Middle Market Loans

As of December 31, 2016 and 2015, our investment in middle market loan receivables, net of loan loss reserves and

inclusive of those loans held in unit trust structures as discussed above, was $319 million and $118 million, respectively.

These balances include an unfunded amount of $91 million and $53 million as of December 31, 2016 and 2015,

respectively, that was reflected in other liabilities on the consolidated balance sheets. As of December 31, 2016 and 2015,

we had no loans that were past due in regards to principal and/or interest payments. Additionally, we held no loans that

were on nonaccrual status or considered impaired as of December 31, 2016 and 2015. Our middle market loan allowance

for losses was immaterial as of December 31, 2016 and 2015. Our middle market loan allowance for losses is established

using a general allowance methodology by applying industry average long term historical loss rates to our outstanding

middle market loan balances. We had no troubled debt restructurings during December 31, 2016 and 2015.

As of December 31, 2016, we had commitments of $779 million to fund potential future loan originations related to this

investment program, inclusive of loans held in unit trust structures. These commitments are contingent upon the

availability of middle market loans that meet our underwriting criteria.

Commercial Mortgage Loans

In 2016, we began funding investments in commercial mortgage loans. As of December 31, 2016, the amortized cost

of these investments, net of loan loss reserves and inclusive of those loans held in unit trust structures as discussed

above, was $855 million. We had no loans that were past due in regards to principal and/or interest payments, and we

held no loans that were on nonaccrual status or considered impaired as of December 31, 2016. Our commercial mortgage

loan allowance for losses was immaterial as of December 31, 2016. We had no troubled debt restructurings during the

year ended December 31, 2016.

As of December 31, 2016, we had $19 million in outstanding commitments to fund commercial mortgage loans,

inclusive of loans held in unit trust structures. These commitments are contingent on the final underwriting and due

diligence to be performed.

112

Securities Lending and Pledged Securities

We lend fixed-maturity securities to financial institutions in short-term security-lending transactions. These short-term

security-lending arrangements increase investment income with minimal risk. Our security lending policy requires that the

fair value of the securities and/or unrestricted cash received as collateral be 102% or more of the fair value of the loaned

securities. These securities continue to be carried as investment assets on our balance sheet during the terms of the

loans and are not reported as sales. We receive cash or other securities as collateral for such loans. For loans involving

unrestricted cash or securities as collateral, the collateral is reported as an asset with a corresponding liability for the

return of the collateral.

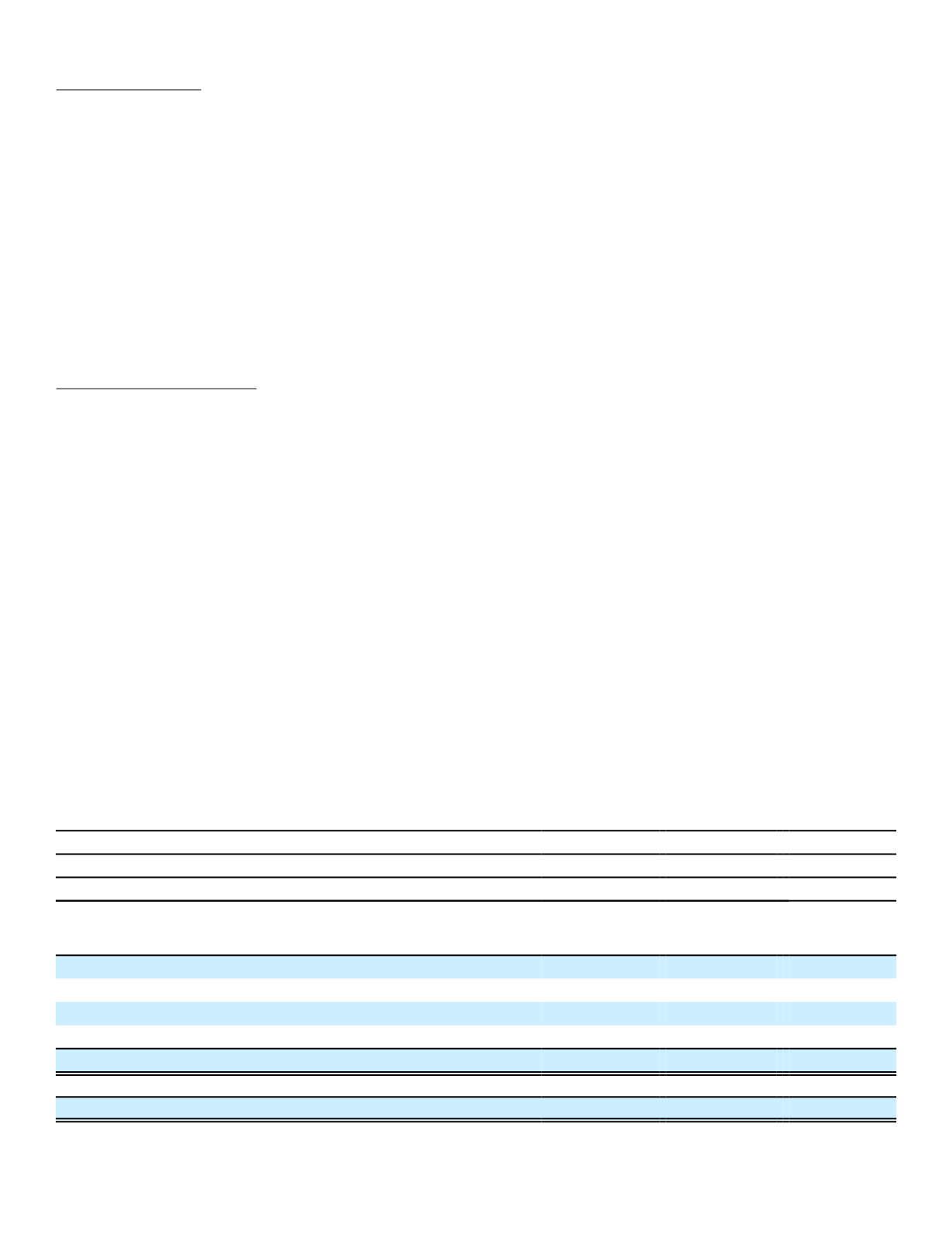

Details of our securities lending activities as of December 31 were as follows:

Securities Lending Transactions Accounted for as Secured Borrowings

2016

Remaining Contractual Maturity of the Agreements

(In millions)

Overnight

and

Continuous

(1)

Up to 30

days

Total

Securities lending transactions:

Public utilities

$

62 $

0 $

62

Banks/financial institutions

34

0

34

Other corporate

430

0

430

Total borrowings

$

526 $

0 $

526

Gross amount of recognized liabilities for securities lending transactions

$

526

Amounts related to agreements not included in offsetting disclosure in Note 4

$

0

(1)

These securities are pledged as collateral under our U.S. securities lending program and can be called at our discretion; therefore,

they are classified as Overnight and Continuous.