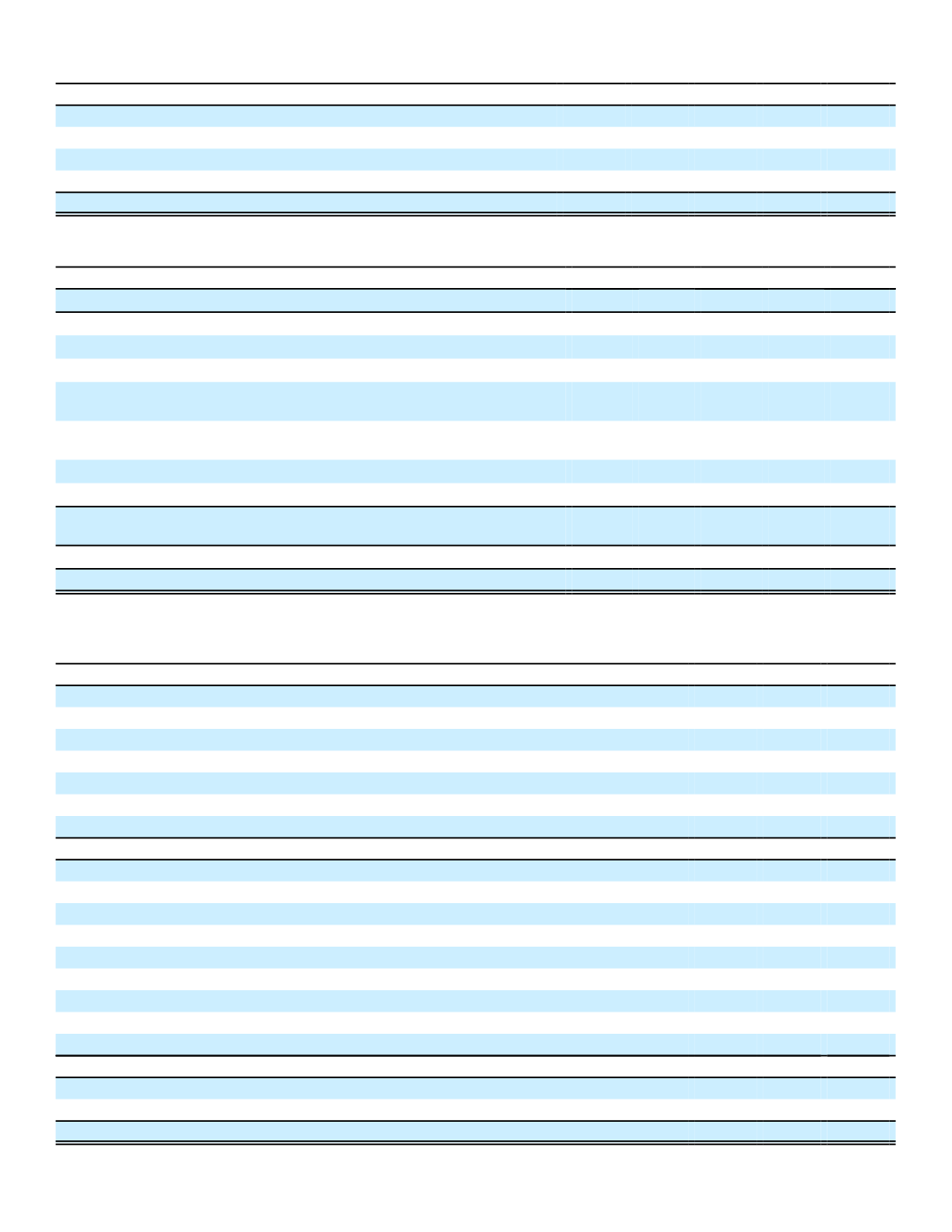

the years ended December 31 were as follows:

(In millions)

2016

2015

2014

Income taxes based on U.S. statutory rates

$ 1,424

$ 1,352

$ 1,572

Utilization of foreign tax credit

(30)

(27)

(32)

Nondeductible expenses

8

3

5

Other, net

6

1

(5)

Income tax expense

$ 1,408

$ 1,329

$ 1,540

Total income tax expense for the years ended December 31 was allocated as follows:

(In millions)

2016

2015

2014

Statements of earnings

$ 1,408

$ 1,329

$1,540

Other comprehensive income (loss):

Unrealized foreign currency translation gains (losses) during period

70

16

(419)

Unrealized gains (losses) on investment securities:

Unrealized holding gains (losses) on investment

securities during period

962

(931)

2,237

Reclassification adjustment for realized (gains) losses

on investment securities included in net earnings

18

21

19

Unrealized gains (losses) on derivatives during period

1

0

(3)

Pension liability adjustment during period

(16)

(7)

(31)

Total income tax expense (benefit) related to items of

other comprehensive income (loss)

1,035

(901)

1,803

Additional paid-in capital (exercise of stock options)

(10)

4

(7)

Total income taxes

$ 2,433

$ 432

$3,336

The income tax effects of the temporary differences that gave rise to deferred income tax assets and liabilities as of

December 31 were as follows:

(In millions)

2016

2015

Deferred income tax liabilities:

Deferred policy acquisition costs

$ 2,439

$ 2,282

Unrealized gains on investment securities

2,636

1,684

Premiums receivable

111

139

Policy benefit reserves

1,638

1,313

Depreciation

70

61

Other

0

0

Total deferred income tax liabilities

6,894

5,479

Deferred income tax assets:

Other basis differences in investment securities

1,167

1,422

Unfunded retirement benefits

13

15

Other accrued expenses

11

7

Policy and contract claims

146

113

Foreign currency loss on Japan branch

185

208

Deferred compensation

210

181

Capital loss carryforwards

3

0

Other

103

95

Total deferred income tax assets

1,838

2,041

Net deferred income tax liability

5,056

3,438

Current income tax liability

331

902

Total income tax liability

$ 5,387

$ 4,340

147