Assuming no credit-related factors develop, unrealized gains and losses on fixed maturities and perpetual securities

are expected to diminish as investments near maturity. Based on our credit analysis, we believe that the issuers of our

fixed maturity and perpetual security investments in the sectors shown in the table above have the ability to service their

obligations to us.

110

Variable Interest Entities (VIEs)

As a condition to our involvement or investment in a VIE, we enter into certain protective rights and covenants that

preclude changes in the structure of the VIE that would alter the creditworthiness of our investment or our beneficial

interest in the VIE.

For those VIEs other than certain unit trust structures, our involvement is passive in nature. We are not, nor have we

been, required to purchase any securities issued in the future by these VIEs.

Our ownership interest in VIEs is limited to holding the obligations issued by them. We have no direct or contingent

obligations to fund the limited activities of these VIEs, nor do we have any direct or indirect financial guarantees related to

the limited activities of these VIEs. We have not provided any assistance or any other type of financing support to any of

the VIEs we invest in, nor do we have any intention to do so in the future. For those VIEs in which we hold debt

obligations, the weighted-average lives of our notes are very similar to the underlying collateral held by these VIEs where

applicable.

We also utilize unit trust structures in our Aflac Japan segment to invest in various asset classes. As the sole investor

of these VIEs, we are required to consolidate these entities under U.S. GAAP.

Our risk of loss related to our interests in any of our VIEs is limited to the carrying value of the related investments

held in the VIE.

VIEs - Consolidated

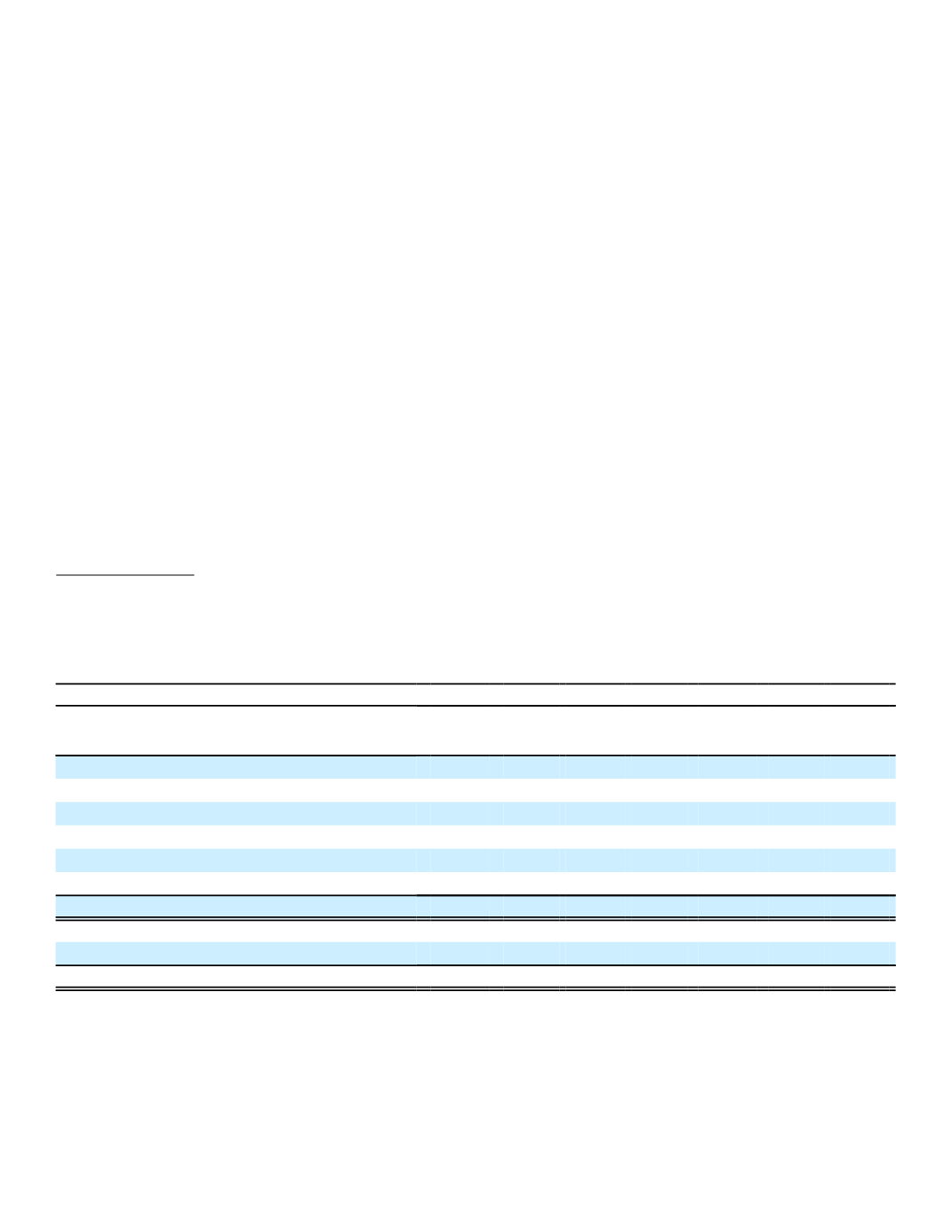

The following table presents the cost or amortized cost, fair value and balance sheet caption in which the assets and

liabilities of consolidated VIEs are reported as of December 31.

Investments in Consolidated Variable Interest Entities

2016

2015

(In millions)

Cost or

Amortized

Cost

Fair

Value

Cost or

Amortized

Cost

Fair

Value

Assets:

Fixed maturities, available for sale

$4,168

$4,982

$3,739

$4,554

Perpetual securities, available for sale

237

208

255

228

Equity securities

972

1,044

363

363

Other investments

819

789

0

0

Other assets

127

127

102

102

Total assets of consolidated VIEs

$6,323

$7,150

$4,459

$5,247

Liabilities:

Other liabilities

$ 146

$ 146

$ 293

$ 293

Total liabilities of consolidated VIEs

$ 146

$ 146

$ 293

$ 293

We are substantively the only investor in the consolidated VIEs listed in the table above. As the sole investor in these

VIEs, we have the power to direct the activities of the variable interest entity that most significantly impact the entity's

economic performance and are therefore considered to be the primary beneficiary of the VIEs that we consolidate. We

also participate in substantially all of the variability created by these VIEs. The activities of these VIEs are limited to

holding invested assets and foreign currency, and/or CDS, as appropriate, and utilizing the cash flows from these

securities to service our investment. Neither we nor any of our creditors are able to obtain the underlying collateral of the

VIEs unless there is an event of default or other specified event. For those VIEs that contain a swap, we are not a direct

counterparty to the swap contracts and have no control over them. Our loss exposure to these VIEs is limited to our