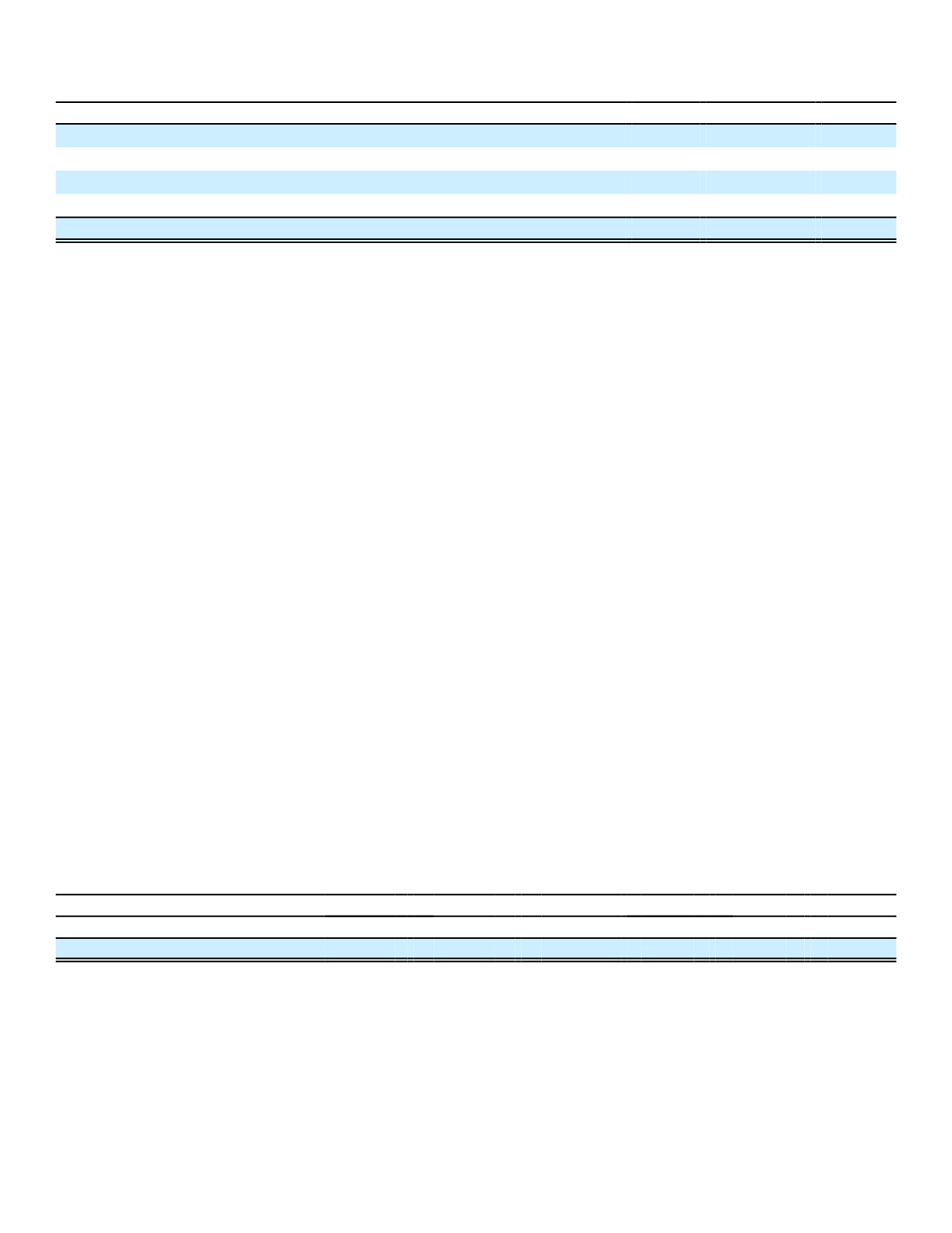

A reconciliation of Aflac's capital and surplus between SAP and practices permitted by the state of Nebraska is shown

below:

(In millions)

2016

2015

Capital and surplus, Nebraska state basis

$ 11,221

$ 11,298

State Permitted Practice:

Refundable lease deposits – Japan

(40)

(38)

Reinsurance - Japan

(764)

(707)

Capital and surplus, NAIC basis

$ 10,417

$ 10,553

As of December 31, 2016, Aflac's capital and surplus significantly exceeded the required company action level capital

and surplus of $1.3 billion. As determined on a U.S. statutory accounting basis, Aflac's net income was $2.8 billion in

2016, $2.3 billion in 2015 and $2.4 billion in 2014.

Aflac Japan must report its results of operations and financial position to the Japanese Financial Services Agency

(FSA) on a Japanese regulatory accounting basis as prescribed by the FSA. Capital and surplus of the Japan branch,

based on Japanese regulatory accounting practices, was $5.6 billion at December 31, 2016, compared with $4.7 billion at

December 31, 2015. Japanese regulatory accounting practices differ in many respects from U.S. GAAP. Under Japanese

regulatory accounting practices, policy acquisition costs are expensed immediately; policy benefit and claim reserving

methods and assumptions are different; premium income is recognized on a cash basis; different consolidation criteria

apply to VIEs; reinsurance is recognized on a different basis; and investments can have a separate accounting

classification and treatment referred to as policy reserve matching bonds (PRM).

The Parent Company depends on its subsidiaries for cash flow, primarily in the form of dividends and management

fees. Consolidated retained earnings in the accompanying financial statements largely represent the undistributed

earnings of our insurance subsidiary. Amounts available for dividends, management fees and other payments to the

Parent Company by its insurance subsidiary may fluctuate due to different accounting methods required by regulatory

authorities. These payments are also subject to various regulatory restrictions and approvals related to safeguarding the

interests of insurance policyholders. Our insurance subsidiary must maintain adequate risk-based capital for U.S.

regulatory authorities and our Japan branch must maintain adequate solvency margins for Japanese regulatory

authorities. Additionally, the maximum amount of dividends that can be paid to the Parent Company by Aflac without prior

approval of Nebraska's director of insurance is the greater of the net income from operations, which excludes net realized

investment gains, for the previous year determined under statutory accounting principles, or 10% of statutory capital and

surplus as of the previous year-end. Dividends declared by Aflac during 2017 in excess of $2.8 billion would require such

approval. Aflac declared dividends of $2.0 billion during 2016.

A portion of Aflac Japan earnings, as determined on a Japanese regulatory accounting basis, can be repatriated each

year to Aflac U.S. after complying with solvency margin provisions and satisfying various conditions imposed by Japanese

regulatory authorities for protecting policyholders. Profit repatriations to the United States can fluctuate due to changes in

the amounts of Japanese regulatory earnings. Among other items, factors affecting regulatory earnings include Japanese

regulatory accounting practices and fluctuations in currency translation of Aflac Japan's U.S. dollar-denominated

investments and related investment income into yen. Profits repatriated by Aflac Japan to Aflac U.S. were as follows for

the years ended December 31:

In Dollars

In Yen

(In millions of dollars and billions of yen)

2016

2015

2014

2016

2015

2014

Profit repatriation

$1,286

$ 2,139

$1,704

138.5

259.0

181.4

We entered into foreign exchange forwards and options as part of an economic hedge on foreign exchange risk on

114.0 billion yen of profit repatriation received in 2016, resulting in $64 million less funds received when the yen were

exchanged into dollars. As of December 31, 2016, we had foreign exchange forwards and options as part of a hedging

strategy on 122.6 billion yen of future profit repatriation.

156

14. BENEFIT PLANS

Pension and Other Postretirement Plans

We have funded defined benefit plans in Japan and the United States, however the U.S. plan was frozen to new

participants effective October 1, 2013. We also maintain non-qualified, unfunded supplemental retirement plans that