Interest Rate Risk

Our primary interest rate exposure is to the impact of changes in interest rates on the fair value of our investments in

debt and perpetual securities. We monitor our investment portfolio on a quarterly basis utilizing a full valuation

methodology, measuring price volatility, and sensitivity of the fair values of our investments to interest rate changes on the

debt and perpetual securities we own. For example, if the current duration of a debt security or perpetual security is 10

years, then the fair value of that security will increase by approximately 10% if market interest rates decrease by 100

basis points, assuming all other factors remain constant. Likewise, the fair value of the debt security or perpetual security

will decrease by approximately 10% if market interest rates increase by 100 basis points, assuming all other factors

remain constant.

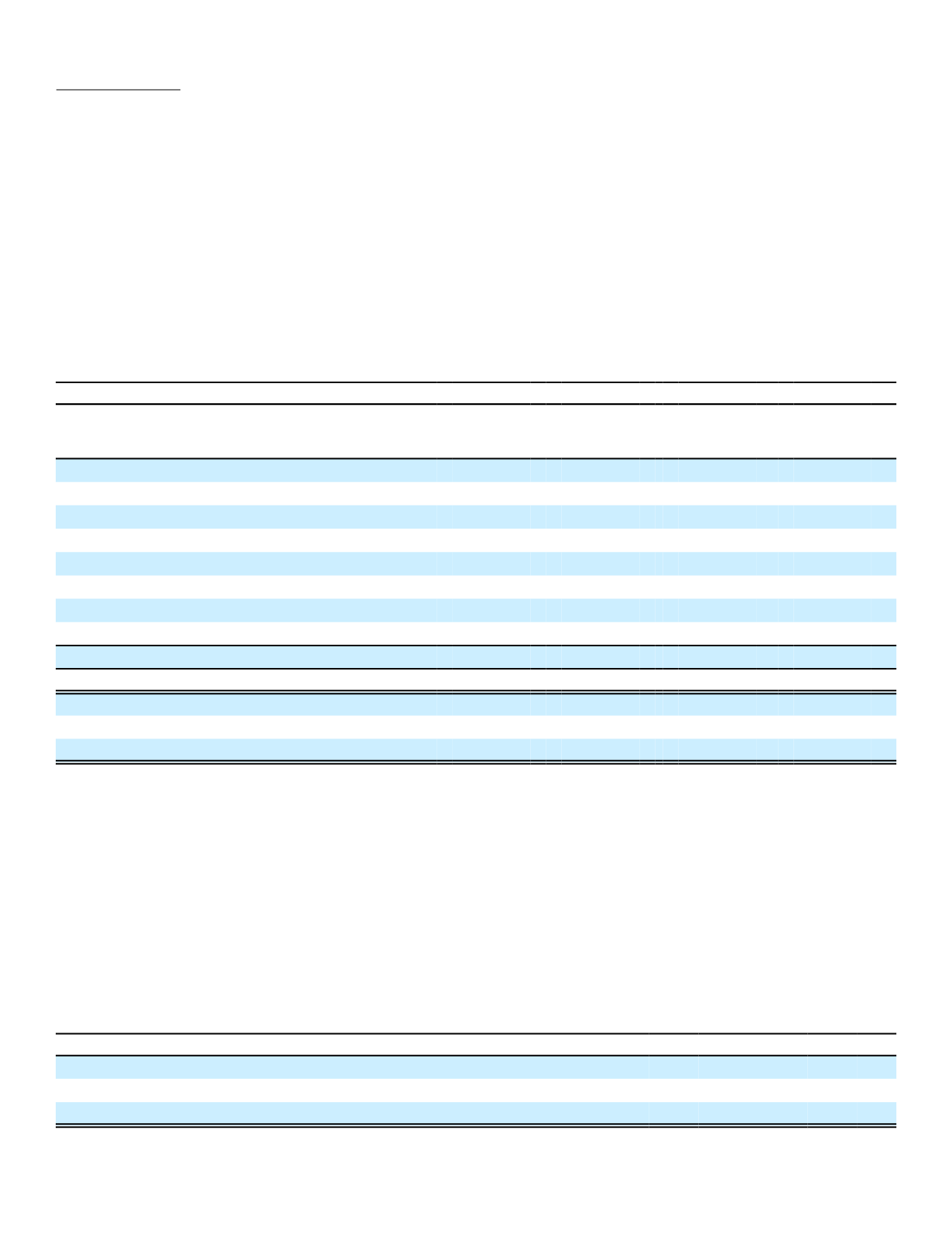

The estimated effect of potential increases in interest rates on the fair values of debt and perpetual securities we own;

derivatives, excluding credit default swaps, and notes payable as of December 31 follows:

Sensitivity of Fair Values of Financial Instruments

to Interest Rate Changes

2016

2015

(In millions)

Fair

Value

+100

Basis

Points

Fair

Value

+100

Basis

Points

Assets:

Debt and perpetual securities:

Fixed-maturity securities:

Yen-denominated

$ 77,170 $ 66,636

$ 66,031

$ 57,470

Dollar-denominated

36,611

33,611

36,838

32,364

Perpetual securities:

Yen-denominated

1,558

1,434

1,836

1,704

Dollar-denominated

75

68

111

103

Total debt and perpetual securities

$ 115,414 $ 101,749

$ 104,816

$ 91,641

Derivatives

$ 1,205 $ 1,309

$ 675

$ 675

Liabilities:

Notes payable

(1)

$ 5,530 $ 5,175

$ 5,256

(2)

$ 4,907

(2)

Derivatives

1,998

1,901

371

200

(1)

Excludes capitalized lease obligations

(2)

Amounts have been adjusted for the adoption of accounting guidance on January 1, 2016 related to debt issuance costs.

There are various factors that affect the fair value of our investment in debt and perpetual securities. Included in those

factors are changes in the prevailing interest rate environment, which directly affect the balance of unrealized gains or

losses for a given period in relation to a prior period. Decreases in market yields generally improve the fair value of debt

and perpetual securities, while increases in market yields generally have a negative impact on the fair value of our debt

and perpetual securities. However, we do not expect to realize a majority of any unrealized gains or losses because we

generally have the intent and ability to hold such securities until a recovery of value, which may be maturity. For additional

information on unrealized losses on debt and perpetual securities, see Note 3 of the Notes to the Consolidated Financial

Statements.

We attempt to match the duration of our assets with the duration of our liabilities. The following table presents the

approximate duration of Aflac Japan's yen-denominated assets and liabilities, along with premiums, as of December 31.

(In years)

2016

2015

Yen-denominated debt and perpetual securities

15

14

Policy benefits and related expenses to be paid in future years

14

14

Premiums to be received in future years on policies in force

10

10

73