correlation determined and the appropriate spreads selected, a valuation is calculated. An increase in the CDS spreads in

the underlying portfolio leads to a decrease in the value due to higher probability of defaults and losses. The impact on the

valuation due to base correlation depends on a number of factors, including the riskiness between market tranches and

the modeled tranche based on our portfolio and the equivalence between detachment points in these tranches. Generally

speaking, an increase in base correlation will decrease the value of the senior tranches while increasing the value of

junior tranches. This may result in a positive or negative value change.

The CDO tranche in our portfolio is a senior mezzanine tranche and, due to the low level of credit support for this type

of tranche, exhibits equity-like behavior. As a result, an increase in recovery rates tends to cause its value to decrease.

Base correlations, CDS spreads, and recovery rates are unobservable inputs in the determination of fair value of

credit default swaps.

For additional information on our investments and financial instruments, see the accompanying Notes 1, 3 and 4.

138

6. DEFERRED POLICY ACQUISITION COSTS AND INSURANCE EXPENSES

Consolidated policy acquisition costs deferred were $1.4 billion in 2016, compared with $1.3 billion in 2015 and 2014.

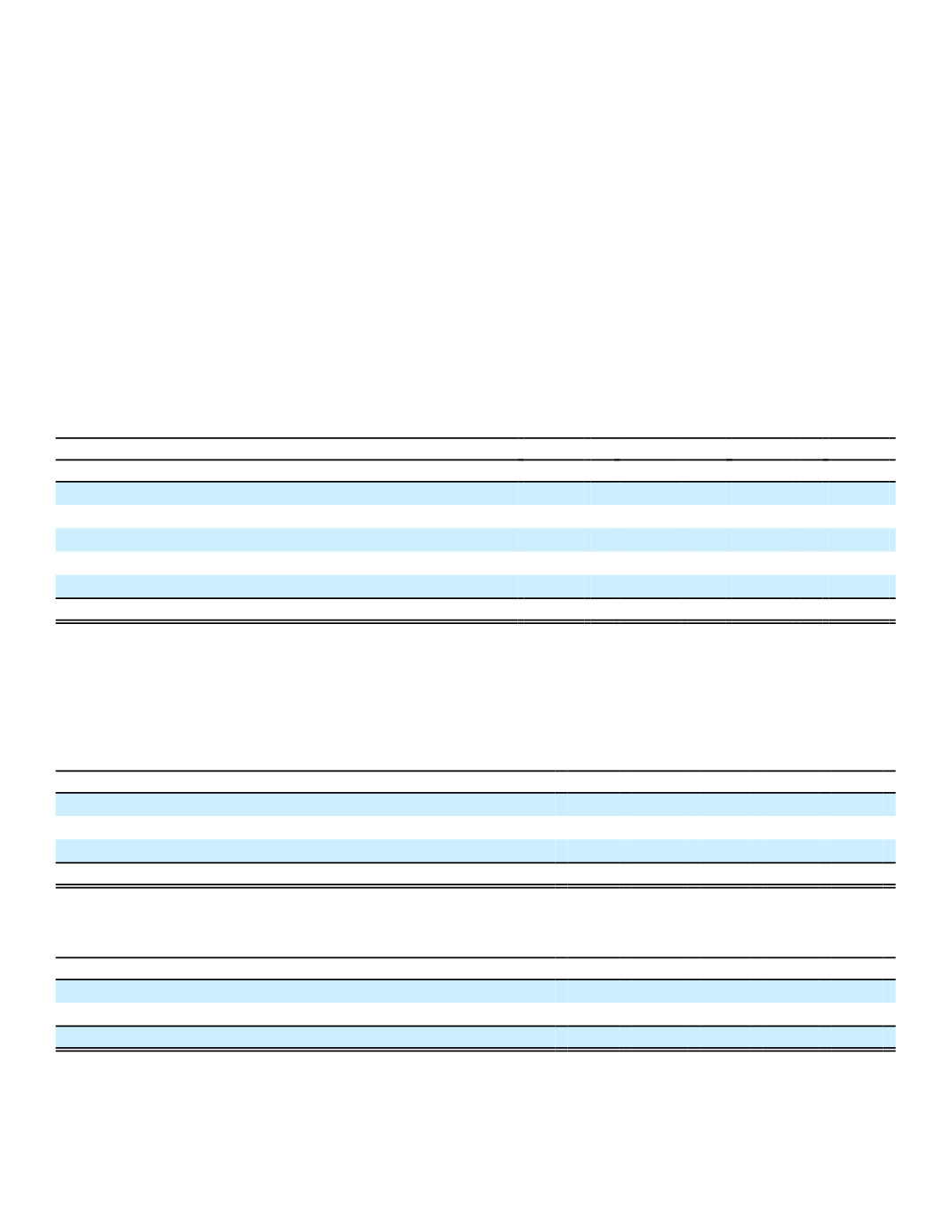

The following table presents a rollforward of deferred policy acquisition costs by segment for the years ended

December 31.

2016

2015

(In millions)

Japan

U.S.

Japan

U.S.

Deferred policy acquisition costs:

Balance, beginning of year

$ 5,370

$ 3,141

$ 5,211

$ 3,062

Capitalization

864

583

738

578

Amortization

(644)

(497)

(578)

(488)

Foreign currency translation and other

175

1

(1)

(11)

Balance, end of year

$ 5,765

$ 3,228

$ 5,370

$ 3,141

Commissions deferred as a percentage of total acquisition costs deferred were 74% in 2016 and 2015, compared with

77% in 2014.

Personnel, compensation and benefit expenses as a percentage of insurance expenses were 53% in 2016, compared

with 52% in 2015 and 2014. Advertising expense, which is included in insurance expenses in the consolidated statements

of earnings, was as follows for the years ended December 31:

(In millions)

2016

2015

2014

Advertising expense:

Aflac Japan

$ 100

$ 82

$ 103

Aflac U.S.

124

129

126

Total advertising expense

$ 224

$ 211

$ 229

Depreciation and other amortization expenses, which are included in insurance expenses in the consolidated

statements of earnings, were as follows for the years ended December 31:

(In millions)

2016

2015

2014

Depreciation expense

$ 48

$ 44

$ 47

Other amortization expense

6

6

8

Total depreciation and other amortization expense

$ 54

$ 50

$ 55