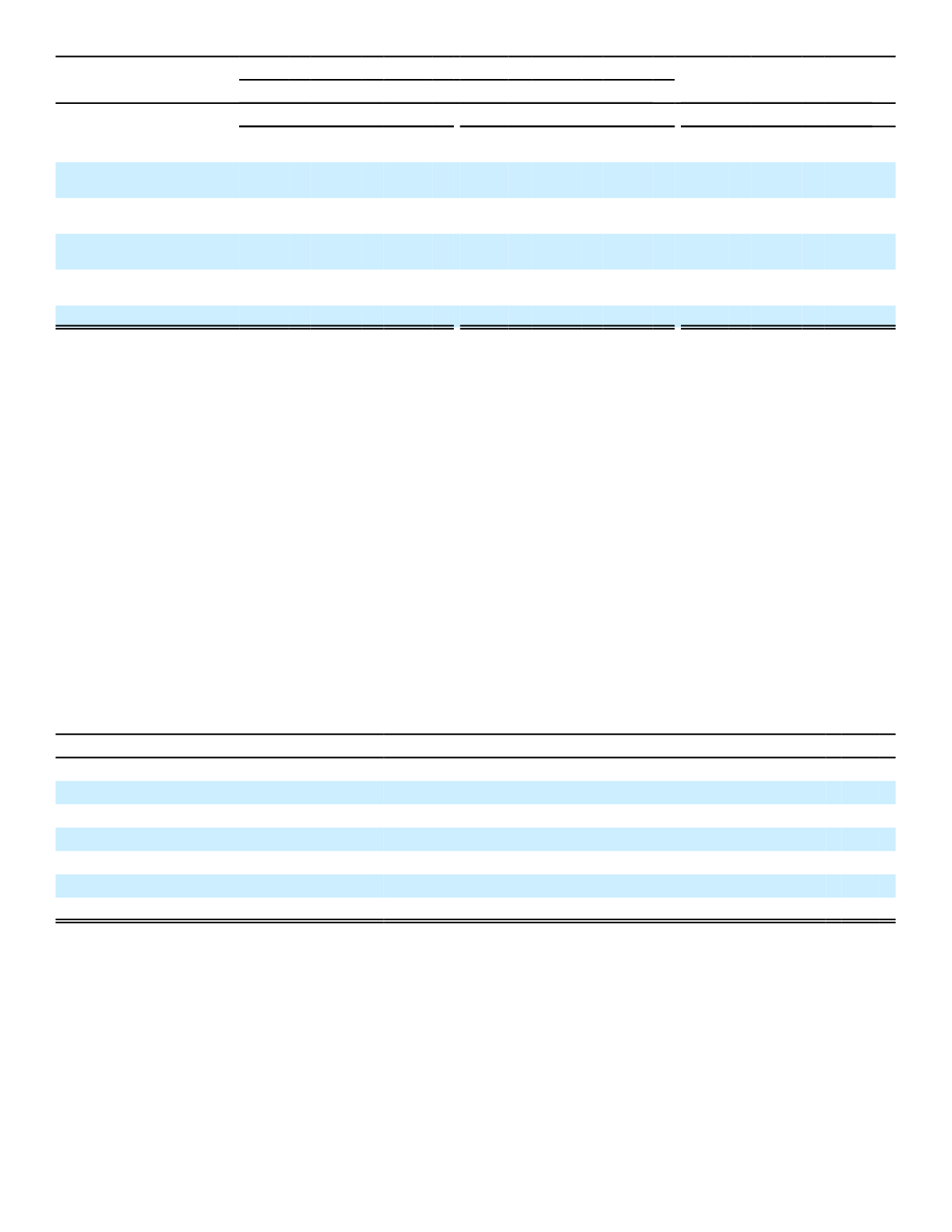

Pension Benefits

Other

Japan

U.S.

Postretirement Benefits

2016

2015

2014

2016

2015

2014

2016

2015

2014

Weighted-average

actuarial assumptions:

Discount rate - net periodic

benefit cost

1.75%

1.75% 2.25%

4.50%

4.50% 4.75%

4.50%

4.50% 4.75%

Discount rate - benefit

obligations

1.25

1.75

1.75

4.25

4.50

4.50

4.25

4.50

4.50

Expected long-term return

on plan assets

2.00

2.00

2.00

7.00

7.25

7.50

N/A

(1)

N/A

(1)

N/A

(1)

Rate of compensation

increase

N/A

(1)

N/A

(1)

N/A

(1)

4.00

4.00

4.00

N/A

(1)

N/A

(1)

N/A

(1)

Health care cost trend rates

N/A

(1)

N/A

(1)

N/A

(1)

N/A

(1)

N/A

(1)

N/A

(1)

5.20

(2)

5.30

(2)

5.70

(2)

(1)

Not applicable

(2)

For the years 2016, 2015 and 2014, the health care cost trend rates are expected to trend down to 4.5% in 74 years, 4.5% in 78

years, and 4.6% in 78 years, respectively.

We determine our discount rate assumption for our pension retirement obligations based on indices for AA corporate

bonds with an average duration of approximately 20 years for the Japan pension plans and 17 years for the U.S. pension

plans, and determination of the U.S. pension plans discount rate utilizes the 85-year extrapolated yield curve. In Japan,

participant salary and future salary increases are not factors in determining pension benefit cost or the related pension

benefit obligation.

We base our assumption for the long-term rate of return on assets on historical trends (10-year or longer historical

rates of return for the Japanese plan assets and 15-year historical rates of return for the U.S. plan assets), expected

future market movement, as well as the portfolio mix of securities in the asset portfolio including, but not limited to, style,

class and equity and fixed income allocations. In addition, our consulting actuaries evaluate our assumptions for long-term

rates of return under Actuarial Standards of Practice (ASOP). Under the ASOP, the actual portfolio type, mix and class is

modeled to determine a best estimate of the long-term rate of return. We in turn use those results to further validate our

own assumptions.

Assumed health care cost trend rates have a significant effect on the amounts reported for the health care plan. A

one-percentage point increase and decrease in assumed health care cost trend rates would have the following effects as

of December 31, 2016:

(In millions)

One percentage point increase:

Increase in total service and interest costs

$ 0

Increase in postretirement benefit obligation

2

One percentage point decrease:

Decrease in total service and interest costs

$ 0

Decrease in postretirement benefit obligation

2

Components of Net Periodic Benefit Cost

Pension and other postretirement benefit expenses, included in acquisition and operating expenses in the

consolidated statements of earnings for the years ended December 31, included the following components:

158