155

Annual Report and Accounts 2014

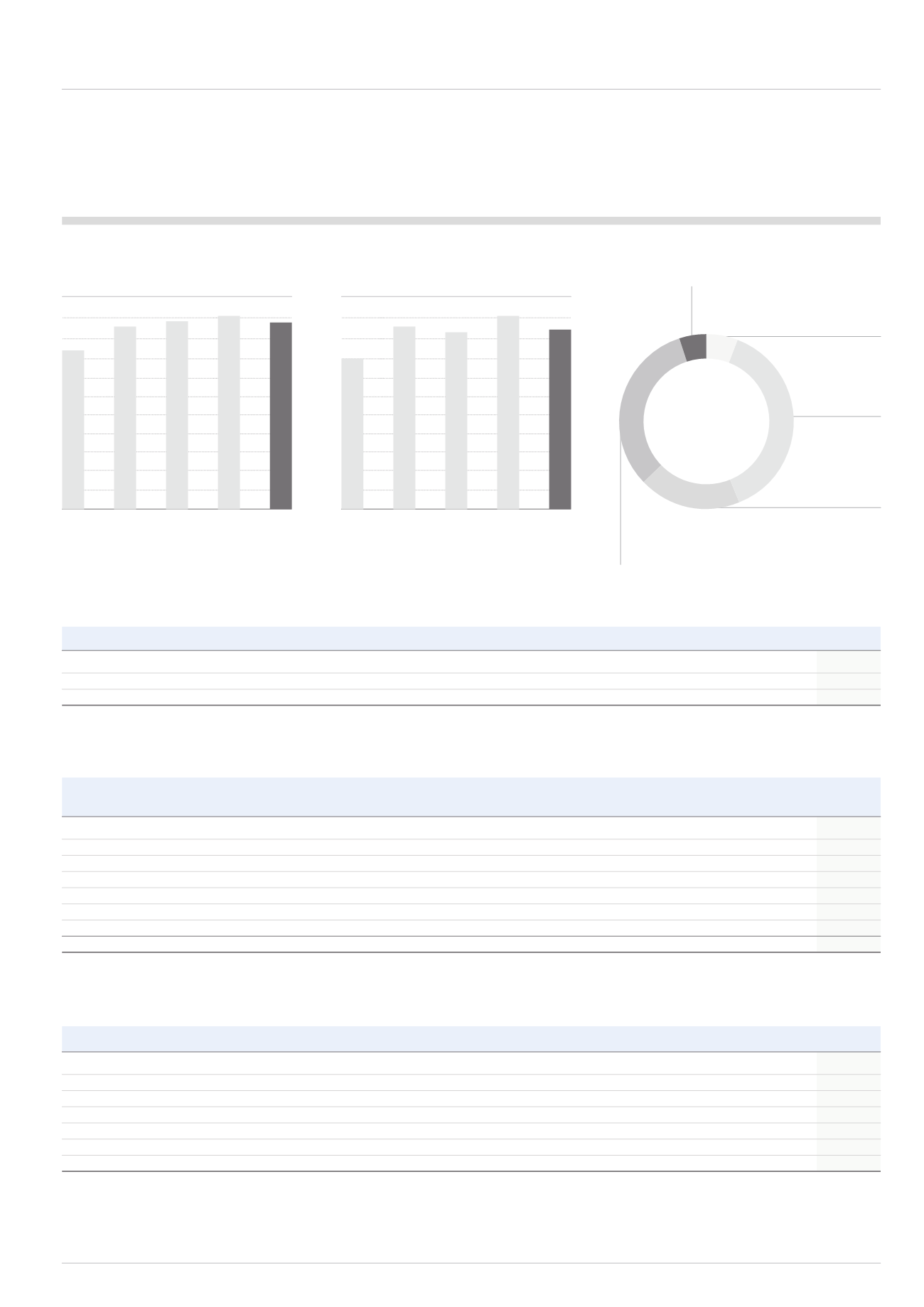

2012

Revenue £m

Adjusted profit before tax* £m

* Before exceptional items.

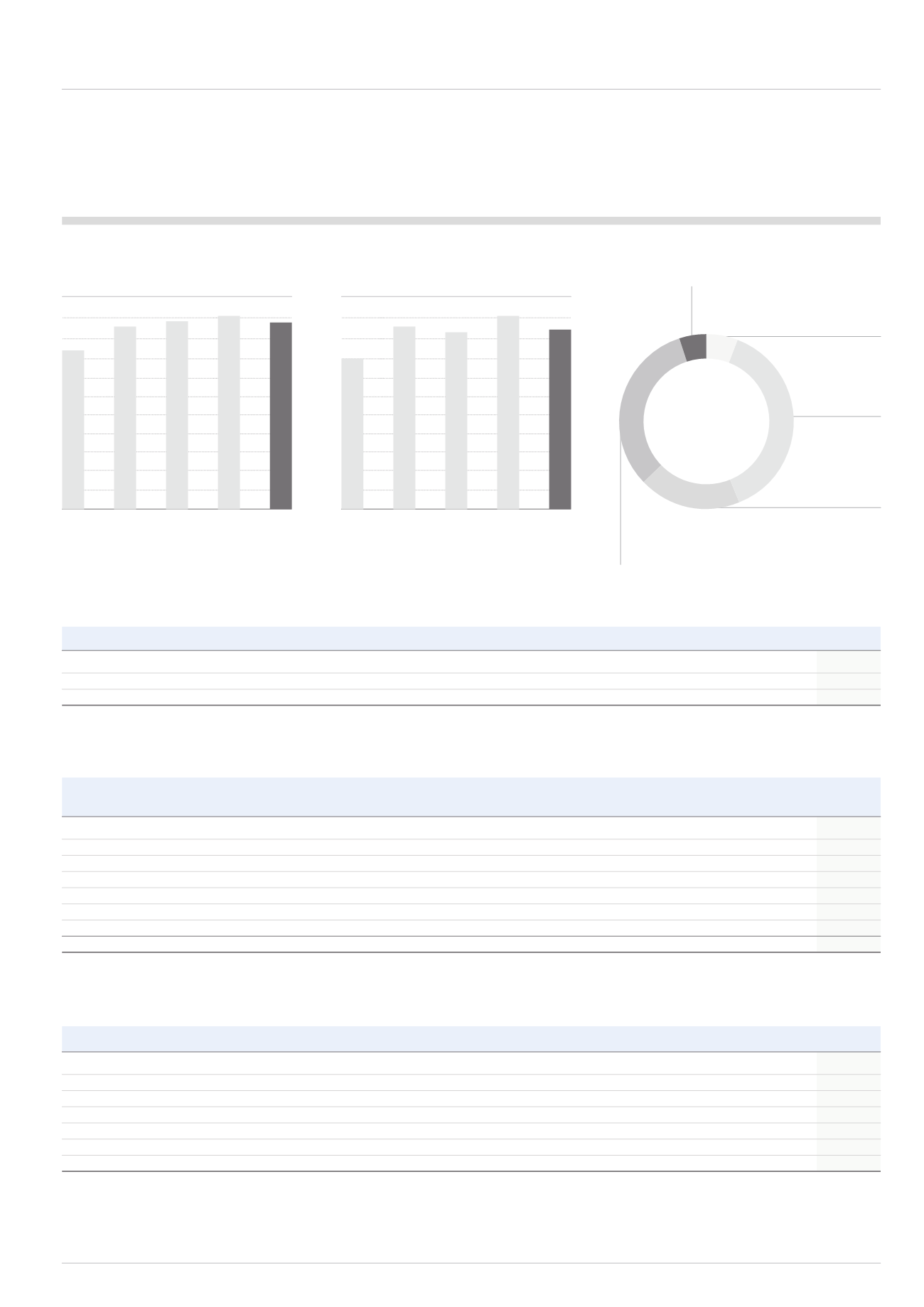

Continuing revenue by geographic destination 2014

Rest of the

World

5%

Emerging

Markets

32%

North America

19%

Westen Europe

38%

UK

6%

2010

2014

1,686

2010

1,427

2011

1,645

2012

1,694

2013

1,744

2014

278

235

2011

281

275

2013

298

Earnings and dividends

2010

2011

2012

2013

2014

Adjusted earnings per share (continuing)

52.6p

64.5p

64.7p

72.6p

78.0p

Basic earnings per share (continuing)

54.3p

50.5p

53.9p

60.4p

69.2p

Ordinary dividend per share

26.0p

30.0p

32.5p

35.3p

37.6p

Balance sheet

2010

2011

2012

2013

2014

£m

£m

£m

£m

£m

Segmental net assets

Continuing

791

806

906

897

849

Discontinued

194

192

189

196

-

Other net non-operating liabilities excluding borrowings

(264)

(275)

(267)

(246)

(95)

Net debt

Continuing

(164)

(127)

(160)

(226)

(200)

Discontinued

19

18

16

27

-

Net assets

576

614

684

648

554

Statistics

2010

2011

2012

2013

2014

Segmental operating profit as a percentage of segmental revenue

18.3% 18.7% 17.7% 18.4%

17.5%

Segmental operating profit as a percentage of segmental net assets

33.2% 38.2% 33.1% 35.9%

34.8%

Effective tax rate on adjusted profit before tax

28.0% 26.0% 24.0% 22.0%

22.0%

Net assets per share (excluding treasury and EBT shares)

181.9p 193.5p 214.0p 210.0p

218.4p

Net debt as a percentage of shareholders’ funds

28.5% 20.7% 23.4% 34.9%

36.1%

Net debt: EBITDA**

0.5

0.4

0.5

0.7

0.5

EBITDA: Interest

21

19

18

21

26

** For 2014, net debt to EBITDA excluding disposal gains and one off pension gains was 0.6 times.