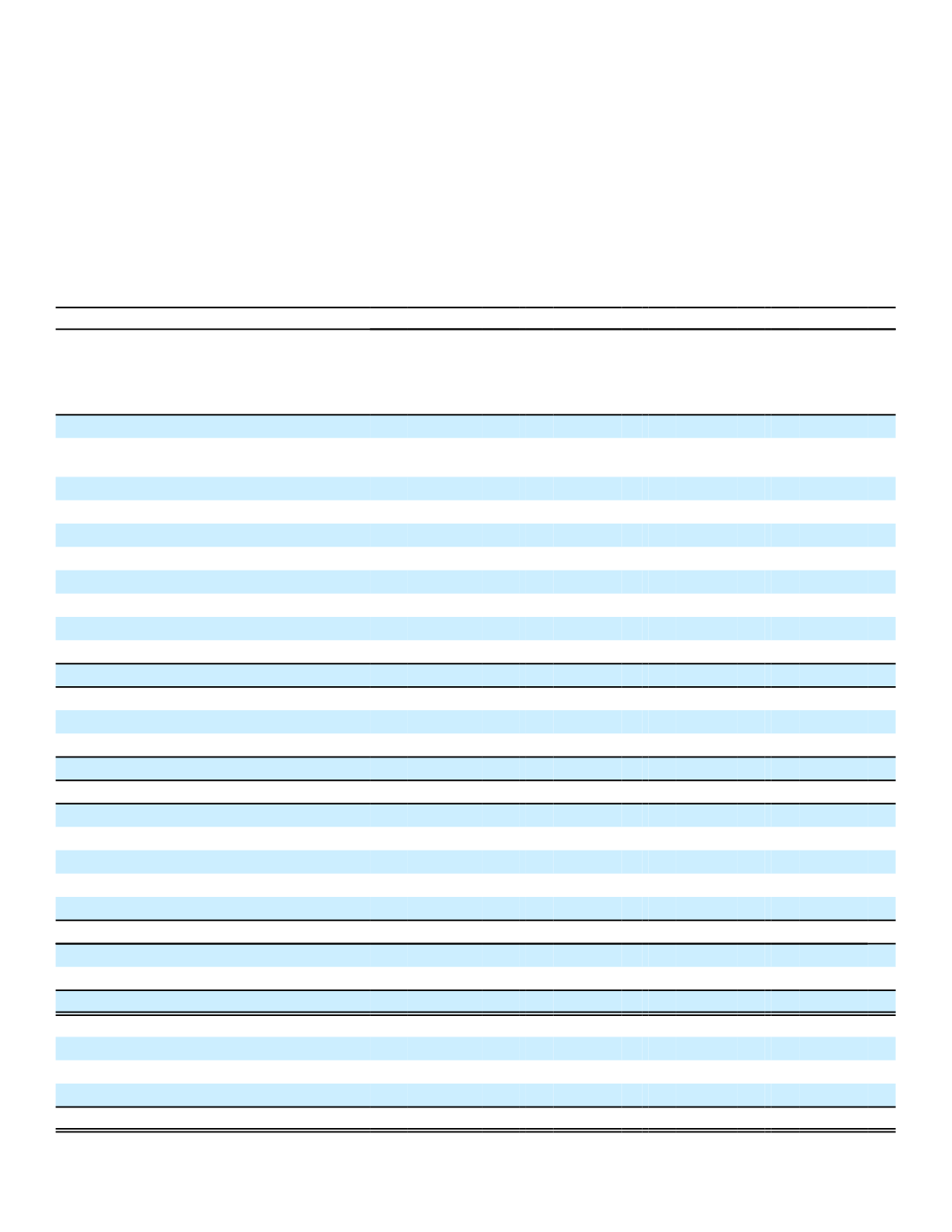

5. FAIR VALUE MEASUREMENTS

Fair Value Hierarchy

U.S. GAAP specifies a hierarchy of valuation techniques based on whether the inputs to those valuation techniques

are observable or unobservable. These two types of inputs create three valuation hierarchy levels. Level 1 valuations

reflect quoted market prices for identical assets or liabilities in active markets. Level 2 valuations reflect quoted market

prices for similar assets or liabilities in an active market, quoted market prices for identical or similar assets or liabilities in

non-active markets or model-derived valuations in which all significant valuation inputs are observable in active markets.

Level 3 valuations reflect valuations in which one or more of the significant inputs are not observable in an active market.

The following tables present the fair value hierarchy levels of the Company's assets and liabilities that are measured

and carried at fair value on a recurring basis as of December 31.

2016

(In millions)

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Fair

Value

Assets:

Securities available for sale, carried at

fair value:

Fixed maturities:

Government and agencies

$ 25,387

$ 827

$ 0

$ 26,214

Municipalities

0

1,295

0

1,295

Mortgage- and asset-backed securities

0

1,139

198

1,337

Public utilities

0

7,667

16

7,683

Sovereign and supranational

0

1,469

0

1,469

Banks/financial institutions

0

6,038

25

6,063

Other corporate

0

29,699

0

29,699

Total fixed maturities

25,387

48,134

239

73,760

Perpetual securities:

Banks/financial institutions

0

1,420

0

1,420

Other corporate

0

213

0

213

Total perpetual securities

0

1,633

0

1,633

Equity securities

1,300

6

3

1,309

Other assets:

Foreign currency swaps

0

365

125

490

Foreign currency forwards

0

672

0

672

Foreign currency options

0

43

0

43

Credit default swaps

0

0

2

2

Total other assets

0

1,080

127

1,207

Other investments

276

0

0

276

Cash and cash equivalents

4,859

0

0

4,859

Total assets

$ 31,822

$ 50,853

$ 369

$ 83,044

Liabilities:

Foreign currency swaps

$

0

$ 84

$ 146

$ 230

Foreign currency forwards

0

1,717

0

1,717

Foreign currency options

0

51

0

51

Total liabilities

$

0

$ 1,852

$ 146

$ 1,998

122