152

IMI plc

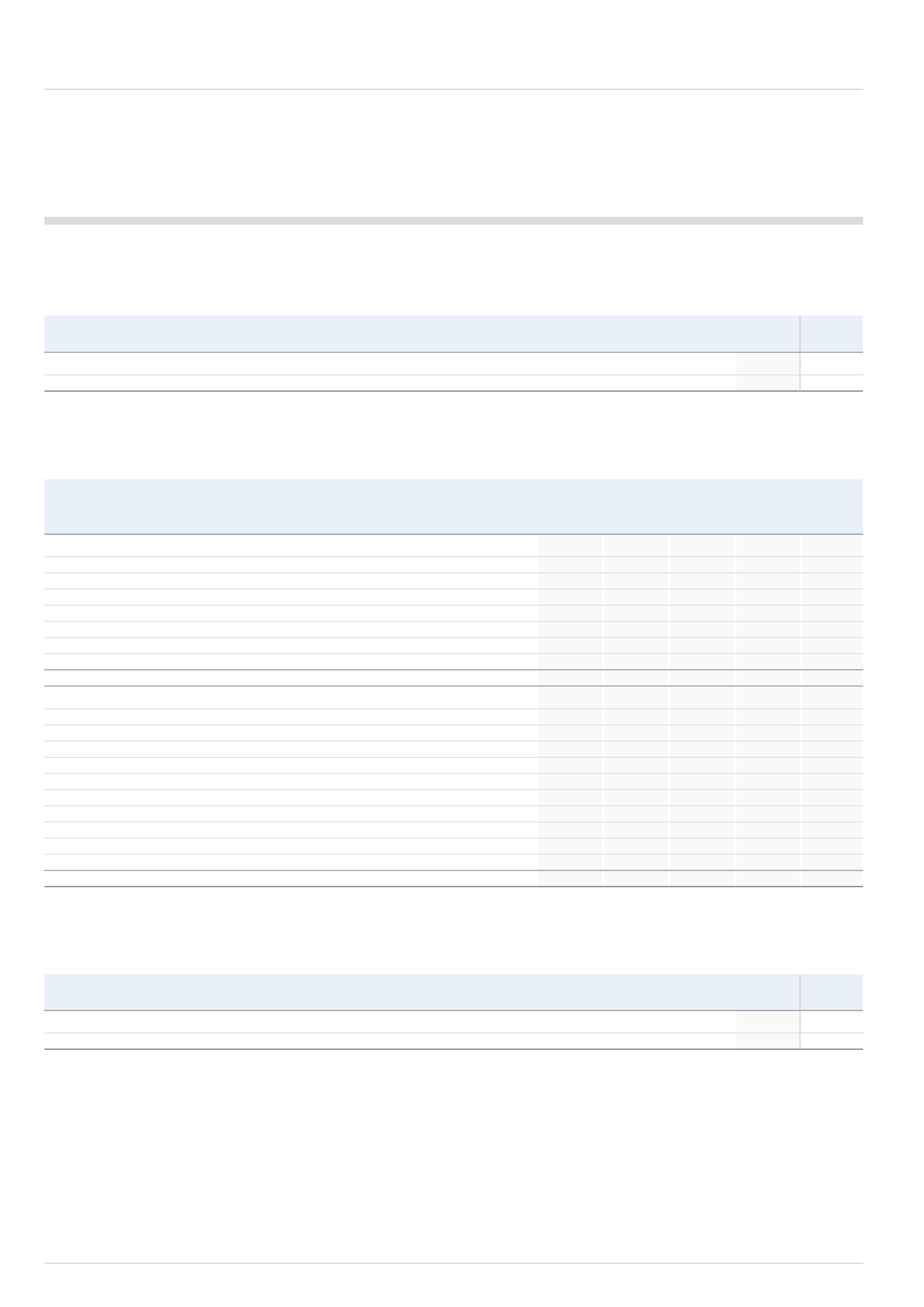

C8. Borrowings

This note provides information about the contractual terms of the Company’s interest-bearing loans and borrowings. For more information about the Company’s

exposure to interest rate and foreign currency risk, see section 4.4 in the Group financial statements.

2014

2013

£m

£m

Due within one year:

Unsecured US loan notes 2014

-

19.0

The reduction in unsecured loan notes is due to their settlement in the year.

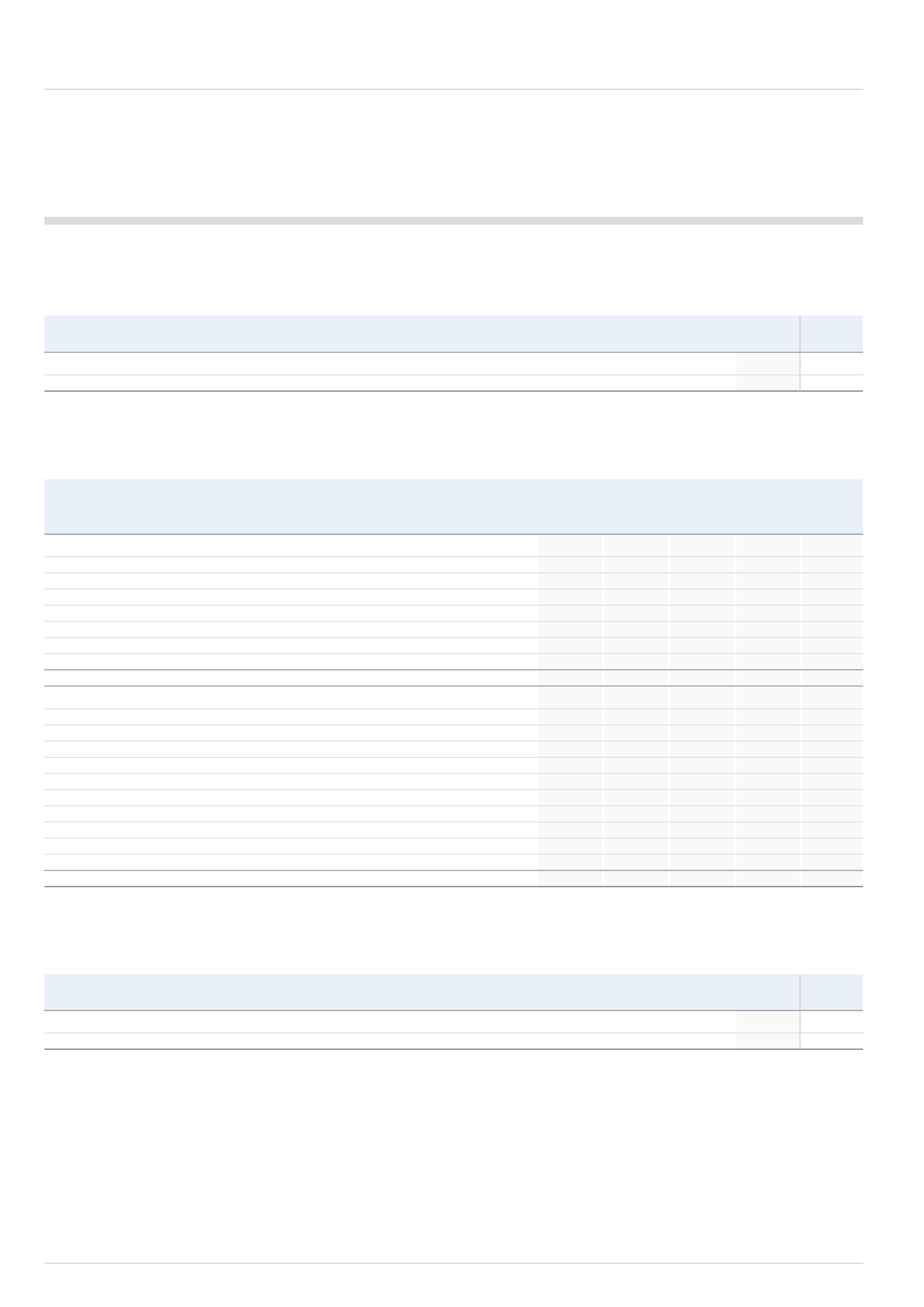

C9. Share capital and reserves

Share

Share Redemption

Retained

Parent

capital

premium reserve

earnings

equity

£m

£m

£m

£m

£m

At 1 January 2013

85.2

170.3

7.9

328.5

591.9

Retained profit for the year

288.9

288.9

Shares issued in the year

0.1

1.5

1.6

Dividends paid

(106.2)

(106.2)

Share-based payments

11.2

11.2

Shares acquired for:

employee share scheme trust

(24.2)

(24.2)

share buyback programme

(164.3)

(164.3)

At 31 December 2013

85.3

171.8

7.9

333.9

598.9

Retained profit for the year

659.3

659.3

Dividends paid on ordinary shares

(97.3)

(97.3)

Shares issued in the year

0.1

1.8

1.9

Issue of ‘B’ shares - capital option

151.9

(151.9)

-

Issue of ‘C’ shares - income option

10.9

(10.9)

-

Redemption of ‘B’ and ‘C’ shares

(162.8)

162.8

(162.8)

(162.8)

Dividends paid on ‘C’ shares

(457.5)

(457.5)

Cancellation of treasury shares

(3.7)

3.7

-

Share-based payments

4.4

4.4

Shares acquired for:

employee share scheme trust

(30.7)

(30.7)

At 31 December 2014

81.7

10.8

174.4

249.3

516.2

All of the retained earnings held at both 31 December 2014 and 31 December 2013 are considered to be distributable reserves.

Share capital

2014

2013

£m

£m

Issued and fully paid

286.0m (2013: 341.0m) ordinary shares of 28 4/7p (2013: 25p) each

81.7

85.3

C10. Contingencies

Contingent liabilities relating to guarantees in the normal course of business and other items amounted to £73.5m (2013: £74.1m).

There is a right of set-off with three of the Company’s bankers relating to the balances of the Company and a number of its wholly-owned UK subsidiaries.

Where the Company enters into financial guarantee contracts to guarantee the indebtedness of other companies within its Group, the Company considers these

to be insurance arrangements, and accounts for them as such. In this respect, the Company treats the guarantee contract as a contingent liability until such time

as it becomes probable that the Company will be required to make a payment under the guarantee.

The Company, as parent of the IMI Group, has contingent liabilities in respect of contingencies within the Group as described in Section 5.1 of the

Group financial statements.

COMPANY NOTES TO THE FINANCIAL STATEMENTS

Continued