Multiple Shareholders Sharing the Same Address

The Company is sending only one Annual Report and

one Proxy Statement or notice of availability of these

materials to shareholders who consented and who

share a single address. This is known as

“householding.” However, if a registered shareholder

residing at such an address wishes to receive a

separate Annual Report or Proxy Statement, he or she

may contact Shareholder Services by phone at (800)

227-4756, by e-mail at

shareholder@aflac.com, or by

mail at the following address: Shareholder Services,

1932 Wynnton Road, Columbus, Georgia 31999.

Registered shareholders who receive multiple copies of

the Company’s Annual Report or Proxy Statement or

notice of availability of these materials may request

householding by contacting Shareholder Services using

the preceding options. Shareholders who own the

Company’s shares through a bank, broker, or other

holder of record may request householding by

contacting the holder of record.

Description of Voting Rights

In accordance with the Company’s Articles of

Incorporation, shares of the Company’s Common

Stock, par value $.10 per share (the “Common Stock”),

are entitled to one vote per share until they have been

held by the same beneficial owner for a continuous

period of greater than 48 months prior to the record

date of the meeting, at which time they become entitled

to 10 votes per share. Where a share is transferred to a

transferee by gift, devise, or bequest, or otherwise

through the laws of inheritance, descent, or distribution

from the estate of the transferor, or by distribution to a

beneficiary of shares held in trust for such beneficiary,

the transferee is deemed to be the same beneficial

owner as the transferor for purposes of determining the

number of votes per share. Shares acquired as a direct

result of a stock split, stock dividend, or other

distribution with respect to existing shares (“dividend

shares”) are deemed to have been acquired and held

continuously from the date on which the shares with

regard to which the issued dividend shares were

acquired. Shares of Common Stock acquired pursuant

to the exercise of a stock option are deemed to have

been acquired on the date the option was granted.

Shares of Common Stock held in “street” or “nominee”

name are presumed to have been held for less than 48

months and are entitled to one vote per share unless

this presumption is rebutted by providing evidence to

the contrary to the Board of Directors of the Company.

Shareholders desiring to rebut this presumption should

complete and execute the affidavit appearing on the

reverse side of their proxy. The Board of Directors

reserves the right to require evidence to support the

affidavit.

Quorum and Vote Requirements

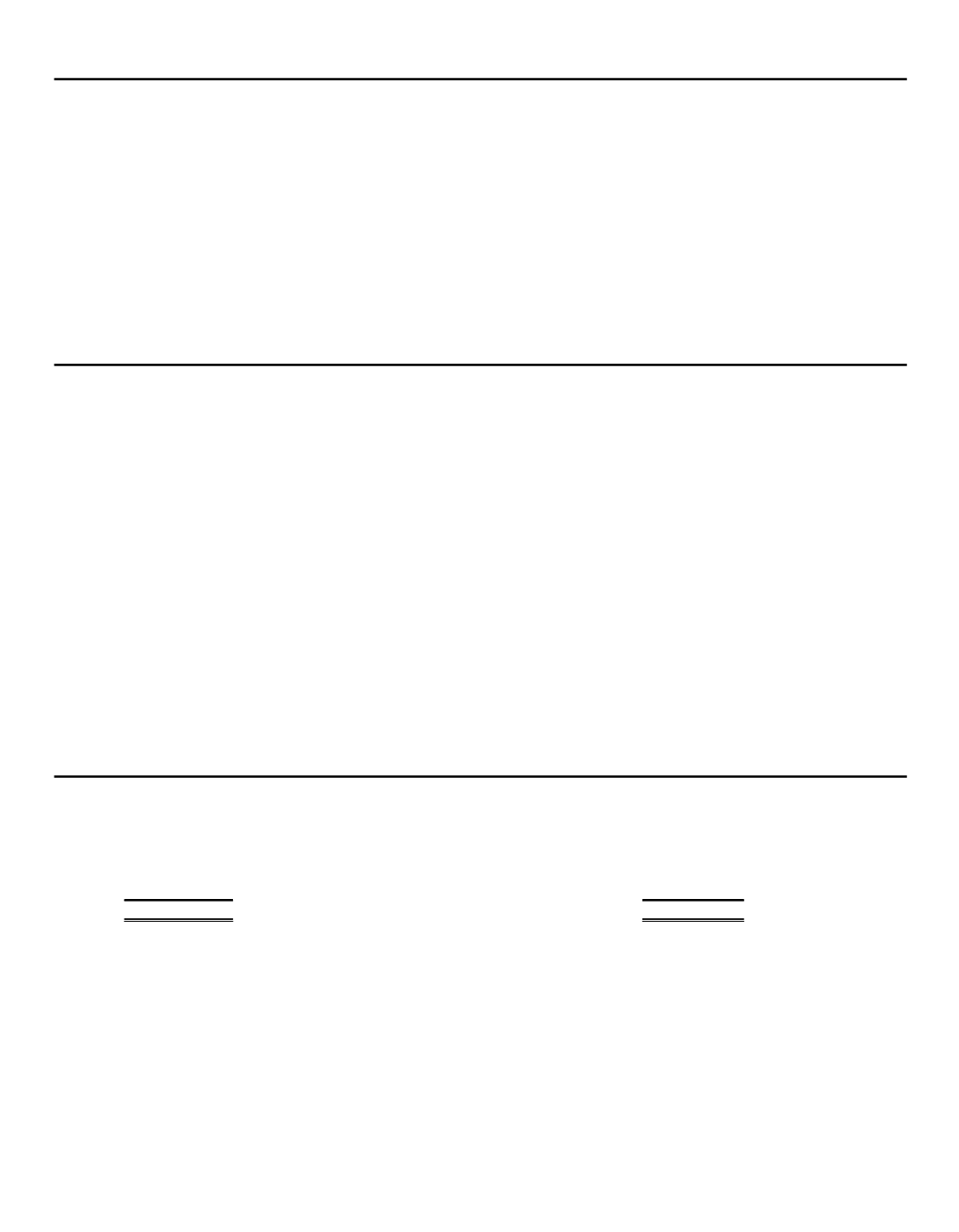

Holders of record of Common Stock at the close of business on February 24, 2016, will be entitled to vote at the Annual

Meeting. At that date, the number of outstanding shares of Common Stock entitled to vote was 419,040,439. According

to the Company’s records, this represents the following voting rights:

387,5

71,328

Shares

@ 1 Vote Per Share

=

31,4

69,111

Shares

@ 10 Votes Per Share

=

419,040,439 Shares

Total

387,5

71,328

Votes

314,

691,110

Votes

702,

262,438

Votes

Shareholders shown above with one vote per share can

rebut the presumption that they are entitled to only one

vote as outlined in “Description of Voting Rights” above.

If all of the outstanding shares were entitled to 10 votes

per share, the total votes available would be

4,190,404,390. However, for the purposes of this Proxy

Statement, it is assumed that the total votes available to

be cast at the Annual Meeting will be 702,262,4

38

.

The holders of a majority of the voting rights entitled to

vote at the Annual Meeting, present in person or

represented by proxy, shall constitute a quorum for the

transaction of such business that comes before the

meeting. Abstentions are counted as “shares present”

at the Annual Meeting for purposes of determining

whether a quorum exists. A broker non-vote occurs

when a nominee holding shares for a beneficial owner

does not vote on a particular proposal because the

nominee does not have discretionary voting power with

respect to that item and has not received voting

instructions from the beneficial owner. Broker non-votes

are also counted as “shares present” at the Annual

Meeting for purposes of determining whether a quorum

exists.

6