NQSOs, restricted stock, and stock appreciation rights. The ISOs and NQSOs have a term of 10 years, and the share-

based awards generally vest upon time-based conditions or time- and performance-based conditions. Time-based vesting

generally occurs after three years. Performance-based vesting conditions generally include the attainment of goals related

to Company financial performance. As of December 31, 2016, approximately 8.8 million shares were available for future

grants under this plan, and the only performance-based awards issued and outstanding were restricted stock awards.

Share-based awards granted to U.S.-based grantees are settled with authorized but unissued Company stock, while

those issued to Japan-based grantees are settled with treasury shares.

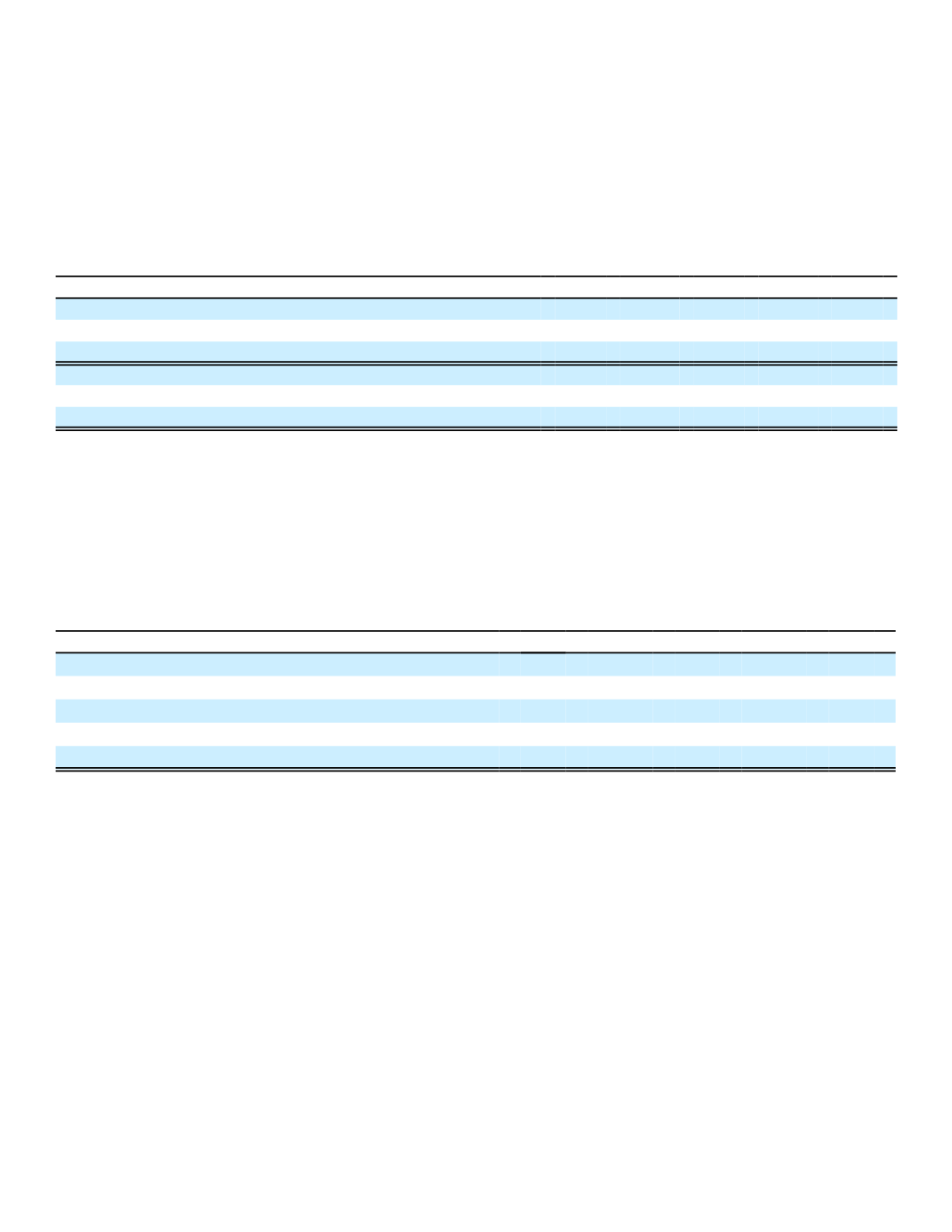

The following table presents the impact of the expense recognized in connection with share-based awards for the

periods ended December 31.

(In millions, except for per-share amounts)

2016

2015

2014

Impact on earnings from continuing operations

$ 68

$ 39

$ 41

Impact on earnings before income taxes

68

39

41

Impact on net earnings

46

27

28

Impact on net earnings per share:

Basic

$ .11

$ .06

$ .06

Diluted

.11

.06

.06

We estimate the fair value of each stock option granted using the Black-Scholes-Merton multiple option approach.

Expected volatility is based on historical periods generally commensurate with the estimated terms of the options. We use

historical data to estimate option exercise and termination patterns within the model. Separate groups of employees that

have similar historical exercise patterns are stratified and considered separately for valuation purposes. The expected

term of options granted is derived from the output of our option model and represents the weighted-average period of time

that options granted are expected to be outstanding. We base the risk-free interest rate on the Treasury note rate with a

term comparable to that of the estimated term of the options. The weighted-average fair value of options at their grant

date was $12.70 per share for 2016, compared with $9.46 for 2015 and $16.24 in 2014. The following table presents the

assumptions used in valuing options granted during the years ended December 31.

2016

2015

2014

Expected term (years)

6.4

6.3

6.3

Expected volatility

27.0 %

20.0 %

30.0 %

Annual forfeiture rate

3.2

2.8

2.7

Risk-free interest rate

2.2

2.0

2.8

Dividend yield

2.9

2.7

2.3

153