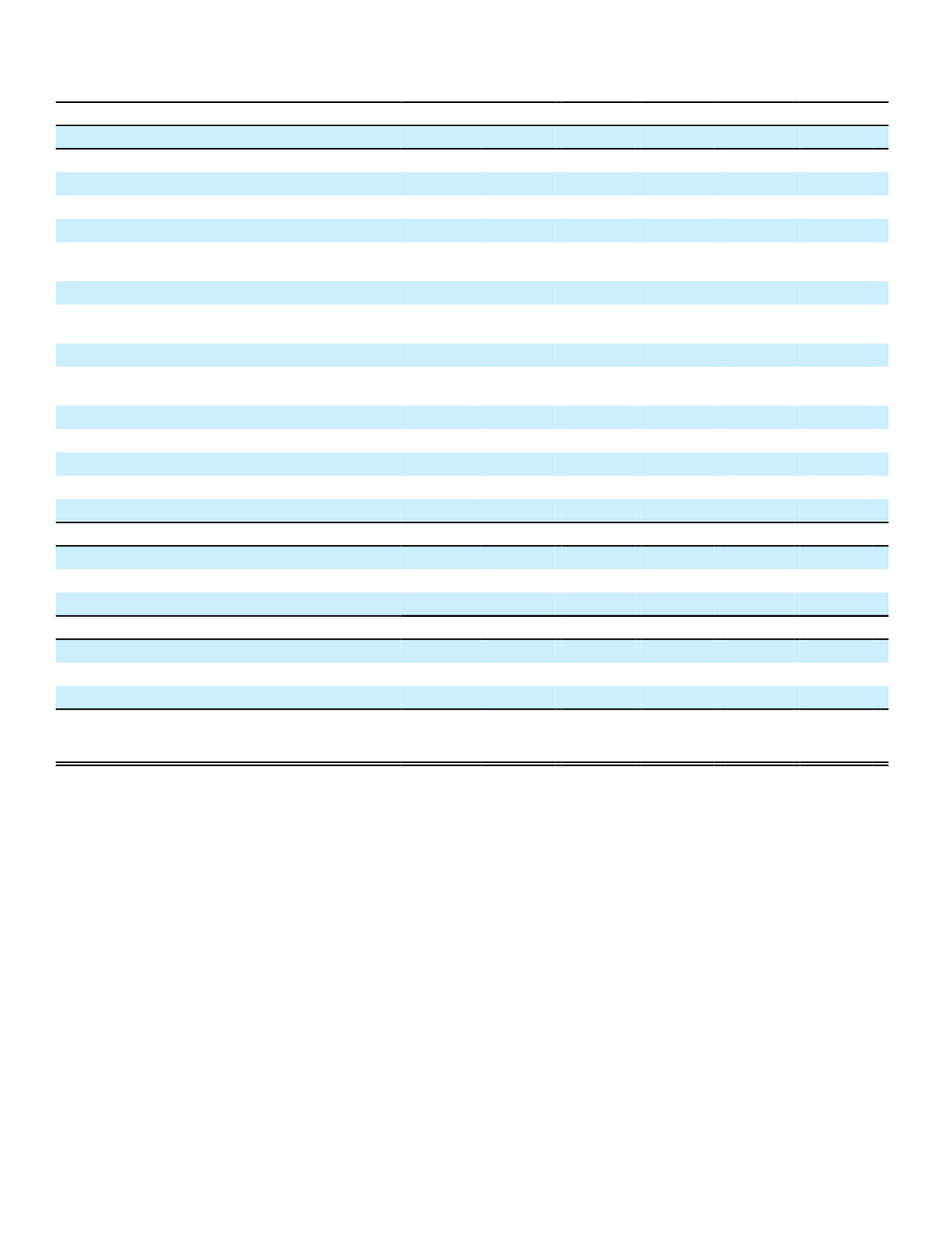

Dollar Value of Yen-Denominated Assets and Liabilities

at Selected Exchange Rates

(In millions)

2016

2015

Yen/dollar exchange rates

101.49 116.49

(1)

131.49

105.61 120.61

(1)

135.61

Yen-denominated financial instruments:

Assets:

Securities available for sale:

Fixed maturities

(2)

$ 41,856 $ 36,467 $ 32,306

$ 31,544 $ 27,621 $ 24,566

Fixed maturities - consolidated variable

interest entities

(3)

783

682

604

1,016

890

792

Perpetual securities

1,557 1,357 1,202

1,883 1,649 1,466

Perpetual securities - consolidated

variable interest entities

(3)

231

201

178

214

187

167

Equity securities

155

136

120

408

357

318

Equity securities - consolidated variable

interest entities

653

569

504

149

130

116

Securities held to maturity:

Fixed maturities

38,279 33,350 29,545

38,212 33,459 29,758

Cash and cash equivalents

1,013

883

782

730

640

569

Derivatives

2,245 1,207 3,515

2,416

676

968

Other financial instruments

206

178

159

179

156

139

Subtotal

86,978 75,030 68,915

76,751 65,765 58,859

Liabilities:

Notes payable

304

265

235

234

205

183

Derivatives

1,712 1,998 5,549

545

371 1,901

Subtotal

2,016 2,263 5,784

779

576 2,084

Net yen-denominated financial instruments

84,962 72,767 63,131

75,972 65,189 56,775

Other yen-denominated assets

8,741 7,616 6,747

8,195 7,176 6,382

Other yen-denominated liabilities

102,132 88,981 78,830

94,775 82,988 73,808

Consolidated yen-denominated net assets

(liabilities) subject to foreign currency

fluctuation

(2)

$ (8,429) $ (8,598) $ (8,952)

$ (10,608) $ (10,623) $ (10,651)

(1)

Actual period-end exchange rate

(2)

Does not include the U.S. dollar-denominated corporate bonds for which we have entered into foreign currency derivatives as

discussed in the Aflac Japan Investment subsection of MD&A

(3)

Does not include U.S. dollar-denominated bonds that have corresponding cross-currency swaps in consolidated VIEs

We are required to consolidate certain VIEs. Some of the consolidated VIEs in Aflac Japan's portfolio use foreign

currency swaps to convert foreign denominated cash flows to yen, the functional currency of Aflac Japan, in order to

minimize cash flow fluctuations. Foreign currency swaps exchange an initial principal amount in two currencies, agreeing

to re-exchange the currencies at a future date, at an agreed upon exchange rate. There may also be periodic exchanges

of payments at specified intervals based on the agreed upon rates and notional amounts. Prior to consolidation, our

beneficial interest in these VIEs was a yen-denominated available-for-sale fixed maturity security. Upon consolidation, the

original yen-denominated investment was derecognized and the underlying fixed-maturity or perpetual securities and

cross-currency swaps were recognized. The combination of a U.S. dollar-denominated investment and cross-currency

swap economically creates a yen-denominated investment and has no impact on our net investment hedge position.

Similarly, the combination of the U.S. corporate bonds and the foreign currency forwards and options that we have

entered into, as discussed in the Aflac Japan Investment subsection of MD&A, economically creates a yen-denominated

investment that qualifies for inclusion as a component of our investment in Aflac Japan for net investment hedge

purposes.

For additional information regarding our Aflac Japan net investment hedge, see the Hedging Activities subsection of

MD&A.

72