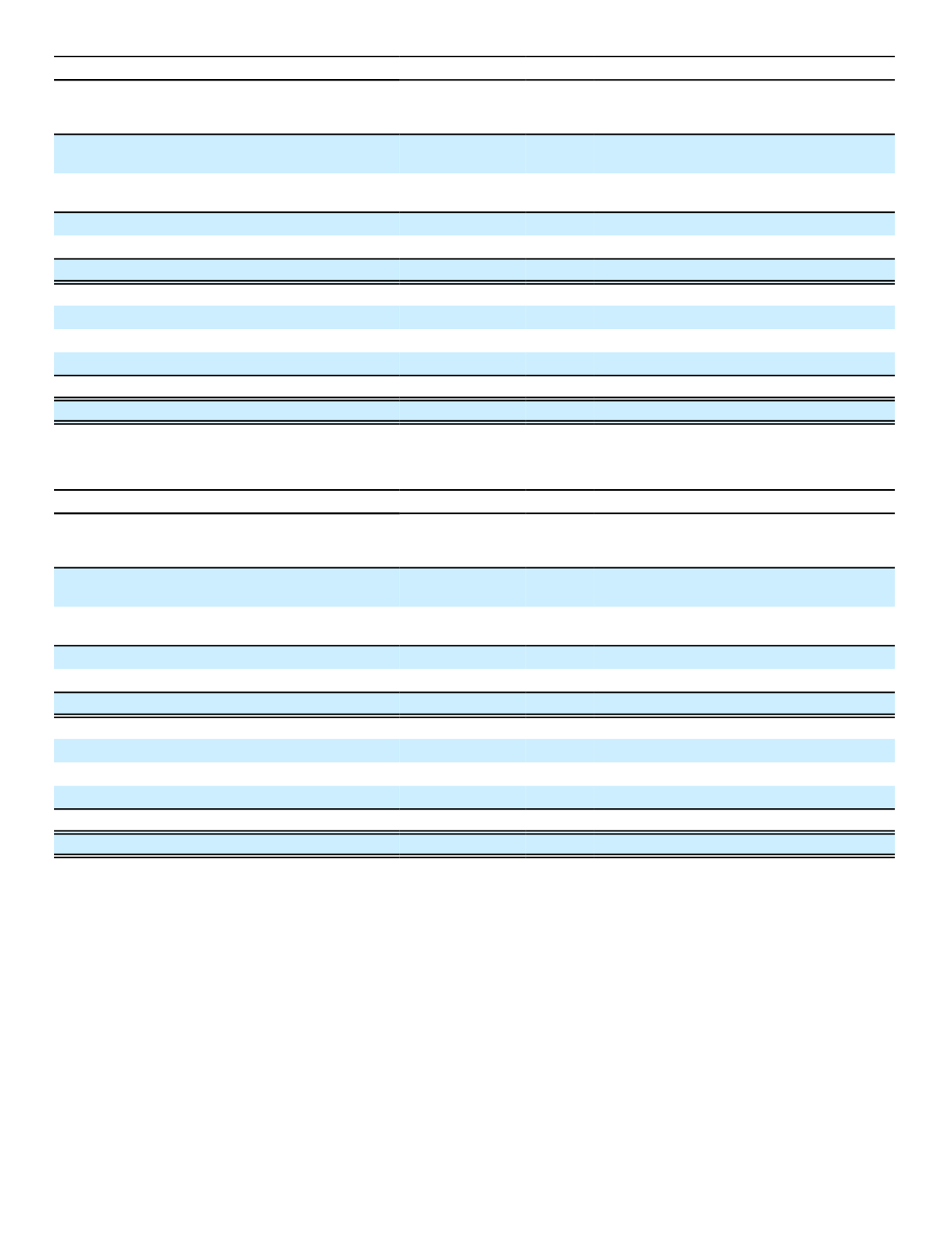

(In millions)

2015

Details about Accumulated Other

Comprehensive Income Components

Amount Reclassified

from Accumulated Other

Comprehensive Income

Affected Line Item in the

Statements of Earnings

Unrealized gains (losses) on available-for-sale

securities

$ 214

Sales and redemptions

(153)

Other-than-temporary impairment

losses realized

61

Total before tax

(21)

Tax (expense) or benefit

(1)

$ 40

Net of tax

Amortization of defined benefit pension items:

Actuarial gains (losses)

$ (17)

Acquisition and operating expenses

(2)

Prior service (cost) credit

17

Acquisition and operating expenses

(2)

0

Tax (expense) or benefit

(1)

$ 0

Net of tax

Total reclassifications for the period

$ 40

Net of tax

(1)

Based on 35% tax rate

(2)

These accumulated other comprehensive income components are included in the computation of net periodic pension cost (see Note

14 for additional details).

(In millions)

2014

Details about Accumulated Other

Comprehensive Income Components

Amount Reclassified

from Accumulated Other

Comprehensive Income

Affected Line Item in the

Statements of Earnings

Unrealized gains (losses) on available-for-sale

securities

$ 57

Sales and redemptions

(3)

Other-than-temporary impairment

losses realized

54

Total before tax

(19)

Tax (expense) or benefit

(1)

$ 35

Net of tax

Amortization of defined benefit pension items:

Actuarial gains (losses)

$ (15)

Acquisition and operating expenses

(2)

Prior service (cost) credit

17

Acquisition and operating expenses

(2)

(1)

Tax (expense) or benefit

(1)

$ 1

Net of tax

Total reclassifications for the period

$ 36

Net of tax

(1)

Based on 35% tax rate

(2)

These accumulated other comprehensive income components are included in the computation of net periodic pension cost (see Note

14 for additional details).

152

12. SHARE-BASED COMPENSATION

As of December 31, 2016, the Company has outstanding share-based awards under two long-term incentive

compensation plans.

The first plan, which expired in February 2007, is a stock option plan which allowed grants for incentive stock options

(ISOs) to employees and non-qualifying stock options (NQSOs) to employees and non-employee directors. The options

have a term of 10 years. The exercise price of options granted under this plan is equal to the fair market value of a share

of the Company's common stock at the date of grant. Options granted before the plan's expiration date remain

outstanding in accordance with their terms.

The second long-term incentive compensation plan allows awards to Company employees for ISOs, NQSOs,

restricted stock, restricted stock units, and stock appreciation rights. Non-employee directors are eligible for grants of