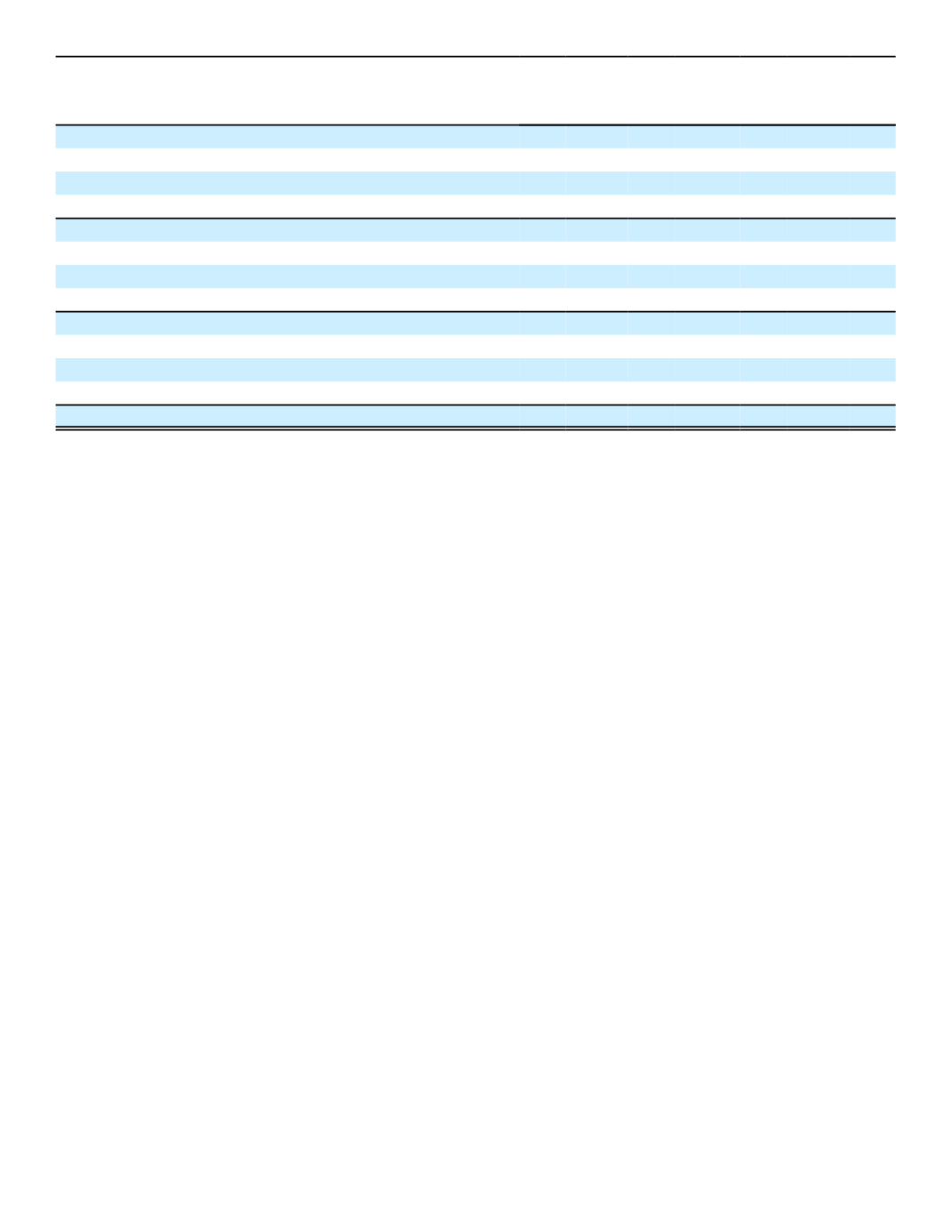

(In thousands of shares)

Shares

Weighted-Average

Grant-Date

Fair Value

Per Share

Restricted stock at December 31, 2013

1,671

$ 52.12

Granted in 2014

584

62.12

Canceled in 2014

(27)

52.66

Vested in 2014

(348)

56.95

Restricted stock at December 31, 2014

1,880

54.33

Granted in 2015

638

61.51

Canceled in 2015

(145)

57.52

Vested in 2015

(558)

48.41

Restricted stock at December 31, 2015

1,815

58.42

Granted in 2016

878

61.68

Canceled in 2016

(76)

60.65

Vested in 2016

(749)

53.68

Restricted stock at December 31, 2016

1,868

$ 61.76

As of December 31, 2016, total compensation cost not yet recognized in our financial statements related to restricted

stock awards was $33 million, of which $10 million (953 thousand shares) was related to restricted stock awards with a

performance-based vesting condition. We expect to recognize these amounts over a weighted-average period of

approximately 1.0 years. There are no other contractual terms covering restricted stock awards once vested.

155

13. STATUTORY ACCOUNTING AND DIVIDEND RESTRICTIONS

Our insurance subsidiaries are required to report their results of operations and financial position to state insurance

regulatory authorities on the basis of statutory accounting practices prescribed or permitted by such authorities. Statutory

accounting practices primarily differ from U.S. GAAP by charging policy acquisition costs to expense as incurred,

establishing future policy benefit liabilities using different actuarial assumptions as well as valuing investments and certain

assets and accounting for deferred taxes on a different basis.

Aflac, the Company's most significant insurance subsidiary, reports statutory financial statements that are prepared on

the basis of accounting practices prescribed or permitted by the Nebraska Department of Insurance (NDOI). The NDOI

recognizes statutory accounting principles and practices prescribed or permitted by the state of Nebraska for determining

and reporting the financial condition and results of operations of an insurance company, and for determining a company's

solvency under Nebraska insurance law. The National Association of Insurance Commissioners' (NAIC)

Accounting

Practices and Procedures Manual

(SAP) has been adopted by the state of Nebraska as a component of those prescribed

or permitted practices. Additionally, the Director of the NDOI has the right to permit other specific practices which deviate

from prescribed practices. Aflac has been given explicit permission by the Director of the NDOI for two such permitted

practices. These permitted practices, which do not impact the calculation of net income on a statutory basis or prevent the

triggering of a regulatory event in the Company's risk-based capital calculation, are as follows:

•

Aflac has reported as admitted assets the refundable lease deposits on the leases of commercial office space

which house Aflac Japan's sales operations. These lease deposits are unique and part of the ordinary course of

doing business in the country of Japan; these assets would be non-admitted under SAP.

• Aflac entered into a reinsurance agreement effective March 31, 2015 with a then unauthorized reinsurer. The

effective date of this agreement predated the effective date of Nebraska's Amended Credit for Reinsurance

statute (44-416) allowing certified reinsurers and also predated the subsequent approval of the agreement's

assuming reinsurer as a Certified Reinsurer, which occurred on August 30, 2015 and December 24, 2015,

respectively. Aflac has obtained a permitted practice to recognize this treaty and counterparty as Certified

Reinsurer for the purpose of determining the collateral required to receive reinsurance reserve credit.