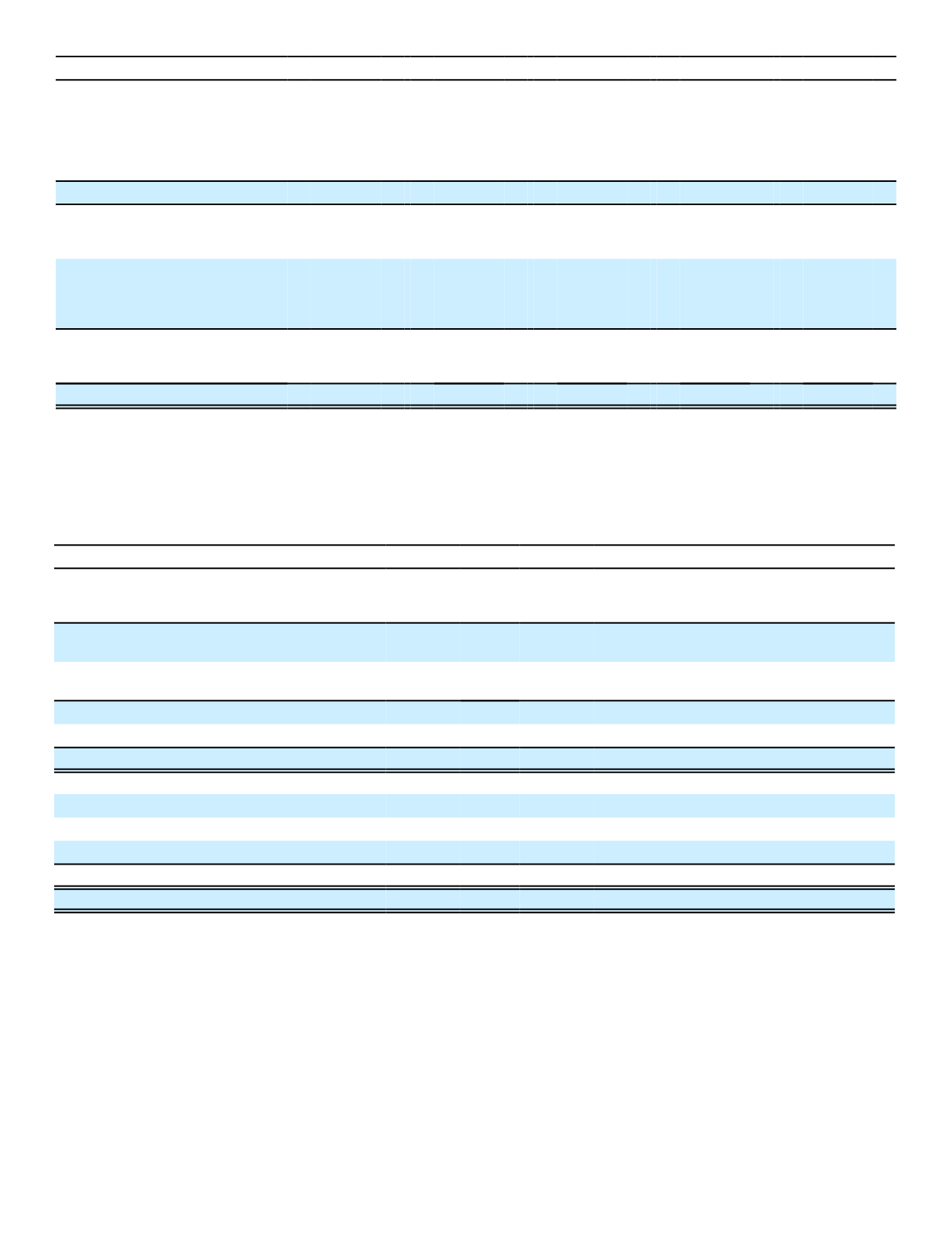

2014

(In millions)

Unrealized

Foreign

Currency

Translation

Gains

(Losses)

Unrealized

Gains

(Losses)

on Investment

Securities

Unrealized

Gains

(Losses)

on Derivatives

Pension

Liability

Adjustment

Total

Balance, beginning of period

$ (1,505)

$ 1,035

$ (12)

$ (81)

$ (563)

Other comprehensive

income (loss) before

reclassification

(1,036)

3,672

(14)

(44)

2,578

Amounts reclassified from

accumulated other

comprehensive income

(loss)

0

(35)

0

(1)

(36)

Net current-period other

comprehensive

income (loss)

(1,036)

3,637

(14)

(45)

2,542

Balance, end of period

$ (2,541)

$ 4,672

$ (26)

$ (126)

$ 1,979

All amounts in the table above are net of tax.

The table below summarizes the amounts reclassified from each component of accumulated other comprehensive

income based on source for the years ended December 31.

Reclassifications Out of Accumulated Other Comprehensive Income

(In millions)

2016

Details about Accumulated Other

Comprehensive Income Components

Amount Reclassified from

Accumulated Other

Comprehensive Income

Affected Line Item in the

Statements of Earnings

Unrealized gains (losses) on available-for-sale

securities

$ 136

Sales and redemptions

(83)

Other-than-temporary impairment

losses realized

53

Total before tax

(18)

Tax (expense) or benefit

(1)

$ 35

Net of tax

Amortization of defined benefit pension items:

Actuarial gains (losses)

$ (15)

Acquisition and operating expenses

(2)

Prior service (cost) credit

11

Acquisition and operating expenses

(2)

1

Tax (expense) or benefit

(1)

$ (3)

Net of tax

Total reclassifications for the period

$ 32

Net of tax

(1)

Based on 35% tax rate

(2)

These accumulated other comprehensive income components are included in the computation of net periodic pension cost (see

Note 14 for additional details).

151