original investment. Our consolidated VIEs do not rely on outside or ongoing sources of funding to support their activities

beyond the underlying collateral and swap contracts, if applicable. With the exception of our investments in unit trust

structures, the underlying collateral assets and funding of our consolidated VIEs are generally static in nature and the

underlying collateral and the reference corporate entities covered by any CDS contracts were all investment grade at the

time of issuance.

Investments in Unit Trust Structures

We invest through unit trust structures in yen-denominated public equity securities, U.S. dollar-denominated public

equity securities, bank loans, commercial mortgage loans, and middle market loans in which we are the only investor,

requiring us to consolidate these trusts under U.S. GAAP. The yen-denominated and U.S. dollar-denominated equity

securities are classified as available-for-sale in the financial statements. As of December 31, 2016, the amortized cost and

fair value of these equity securities was $972 million and $1.0 billion, compared with amortized cost and fair value of $363

million as of December 31, 2015. The bank loans are classified as available-for-sale fixed-maturity securities in the

financial statements. As of December 31, 2016, the amortized cost and fair value of our bank loan investments was $2.0

billion and $1.9 billion, respectively, compared with an amortized cost and fair value of $1.4 billion as of December 31,

2015. The commercial mortgage loans, all of which were purchased in 2016, are classified as held for investment and

reflected in other investments on the consolidated balance sheets. As of December 31, 2016, the amortized cost of these

loans, net of loan loss reserves, was $745 million. The middle market loans, which were purchased in 2016, are classified

as held for investment and reflected in other investments on the consolidated balance sheets. As of December 31, 2016,

the amortized cost of these loans, net of loan loss reserves, was $74 million.

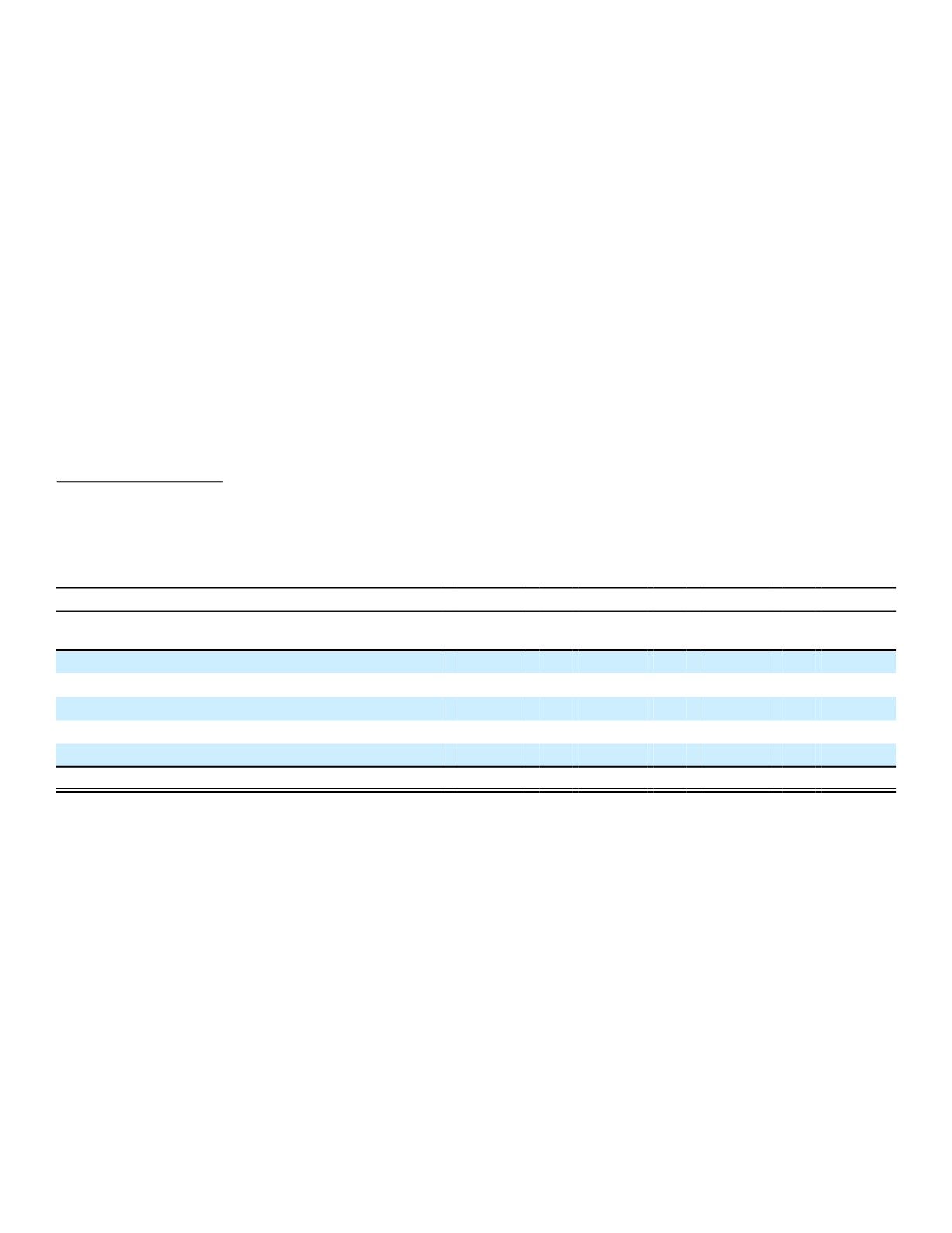

VIEs - Not Consolidated

The table below reflects the amortized cost, fair value and balance sheet caption in which our investment in VIEs not

consolidated are reported as of December 31.

Investments in Variable Interest Entities Not Consolidated

2016

2015

(In millions)

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Assets:

Fixed maturities, available for sale

$ 4,729

$ 5,261

$ 4,731

$ 5,093

Perpetual securities, available for sale

172

200

249

253

Fixed maturities, held to maturity

2,563

2,948

2,477

2,636

Other investments

1

1

0

0

Total investments in VIEs not consolidated

$ 7,465

$ 8,410

$ 7,457

$ 7,982

Prior year amounts have been adjusted for the adoption of accounting guidance on January 1, 2016 related to consolidations.

The VIEs that we are not required to consolidate are investments that are in the form of debt obligations from the VIEs

that are irrevocably and unconditionally guaranteed by their corporate parents or sponsors. These VIEs are the primary

financing vehicles used by their corporate sponsors to raise financing in the capital markets. The variable interests

created by these VIEs are principally or solely a result of the debt instruments issued by them. We do not have the power

to direct the activities that most significantly impact the entity's economic performance, nor do we have the obligation to

absorb losses of the entity or the right to receive benefits from the entity. As such, we are not the primary beneficiary of

these VIEs and are therefore not required to consolidate them. These VIE investments comprise securities from 145

separate issuers with an average credit rating of BBB as of December 31, 2016, compared with 169 separate issuers with

an average credit rating of BBB as of December 31, 2015.

Loans and Loan Receivables

We classify our loans and loan receivables as held-for-investment and include them in the other investments line on

the consolidated balance sheets. We carry them on the balance sheet at amortized cost less an estimated allowance for

loan losses. Our loan allowance for losses is established using both specific and general allowances. The specific

allowance is used on an individual loan basis for those impaired loans where we expect to incur a loss. The general

allowance is used for loans grouped by similar risk characteristics where a loan-specific or market-specific risk has not

been identified, but for which we anticipate to incur a loss.

111