will keep the assessment under review

Looking more externally, considerable focus is rightly placed on the objectivity and independence of the external auditor and the committee has focused throughout the year on the evolving regulatory environment related to external audit. During the year the Committee reviewed the Group’s policy on external audit tendering keeping in mind the evolving regulatory backdrop. In last year’s Report we undertook to report more fully on the Code’s requirements on external audit tendering which we shall do later in this Report alongside an examination of expected future developments related to the external audit driven by the European Commission.

Andrew Carr-Locke Chairman of the Audit Committee

21 May 2014

Membership: details of the members of the Committee at the date of this Report and any changes throughout the year together with details of attendance at meetings are set out at page 37. The Board considers that the Chairman of the Committee has recent and relevant financial experience for the purposes of the Code.

Invitations to attend meetings: A standing invitation has been made by the Committee to the Chairman of the Board as well as all other Directors to attend the Committee’s meetings. The Group Reporting Controller, Group Financial Controller, Head of Group Internal Audit and representatives of EY attend also meetings at the invitation of the Committee. During the year the External and Internal Auditors attended all meetings and also met privately with the Committee.

Role and responsibilities: Consistent with the FRC’s “Guidance on Audit Committees” the Committee’s role and responsibilities are concerned with financial reporting, narrative reporting, whistleblowing and fraud, internal controls and risk management systems, internal audit and external audit. The Committee’s scheduled activities are planned in accordance with its terms of reference, which have been approved by the Board.

Terms of reference: the Committee has documented terms of reference which are approved by the Board. They are reviewed at least annually and during the year they were reviewed at the Committee’s meeting in September 2013. Its terms of reference are in compliance with the Code and can be found on the Group’s website.

Objectives: the Board has delegated authority to the Committee to oversee and review the Group’s financial reporting process, system of internal control and management of business risks, the internal audit process, the external audit process and relationship with the external auditor and the Company’s process for monitoring compliance with laws and external regulations. Final responsibility for financial reporting, compliance with laws and regulations and risk management rests with the Board to which the Committee regularly reports back.

Meetings: During the year, the Committee undertook the following core work at its meetings;

|

13 May 2013 |

• |

Reviewed the external auditor’s 2013 Audit Results Report |

|

• |

Reviewed compliance during the year with Management and the Board’s procedures related to the preparation of the Going Concern Statement and the statement for inclusion in the Accounts and the draft Report and Accounts for the year ending 31 March 2013 and recommended their adoption to the Board |

|

|

• |

Reviewed prior year agendas and planned agendas against its work plan and terms of reference and satisfied itself that sufficient additional time existed to accommodate one-off items arising |

|

|

• |

Reviewed its own performance and that of EY along with EY’s objectivity and the independence and effectiveness of EY’s processes, and recommended to the Board EY’s reappointment as the external auditor |

|

|

• |

Received Group Internal Audit’s updates on pre-existing whistleblowing notifications and any new notifications as well as its report on financial and operational controls audits and its progress against audit plan. Approved Group Internal Audit’s work plan for the next financial year |

|

|

15 July 2013 |

• |

Received and considered recommendations contained in EY’s management letter findings and responses from its 2013 audit |

|

16 September 2013 |

• |

Received Group Internal Audit’s report on financial and operational controls audits, pre-existing whistleblowing notifications and any new notifications |

|

• |

Received an update report on the tax affairs of the Group |

|

|

• |

Considered and approved EY’s 2013/14 audit planning report |

|

|

• |

Received training concerning the Committee’s obligations related to changes to corporate governance, regulation and auditing standards |

|

|

• |

Examined the potential risks to the financial control systems associated with the One Dairy Crest project and associated opportunities to identify new ways of working for management with clearer lines of responsibility; including, review and refreshment of key financial control documents (Authority Protocols and Minimum Levels of Financial Control) and other appropriate steps for mitigation of project risks. Approved new Authority Protocols and new Minimum Levels of Financial Control |

|

• |

Reviewed and approved appropriately amended Committee terms of reference in the context of the FRC’s (Guidance on Audit Committees) issued in September 2012 |

|

|

• |

Considered a proposed plan of action to address the new fair, balanced and understandable requirement |

|

|

• |

Reviewed the Company’s policy on external auditor independence and provision of non-audit services including evolving audit tender regulation |

|

|

1 November 2013 |

• |

Received and considered EY’s Interim Review Report for the period ended 30 September 2013 |

|

• |

Reviewed and approved for recommendation to the Board draft Interim Accounts for the period ended 30 September 2013 |

|

|

• |

Reviewed Management’s self-assessment of IT security and an independent assessment of the Group’s IT security and business systems controls environment conducted by PwC, and agreed with Management specific actions to improve that control environment |

|

|

• |

Received Group Internal Audit’s report on financial and operational controls audits, pre-existing whistleblowing notifications and any new notifications |

|

|

• |

Received and considered an update on further evolution of external audit tendering regulation and adopted appropriate amendments to the Group’s external audit tendering policy |

|

|

7 March 2014 |

• |

Received Group Internal Audit’s update on audits conducted in the period and progress with its audit plan, as well as whistleblowing notifications received during the period and an update on investigations into previous notifications |

|

• |

Reviewed the year end process and timetable particularly in the context of the fair, balanced and understanding obligations |

|

|

• |

Received and considered EY’s Audit Update Report |

|

|

• |

Approved the adoption of an updated audit tender policy for the Company and Group |

|

|

• |

Reviewed the Committee’s performance during the year against its work plan satisfying itself that it had achieved its work plan as well as a number of additional matters which had arisen during the year |

|

|

• |

Reviewed and approved updated Treasury and Accounting Policies for the Company and the Group |

|

|

• |

Reviewed and considered an independent cyber maturity benchmark prepared by PwC following work on cyber security undertaken earlier in the year and endorsed proposed actions for implementation |

External auditor objectivity and independence: The objectivity and independence of the external auditor is critical to the integrity of the audit. During the year the Committee reviewed the external auditor’s own policies and procedures for safeguarding its objectivity and independence. The audit engagement partner gave representations as to the external auditor’s independence and confirmed that the external auditor’s reward and remuneration structure includes no incentives for audit engagement partners to cross sell non-audit services to audit clients. The Committee’s assessment is underpinned by the Group’s policy on the engagement of the external auditor for the provision of non-audit services, which was revised and significantly strengthened in the prior year. The Committee conducted a review of the policy during the year and was satisfied that it continued to be appropriate. The policy contains a presumption against the use of the external auditor for non-audit services. The external auditor may only be engaged for the provision of non-audit services in contravention of that presumption where those services are expressly permitted under the policy and where there is a demonstrable efficiency, audit enhancement or cost benefit resulting from the engagement of the external auditor. Furthermore, before it may be engaged for the provision of such non-audit services, alternative providers must have been considered and discounted.

Services which the external auditor is prohibited from providing to the Group include, amongst others:

- Bookkeeping services and preparation of financial information

- The design, supply or implementation of financial information systems

- Appraisal or valuation services

- Internal audit services

- Actuarial services

Fees paid to EY during the year are set out in the table below, together with prior year comparisons:

|

2013/14 £m |

2012/13 £m |

|

|---|---|---|

|

Total audit fees |

0.4 |

0.4 |

|

Non-audit fees |

||

|

Taxation services |

0.1 |

0.1 |

|

Other non-audit services |

– |

0.2 |

|

Total non-audit fees |

0.1 |

0.3 |

|

Total Fees |

0.5 |

0.7 |

Details of the non-audit work undertaken by EY during the year are set out at Note 2 to the Accounts at page 84.

The Committee was satisfied that the overall levels of audit related and non-audit fees were not material relative to the income of the external auditor firm as a whole. It was satisfied that the objectivity and independence of the external auditor was maintained throughout the year.

External auditor appointment:

EY was first appointed as external auditor to the Company in 1996. There are no contractual restrictions on the Company with regard to its appointment. The external audit appointment to the Company and Group has not been tendered competitively since EY’s appointment.

As reported last year, the Committee has been closely monitoring regulatory developments concerning external auditor tendering. Since the publication of the Code in September 2012 where at provision C.3.7 it required that FTSE 350 companies “should put the external audit contract out to tender at least every 10 years”, the Competition Commission’s report on the statutory audit tender market was expected to result in a requirement that audit services are tendered at least each ten years and should they not be tendered each five years, companies should explain why it is in the best interests of their shareholders that the audit engagement is not tendered. Furthermore, the Competition Commission had stated an intention to introduce a requirement that companies who last put their audit to tender before 2005 must do so within two years of the next rotation of their audit engagement partner. In the case of Dairy Crest, that will require that the Group tenders the external audit engagement in 2019. As of January 2014, the Competition Commission had announced its intention to place implementation of an Order on hold pending the outcome of the European Commission’s review of the external audit market and its implementation of anticipated regulation placing particular requirements or companies for the tendering and rotation of external audit services. Should the European Commission implement regulation in the anticipated form, companies will be required to change auditor each 10 years. It is anticipated that national states shall be able to derogate from the regulation by allowing an extension of up to 10 years for rotation, provided shareholders ratify the implementation of such extension. The Company has introduced a policy which requires the tendering of the external auditing engagement each 10 years, the first of which tendering exercises must be undertaken not later than the end of 2019. The Committee shall continue closely to monitor the developing regulatory landscape and will review the Company’s policy on audit tendering as required in response to further regulatory changes.

The Committee monitors the performance of the external auditor throughout the year and formally concludes the assessment of its performance in each May and makes a commensurate recommendation on the appointment of EY for the financial year to the Board. Shareholders then formally appoint the auditor at the AGM in July. In the light of the assessments and review undertaken, the Board endorsed the Committee’s recommendation which was approved by shareholders in July 2013. At its meeting in May 2014, the Audit Committee considered the appropriateness of the re-appointment of EY as the Group’s external auditor for the 2013/14 year. In doing so it took account of the Committee’s review of the external auditor’s independence and objectivity, the ratio of audit to non-audit fees and the effectiveness of the audit process together with other relevant review processes conducted throughout the year. The Committee was satisfied that it should recommend to the Board the re-appointment of EY as the Company’s and Group’s external auditor at the AGM on 15 July 2014.

Nomination Committee report

In Anthony Fry’s absence I present to shareholders the report on the work of the Nomination Committee during the 2013/14 financial year. Details of the membership of the Committee and the attendance of members at Committee meetings during the year are set out on page 37.

The Committee is responsible for overseeing the selection and appointment of Directors and making its recommendations to the Board. In conjunction with the Chairman, it also evaluates the commitments of individual Directors and ensures that the membership of the Board and its principal committees are refreshed periodically. The Board believes that it is in the best interests of the Company that Executive Directors take up opportunities to act as non-executive directors in other appropriate companies. Executive Directors are permitted to serve in a non-executive capacity on the board of one other company and to retain any fees received. Non-executive Directors may serve as directors, executive or otherwise, on the boards of other companies. As Non-executive Directors’ letters of appointment require them to seek prior approval from the Board for other appointments, the Board is given the opportunity to satisfy itself that their other commitments allow sufficient time for Non-executive Directors to devote adequate time to their commitments to the Company. The Board approved all new appointments of Directors during the year and is satisfied that all Directors continue to have sufficient time to devote themselves properly to their duties for the Company.

The Committee has not been required during the year to assist the Board with the recruitment of a Director. Were it to be so required, it would ensure that the recruitment exercise was conducted against a documented brief setting out the requirements of the role and the skills and experience required of the person to fill it. In the past, the Company has engaged the services of external search consultancies and it is anticipated, in the ordinary course, that it would continue to do so in the future. Were it not to do so, open advertising would be used as an alternative. None of the Non-executive Directors, or the Chairman, who was independent on appointment, has yet served six years in office. Andrew Carr-Locke is the longest serving of the independent Non-executive Directors, the test of independence no longer applying to the Chairman. He will have served six years on the Board in August 2015.

Following on from the work of the Committee in the prior year, its focus during 2013/14 has been on ensuring the appropriate balance of skills and experience on the Board. As Tom Atherton took on the role as Group Finance Director in the early summer 2013, the Committee was keen to ensure that he was given the appropriate support and guidance to help him flourish in his new role. Through the Board, the Committee took steps to ensure that he was given the necessary formal training and was provided with support, in the guise of a coach/mentor. In tandem with the Audit Committee, the Committee also wanted to ensure that appropriate steps were taken amongst the senior management group in the finance arena to enable Tom to focus on his new role and not get drawn into the work and accountabilities of his previous role as Director of Financial Control. That meant ensuring that there was sufficient breadth of experience and expertise in the finance team working for Tom such that they were able properly to support him in his new role.

During 2013/14 there were a number of other changes which occurred within the senior management team of the Group arising from the One Dairy Crest project. The Committee ensured that appropriate succession planning was in place for the level below the Board and we have been pleased to see a number of internal promotions to senior positions, including promotions to the Management Board.

The Group has not adopted targets for female representation amongst the Directors. It interprets diversity in its widest sense and aims to achieve the best possible leadership for the Group by ensuring an appropriate mix of skills, backgrounds, gender, experience and knowledge amongst its Directors, senior managers and other employees. The Committee considers that first and foremost, appointments must be made based on an objective assessment of who is the best person to fill a role, with candidates drawn from a diverse range of backgrounds. The Group will continue to operate policies giving equal opportunities to all, irrespective of age, gender, marital status, disability, nationality, colour, ethnic origin, sexual orientation or religious affiliation.

Richard Macdonald Acting Chairman of the Nomination Committee

21 May 2014

Report of the Corporate Responsibility Committee

As Chairman of the Corporate Responsibility Committee I am pleased to present the Group’s Corporate Responsibility report to shareholders for the financial year 2013/14 on pages 23 to 27. The Committee oversees the Group’s corporate responsibility programme and ensures that key social, ethical and environmental issues are assessed and prioritised including reviewing the Company’s 40 corporate responsibility pledges. Sue Farr, each of the Executive Directors, the Company Secretary, the Group HR Director and Head of Corporate Responsibility are the other members of the Committee. To ensure risks are fully identified staff with expertise in the relevant corporate responsibility issues are invited to present to the Committee at each of the meetings.

Over the course of the year we believe good progress has been made towards ensuring that the Group’s commitment to ‘doing the right thing’ has benefitted the environment and society, and that the actions taken have improved profits and reduced risks for the business. Highlights include: the continued reduction of accidents in the workplace, which have fallen for the fifth consecutive year; the continued reduction of water usage and the launch of innovative, healthier products.

In 2013/14 the Group also benefitted from working in collaboration with other businesses to deliver larger scale benefits to society, examples of which include working in partnerships to help young unemployed people gain employment and the work done through the Prince’s Dairy Initiative which helps the most vulnerable dairy farmers become more economically sustainable.

The Committee believes that the Group’s employees should be especially proud of achieving four and a half stars in the 2014 BITC corporate responsibility audit. This is the highest rating of any participating member company and builds on the Platinum Big Tick achieved in 2013. The Committee also noted the great achievement of being shortlisted to be the FT’s Responsible Business of the Year 2014 and the several other prestigious sustainability accolades independently awarded over the course of the last 12 months.

Overall the Committee views corporate responsibility as an opportunity to improve the business. Accordingly, good corporate responsibility is in the interests of all of Dairy Crest’s stakeholders. We believe that the Group’s approach helps to spark creative, innovative ideas which contribute to the business’ better understanding of its consumers.

Richard Macdonald Chairman of the Corporate Responsibility Committee

21 May 2014

Management Board

The Chief Executive chairs the Management Board which comprises the other Executive Directors and senior members of the Group’s executive team. Details of the members of the Management Board can be found at pages 32 to 34. The Management Board is responsible, amongst other matters, for implementing the Group’s strategic direction and monitoring the performance of the business and its control procedures on a day-to-day basis, as well as the day-to-day operations of the Group’s business, its performance against forecasts and budgets and profitability. The Management Board normally meets weekly.

Information included in the Directors’ report

Certain information fulfilling the requirements of the Corporate Governance Report can be found in the Directors’ Report at pages 63 to 65 under the headings “Substantial shareholdings”, “Rights and obligations attaching to shares”, “Articles of association” and “Purchase of own shares” and is incorporated into this Corporate Governance Report by reference.

By order of the Board

Robin Miller Company Secretary & General Counsel

21 May 2014