Main Section Title [H1]

|

Subsection Title [H2]

AFLAC INCORPORATED

2017 PROXY STATEMENT

47

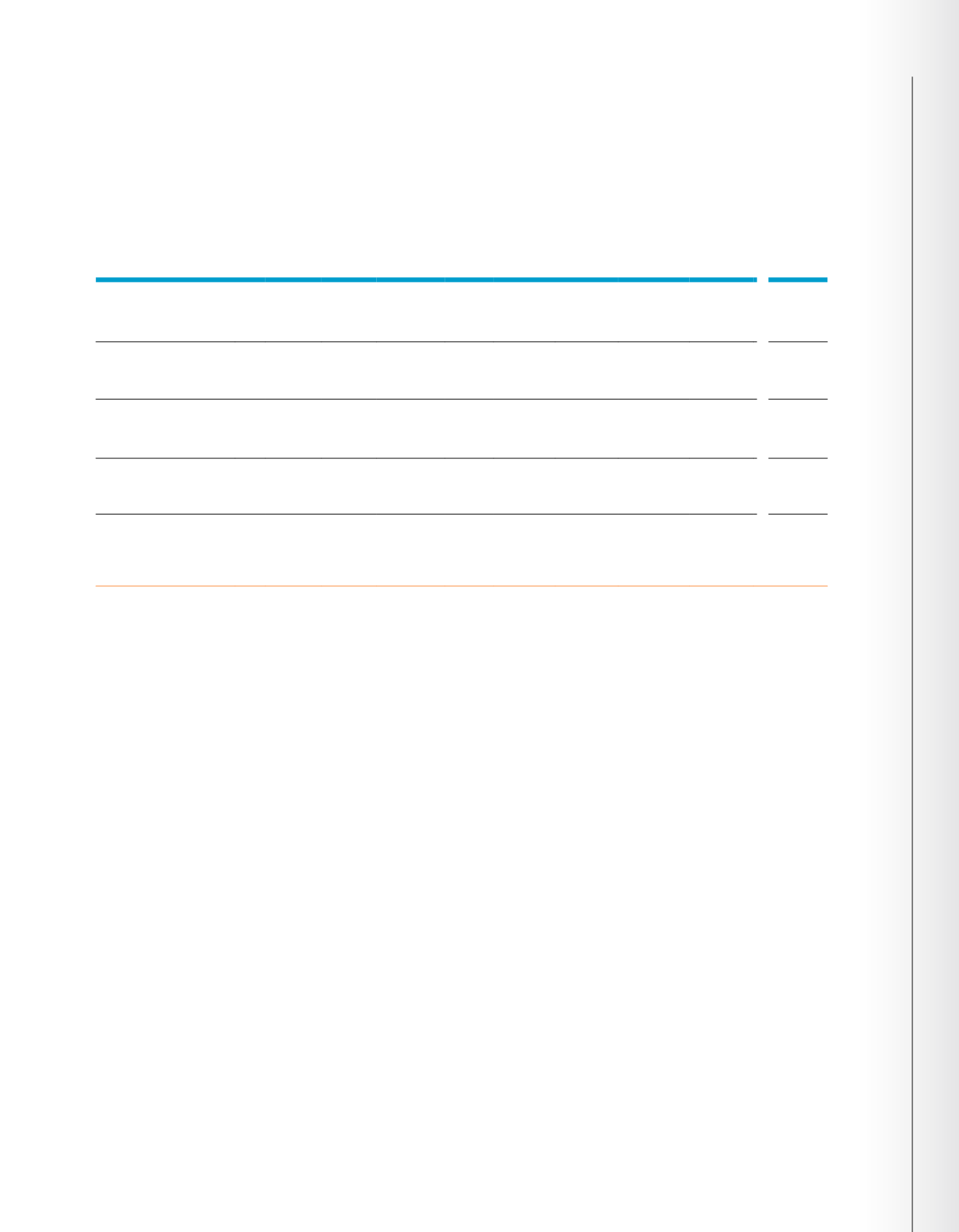

The following table provides information concerning total compensation earned or paid to our CEO, CFO and the

three other most highly compensated executive officers who were serving as executive officers during 2016. These

five officers are referred to as our NEOs in this Proxy Statement.

* Total without Change in Pension Value represents total compensation, as determined under applicable SEC rules, minus the change in pension value

reported in the Change in Pension Value and Nonqualified Deferred Compensation Earnings column. This additional column has been included to show

the effect that the year-over-year change in pension value had on total compensation as determined under applicable SEC rules. The amounts reported in

the Total without Change in Pension Value column differ from the amounts reported in the Total column required under SEC rules and are not a substitute

for total compensation. The change in pension value, as discussed in footnote 4 below, is subject to many external variables that are not related to the

Company’s performance.

(1) In each of the 3 years above, includes $441,100 deferred for Mr. Daniel P. Amos. This amount has been included in the 2016 Nonqualified Deferred

Compensation table below.

(2) Mr. Crawford received a one-time discretionary award of 4,104 shares of performance-based restricted stock that will vest on the third anniversary of the

grant date if the related performance metrics are met.

(3) In accordance with the SEC’s reporting requirements, we report all equity awards at their full grant date fair value under ASC 718. The Company’s valuation

assumptions are described in Note 12 “Share-Based Compensation” in the Notes to the Consolidated Financial Statements in the Company’s Annual Form

10-K filed with the SEC for the year ended December 31, 2016. See page 50 for a more detailed discussion of our outstanding equity grants compared to

current fair market value.

(4) No amount in this column is attributable to above-market earnings on deferred compensation. The aggregate change in the actuarial present value of the

accumulated benefit obligation of the defined benefit pension plan and Retirement Plan for Senior Officers for Messrs. Daniel P. Amos and Cloninger was a

decrease of $1,299,019 and $243,315, respectively. Mr. Crawford is not eligible to participate in the defined benefit plans because the plans were frozen

prior to his hire date. See the “Pension Benefits” section and the accompanying table beginning on page 52 for a more detailed discussion of the retirement

plans.

(5) Additional information regarding all other compensation is provided in the “All Other Compensation” or “Perquisites” tables detailed on the following page

.

Name and

Principal Position

Year

Salary

(1)

($)

Bonus

($)

Stock Awards

(2)(3)

($)

Option

Awards

(3)

($)

Non-equity

Incentive

Plan

Compensation

($)

Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

(4)

($)

All Other

Compensation

(5)

($)

Total

($)

Total

without

Change in

Pension

Value*

($)

Daniel P. Amos

Chairman and CEO

2016

2015

2014

1,441,100

1,441,100

1,441,100

–

–

–

13,773,466

4,800,556

2,141,162

–

–

–

4,884,442

5,509,362

4,829,415

–

–

6,835,154

313,002

231,365

230,517

20,412,010

11,982,383

15,477,348

20,412,010

11,982,383

8,642,194

Frederick J. Crawford

Executive Vice

President, CFO

2016

2015

2014

700,000

360,606

–

–

1,240,000

–

1,420,062

847,987

–

280,003

211,994

–

1,400,700

799,652

–

–

–

–

454,628

47,335

–

4,255,393

3,507,574

–

4,255,393

3,507,574

–

Kriss Cloninger III

President

2016

2015

2014

975,000

975,000

975,000

–

–

–

7,772,382

3,017,256

2,644,624

–

–

661,159

2,321,529

2,583,298

2,190,304

–

278,335

2,329,649

139,409

134,538

116,359

11,208,320

6,988,427

8,917,095

11,208,320

6,710,092

6,587,446

Paul S. Amos II

President, Aflac

2016

2015

2014

700,000

677,900

667,900

–

–

–

1,120,019

1,093,011

1,655,800

280,003

257,128

333,948

1,564,038

1,619,607

1,238,548

1,402,759

716,225

1,290,895

1,579,325

1,088,891

982,557

6,646,144

5,452,762

6,169,648

5,243,385

4,736,537

4,878,753

Eric M. Kirsch

Executive Vice

President, Global Chief

Investment Officer, Aflac

2016

2015

2014

593,800

593,800

585,000

–

–

–

950,052

957,391

1,170,000

237,519

239,348

292,507

1,906,407

2,262,378

1,898,061

36,505

26,174

30,759

17,281

8,363

11,395

3,741,564

4,087,454

3,987,722

3,705,059

4,061,280

3,956,963

2016 Summary Compensation Tables