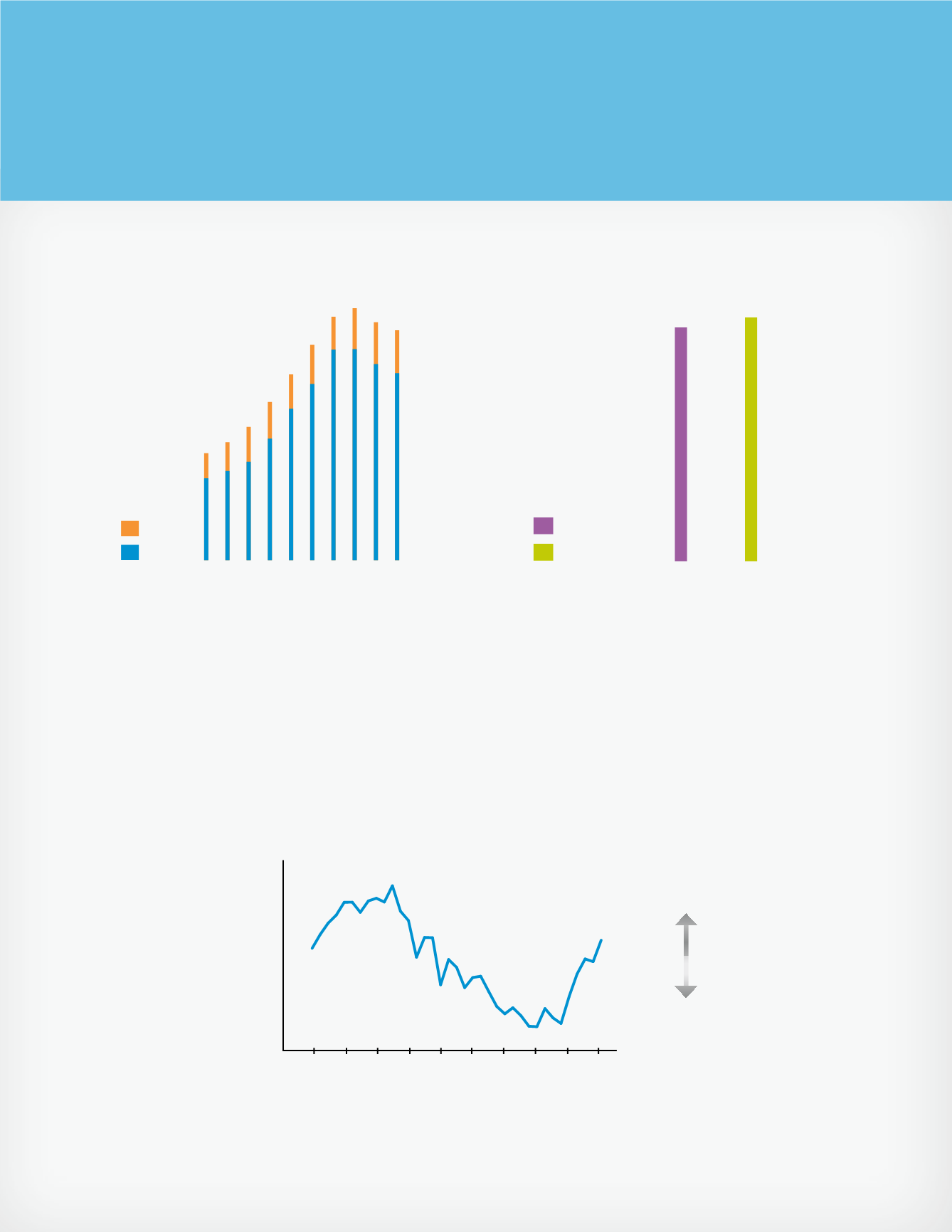

Average

Yen/Dollar Exchange Rates

2005 2006 2007 2008 2009 2010 2011

2012

2013

2014

Yen/Dollar

Exchange Rate

(Average)

90

100

80

70

110

120

¥130

YEN

WEAKENING

YEN

STRENGTHENING

Source: Bloomberg ©

The company believes that it is important to understand

the impact of translating yen into dollars on our financial

statements. A significant portion of Aflac’s business is

in Japan, where the functional currency is the yen. For

financial reporting purposes, we translate Aflac Japan’s

results in yen into U.S. dollars. It’s noteworthy that Aflac’s

currency exposure is primarily translation-related as

opposed to currency transactions. Due to the significant

05 06 07 08 09 10 11 12

13

14

4.5 4.4

2.0

2.2

2.5

2.9

3.4

4.0

4.7

4.3

U.S.

Japan

10 11 12

13

14

4.5 4.4

4.0

4.7

4.3

U.S.

Japan

2014

2014

4.4

4.3

As Reported

Excluding Yen Impact

THE IMPACT OF FOREIGN CURRENCY ON AFLAC

Impact of Currency on the Income Statement

Aflac’s income statement is translated at the average exchange

rate for the period. In years when the yen strengthens, trans-

lating yen into dollars causes more dollars to be reported. In

years when the yen weakens, translating yen into dollars causes

fewer dollars to be reported. After several years of strength-

ening, the yen has weakened for the past two years. In 2014, the

average yen/dollar exchange rate weakened 7.5% from 97.54

yen to the dollar to 105.46 yen to the dollar, which suppressed

Aflac’s income statement in dollar terms. We believe that viewing

our results excluding the impact from foreign currency is the

most meaningful way to evaluate our financial performance.

Operating earnings for the full year of 2014 were $4.3 billion.

Excluding the impact from the weaker yen, operating earnings

were $4.4 billion.

*Aflac believes that an analysis of operating earnings, a non-GAAP financial measure, is vitally important to an understanding of the company’s underlying profit-

ability drivers. Aflac defines operating earnings as the profits derived from operations, inclusive of interest cash flows associated with notes payable, but before

realized investment gains and losses from securities transactions, impairments, and derivative and hedging activities, as well as other and nonrecurring items.

PRETAX OPERATING EARNINGS*

(Dollars, In Billions)

8