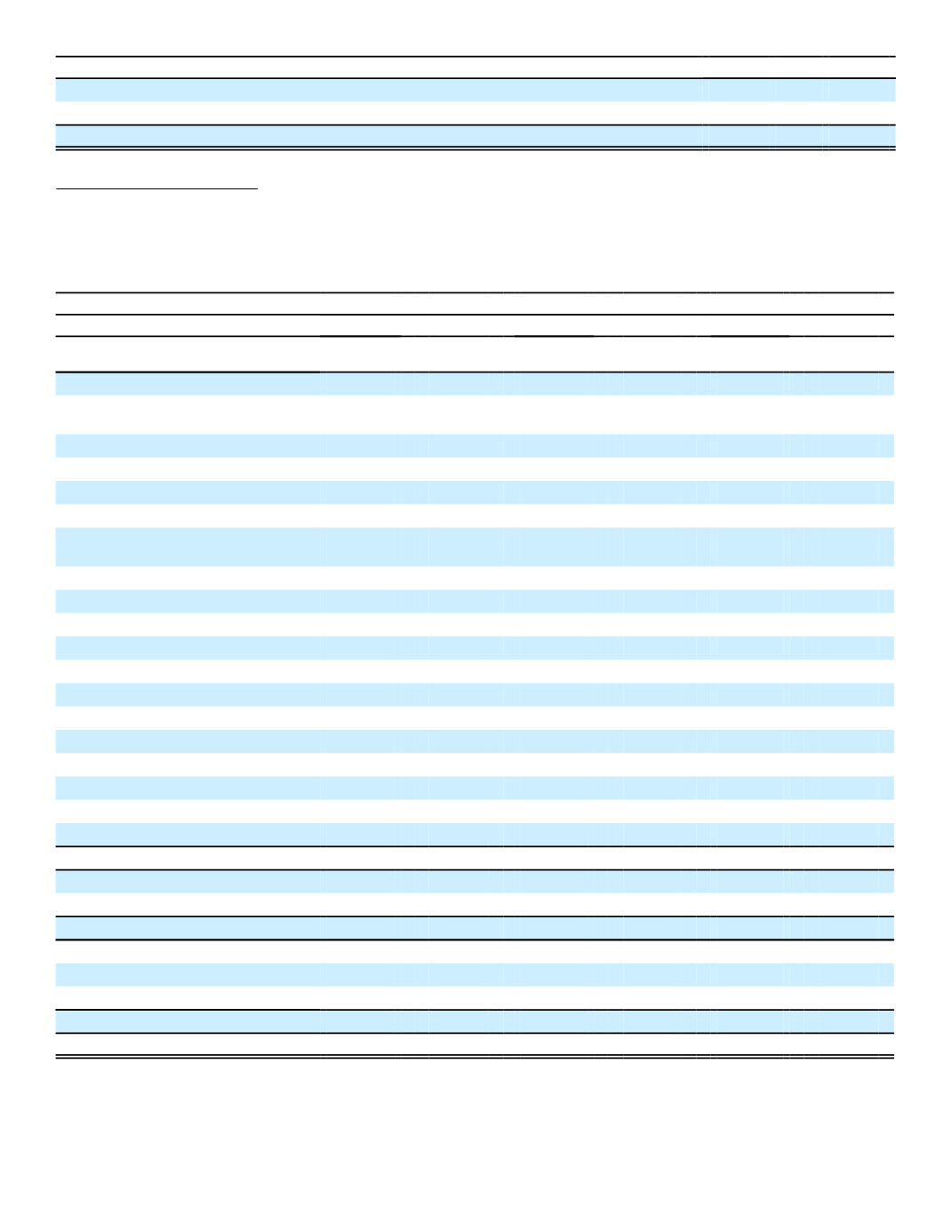

(In millions)

2016

2015

Unrealized gains (losses) on securities available for sale

$ 7,630

$ 4,831

Deferred income taxes

(2,825)

(1,845)

Shareholders’ equity, unrealized gains (losses) on investment securities

$ 4,805

$ 2,986

Gross Unrealized Loss Aging

The following tables show the fair values and gross unrealized losses of our available-for-sale and held-to-maturity

investments that were in an unrealized loss position, aggregated by investment category and length of time that individual

securities have been in a continuous unrealized loss position at December 31.

2016

Total

Less than 12 months

12 months or longer

(In millions)

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

Fixed Maturities:

Japan government and

agencies:

Yen-denominated

$ 3,958

$ 160 $ 3,958

$ 160

$ 0

$ 0

Municipalities:

Dollar-denominated

44

8

0

0

44

8

Yen-denominated

105

8

105

8

0

0

Mortgage- and asset-

backed securities:

Yen-denominated

713

8

713

8

0

0

Public utilities:

Dollar-denominated

1,265

60

790

32

475

28

Yen-denominated

635

26

347

14

288

12

Sovereign and supranational:

Yen-denominated

244

13

38

5

206

8

Banks/financial institutions:

Dollar-denominated

268

16

238

10

30

6

Yen-denominated

1,521

100

636

19

885

81

Other corporate:

Dollar-denominated

10,462

690

7,252

346

3,210

344

Yen-denominated

321

10

321

10

0

0

Total fixed maturities

19,536

1,099

14,398

612

5,138

487

Perpetual securities:

Yen-denominated

479

49

85

1

394

48

Total perpetual securities

479

49

85

1

394

48

Equity securities:

Dollar-denominated

211

6

211

6

0

0

Yen-denominated

49

2

49

2

0

0

Total equity securities

260

8

260

8

0

0

Total

$ 20,275

$1,156 $14,743

$ 621

$ 5,532

$ 535

108