dollars to 2.07% in yen. In July 2012, the Parent Company issued $250 million of senior notes that are an addition to the

original first series of senior notes issued in February 2012. These notes have a five-year maturity and a fixed rate of

2.65% per annum, payable semiannually.

In 2010 and 2009, we issued senior notes through U.S. public debt offerings; the details of these notes are as follows.

In August 2010, we issued $450 million of senior notes that have a 30-year maturity. In December 2009, we issued $400

million of senior notes that have a 30-year maturity. These senior notes pay interest semiannually and are redeemable at

our option in whole at any time or in part from time to time at a redemption price equal to the greater of: (i) the principal

amount of the notes or (ii) the present value of the remaining scheduled payments of principal and interest to be

redeemed, discounted to the redemption date, plus accrued and unpaid interest.

In December 2016, the Parent Company completed a tender offer in which it extinguished $176 million principal of its

6.90% senior notes due 2039 and $193 million principal of its 6.45% senior notes due 2040. The pretax loss due to the

early redemption of these notes was $137 million.

In September 2016, we extinguished 8.0 billion yen of 2.26% fixed rate Uridashi notes upon their maturity and in July

2016, we extinguished 15.8 billion yen of 1.84% fixed rate Samurai notes upon their maturity.

For our yen-denominated notes and loans, the principal amount as stated in dollar terms will fluctuate from period to

period due to changes in the yen/dollar exchange rate. We have designated the majority of our yen-denominated notes

payable as a nonderivative hedge of the foreign currency exposure of our investment in Aflac Japan.

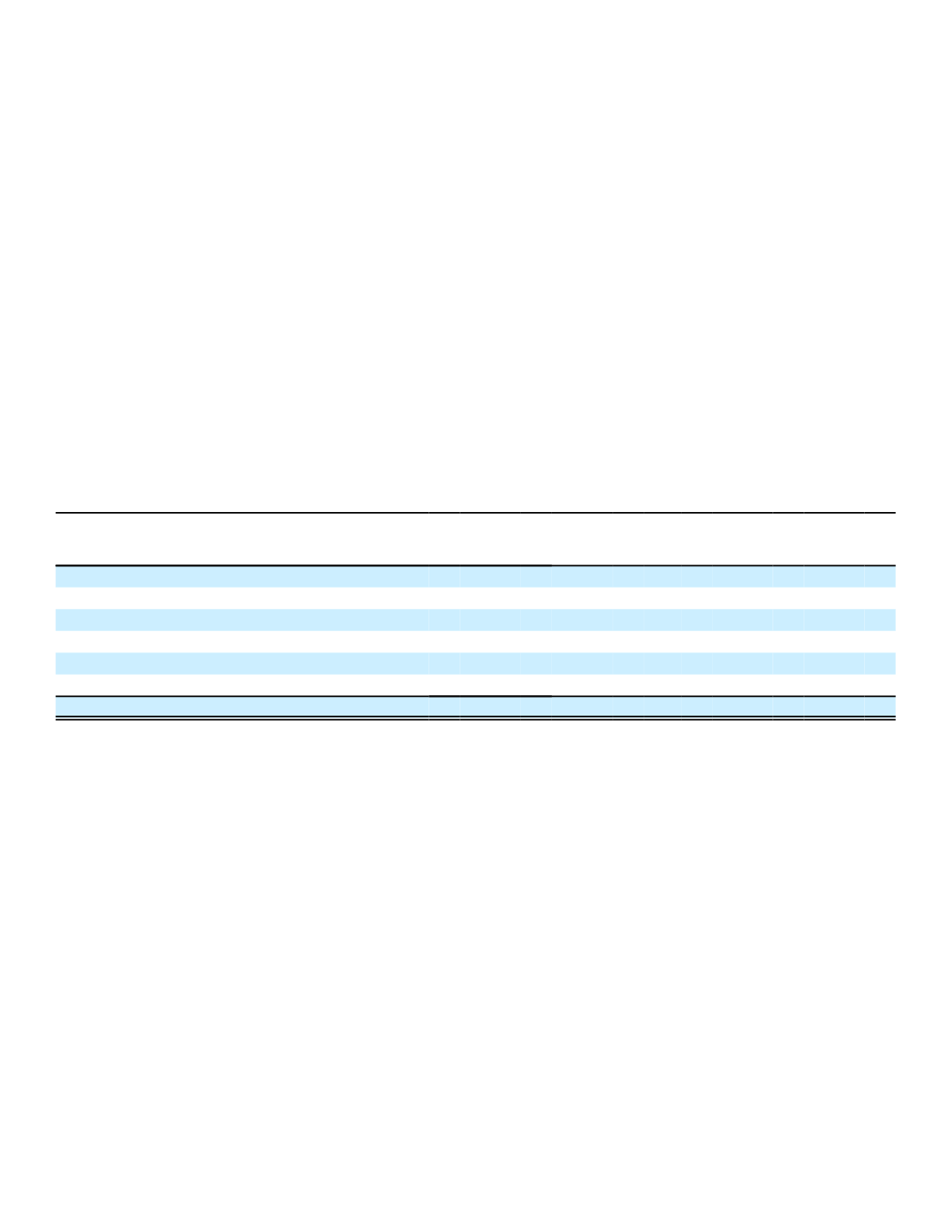

The aggregate contractual maturities of notes payable during each of the years after December 31, 2016, are as

follows:

(In millions)

Long-term

Debt

Capitalized

Lease

Obligations

Total

Notes

Payable

2017

$ 650

$ 6

$ 656

2018

0

6

6

2019

0

5

5

2020

550

2

552

2021

43

1

44

Thereafter

4,145

1

4,146

Total

$ 5,388

$21

$ 5,409

In October 2016, the Parent Company and Aflac renewed a 364-day uncommitted bilateral line of credit that provides

for borrowings in the amount of $100 million. Borrowings will bear interest at the rate quoted by the bank and agreed upon

at the time of making such loan and will have up to a three-month maturity period. There are no related facility fees,

upfront expenses or financial covenant requirements. Borrowings under this credit agreement may be used for general

corporate purposes. Borrowings under the financing agreement will mature no later than three months after the last

drawdown date of October 14, 2017. As of December 31, 2016, we did not have any borrowings outstanding under our

$100 million credit agreement.

In March 2016, the Parent Company entered into a three-year senior unsecured revolving credit facility agreement

with a syndicate of financial institutions that provides for borrowings of up to 100.0 billion yen on a revolving basis.

Borrowings bear interest at a rate per annum equal to TIBOR plus, at our option, either (a) the applicable TIBOR margin

during the period from the closing date to the commitment termination date or (b) the applicable TIBOR margin during the

term out period. The applicable margin ranges between .35% and .75% during the period from the closing date to the

commitment termination date and .70% and 1.50% during the term out period, depending on the Parent Company’s debt

ratings as of the date of determination. In addition, the Parent Company is required to pay a facility fee on the

commitments ranging between .30% and .50%, also based on the Parent Company’s debt ratings as of the date of

determination. Borrowings under this credit agreement may be used for general corporate purposes, including a capital

contingency plan for the operations of the Parent Company, and will expire on the earlier of (a) March 31, 2019, or (b) the

date the commitments are terminated pursuant to an event of default, as such term is defined in the credit agreement. The

credit facility requires compliance with certain financial covenants on a quarterly basis. As of December 31, 2016, we did

not have any borrowings outstanding under our 100.0 billion yen revolving credit agreement.

145