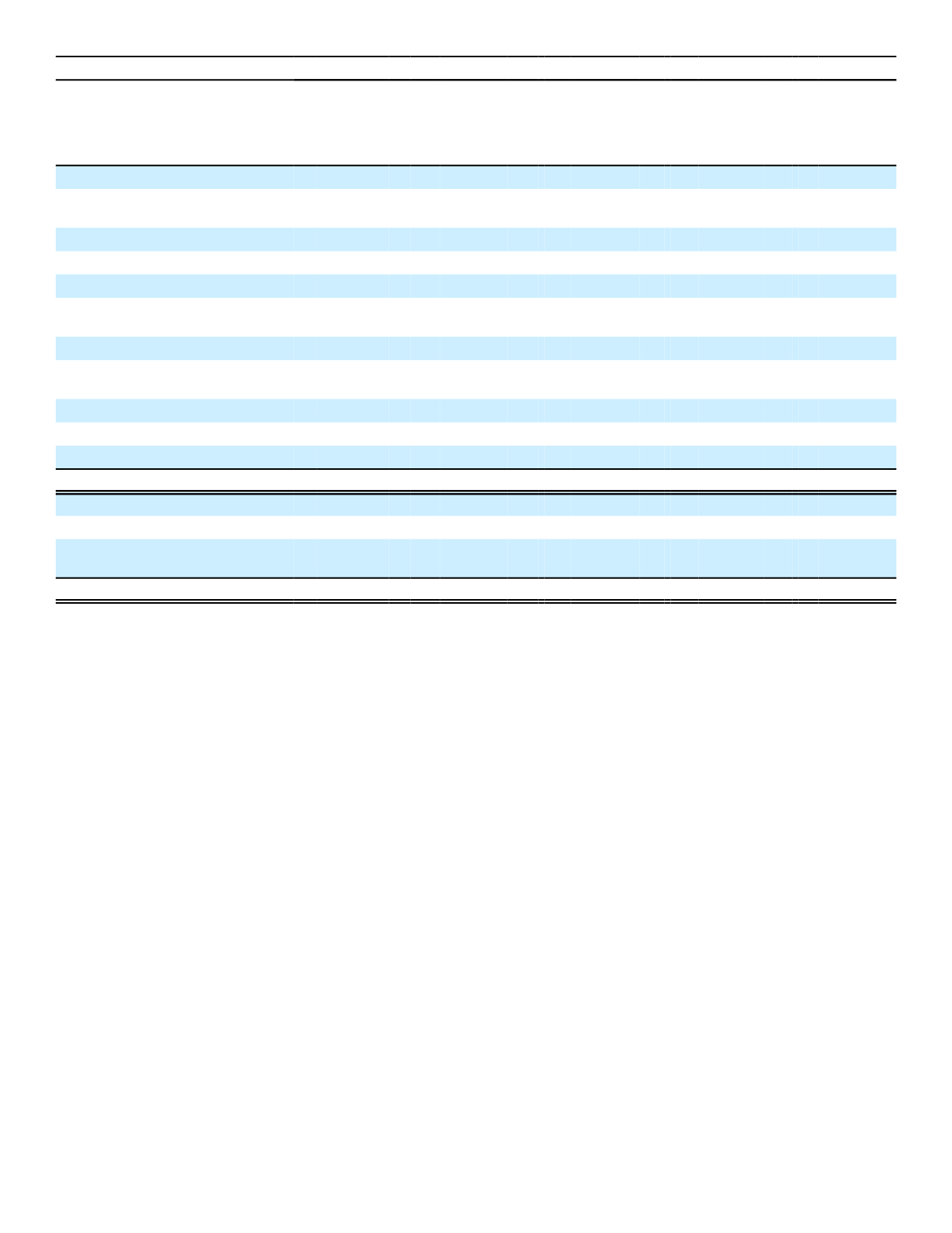

2015

(In millions)

Carrying

Value

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Fair

Value

Assets:

Securities held to maturity,

carried at amortized cost:

Fixed maturities:

Government and agencies

$ 20,004

$23,391

$ 0

$ 0

$ 23,391

Municipalities

341

0

415

0

415

Mortgage and asset-backed

securities

36

0

12

26

38

Public utilities

3,092

0

3,203

0

3,203

Sovereign and

supranational

2,555

0

2,711

0

2,711

Banks/financial institutions

4,431

0

4,546

0

4,546

Other corporate

3,000

0

3,216

0

3,216

Other investments

118

0

0

118

118

Total assets

$ 33,577

$23,391

$ 14,103

$ 144

$ 37,638

Liabilities:

Other policyholders’ funds

$ 6,285

$ 0

$ 0

$ 6,160

$ 6,160

Notes payable

(excluding capital leases)

4,951

0

0

5,256

5,256

Total liabilities

$ 11,236

$ 0

$ 0

$11,416

$ 11,416

Amounts have been adjusted for the adoption of accounting guidance on January 1, 2016 related to debt issuance costs.

Fair Value of Financial Instruments

U.S. GAAP requires disclosure of the fair value of certain financial instruments including those that are not carried at

fair value. The carrying amounts for cash and cash equivalents, other investments (excluding loan receivables),

receivables, accrued investment income, accounts payable, cash collateral and payables for security transactions

approximated their fair values due to the nature of these instruments. Liabilities for future policy benefits and unpaid policy

claims are not financial instruments as defined by U.S. GAAP.

Fixed maturities, perpetual securities, and equity securities

We determine the fair values of our fixed maturity securities, perpetual securities, and public and privately issued

equity securities using the following approaches or techniques: price quotes and valuations from third party pricing

vendors (including quoted market prices readily available from public exchange markets) and non-binding price quotes we

obtain from outside brokers.

A third party pricing vendor has developed valuation models to determine fair values of privately issued securities to

reflect the impact of the persistent economic environment and the changing regulatory framework. These models are

discounted cash flow (DCF) valuation models, but also use information from related markets, specifically the CDS market

to estimate expected cash flows. These models take into consideration any unique characteristics of the securities and

make various adjustments to arrive at an appropriate issuer-specific loss adjusted credit curve. This credit curve is then

used with the relevant recovery rates to estimate expected cash flows and modeling of additional features, including

illiquidity adjustments, if necessary, to price the security by discounting those loss adjusted cash flows. In cases where a

credit curve cannot be developed from the specific security features, the valuation methodology takes into consideration

other market observable inputs, including: 1) the most appropriate comparable security(ies) of the issuer; 2) issuer-

specific CDS spreads; 3) bonds or CDS spreads of comparable issuers with similar characteristics such as rating,

geography, or sector; or 4) bond indices that are comparative in rating, industry, maturity and region.

125