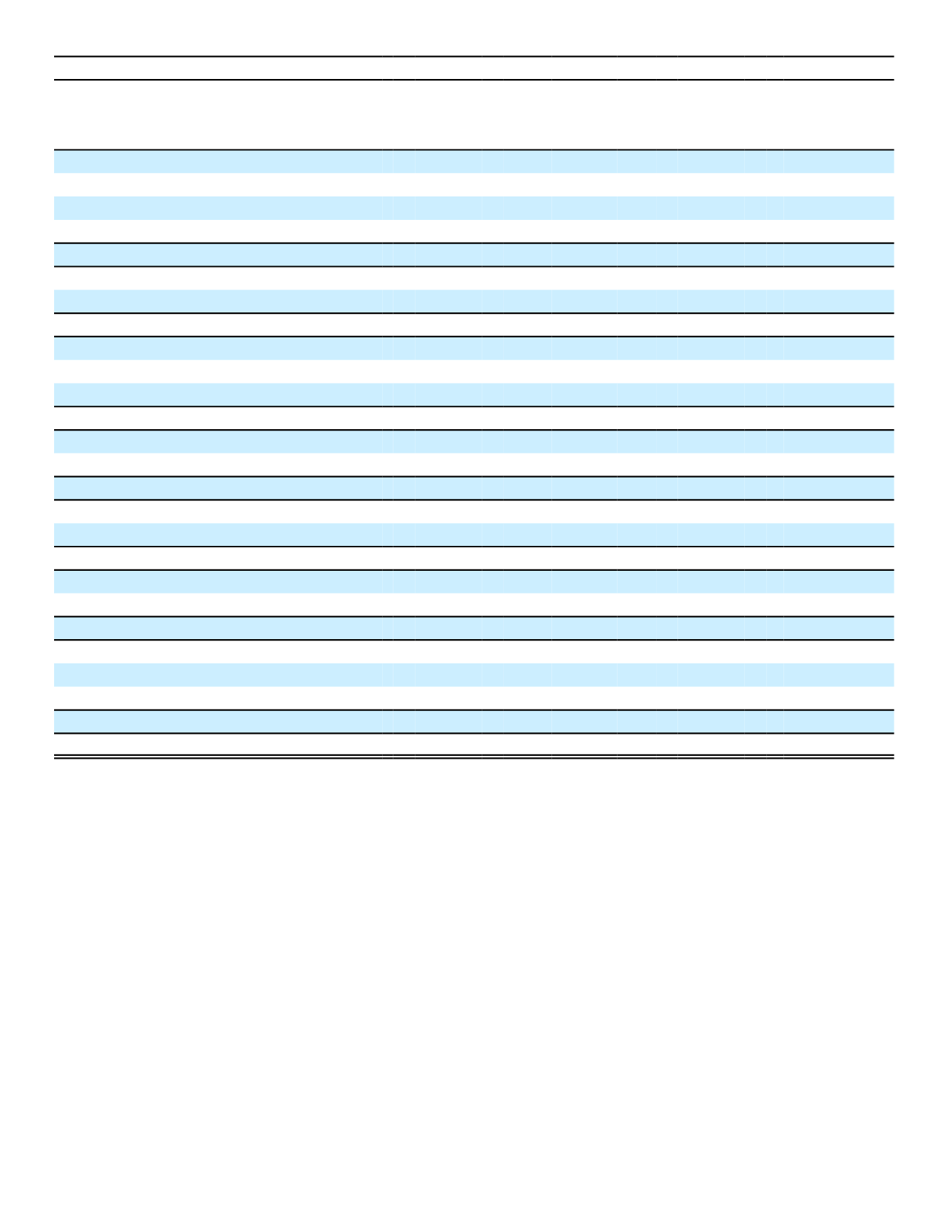

2015

(In millions)

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Fair

Value

Securities held to maturity, carried at amortized cost:

Fixed maturities:

Government and agencies:

Third party pricing vendor

$ 23,391

$

0

$

0

$ 23,391

Total government and agencies

23,391

0

0

23,391

Municipalities:

Third party pricing vendor

0

415

0

415

Total municipalities

0

415

0

415

Mortgage- and asset-backed securities:

Third party pricing vendor

0

12

0

12

Broker/other

0

0

26

26

Total mortgage- and asset-backed securities

0

12

26

38

Public utilities:

Third party pricing vendor

0

3,203

0

3,203

Total public utilities

0

3,203

0

3,203

Sovereign and supranational:

Third party pricing vendor

0

2,711

0

2,711

Total sovereign and supranational

0

2,711

0

2,711

Banks/financial institutions:

Third party pricing vendor

0

4,546

0

4,546

Total banks/financial institutions

0

4,546

0

4,546

Other corporate:

Third party pricing vendor

0

3,189

0

3,189

Broker/other

0

27

0

27

Total other corporate

0

3,216

0

3,216

Total securities held to maturity

$ 23,391

$ 14,103

$

26

$ 37,520

The following is a discussion of the determination of fair value of our remaining financial instruments.

Derivatives

We use derivative instruments to manage the risk associated with certain assets. However, the derivative instrument

may not be classified in the same fair value hierarchy level as the associated asset. Inputs used to value derivatives

include, but are not limited to, interest rates, credit spreads, foreign currency forward and spot rates, and interest volatility.

The fair values of the foreign currency forwards, options, and interest rate swaptions associated with certain

investments; the foreign currency forwards and options used to hedge foreign exchange risk from our net investment in

Aflac Japan and economically hedge certain portions of forecasted cash flows denominated in yen; and the foreign

currency swaps associated with certain senior notes and our subordinated debentures are based on the amounts we

would expect to receive or pay. The determination of the fair value of these derivatives is based on observable market

inputs, therefore they are classified as Level 2.

For derivatives associated with VIEs where we are the primary beneficiary, we are not the direct counterparty to the

swap contracts. As a result, the fair value measurements incorporate the credit risk of the collateral associated with the

VIE. We receive valuations from a third party pricing vendor for these derivatives. Based on an analysis of these

derivatives and a review of the methodology employed by the pricing vendor, we determined that due to the long duration

of these swaps and the need to extrapolate from short-term observable data to derive and measure long-term inputs,

certain inputs, assumptions and judgments are required to value future cash flows that cannot be corroborated by current

130