Retirement Plan for Senior Officers

The CEO participates in the Retirement Plan for Senior

Officers (“RPSO”). Participants in the RPSO receive full

compensation for the first 12 months after retirement.

Thereafter, a participant may elect to receive annual

lifetime retirement benefits equal to 60% of final

compensation, or 54% of such compensation with 50%

of such amount to be paid to a surviving spouse for a

specified period after death of the participant. Final

compensation is deemed to be the higher of either the

compensation paid during the last 12 months of active

employment with the Company or the highest

compensation received in any calendar year of the last

three years preceding the date of retirement.

Compensation under this plan is defined to be base

salary plus non-equity incentive award earned.

Generally, no benefits are payable until the participant

accumulates 10 years of credited service at age 60, or

20 years of credited service. Reduced benefits may be

paid to a participant who retires (other than for

disability) before age 65 with less than 20 years

credited service. The CEO is currently the only active

employee participating in the RPSO, and he has 42

years of credited service, meaning he is fully vested for

retirement benefits. The RPSO was frozen for

participation purposes on January 1, 2009, such that no

new participants will be added to the RPSO.

All benefits under the RPSO are subject to annual cost-

of-living increases as approved by the Compensation

Committee. Retired participants and their spouses are

also entitled to receive full medical expense benefits for

their lifetimes. The benefits payable under the RPSO

are not subject to Social Security or qualified Plan

offsets.

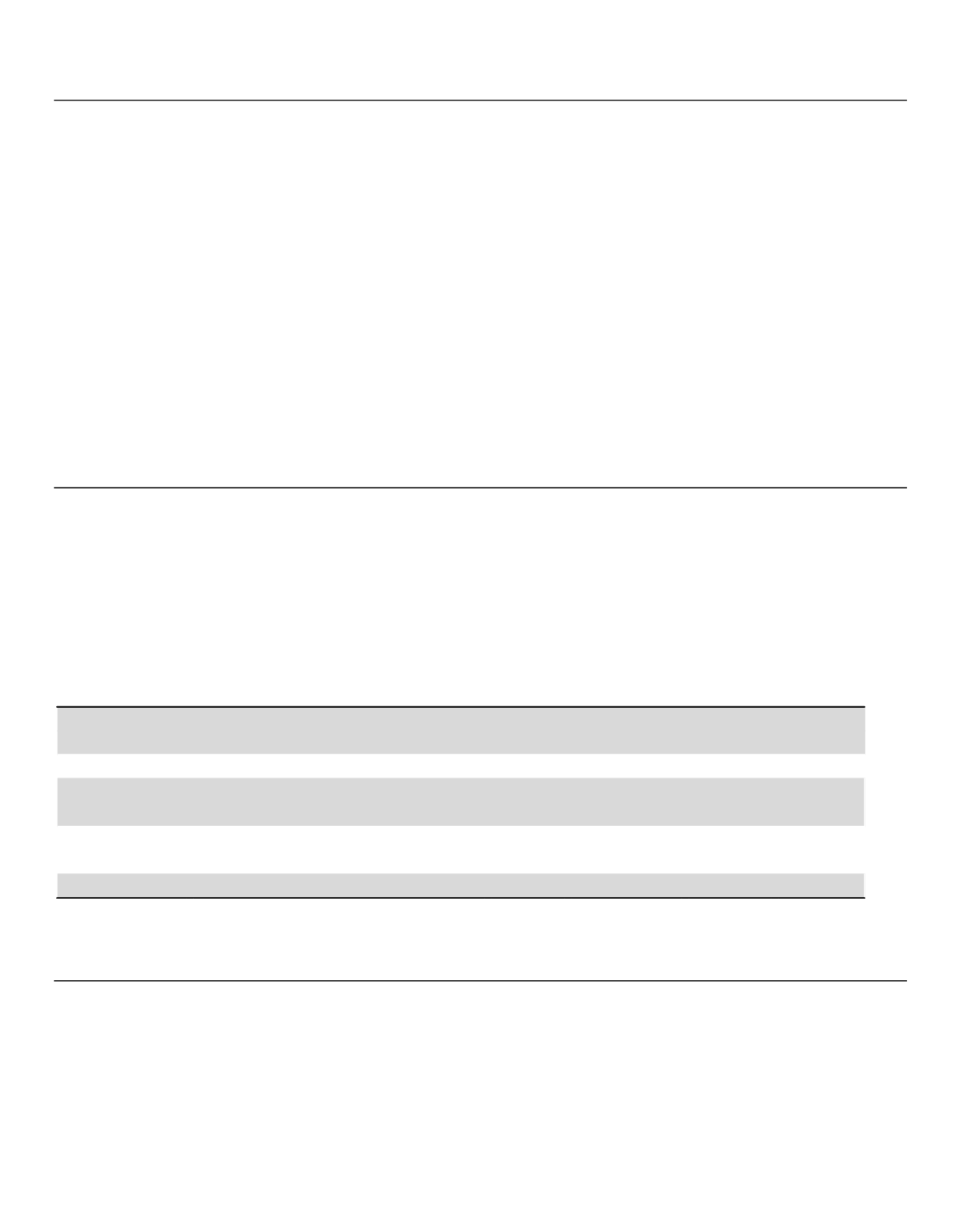

Assumed retirement age for all calculations was the earliest retirement age for unreduced benefits. Assumptions used to calculate

pension benefits are more fully described in Note 14, “Benefit Plans,” in the Notes to the Consolidated Financial Statements in the

Company’s Annual Report on Form 10-K filed with the SEC for the year ended December 31, 2015.

Number

of Years Present Value Change Payments

Credited of Accumulated from Prior During Last

Name

Plan Name

Service

Benefit*

Year

Fiscal Year

(#)

($)

($)

($)

42

53,253,538 (7,861,452)

—

42

1,148,852

(2,212)

—

—

—

—

—

24

22,662,020

265,720

—

24

728,506

12,615

—

11

5,127,008

683,498

—

11

240,023

32,727

—

Daniel P. Amos

Retirement Plan for Senior Officers

Aflac Incorporated Defined Benefit Pension Plan

Frederick J. Cra

w

ford

Aflac Incorporated Defined Benefit Pension Plan

Kriss Cloninger III

Supplemental Executive Retirement Plan

Aflac Incorporated Defined Benefit Pension Plan

Paul S. Amos II

Supplemental Executive Retirement Plan

Aflac Incorporated Defined Benefit Pension Plan

Eric

M.

Kirsch

Aflac Incorporated Defined Benefit Pension Plan

4

96,992

26,174

—

2015 PENSION BENEFITS

The following table provides certain information the Company’s pension benefits at December 31, 2015 and for the

year then ended.

52