Evaluating the underlying risks in our credit portfolio involves a multitude of factors including but not limited to our

assessment of the issuer's or borrower's business activities, assets, products, market position, financial condition, and

future prospects. We incorporate the assessment of the NRSROs in assigning credit ratings and we incorporate the rating

methodologies of our specialist external managers in assigning loan ratings to portfolio holdings. We perform extensive

internal assessments of the credit risks for all our portfolio holdings and potential new investments, which includes using

analyses provided by our specialist external managers. For assets managed by external asset managers, we provide

investment and credit risk parameters that must be used when making investment decisions and require ongoing

monitoring and reporting from the asset managers on significant changes in credit risks within the portfolio.

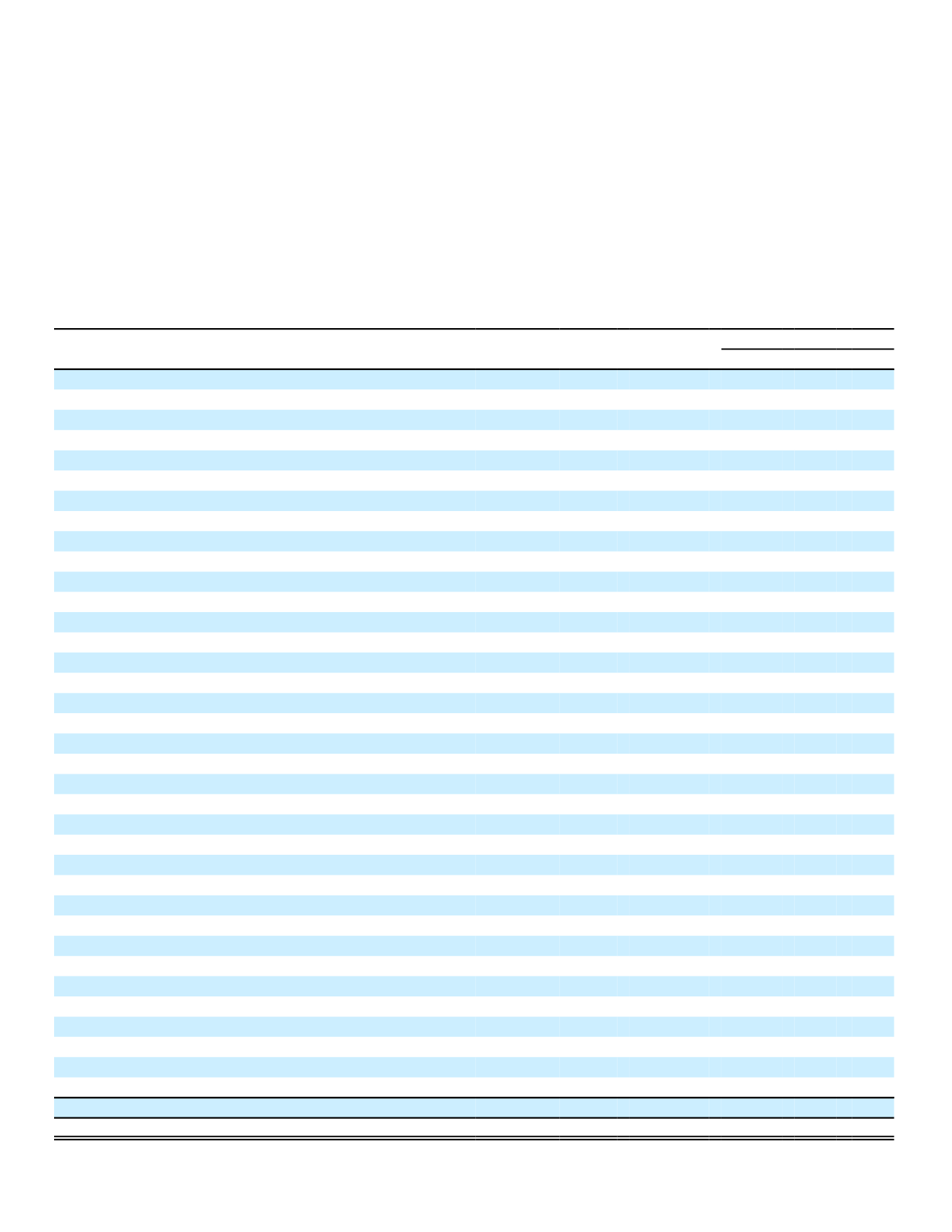

Investment Concentrations

Our 15 largest global investment exposures as of December 31, 2016, were as follows:

Largest Global Investment Positions

Amortized % of

Ratings

(In millions)

Cost

Total

Seniority Moody’s S&P Fitch

Japan National Government

(1)

$ 42,931 42.41%

Senior

A1

A+

A

Japan Housing Finance Agency

933

.92

Senior

— AAA —

Republic of South Africa

515

.51

Senior

Baa2

BBB-

BBB-

Bank of America NA

386

.38

Bank of America Corp.

215

.21 Senior

Baa1 BBB+

A

Bank of America Corp.

171

.17 Lower Tier II

Baa3

BBB A-

Bank of Tokyo-Mitsubishi UFJ Ltd.

386

.38

BTMU Curacao Holdings NV

386

.38 Lower Tier II

A2

— A-

Investcorp SA

368

.36

Investcorp Capital Limited

318

.31 Senior

Ba2

— BB

Investcorp Capital Limited

50

.05 Senior

Ba2

— —

JP Morgan Chase & Co.

336

.33

JPMorgan Chase & Co. (including Bear Stearns Companies Inc.)

302

.30 Senior

A3

A-

A+

JPMorgan Chase & Co. (Bank One Corp.)

17

.02 Lower Tier II

Baa1 BBB+

A

JPMorgan Chase & Co. (NBD Bank)

11

.01 Lower Tier II

A1

A-

A

JPMorgan Chase & Co. (FNBC)

6

.00 Senior

Aa1

A+

—

Banobras

318

.31

Senior

A3

BBB+ BBB+

Sultanate of Oman

300

.30

Senior

Baa1

BBB-

—

Nordea Bank AB

289

.29

Nordea Bank AB

221

.22 Tier I

Baa3

BBB —

Nordea Bank Finland

68

.07 Upper Tier II

Baa2

— —

Petroleos Mexicanos (Pemex)

283

.28

Pemex Proj FDG Master TR

258

.25 Senior

Baa3 BBB+ BBB+

Pemex Finance Ltd.

25

.03 Senior

Baa3

A

A+

AXA

282

.28

AXA-UAP

231

.23 Upper Tier II

A3

BBB+ BBB

AXA

51

.05 CC FNB

A3

BBB+ BBB+

Deutsche Telekom AG

279

.28

Deutsche Telekom AG

258

.26 Senior

Baa1 BBB+ BBB+

Deutsche Telekom International Finance

21

.02 Senior

Baa1 BBB+ BBB+

CFE

275

.27

Senior

Baa1 BBB+ BBB+

Barclays Bank PLC

271

.27

Barclays Bank PLC

119

.12 Lower Tier II

Baa3

BBB-

A-

Barclays Bank PLC

106

.10 Upper Tier II

Ba1

BB BBB

Barclays Bank PLC

39

.04 Tier I

Ba2

BB BB+

Barclay's Bank PLC

7

.01 Tier I

Ba2

BB BB+

Subtotal

$ 48,152 47.57%

Total debt and perpetual securities

$ 101,219 100.00%

(1)

JGBs or JGB-backed securities

75