NONQUALIFIED DEFERRED COMPENSATION

The following 2015 Nonqualified Deferred Compensation table shows, for Mr. Daniel P. Amos, Company contributions to

and earnings and account balances under the Aflac Incorporated Executive Deferred Compensation Plan (“EDCP”), an

unfunded, unsecured deferred compensation plan.

The EDCP allows certain U.S.-based officers, including

the NEOs (the “Participants”), to defer up to 75% of

their base salaries and up to 100% of their annual non-

equity incentive awards. The Company may make

discretionary matching or other discretionary

contributions in such amounts, if any, that the

Compensation Committee may determine from year to

year.

The EDCP is subject to the requirements of Section

409A of the IRC. The Company amended the EDCP

document to conform to Section 409A’s requirements in

December 2009. Deferred amounts earned and vested

prior to 2005 (“grandfathered” amounts) under the

EDCP are not subject to Section 409A’s requirements

and continue to be governed generally under the terms

of the EDCP and the tax laws in effect before January

1, 2005, as applicable.

In addition to amounts that Mr. Daniel P. Amos elected

to defer and amounts of discretionary contributions the

Company credited to his account, the amounts in the

Aggregate Balance column include investment earnings

(and losses) determined under the phantom

investments described below. Account balances may

be invested in phantom investments selected by

Participants from an array of investment options that

substantially mirror the funds available under the

Company’s 401(k) Plan, except for Common Stock. The

array of available investment options changes from time

to time. Since December 31, 2011, Participants could

choose from among several different investment

options, including domestic and international equity,

income, short-term investment and blended funds.

Participants can change their investment selections

daily (unless prohibited by the fund) by contacting the

EDCP’s third-party recordkeeper in the same manner

that applies to participants in the 401(k) Plan.

Each year, when Participants elect whether to defer

compensation under the EDCP for the following year,

they also elect the timing and form of their future

distributions attributable to those deferrals, with a

separate election permitted for each type of deferral

(i.e., salary and non-equity incentive award). Under this

process, each Participant may elect for distributions

attributable to deferrals either to be made or begin in a

specific year (whether or not employment has then

ended) or at a time that begins six months after the

Participant’s termination of employment. Each

Participant may elect for any distribution to be made in

a lump sum or in up to 10 annual installments.

Distributions attributable to discretionary contributions

are made in the form and at the time specified by the

Company.

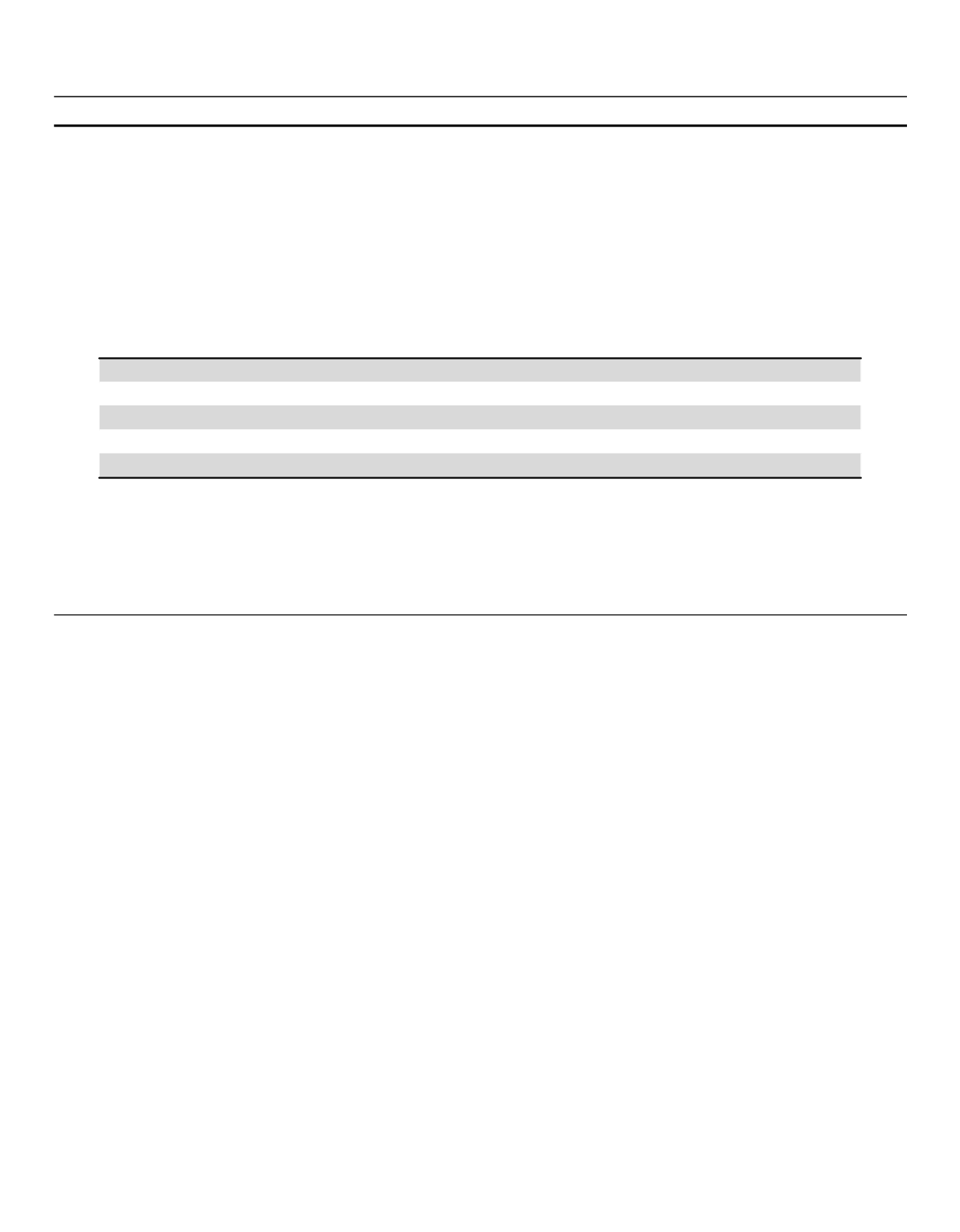

Name

Aggregate

Balance at

Last Fiscal

Year-End

($)

—

441,100

7,683

— 5,418,197

—

—

—

—

—

—

—

—

—

—

—

—

—

—

—

Daniel P. Amos

Frederick J. Crawford

Kriss Cloninger III

Paul S. Amos II

Eric M. Kirsch

—

—

—

—

—

1) The $441,100 deferred for Mr. Daniel P. Amos has been included in the Summary Compensation Table for the

current year. Additionally, previous years' deferrals included in the Aggregate Balance column were reported as

compensation in prior periods.

2) The Company does not pay or credit above market earnings on amounts deferred by executives.

2015 NONQUALIFIED DEFERRED COMPENSATION

Executive

Contributions in Last

Fiscal Year

($)

Registrant

Contributions

in Last

Fiscal Year

(1)

($)

Aggregate

Earnings

(Loss)

in Last

Fiscal Year

(2)

($)

Aggregate

Withdrawals/

Distributions

($)

53