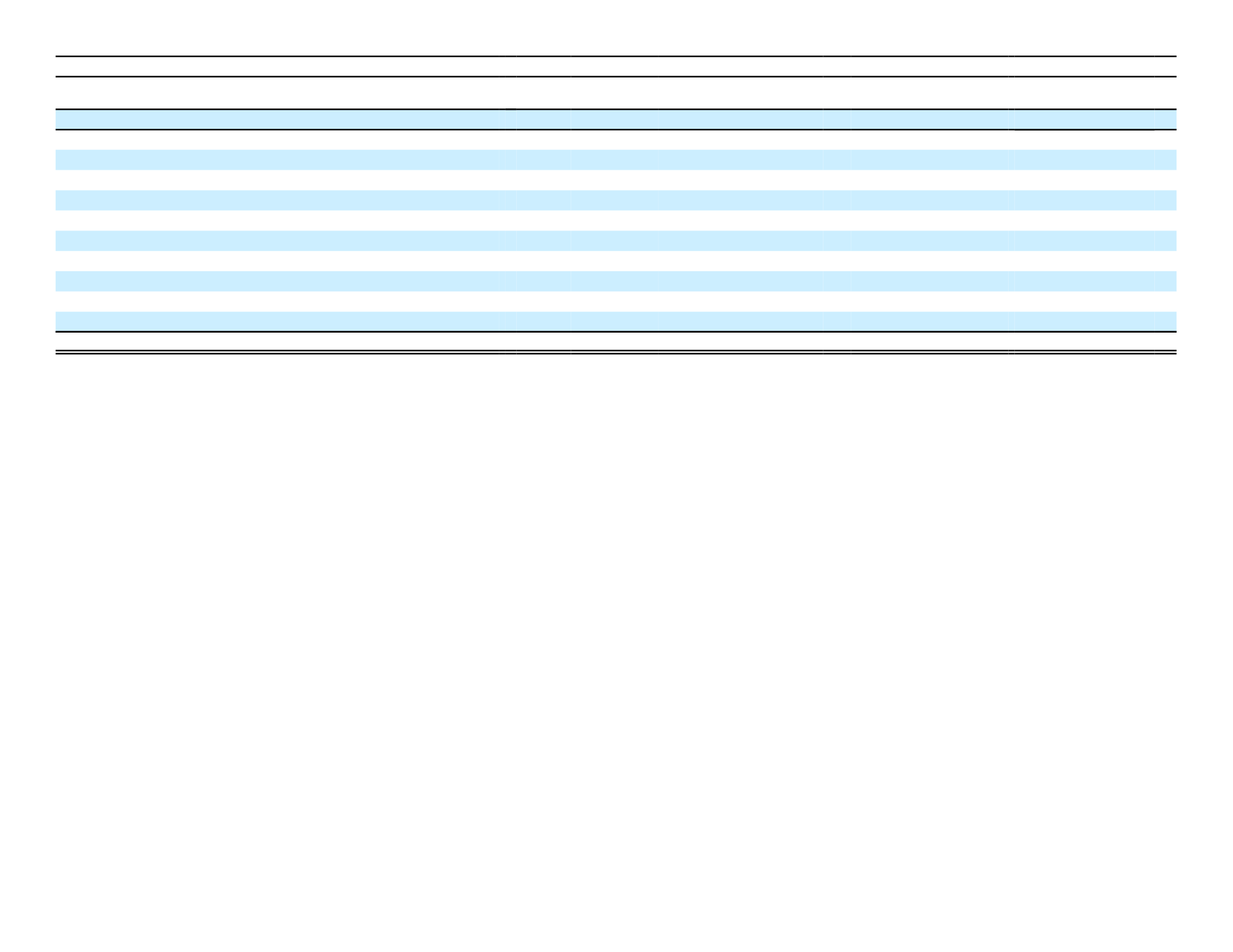

2016

(In millions)

Fair Value

Valuation Technique(s)

Unobservable Input

Range

(Weighted Average)

Liabilities:

Foreign currency swaps

$ 113

Discounted cash flow

Interest rates (USD)

2.34% - 2.59%

(a)

Interest rates (JPY)

.22% - .80%

(b)

CDS spreads

17 - 172 bps

Foreign exchange rates

21.47%

(c)

23

Discounted cash flow

Interest rates (USD)

2.34% - 2.59%

(a)

Interest rates (JPY)

.22% - .80%

(b)

CDS spreads

24 - 216 bps

10

Discounted cash flow

Interest rates (USD)

2.34% - 2.59%

(a)

Interest rates (JPY)

.22% - .80%

(b)

Foreign exchange rates

21.47%

(c)

Total liabilities

$ 146

(a) Inputs derived from U.S. long-term rates to accommodate long maturity nature of our swaps

(b) Inputs derived from Japan long-term rates to accommodate long maturity nature of our swaps

(c) Based on 10 year volatility of JPY/USD exchange rate

134