Directors’ remuneration report

On behalf of the Board, I am pleased to present the Directors’ Remuneration Report for the 2013/14 financial year.

The Dairy Crest remuneration policy continues to be based upon a core set of principles which support the strategic and financial ambitions of the Company:

- The remuneration package should support a performance based culture, attract and retain talented personnel and align executives’ and shareholders’ interests.

- The remuneration structure is both uncomplicated and transparent, and we remain committed to open disclosure.

- The measures used for incentive plans reflect the strategic priorities which the Committee considers critical to the future success of the Company.

During the year, the Committee has reviewed the components of executive remuneration in order to ensure that they remain true to these guiding principles, are motivating to Executives, appropriate to the needs of the business and competitive with the market.

2013/14

2013/14 has been a year of progress for Dairy Crest in which we have continued to deliver against our strategy despite challenging trading conditions reflecting a very competitive UK grocery market. The completion of our internal restructure delivered the forecast savings and streamlined and improved our processes. The new structure has delivered a greater focus on both customer and consumer insight, whilst offering opportunities to develop talent within the Company. The development of the whey business provides exciting revenue potential as well as further opportunities to nurture talent within the business. During the year the cost base has been effectively managed. In a year of considerable change and progress for the business, leadership by the Executives has been key in delivering value.

The Dairy Crest annual bonus incorporates stretching short term financial targets and personal objectives. This year’s bonus payments reflect improved profit before tax performance (including enhanced property profits), resulting in payments of 81.75% of salary for Mark Allen, 75.50% for Martyn Wilks and 81.75% for Tom Atherton.

Awards under the Long Term Incentive Share Plan (‘LTISP’) 2011 had a three-year performance period to March 2014. Of the total award, 40% was based on the Group’s adjusted basic earnings per share (‘Adjusted EPS’) and 60% was dependent on the Company’s total shareholder return (‘TSR’) performance against the TSR of the FTSE 250 (excluding financial services companies, real estate companies and investment trusts). The Company did not achieve the minimum Adjusted EPS target threshold and so for this element, no awards will be released. Against the TSR performance measure, the Company achieved 39.1% growth which resulted in 23.5% of awards vesting.

Following a broad shareholder communication and consultation process we were delighted to receive strong shareholder support at the 2013 AGM for the revised long term incentive scheme, the LTAP, with a 97.8% vote in support. Constructed around a set of strategic Key Performance Indicators (‘KPIs’) supported by a 3 year performance measure relating to dividend performance, we believe this incentive structure delivers value to both the Company and its Executives and further aligns their interests with shareholders.

- For the 2012/13 financial year, performance against the LTAP scorecard delivered a grant of 80% of basic pay for Executive Directors, reflecting the strong performance of Dairy Crest against the Company’s strategic objectives. In the year, the Company faced highly challenging market conditions with reductions in milk production leading to significant increases in milk price. The achieved EBITDA growth represented a good performance against this very challenging backdrop. Particularly strong performance was noted against the balance sheet efficiency and ROCE metrics, with the disposal of St Hubert supporting a significant reduction in net debt and gearing. One of the key strategic objectives of Dairy Crest continues to be on-going annual cost savings and in 2012/13 the Group delivered savings of £23 million, combined with savings from factory closures, exceeding target. The 2012/13 LTAP award was granted in August 2013, and therefore full details of the outcomes are given in the Implementation Report under “Scheme interests awarded during the financial year”.

- For the 2013/14 financial year, the LTAP grant will be 80% of basic pay for the Executive Directors, which reflects the continued strong performance of Dairy Crest. In particular, EBITDA performance, which is key to our progressive dividend policy, has shown considerable improvement against the backdrop of a difficult market and another year of high milk prices. ROCE for the year of 13.8% was ahead of the long term target (12%), demonstrating a strong return on investment for Dairy Crest while maintaining a sustainable gearing level. This LTAP grant also recognises the above target cost savings of £25m achieved in the year and the Company’s progress towards our brand growth and innovation goals. As the 2013/14 grant level was determined based on performance against the LTAP scorecard over the previous financial year, we have provided full details of the outcomes against these measures in this report. This is contained in the Implementation Report under “Statement of implementation of policy in the following financial year”.

- All grants under the LTAP will vest in two equal tranches after four years and five years, subject to the dividend performance condition being met.

2014/15

2014/15 is expected to be another challenging year particularly in light of the intensely competitive UK grocery market. Our focus will continue to be on investment in brands and innovation, reductions in our cost base and improving the quality of earnings.

Mark Allen and Martyn Wilks will receive no salary increase in 2014. This is in line with our approach to salary reviews for Administrative and Managerial employees for this year. As referenced in last year’s remuneration report, Tom Atherton’s promotion to Group Finance Director was at a salary level significantly below the market rate, but with a clear plan for enhanced salary adjustments in line with increasing experience and good performance in the role. I am pleased to confirm that further to an on-going review of Tom’s performance his salary will be increased by 18% to £260,000 p.a.. This change represents a move to a lower quartile position as compared to FTSE 250 CFOs. In line with our remuneration policy, it is anticipated that Tom’s salary will be moved towards the median for comparable roles over time.

Changes to reporting

Preparing a report in line with the new reporting requirements has been a key focus of the Remuneration Committee during 2013/14. Supportive of the principles underpinning the new regulations, we have delivered a report that fulfils the requirements, providing details of our remuneration policies and outcomes in a way we believe will be most helpful to shareholders.

Approved by the Board and signed on its behalf by

Stephen Alexander

Chairman of the Remuneration Committee

This report covers the reporting period from 1 April 2013 to 31 March 2014 and provides details of the Remuneration Committee and remuneration policy for the Company, together with payments and awards made to Directors.

It complies fully with the new disclosure requirements for remuneration reporting, as required by the Large and Medium-sized Companies and Groups (Accounts and Reports)(Amendment) Regulations 2013, and the rest of this remuneration report is split into two parts as follows

- The Directors’ Remuneration Policy sets out the Company’s proposed policy on Directors’ remuneration and the key factors that were taken into account when determining it. It is intended that the policy in this report will apply for a three year period from 1 April 2015. However, if the remuneration policy ceases to be appropriate, the Committee will consider changes, putting any amended policy to a shareholder vote at the relevant time. This part of the report is subject to a binding vote by shareholders at the 2014 AGM.

- The Annual Report on Remuneration sets out the Remuneration Committee’s activities, payments and awards made to the Directors and details the link between company performance and remuneration for the 2013/14 financial year. This part of the report (together with the Annual Statement) is subject to an advisory vote at the 2014 AGM.

Directors’ remuneration policy

Directors’ remuneration policy

We seek to ensure that remuneration packages contribute to the delivery of long term shareholder value. This is reflected in the Company’s annual bonus scheme and long term alignment plan, which are explained in more detail below. The Committee will be requesting shareholder approval of the following remuneration policy at the Annual General Meeting on 15 July 2014 to cover a period of three years from 1 April 2015.

Future policy table

The remuneration structure for Executive and Non-executive Directors (who are paid only fees and receive no additional benefits), at Dairy Crest, and the underlying principles on which each element of the package is based are set out below:

Notes on policy table and components of remuneration

Performance measures and targets

Measures for incentive plans reflect the strategic priorities which the Committee considers critical to the future success of the Company. Targets are set by reference to budgeted financials, wider Group targets, external market consensus and stretching strategic growth outcomes.

Changes to remuneration policy from that operating in 2013/14

Base salary – No change

Benefits – No change

Pension – No change

Bonus – See Bonus policy page 47

Long-term incentive – In 2013 the Committee introduced the LTAP to replace the LTISP. The LTAP was approved by shareholders at the 2013 AGM, with the first grants made in August 2013.

Differences in remuneration for all employees

The majority of employees participate in a bonus plan. The size of award and the weighting of performance conditions vary by level, with specific measures incorporated where relevant.

All members of the senior management team have historically participated in the LTISP arrangement. A smaller group of senior management now participates in the LTAP at a reward level appropriate to their role.

Statement of consideration of employment conditions elsewhere in the Company

The Committee considers the remuneration of the wider workforce when determining appropriate pay levels for Executive Directors. For 2013/14 there was an 2% increase in basic pay and associated payments for operative level employees and an increase in salaries for administrative and managerial employees of 1.5%. However, the Directors and senior management group did not receive a general increase.

As the Committee has oversight of remuneration matters for the broader senior management population, it brings the reward of these individuals into consideration when discussing packages for Executive Directors.

The Committee does not specifically ask employees to comment on matters related to the remuneration of Executive Directors, but any comments received are taken into account.

Approach to recruitment remuneration

The Committee’s approach to recruitment remuneration is to pay a competitive salary as appropriate to attract and motivate the right talent in the role.

The following table sets out the various components which would be considered for inclusion in the remuneration package for the appointment of an Executive Director. Any new Director’s remuneration package would include the same elements and be subject to the same constraints as those of the existing Directors performing similar roles, as shown below:

|

Component |

Policy and principles |

|---|---|

|

Base salary and benefits |

The salary level will be set taking into account the responsibilities of the individual and the salaries paid for similar roles in comparable companies. Depending on the circumstances of any particular appointment the Committee may choose to set base salary above market median to attract the right talent, or below market median with increases applied over a period of time to achieve alignment with market levels for the role with reference to the experience and performance of the individual, all subject to the Company’s ability to pay. Should relocation of a newly recruited Executive Director be required, reasonable costs associated with this relocation will be met by the Company. Such relocation support could include but not be limited to payment of legal fees, removal costs, temporary accommodation/hotel cost, a contribution to stamp duty, and replacement of non-transferrable household items. In addition, the Committee may grant additional support as appropriate. Other benefits provided will be aligned to those set out on pages 46 to 47. |

|

Pension |

The Executive Director will be able to participate in the defined contribution scheme up to the annual allowance and a cash supplement payment above this. Total benefit will not exceed 23% of Basic Salary. |

|

Annual bonus |

The Executive Director will be eligible to participate in the annual bonus scheme as set out in the remuneration policy table. The policy maximum award under the bonus will be 100% of salary. The Remuneration Committee has discretion to increase the maximum award to 150% of salary in exceptional circumstances. Any bonus over 50% of salary is deferred into shares for three years as set out in the remuneration policy table. |

|

Long-term incentives |

The Executive Director will be eligible to participate in the Long Term Alignment Plan at the Remuneration Committee’s discretion. The maximum potential opportunity under this scheme is 90% of salary. Associated performance measures would apply as set out in the remuneration policy table. |

|

Replacement awards |

The Committee will seek to structure any replacement awards so that overall they are no more generous in terms of quantum or vesting period than the awards forfeited from a new recruit’s previous employer. In determining quantum and structure of replacement awards, the Committee will seek to replicate the value taking into account, as far as practicable, the timing, form and performance requirements of remuneration forgone. The Committee has the flexibility to use cash and/or shares as the format for delivery of any replacement awards. |

Service contracts and policy on payment for loss of office

Service contracts and letters of appointment include the following terms

|

Executive Director |

Date of commencement of contract |

Notice period |

|---|---|---|

|

M Allen |

18 July 2002 |

12 months |

|

M Wilks |

7 January 2008 |

12 months |

|

T Atherton |

23 May 2013 |

12 months |

Executive Directors’ service agreements are available on the Company’s website www.dairycrest.co.uk

|

Non-executive Director |

Letters of appointment |

Notice period |

|---|---|---|

|

A Fry |

15 July 2009 |

3 months |

|

A Carr-Locke |

15 July 2009 |

3 months |

|

R Macdonald |

4 October 2010 |

3 months |

|

S Alexander |

4 October 2010 |

3 months |

|

S Farr |

6 October 2011 |

3 months |

It is the Company’s policy that Non-executive Directors should not normally serve for more than nine years. A template Non-executive Director’s letter of appointment is available on the Company’s website.

External Appointments

Executive Directors may be invited to become Non-executive Directors of other companies and it is recognised that exposure to such duties can broaden their experience and skills which will benefit the Company. External appointments are subject to agreement by the Chairman and reported to the Board. Any external appointment must not conflict with a Director’s duties and commitments to Dairy Crest. Fees may be retained by Directors for such appointments.

Termination policy

The Remuneration Committee’s approach when considering payments in the event of termination is to take account of the individual circumstances including the reason for termination, contractual obligations of both parties as well as share plan and pension scheme rules (including relevant performance conditions).

The table below summarises the key elements of the Executive Director service contract and policy on payment for loss of office.

|

Component |

Policy and principles |

|---|---|

|

Notice period |

12 months’ notice from Company. 12 months’ notice from Director. |

|

Compensation for loss of office in service contracts |

Up to 12 months’ salary plus an additional 3% to account for presumed salary increases from any salary review that may have taken place in the notice period. Payable monthly and subject to mitigation if Director obtains alternative employment up to 12 months after termination. Other payments to the Director in question include medical benefits, cost of company car and a sum equivalent to 23% of annual salary representing pension contribution for the unexpired part of the contractual notice period. Under the terms of Mark Allen’s contract payments on termination are calculated as 90% of the sum of the following items – annual salary, benefits, pension plus 50% of maximum bonus opportunity for the notice period. This will not be the Company’s policy going forward for other Executive Directors. Under the terms of Martyn Wilks’ contract, payments on termination are calculated as annual base salary, benefits and pension contribution, half of which would be paid on termination and the remainder paid in six equal monthly instalments. Contractual provisions in respect of compensation for loss of office for Mark Allen and Martyn Wilks are therefore grandfathered. In the event of a compromise or settlement agreement, the Remuneration Committee may make payments it considers reasonable in settlement of potential legal claims. This may include an entitlement to compensation in respect of their statutory rights under employment protection legislation in the UK or in other jurisdictions. The Remuneration Committee may also include in such payments reasonable reimbursement of professional fees in connection with such agreements. The reimbursement of repatriation costs or fees for professional or outplacement advice may also be included in the termination package, as deemed reasonable by the Committee, as may the continuation of benefits for a limited period. |

|

Treatment of unvested deferred bonus awards under plan rules |

If termination is by way of death, injury, illness, disability, redundancy, retirement, or any other circumstances the Committee determines, deferred shares may be released on termination. Otherwise, the proportion of awards released will be determined at the discretion of the Board. |

|

Treatment of unvested long term incentive plan awards under plan rules |

Any outstanding award will lapse at cessation of employment with the Company, unless the reason for cessation is by way of injury, ill-health, disability, redundancy, retirement, or any other circumstances the Committee determines, when the award will vest at the normal vesting date with the underpin and other conditions considered at the time of vesting. Alternatively, the Committee may determine that a proportion of the award will vest immediately, with the proportion determined by the Committee taking into account satisfaction of the underpin and any other factors the Committee consider relevant. A proportion of the LTAP award will vest immediately on death, pro-rated for time. |

|

Exercise of discretion |

Any discretion available in determining treatment of incentives on termination of employment is intended only to be relied upon to provide flexibility in certain circumstances. The Remuneration Committee’s determination will take into account the particular circumstances of the Director’s departure and the recent performance of the Company. |

|

Change of control |

Outstanding awards and options would normally vest and become exercisable on a change of control to the extent that any performance condition has been satisfied. The proportion of awards that vest under the LTAP will be determined by the Remuneration Committee. Deferred bonus awards would normally be released in full. The Committee reserves the right to alter the performance period or the performance measures and targets of the annual bonus plan or of any outstanding awards under the annual bonus plan or the LTAP in the event of a change of control, to ensure that the performance conditions remain relevant but challenging. The Committee has the discretion to test performance at the point of change of control or to allow awards to continue or roll-over in any reasonable manner with agreement of the acquirer, taking into account the circumstances of the change of control. |

There are no pre-determined special provisions for Non-executive Directors with regard to compensation in the event of loss of office.

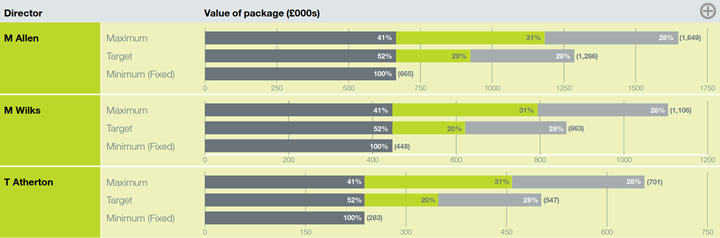

Illustration of application of remuneration policy

A significant proportion of a Director’s total remuneration package is variable, being subject to the achievement of specified short-term and long-term business objectives. The charts below show the composition of total remuneration at minimum, target and maximum performance scenarios for the Executive Directors.

Key:  Fixed Remuneration

Fixed Remuneration Annual Variable Remuneration

Annual Variable Remuneration Long term Variable Remuneration

Long term Variable Remuneration

Notes to the scenarios:

Fixed: This element comprises salary as of 1 April 2014, pension benefits (including salary supplement) and other fixed benefits (company car, etc) as per the last known number.

Annual variable Remuneration: This element shows annual bonus (including any amount deferred) at 100% of salary in the maximum scenario and 50% of salary in the target scenario.

Long-term Variable Remuneration: This element shows remuneration in respect of the LTAP, at 90% of salary in the maximum scenario and 70% of salary in the target scenario. No allowance is made for share price growth, in accordance with the requirements of the disclosure rules.

Statement of consideration of shareholders views

The Board consulted with several larger shareholders on the proposal to replace the LTISP with the new LTAP. Following an in-depth consultation process, the Remuneration Committee and the Board considered the feedback received and put final proposals to a shareholder vote at the 2013 AGM, where a strong vote in favour of 97.8% was received.

The Committee discusses matters relating to Directors’ remuneration with major investors on an on-going basis and takes into account any comments which are received.

Annual report on remuneration

Single total figure of remuneration – subject to audit

The table below sets out the analysis of total remuneration for each Director. An explanation of how the figures are calculated follows the table. The total remuneration for each Director reflects the performance of the Company and the contribution each individual has made to the on-going success of the Company.

|

Director |

|

Base salary/fees |

|

Taxable benefits |

|

Bonus |

|

LTISP 2011 iii |

|

Pension iv |

|

Total |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

(£’000s) |

|

2013/14 |

|

2012/13 |

|

2013/14 |

|

2012/13 |

|

2013/14 |

|

2012/13 |

|

2013/14 |

|

2012/13 |

|

2013/14 |

|

2012/13 |

|

2013/14 |

|

2012/13 |

|

Non-executive Chairman |

||||||||||||||||||||||||

|

A Fry |

155 |

155 |

– |

– |

– |

– |

– |

– |

– |

– |

155 |

155 |

||||||||||||

|

Executive Directors |

||||||||||||||||||||||||

|

M Allen |

518 |

518 |

28 |

28 |

423 |

272 |

193 |

– |

119 |

119 |

1,281 |

937 |

||||||||||||

|

M Wilks |

346 |

346 |

22 |

21 |

261 |

171 |

129 |

– |

80 |

80 |

838 |

618 |

||||||||||||

|

A Murray i |

51 |

345 |

3 |

21 |

– |

170 |

92 |

– |

11 |

80 |

157 |

616 |

||||||||||||

|

T Atherton ii |

183 |

– |

13 |

– |

149 |

– |

26 |

– |

42 |

– |

413 |

– |

||||||||||||

|

Non-executive Directors |

||||||||||||||||||||||||

|

A Carr-Locke |

43 |

43 |

– |

– |

– |

– |

– |

– |

– |

– |

43 |

43 |

||||||||||||

|

R Macdonald |

48 |

47 |

– |

– |

– |

– |

– |

– |

– |

– |

48 |

47 |

||||||||||||

|

S Alexander |

43 |

42 |

– |

– |

– |

– |

– |

– |

– |

– |

43 |

42 |

||||||||||||

|

S Farr |

38 |

38 |

– |

– |

– |

– |

– |

– |

– |

– |

38 |

38 |

||||||||||||

i Alastair Murray left the Board on 23 May 2013.

ii Tom Atherton joined the Board on 23 May 2013.

iii The values included for the 2011 LTISP have been calculated using the average middle market price during the final quarter of 2013/14. Awards will vest on 1 July 2014. Should an Executive Director leave employment before 1 July 2014, vesting shall be dependent upon qualification as a good leaver under the scheme rules. The 2013 LTAP award will be included in the single figure table in the 2015/16 annual report on remuneration following completion of the dividend underpin performance period for this award.

iv Pension amounts include employer’s pension contribution and salary supplement.

Base salary, bonus and LTISP are defined on pages 46 to 48. Bonuses detailed above include the full value of bonus entitlement including bonus to be deferred in shares being £164k for Mark Allen, £88k for Martyn Wilks and £67k for Tom Atherton.

Taxable benefits comprise £63k, valued at the taxable value.

During the year, Mark Allen held the position of Non-executive Director including Audit Committee member and Remuneration Committee member at Howdens Joinery Group plc, with fees in association with this work totalling £43k (2013: £40k).

Additional requirements in respect of the single total figure table – subject to audit

Performance against targets for annual bonus

Payment of the bonus is subject to the achievement of demanding short-term financial targets and personal objectives. To ensure that an appropriate balance is maintained between long-term and short-term reward, any bonus earned over 50% of annual salary is paid in the Company’s shares and deferred for a three-year period subject to continued employment.

Bonus payouts for the 2013/14 performance year are set out below:

|

Measure |

Details |

Maximum potential as a % of salary |

M Allen – outcome as a % of salary |

M Wilks – outcome as a % of salary |

T Atherton – outcome as a % of salary |

|---|---|---|---|---|---|

|

Profit before tax |

Stretching targets based on budget, with a sliding scale between threshold and maximum |

60% |

60% |

60% |

60% |

|

Net debt |

Stretching targets based on budget, with a sliding scale between threshold and maximum |

15% |

3% |

3% |

3% |

|

Personal objectives |

A range of non-financial operational and strategic objectives will be assessed by the Committee, with an appropriate award level set under this element with reference to the overall performance of the business. |

25% |

18.75% |

12.5% |

18.75% |

|

Total |

– |

100% of salary – |

81.75% of salary £423k |

75.50% of salary £261k |

81.75% of salary £149k |

|

Deferred into shares |

– |

– |

31.75% of salary £164k |

25.5% of salary £88k |

31.75% of salary £67k |

Group adjusted profit before tax increased by 31% in the year to £65.3m triggering a maximum payout in respect of the profit target.

Net debt increased by £82m in the year, albeit reduced by £50m from 30 September 2013. Despite this improved second half performance, the overall increase in net debt resulted in an award at the lower end of the range.

Long Term Incentive Share Plan 2011

Awards under the LTISP 2011 had a three-year performance period to 31 March 2014. 40% of the total award was based on the Group’s Adjusted EPS and 60% was measured against the TSR performance of the FTSE 250 (excluding financial services companies, real estate companies and investment trusts).

|

Measure |

Threshold |

Maximum |

Outcome |

Vesting (as % award granted in 2011) |

|---|---|---|---|---|

|

TSR performance against FTSE 250 constituents (60% of total LTISP award) |

Median (30% of TSR award vests) |

Upper quartile or above (100% of TSR award vests) |

73/155 |

23.5% |

|

EPS target (40% of total LTISP award) |

RPI + 1% p.a. over the three year performance period (30% of EPS award vests) |

RPI + 5% p.a. over the three year performance period (100% of EPS award vests) |

Threshold level not achieved |

0% |

|

Overall outcome |

23.5% |

Current position on outstanding LTISP awards – not subject to audit

The table below sets out the current position against performance targets for the LTISP award granted in 2012:

|

Measure |

Threshold |

Maximum |

Outcome |

Vesting (as % award granted in 2012) |

|---|---|---|---|---|

|

TSR performance against FTSE 250 constituents (60% of total LTISP award) |

Median (30% of TSR award vests) |

Upper quartile or above (100% of TSR award vests) |

59/159 |

40.3% |

|

EPS target (40% of total LTISP award) |

RPI + 1% p.a. over the three year performance period (30% of EPS award vests) |

RPI + 5% p.a. over the three year performance period (100% of EPS award vests) |

Threshold level unlikely to be achieved |

0% |

|

Overall outcome |

40.3% |

Current position on outstanding LTAP awards – not subject to audit

The LTAP award made in the year under review is subject to a dividend underpin for three years following the award being made. An amount of the award proportional to the percentage decrease in dividend may be clawed back in the event of a decline of up to 50%. If the decline exceeds 50%, the Committee will use its discretion to determine the proportion of the award that shall vest.

Dividend cover must also be maintained in the range 1.5 – 2.5 over the three-year measurement period. The dividend increase over the period following the award is currently 3%, and the dividend cover is 1.9 times. Based on this performance continuing the full award granted would vest.

Total pension entitlements – subject to audit

Following the closure of the Dairy Crest Group Pension Fund (a defined benefit scheme) to future accruals, there is no increase in accrued pension during the year other than inflationary increases.

The scheme closed to future accrual at 31 March 2010. Mark Allen decided to draw benefits from 31 March 2010 and receives an annual pension and received a cash lump sum of £221,510 in 2010/11. Benefit accrual ceased on 31 March 2010 and Mark Allen is no longer paying contributions into the scheme.

Mark Allen and Tom Atherton were members of the defined contribution scheme throughout 2013/14. Alastair Murray was also a member of the defined contribution scheme until leaving the Company on 23 May 2013. The Company made contributions up to the £50,000 limit for employee and employer contributions. Further cash supplements were paid such that the total of cash supplements and employer contributions amounted to 23% of basic salary. Martyn Wilks was not a member of any Company pension scheme in the year ended 31 March 2014 and received a salary supplement of 23% of basic salary.

Payments for loss of office – subject to audit

Alastair Murray left the Board on 23 May 2013 and was succeeded as Group Finance Director by Tom Atherton. The payments for loss of office made to Alastair Murray are as follows:

Termination payment

The termination payment to Alastair Murray on leaving employment was £557,020, calculated in accordance with the provisions of his service contract, which entitled him to an amount based on his salary, non-cash benefits, pension benefits and 50% of the maximum annual bonus potentially payable in the financial year of his departure. This amount was pro-rated by a factor of 0.9 for accelerated payment under a contractual formula.

Deferred bonus

All outstanding deferred bonus shares were released to Alastair Murray comprising 46.692 shares (including on vesting additional shares in respect of dividends paid).

Long term incentives

As his outstanding LTISP awards did not meet the minimum performance requirements for threshold vesting, no shares were released to Alastair Murray under these schemes.

Payments to past Directors – subject to audit

No payments were made in the year to past Directors other than the termination payments to Alastair Murray detailed above.

Scheme interests awarded during the financial year – subject to audit

LTAP 2013 award

The award made under the LTAP in 2013 was made on 15 August 2013. The award level is determined based on achievements over the prior year against the pre-grant performance scorecard, comprising of measures aligned to Dairy Crest’s strategic priorities. Outcomes against the 2013 scorecard are summarised in the second table below, and detail on these outcomes against the targets set and context in which decisions were made is included thereafter. Note that this award is subject to a dividend underpin for the first three years of the vesting period.

|

Director |

Level of award % of salary |

Face value £000s |

Percentage vesting at threshold performance |

Number of shares |

End of vesting period |

|---|---|---|---|---|---|

|

Mark Allen |

80% |

414 |

N/A |

79,329 |

50% at August 2017 50% at August 2018 |

|

Martyn Wilks |

80% |

277 |

N/A |

53,068 |

50% at August 2017 50% at August 2018 |

|

Tom Atherton |

80% |

160 |

N/A |

30,651 |

50% at August 2017 50% at August 2018 |

Determination of 2013 grant:

|

Measure |

KPI |

Alignment with strategy |

Weighting |

Outcome |

|---|---|---|---|---|

|

1. Profit |

Adjusted EBITDA target each year. |

Delivery of profit is core to the business and supports the progressive dividend policy. |

30% |

13% |

|

2. Balance sheet efficiency |

ROCE target each year whilst maintaining net debt/EBITDA in the 1.0-2.0 x range. |

Ensuring acceptable return on investment within a sustainable level of gearing. |

20% |

20% |

|

3. Corporate Activity & Efficiencies |

Delivery of annual cost savings targets. Delivery of synergies and return on investment following acquisitions or successful divestments (when relevant). |

Ensuring cost savings are delivered on an on-going basis. Ensuring that major acquisitions/ divestments deliver against relevant synergy and return targets. |

15% |

15% |

|

4. Brand Growth |

Key brand value growth over one and three years versus markets in which they operate. |

Brand growth is key to longer term business growth. |

15% |

12% |

|

5. Innovation |

Achieve each year the targeted proportion of revenue from innovation in previous three years. |

Innovation is a key driver of productivity and growth. |

10% |

6% |

|

6. Corporate Responsibility |

A range of metrics including improvements in accident incident rates, reduced CO2 emissions & improved employee engagement. |

Delivering results in a sustainable way which enhance reputation and stakeholder engagement. |

10% |

9% |

|

Total |

75% For Executive Directors this converts to an award of 80% of salary. |

1. Profit |

Weighting: 30%. Outcome: 13% |

Profit was assessed by the Remuneration Committee against an adjusted EBITDA KPI target range set by reference to the budget and taking into consideration the level of challenge included in budget at the beginning of the year.

Conditions were particularly challenging in 2012. During the first part of the year cream prices fell dramatically before recovering as milk supply decreased. Milk costs reduced in the first quarter of 2012/13, but on-farm inflation, farmer action and significant reductions in milk production led to a 10% increase in the price of milk thereafter resulting in a c£60m increase in costs that had to be recovered. The business also incurred non-milk input cost inflation and the consumer environment remained weak.

The Remuneration Committee therefore considered that against this context the small year on year increase in adjusted EBITDA, in line with market consensus, represented a good performance although did not achieve budgeted levels. A reduced award under this component to 13% was therefore considered appropriate.

2. Balance sheet efficiency |

Weighting: 20%. Outcome: 20% |

The Remuneration Committee determined balance sheet efficiency for FY 2012/13 through the assessment of ROCE performance (calculated based on average operating assets) against an annual target based on budget and the long term objective of 12%. The Remuneration Committee felt it important to underpin the assessment with the requirement that gearing (being net debt/adjusted EBITDA) remain below 2.0 times.

The disposal of St Hubert during the year transformed the Group’s balance sheet, leading to a significant reduction in net debt and gearing to fall to 0.6 times by year end. ROCE for the year of 13.3% was ahead of the long term 12% target.

This result, especially its positive impact on our ability to invest in future growth, was considered a significant accomplishment against our balance sheet efficiency objectives and resulted in a full award being made under this component.

3. Corporate Activity & Efficiencies |

Weighting: 15%. Outcome: 15% |

For this year, the Remuneration Committee split this measure to be based on two equally-weighted KPIs: the assessment of the full year effect of cost efficiency projects initiated in the year, and the delivery of synergies and returns on acquisitions.

The Remuneration Committee recognised that the Group delivered cost savings of £23m against a target of £20m, alongside cost benefits from factory closures, and considered that this achievement warranted the full amount of this award.

In assessing the second KPI, the Remuneration Committee considered the post-acquisition performance of MH Foods where a simplification of the business’s product range helped deliver operating profits in excess of targets, again resulting in the decision to award the full amount under this measure.

4. Brand Growth |

Weighting: 15%. Outcome: 12% |

Under this measure, the Remuneration Committee assessed the performance of the Cathedral City, Country Life, Clover and FRijj retail brands, both over a one year and three year timeline to ensure the rewarding of both short and long term growth.

Based on independent market data (Nielsen), brand growth for three of the four key brands was ahead of the market in 2012/13, the exception being FRijj where the market has seen several new branded entrants supported by heavy marketing and promotional activity plus our ability to promote being constrained pending the completion of our investment in Severnside which will increase capacity. In the view of the Remuneration Committee, brand performance for the year was good and also represented an improvement over the three-year performance period versus the market. Taking these factors into account an award of 12% was considered appropriate for this measure.

5. Innovation |

Weighting: 10%. Outcome: 6% |

Under this measure, the Remuneration Committee took into account the Group target that 10% of annual revenue should be generated from product innovation over the previous three years. In their assessment, the Remuneration Committee noted that this target should be considered for branded sales as well as for overall Group revenue.

The Remuneration Committee considered the achievement of 5% of Group revenue and 9% of branded revenue delivered through innovation over the last three years against this target as solid progress albeit it did not meet the Group’s challenging aspirations.

In the view of the Remuneration Committee an award of 6% against this measure was considered appropriate.

6. Corporate Responsibility |

Weighting: 10%. Outcome: 9% |

The assessment for corporate responsibility encompasses a number of measurable targets but judgement is required in order to assess the overall performance in light of this. Overall, the Remuneration Committee noted that budget targets were met across the majority of KPIs, notably reductions in accident incident rates, CO2 emissions and use of water. The challenging target for landfill avoidance was not achieved, albeit progress was made against the prior year.

Furthermore, Dairy Crest’s success in achieving the BITC platinum BIG TICK rating was a strong endorsement of the Group’s progress against the Corporate Responsibility agenda. The Remuneration Committee considered an award of 9% to be appropriate.

Dividend underpin

The level of vesting of this award may be reduced dependent on a dividend underpin over the period April 2013 – March 2016.

An amount of the award proportional to the percentage decrease in dividend may be clawed back in the event of a decline of up to 50%. If the decline exceeds 50%, the Remuneration Committee will use its discretion to determine the proportion of the award that shall vest. In such circumstances not more than 50% of the award will vest.

Dividend cover must be maintained in a specific range over the three-year measurement period. The Committee retains discretion to reduce the vesting of awards as appropriate should dividend cover be outside this range.

Shareholder dilution

In accordance with the guidelines set by the Association of British Insurers (ABI), the Remuneration Committee can satisfy awards under all its share plans with new issue shares or shares issued from treasury up to a maximum of 10% of its issued share capital in a rolling 10-year period to employees under all its share plans. Within this 10% limit, the Company can only issue (as newly issued shares or from treasury) 5% of its issued share capital to satisfy awards under discretionary or executive plans. Currently 6.3% of issued shares have been made under share plans, with 1.6% under discretionary or executive schemes.

Statement of Director’s shareholdings and share interests – subject to audit

Executive Directors are encouraged to build a shareholding in the Company equivalent to 200% of salary and to this end would normally retain 50% of net proceeds from share plans and deferred bonus share awards until that shareholding is achieved. Shareholdings exclude unvested options under the LTISP and include unvested deferred shares granted to Executive Directors as part payment of bonuses and unvested LTAP awards. Mark Allen has satisfied the shareholding requirement. Martyn Wilks and Tom Atherton have not met the requirement and will continue to grow their shareholding.

The interests of the Directors at the end of the year in the ordinary share capital of the Company were as follows:

|

Director |

Number of shares owned outright (including connected persons) |

LTISP 2011i |

LTISP 2012ii |

Unvested LTAP sharesiii |

Deferred annual bonus sharesiv |

SAYEv |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

M Allen |

143,798 |

37,379 |

169,038 |

80,193 |

7,945 |

3,202 |

||||||

|

M Wilks |

46,411 |

25,005 |

113,080 |

53,646 |

3,426 |

3,202 |

||||||

|

T Atherton |

3,347 |

4,996 |

22,861 |

30,985 |

– |

– |

||||||

|

A Murrayvi |

154,018 |

17,794 |

42,959 |

– |

46,692 |

– |

||||||

|

A Carr-Locke |

2,000 |

– |

– |

– |

– |

– |

||||||

|

R Macdonald |

1,000 |

– |

– |

– |

– |

– |

||||||

|

S Alexander |

1,000 |

– |

– |

– |

– |

– |

||||||

|

S Farr |

4,465 |

– |

– |

– |

– |

– |

||||||

|

A Fry |

3,000 |

– |

– |

– |

– |

– |

i Long Term Incentive Share Plan 2011 (nil cost share options) : The performance period ended on 31 March 2014 and all awards will vest on 1 July 2014. Amounts shown are numbers of shares which will vest

ii Long Term Incentive Share Plan 2012 (nil cost share options) : The performance period will end on 31 March 2015 and awards will vest on 3 July 2015. Amounts shown include initial grant and options related to ‘reinvested’ dividends to the date of this Report

iii Long Term Alignment Plan 2013 (nil cost share options) : The period for the dividend underpin condition will end on 31 March 2016. 50% of awards will vest on 15 August 2017 and 50% will vest on 15 August 2018. Amounts shown include initial grant and options related to ‘reinvested’ dividends to the date of this Report

iv This may include both deferred shares or unvested nil cost share options

v Save As You Earn Scheme 2012 (cost options) : The exercise price for these options is 281 pence per share and the exercise period is 3/2016 - 9/2016. There are no applicable performance conditions

vi Interests in shares as at 23 May 2013

There have been no changes in Directors’ shareholdings between 31 March 2014 and 21 May 2014.

Gain on sale of share options

|

Director |

Number of options exercised |

Market value at exercise date £000s |

Gain on exercise of share options £000s |

|||

|---|---|---|---|---|---|---|

|

A Murray |

3,754 |

19 |

19 |

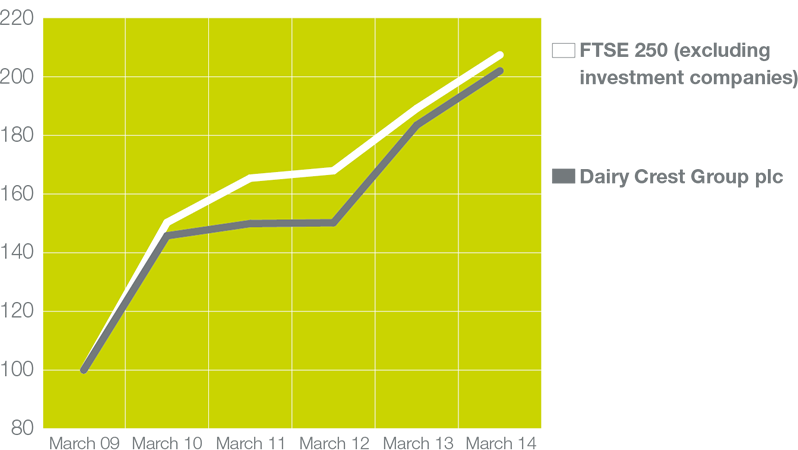

Performance graph and table

The graph below sets out for the five years ended 31 March 2014 the total shareholder return of Dairy Crest Group plc and of the FTSE 250 index (excluding investment companies) of which the Company is a constituent member.

Diary Crest - Total Shareholder Returns for £100 invested

|

CEO pay |

2009/10 |

2010/11 |

2011/12 |

2012/13 |

2013/14 |

|---|---|---|---|---|---|

|

Total remuneration (£’000s) |

1,018 |

888 |

904 |

937 |

1,281 |

|

Annual bonus (% max) |

94% |

54% |

50% |

52.5% |

81.7% |

|

Long term incentive vesting (% max) |

0% |

0% |

0% |

0% |

23.5% |

Percentage change in CEO’s remuneration

The table below sets out the percentage change in the CEO’s salary, benefits and bonus between 2012/13 and 2013/14, compared with the percentage change in the average of each of these components of pay for those salaried members of the clerical, administrative, supervisory and management population allocated to Hay bands. This group comprises 27% of the total workforce, and has been identified as the most appropriate for this table in view of the comparable nature of employment and incentive arrangements:

Salary |

Taxable benefits |

Bonus |

|||||||

|---|---|---|---|---|---|---|---|---|---|

2013/14 |

2012/13 |

% change |

2013/14 |

2012/13 |

% change |

2013/14 |

2012/13 |

% change |

|

|

CEO (£’000s) |

518 |

518 |

0 |

28 |

28 |

0 |

423 |

272 |

56 |

|

Average pay for wider employee population (£’000s) |

41 |

40 |

1.4 |

5.2 |

4.8 |

9 |

5.4 |

3.5 |

56 |

Relative importance of spend on pay

The table below illustrates the relative importance of spend on pay at Dairy Crest, compared with distributions made to shareholders in 2012/13 and 2013/14:

|

£m |

2013/14 |

2012/13 |

% change |

|---|---|---|---|

|

Employee remuneration costs |

157.0 |

176.5 |

-11.0 |

|

Dividends |

28.5 |

27.4 |

4.0 |

Relative importance of spend on pay

The table below illustrates the relative importance of spend on pay at Dairy Crest, compared with distributions made to shareholders in 2012/13 and 2013/14:

|

£m |

2013/14 |

2012/13 |

% change |

|---|---|---|---|

|

Employee remuneration costs |

157.0 |

176.5 |

-11.0 |

|

Dividends |

28.5 |

27.4 |

4.0 |

Statement of implementation of policy in the following financial year

The Directors’ remuneration policy will be implemented for the 2014/15 financial year as follows:

Base salary – £’000s

|

Role |

2013/14 |

Effective 1 April 2014 |

|---|---|---|

|

Mark Allen |

518 |

518 |

|

Martyn Wilks |

346 |

346 |

|

Tom Atherton* |

220 |

260 (from 1/7/2014) |

* Tom Atherton was brought onto the Board at a salary level below the market lower quartile for his role. In line with the Remuneration Committee’s intent as stated in the 2013 Remuneration Report, he has been an awarded an increase for 2014 to bring his salary closer towards a market competitive level. The 18% increase reflects his exceptional performance in his first year and takes his positioning against the market to lower quartile. This forms part of a phased increase over time, and the Remuneration Committee expects that any subsequent increases will be lower as a percentage of salary.

NED fees – £’000s

|

Role |

2013/14 |

Effective 1 April 2014 |

|---|---|---|

|

Non-executive Chairman |

155 |

155 |

|

Non-executive Director (base) |

38 |

38 |

|

Audit Committee Chair |

+5 |

+5 |

|

Corporate Responsibility Chair |

+5 |

+5 |

|

Remuneration Committee Chair |

+5 |

+5 |

|

Senior Independent Director |

+5 |

+5 |

Bonus measures

Maximum opportunity for Executive Directors under the 2014/15 bonus is 100% of salary, with 50% of salary paid for on-target performance.

Performance will be assessed against the following measures:

- Profit before tax (60% of award)

- Net debt (15% of award)

- Personal objectives (25% of award)

The targets for the 2014/15 annual bonus measures are considered commercially sensitive because of the information that this provides to the Company’s competitors. Payout outcomes against these targets will be disclosed in the 2014/15 report.

LTAP 2014 award

The award made under the LTAP 2014 is based on achievements over the prior year against the pre-grant performance scorecard, comprising measures aligned to Dairy Crest’s strategic priorities. Outcomes against the 2014 scorecard are summarised in the second table below and detail on outcomes against the targets set and the context in which decisions were made is included thereafter. Note that this award is subject to a dividend underpin for the first three years of the vesting period.

|

Director |

Level of award % of salary |

Face value £’000s |

End of vesting period |

|---|---|---|---|

|

Mark Allen |

80% |

414 |

50% 4 years after the award date 50% 5 years after the award date |

|

Martyn Wilks |

80% |

277 |

50% 4 years after the award date 50% 5 years after the award date |

|

Tom Atherton |

80% |

176 |

50% 4 years after the award date 50% 5 years after the award date |

The number of shares granted will be calculated in accordance with the rules approved by shareholders at the 2013 AGM.

Determination of 2014 grant:

|

Measure |

KPI |

Alignment with strategy |

Weighting |

Outcome |

|---|---|---|---|---|

|

1. Profit |

Adjusted EBITDA target each year. |

Delivery of profit is core to the business and supports the progressive dividend policy. |

30% |

23% |

|

2. Balance sheet efficiency |

ROCE target each year whilst maintaining net debt/EBITDA in the 1.0-2.0 x range. |

Ensuring acceptable return on investment within a sustainable level of gearing. |

20% |

17% |

|

3. Corporate Activity & Efficiencies |

Delivery of annual cost savings targets. Delivery of synergies and return on investment following acquisitions or successful divestments (when relevant). |

Ensuring cost savings are delivered on an on-going basis. Ensuring that major acquisitions/divestments deliver against relevant synergy and return targets. |

15% |

15% |

|

4. Brand Growth |

Key brand value growth over one and three years versus markets in which they operate. |

Brand growth is key to longer term business growth. |

15% |

5% |

|

5. Innovation |

Achieve each year the targeted proportion of revenue from innovation in previous three years. |

Innovation is a key driver of productivity and growth. |

10% |

6% |

|

6. Corporate Responsibility |

A range of metrics including improvements in accident incident rates, reduced CO2 emissions & improved employee engagement. |

Delivering results in a sustainable way which enhances reputation and stakeholder engagement. |

10% |

8% |

|

Total |

74% For Executive Directors this converts to an award of 80% of salary. |

1. Profit |

Weighting: 30%. Outcome: 23% |

The Remuneration Committee assessed profit performance against an adjusted EBITDA KPI target range set by reference to the budget.

EBITDA performance in 2013/14 showed considerable improvement in what continued to be a challenging market. Milk prices remained high, resulting in a c£45m increase in costs that had to be recovered. Developments in the retail sector and the increased prominence of discounters led to further pressures being applied to the Dairies business.

The Remuneration Committee considered that against this context, the adjusted EBITDA outcome showed a good performance and awarded 23% on this basis.

2. Balance sheet efficiency |

Weighting: 20%. Outcome: 17% |

The Remuneration Committee determined balance sheet efficiency for FY 2012/13 through the assessment of ROCE performance (calculated based on average operating assets) against an annual target based on budget and the long term objective of 12%. As last year, the Remuneration Committee felt it important to underpin the assessment with the requirement that gearing (being net debt/EBITDA) remain below 2.0 times.

ROCE for the year of 13.8% was ahead of the long term 12% target. This result represented a good performance against our balance sheet efficiency objectives and resulted in an award of 17%

3. Corporate Activity & Efficiencies |

Weighting: 15%. Outcome: 15% |

Given no major M&A activity during the year, the outcome for this measure was based upon cost savings. Against a target of £20m the Group made savings of £25m. This resulted in a full award being made against this component.

4. Brand Growth |

Weighting: 15%. Outcome: 5% |

The key brand performance was mixed. Three of our four key brands recorded sales growth below the market albeit both FRijj and Country Life both performed better in the second half of the year. Cathedral City continues to significantly outperform the market. Although longer-term data shows three of our four key brands outperforming the market, we believe an award of 5% is appropriate given the importance of brand growth in the current environment.

5. Innovation |

Weighting: 10%. Outcome: 6% |

Under this measure, the Remuneration Committee took into account the Group target that 10% of annual revenue should be generated from product innovation over the previous three years. In their assessment, the Remuneration Committee noted that this target should be considered for branded sales as well as for overall Group revenue.

Achieving 4% of Group revenue and 7% of branded revenue through innovation was considered by the Remuneration Committee as showing some progress against this component, albeit not in line with the Group’s challenging targets. As a result, an award of 6% was considered appropriate.

6. Corporate Responsibility |

Weighting: 10%. Outcome: 8% |

We have made good progress on health and safety during the year but certain other targets with respect of landfill avoidance and employee engagement were not met. However, we were the highest scoring company in BITC’s CR index with 4.5 out of 5.0. This measures a range of Corporate Responsibility criteria consistent with our LTAP measures and therefore an award of 8% is considered appropriate.

Dividend underpin

The level of vesting of this award may be reduced dependent on a dividend underpin over the period April 2014 – March 2017.

An amount of the award proportional to the percentage decrease in dividend may be clawed back in the event of a decline of up to 50%. If the decline exceeds 50%, the Remuneration Committee will use its discretion to determine the proportion of the award that shall vest. In such circumstances not more than 50% of the award will vest.

Dividend cover must be maintained in a specific range over the three-year measurement period. The Committee retains discretion to reduce the vesting of awards as appropriate should dividend cover be outside this range.

LTAP 2015 award

A grant will be made in 2015 under the LTAP, in line with the disclosed policy. As the grant will be based on scorecard of metrics assessed over the 2014/15 financial year, below we set out the scorecard which will determine the grants made in 2015. We have included the 2014/15 KPIs on which performance will be assessed and the associated alignment to strategy. We have not included specific targets on the KPIs, as the targets are considered commercially sensitive. The outcomes for this award will be disclosed in the 2014/15 Directors Remuneration Report.

|

Measure |

KPI |

Alignment with strategy |

Weighting |

|---|---|---|---|

|

Profit |

Adjusted EBITDA target each year. |

Delivery of profit is core to the business and supports the progressive dividend policy. |

30% |

|

Balance sheet efficiency |

ROCE target each year whilst maintaining net debt/EBITDA in the 1.0-2.0 x range. |

Ensuring acceptable return on investment within a sustainable level of gearing. |

15% |

|

Corporate Activity & Efficiencies |

Delivery of annual cost savings targets. Delivery of synergies and return on investment following acquisitions or successful divestments (when relevant). |

Ensuring cost savings are delivered on an on-going basis. Ensuring that major acquisitions/divestments deliver against relevant synergy and return targets. |

15% |

|

Brand Growth |

Key brand value growth over one and three years versus markets in which they operate. |

Brand growth is key to longer term business growth. |

20% |

|

Innovation |

Achieve each year the targeted proportion of revenue from innovation in previous three years. |

Innovation is a key driver of productivity and growth. |

10% |

|

Corporate Responsibility |

A range of metrics including improvements in accident incident rates, reduced CO2 emissions & improved employee engagement. |

Delivering results in a sustainable way which enhances reputation and stakeholder engagement. |

10% |

|

Dividend underpin |

To increase the dividend over the three years post-grant in line with progressive dividend policy whilst maintaining dividend cover within 1.5-2.5 x range for the three years post-grant. |

Delivery of progressive dividend policy. |

Sharesave Scheme

The Sharesave Scheme is open to all eligible employees and full time Directors. Employees enter into an approved savings contract over a three-year term to make monthly contributions up to an overall maximum of £500 per month (new maximum level with effect from 1 April 2014). At the end of the term, members have the right to buy ordinary shares in the Company at a price fixed at the time of the option grant. Options may not be granted at less than 80% of the market price at the time of grant.

Consideration by the Directors of matters relating to remuneration

Members of the Remuneration Committee

The Board has appointed a Remuneration Committee of Non-executive Directors of the Company. During the year the Committee consisted of:

- Stephen Alexander (Chairman);

- Andrew Carr-Locke; and

- Sue Farr.

Anthony Fry, Company Chairman, Mark Allen, Chief Executive and Tom Atherton, Group Finance Director attend the Remuneration Committee by invitation. Members of the Remuneration Committee have no potential conflicts of interest arising from cross-directorships and they are not involved in the day-to-day running of the Company.

The Committee’s activities during the financial year

The Remuneration Committee is responsible for the broad policy with respect to senior executives’ salary and other remuneration. It specifically determines, within remuneration principles agreed with the Board, the total remuneration package of each Executive Director and reviews with the Chief Executive the remuneration packages for other senior executives. A copy of the terms of reference of the Committee can be found on the Company’s website.

In 2013/14, the Committee met nine times. Details of attendance are shown on page 37 and the Committee discussed, amongst others, the following matters:

|

Meeting |

Agenda items discussed |

|---|---|

|

April |

• Feedback from shareholder consultation on LTAP |

|

May |

• Approval of 2012/13 bonus outcome • Approval of 2013/14 bonus targets • Implementation of LTAP • Approval of remuneration report |

|

May |

• Approval of LTAP rules |

|

June |

• Review of 2013 LTAP outturn and progress on 2014 scorecard |

|

August |

• Approval of LTAP grant for 2013 • Determination of LTAP scorecard for 2014 |

|

November |

• Update on new disclosure rules for remuneration report • Review of Sharesave |

|

December |

• Implications of new disclosure rules for remuneration report • Renewal of share plan rules |

|

January |

• Review of draft remuneration report |

|

March |

• Review of potential bonus and long term incentive outcomes • Review of draft remuneration report |

Advisors to the Remuneration Committee

The Remuneration Committee has appointed PricewaterhouseCoopers LLP (‘PwC’) to provide advice on executive remuneration. PwC have provided such advice historically, and were originally appointed through a competitive tendering process.

Work undertaken by PwC for the Committee included updates to the Remuneration Committee on remuneration and governance trends and market practice, and providing remuneration benchmarking information for Executive Directors. PwC have also supported the Remuneration Committee in the design of the LTAP, and in the preparation of new remuneration reporting disclosures under the BIS requirements. In this financial year, they were paid £95,600 based on agreed hourly rates.

During the year, PwC also provided other consultancy services to the Group, including corporate tax advice, share plans support, and programme management support.

The Remuneration Committee reviews the independence and objectivity of the advice it receives from PwC at a private meeting held in May each year. It is satisfied that PwC is providing objective and robust professional advice. PwC is a member of the Remuneration Consultants Group and has signed up to that group’s Code of Conduct.

The Remuneration Committee also received materials, assistance and advice on remuneration policy from Robert Willock, the Group HR Director of Dairy Crest. The Chief Executive and Group Finance Director attend all meetings by invitation, but are not present at any discussions relating specifically to their own remuneration.

Statement of voting at General Meeting

The table below shows the advisory vote on the 2012/13 remuneration report at the 2013 AGM.

|

Number of votes cast |

For |

Against |

Withheld |

|---|---|---|---|

|

72,025,249 |

68,441,703 (95.02%) |

3,583,546 (4.98%) |

29,543 |

The Directors’ remuneration report from pages 45 to 62 has been approved by the Board and is signed on its behalf by

Stephen Alexander

Chairman of the Remuneration Committee

21 May 2014