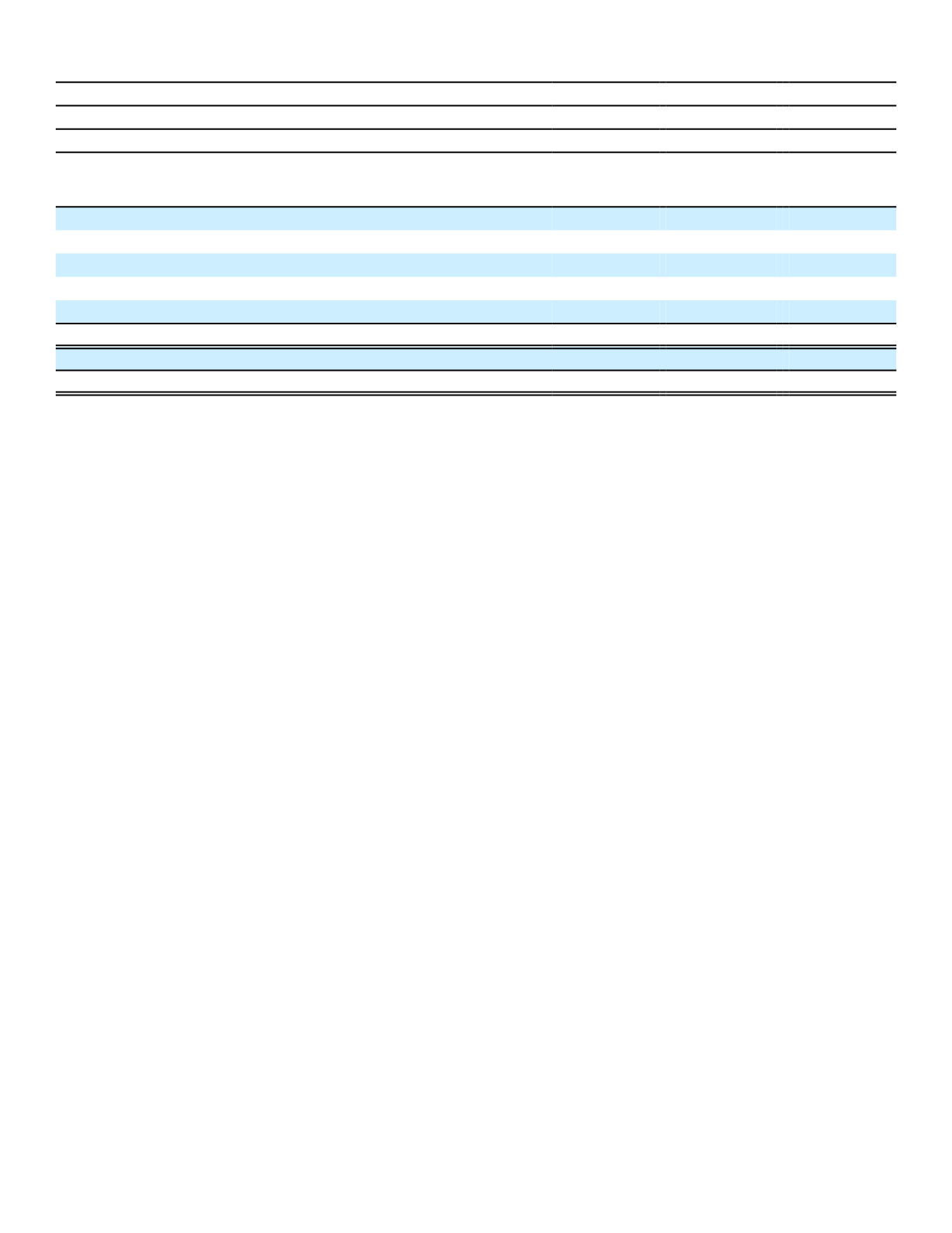

Securities Lending Transactions Accounted for as Secured Borrowings

2015

Remaining Contractual Maturity of the Agreements

(In millions)

Overnight

and

Continuous

(1)

Up to 30

days

Total

Securities lending transactions:

Japan government and agencies

$

0 $

499 $

499

Public utilities

108

0

108

Banks/financial institutions

13

0

13

Other corporate

321

0

321

Total borrowings

$

442 $

499 $

941

Gross amount of recognized liabilities for securities lending transactions

$

941

Amounts related to agreements not included in offsetting disclosure in Note 4

$

0

(1)

These securities are pledged as collateral under our U.S. securities lending program and can be called at our discretion; therefore,

they are classified as Overnight and Continuous.

We did not have any repurchase agreements or repurchase-to-maturity transactions outstanding as of December 31,

2016 and 2015, respectively.

Certain fixed-maturity securities can be pledged as collateral as part of derivative transactions, or pledged to support

state deposit requirements on certain investment programs. For additional information regarding pledged securities

related to derivative transactions, see Note 4.

At December 31, 2016, debt securities with a fair value of $17 million were on deposit with regulatory authorities in the

United States (including U.S. territories) and Japan. We retain ownership of all securities on deposit and receive the

related investment income.

For general information regarding our investment accounting policies, see Note 1.

113

4. DERIVATIVE INSTRUMENTS

Our freestanding derivative financial instruments have historically consisted of: (1) foreign currency swaps and credit

default swaps that are associated with investments in special-purpose entities, including VIEs where we are the primary

beneficiary; (2) foreign currency forwards and options used in hedging foreign exchange risk on U.S. dollar-denominated

investments in Aflac Japan's portfolio; (3) foreign currency forwards and options used to hedge foreign exchange risk from

our net investment in Aflac Japan and economically hedge certain portions of forecasted cash flows denominated in yen;

(4) swaps associated with our notes payable, consisting of cross-currency interest rate swaps, also referred to as foreign

currency swaps, associated with certain senior notes and our subordinated debentures; and (5) options on interest rate

swaps (or interest rate swaptions) and futures used to hedge interest rate risk for certain available-for-sale securities. We

do not use derivative financial instruments for trading purposes, nor do we engage in leveraged derivative transactions.

Some of our derivatives are designated as cash flow hedges, fair value hedges or net investment hedges; however, other

derivatives do not qualify for hedge accounting or we elect not to designate them as an accounting hedge. We utilize a net

investment hedge to mitigate foreign exchange exposure resulting from our net investment in Aflac Japan. In addition to

designating derivatives as hedging instruments, we have designated the majority of the Parent Company's yen-

denominated liabilities (notes payable and loans) as non-derivative hedging instruments for this net investment hedge.

Derivative Types

We enter into foreign currency swaps pursuant to which we exchange an initial principal amount in one currency for

an initial principal amount of another currency, with an agreement to re-exchange the currencies at a future date at an

agreed upon exchange rate. There may also be periodic exchanges of payments at specified intervals based on the

agreed upon rates and notional amounts. Foreign currency swaps are used primarily in the consolidated VIEs in our Aflac

Japan portfolio to convert foreign-denominated cash flows to yen, the functional currency of Aflac Japan, in order to